Half-Year Report | China Learning Tablet Market Online and Offline Omnichannel Report for H1 2025: TOP3 Brands Dominate with 60% Market Share; AI, Adult Education, and Live Services Shine

![]() 07/28 2025

07/28 2025

![]() 568

568

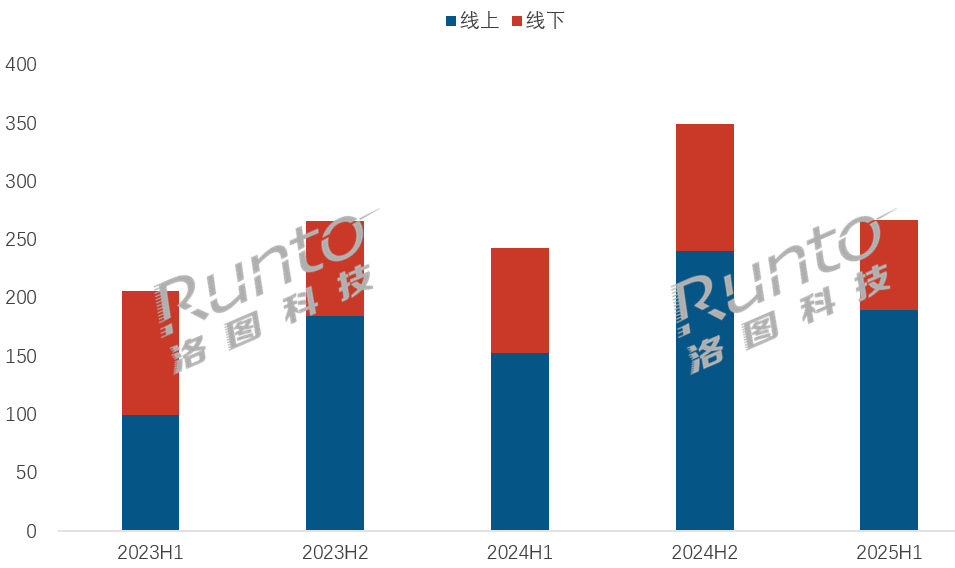

According to RUNTO's latest "China Learning Tablet Retail Market Monthly Tracker" report, sales of learning tablets in China's online and offline omnichannel market reached 2.667 million units in the first half of 2025, marking a 9.7% year-on-year increase.

RUNTO attributes this sustained growth to the strong demand from Chinese parents for high-quality educational resources, coupled with policy incentives. These factors form the underlying logic driving the expansion of China's electronic education market.

In the first half of 2025, several favorable factors contributed to this growth: the expansion of national subsidies at the beginning of the year, which included learning tablets among the 15 major subsidy categories; the streamlined 618 sales promotion, where e-commerce platforms eliminated complex discounts in favor of tiered direct reductions, further activating the online market; and top brands capitalizing on the policy window to launch mid-range products, appealing to price-sensitive consumers. These factors collectively created a virtuous cycle of policy benefits, platform promotions, and product innovation.

China Learning Tablet Omnichannel Market Half-Year Sales from 2023-2025H1

Data Source: RUNTO Omnichannel Data, Unit: Ten Thousand Units

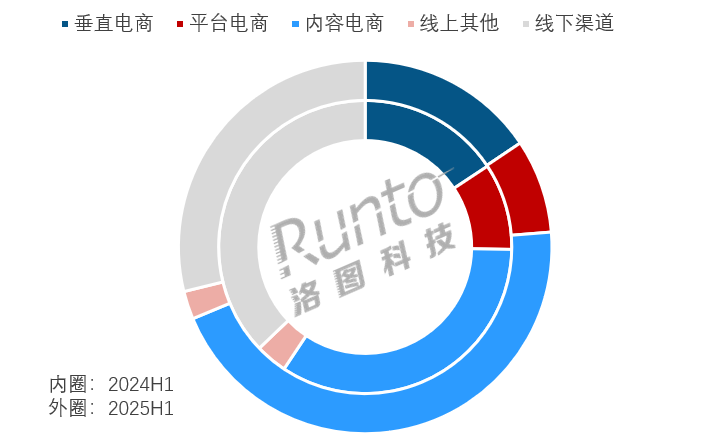

I. Channel Structure:

Online Share Exceeds 70%, Content E-commerce Grows by 45%

In the overall growth trajectory, online channels are poised for faster development in the Chinese market. In H1 2025, e-commerce further cemented its dominance in the learning tablet market. RUNTO's omnichannel data shows online sales hit 1.898 million units, a 24.2% year-on-year increase, accounting for 71.2% of the total market. The offline market, however, contracted due to poor store traffic and escalating marketing costs. While AI study rooms in regions with abundant high-quality teacher resources faced slight challenges, opportunities exist in lower-tier markets.

Within the online segment, both vertical and content e-commerce experienced simultaneous growth. Content e-commerce platforms like Douyin led the charge with targeted user reach and scenario-based marketing, accounting for 65.5% of online sales, an 8-percentage-point increase year-on-year, and a 44.8% sales surge.

China Learning Tablet Market Sales Channel Structure and Changes in H1 2025

Data Source: RUNTO Omnichannel Data, Unit: %

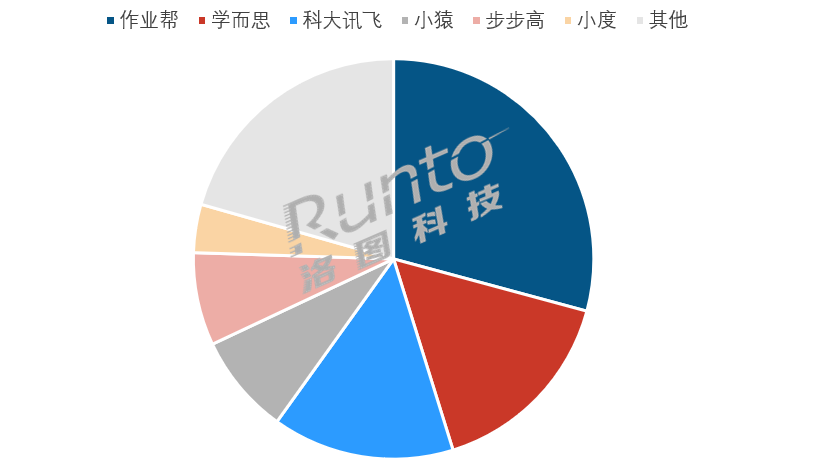

II. Brand Competition:

Market Concentration Intensifies, TOP3 Brands Account for 60% Share

Brand competition in China's learning tablet market is increasingly concentrated among the top players. RUNTO's omnichannel data reveals that in H1 2025, the top six brands—Zuoyebang, Xueersi, Iflytek, Xiaoyuan, BBK, and Xiaodu—held nearly 80% of the market share (CR6). Notably, the TOP3 brands (Zuoyebang, Xueersi, Iflytek) accounted for a whopping 60% of sales.

Zuoyebang led with a nearly 30% market share, thanks to its omnichannel strategy. Xueersi, focusing on high-end products, narrowed the sales volume gap with the leader but lagged in sales amount. Iflytek leveraged its strong offline presence and mature agency model. Xiaoyuan strengthened its "AI diagnosis-study-practice" identity through AI technology and question bank resources.

China Learning Tablet Market Omnichannel Brand Structure by Sales in H1 2025

Data Source: RUNTO Omnichannel Data, Unit: %

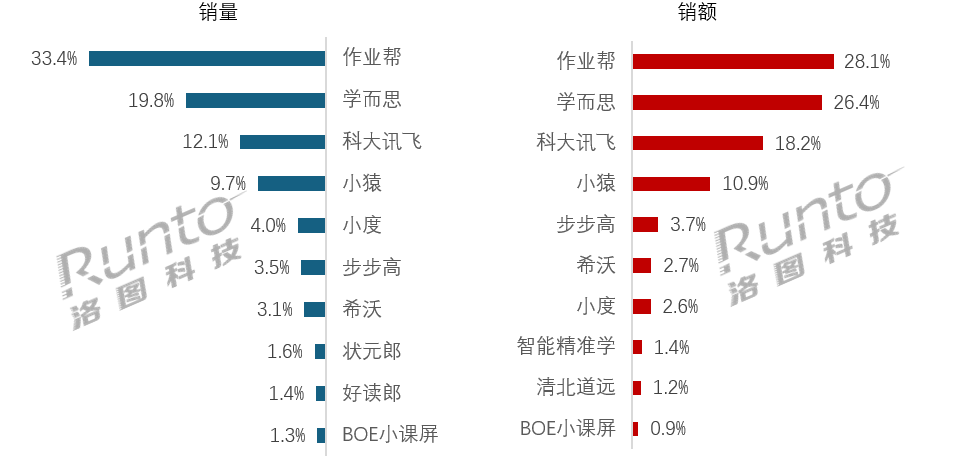

In the broader online market (encompassing vertical, platform, and content e-commerce), the TOP4 brands mirrored the omnichannel market, with consistent sales volume and amount. This suggests that early-stage discrepancies between sales volume and amount due to brand unit price variations are waning.

China Learning Tablet Online Market TOP10 Brand Share in H1 2025

Data Source: RUNTO Online Omnichannel Data, Unit: %

Market dynamics reveal that, besides the dominance of education and training enterprises and heightened concentration, another notable feature of brand competition is the transition from single-point breakthroughs to full price range coverage.

Zuoyebang solidified its position in the 1000-2999 yuan range and expanded into the 3000-3999 yuan segment, launching the X50 to capture the 4000+ yuan market.

Xueersi maintained its lead in the 5000-5999 yuan high-end market with its Xpad series while introducing the P4 to penetrate the sub-3000 yuan mid-range market.

Iflytek dominated the 6000+ yuan segment, concentrated resources on the 4000-4999 yuan and 2000-2999 yuan ranges, and streamlined low-end products to enhance profitability.

Xiaoyuan's new models, P40 and R1, strengthened its mid-range (2000-2999 yuan) and high-end (above 5000 yuan) offerings, while the T4, launched in July, entered the 4000-4999 yuan range.

III. Price Distribution:

Mid-range Market Booms, 2000-2999 Yuan Emerges as the "Golden Range"

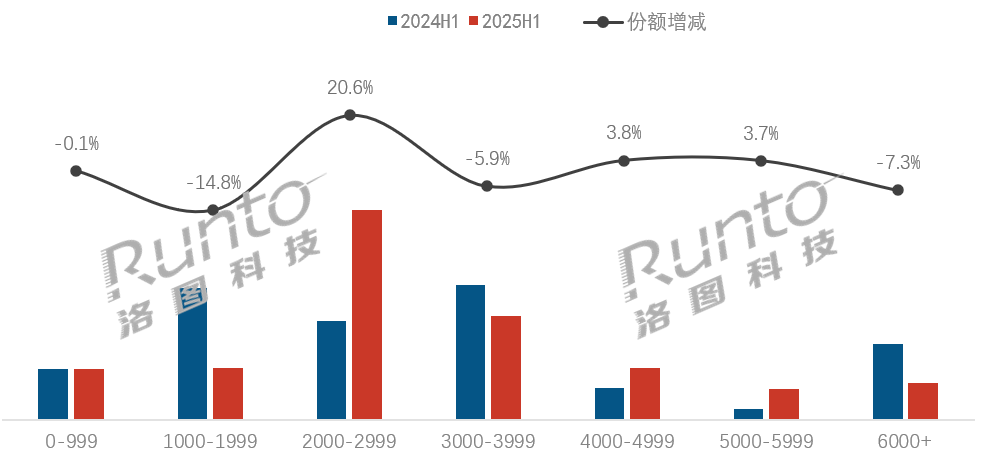

In H1 2025, the 2000-2999 yuan price range surpassed 1000-1999 yuan and 3000-3999 yuan to become the most popular choice. RUNTO's online data shows this range accounted for 39% of sales, a significant 20.6-percentage-point year-on-year increase. This shift reflects the "sweet spot" created by national subsidy policies, where products around 3000 yuan, after a roughly 500-yuan subsidy, fall within the 2500-2800 yuan range.

As a result, this price bracket has become the most targeted for new product launches and the most fiercely contested. Key models like Zuoyebang P30/P50, Iflytek P30, Xueersi P4, Xiaoyuan P40, Xiaodu K30, and Seewo V2pro all fall within this range.

Meanwhile, the 4000-4999 yuan and 5000-5999 yuan ranges also saw slight year-on-year increases of 3.8 and 3.7 percentage points, respectively. Conversely, the above-6000 yuan and 1000-1999 yuan ranges experienced the most significant declines, with the latter shrinking below 10% after a 14.8-percentage-point drop.

China Learning Tablet Online Market Price Range Sales Structure and Changes in H1 2025

Data Source: RUNTO Online Omnichannel Data, Unit: %

IV. Product Trends:

Deep AI Integration, Scenario Expansion, and Live Services

RUNTO observes that learning tablet product iterations are shifting from hardware stacking to "AI + scenario + ecosystem," with three major innovation directions dominating the H1 2025 market.

① Deep Integration of Large AI Models: The market has entered a new era of multi-model collaboration, with the fusion of general large models (e.g., DeepSeek) and vertical education-specific models becoming mainstream. The general model handles natural language understanding and interdisciplinary knowledge graph construction, while the vertical model optimizes educational scenarios, jointly enhancing personalized learning experiences.

② Expansion into Adult Education: Following the early childhood education market, learning tablets are now expanding into vocational education scenarios (e.g., postgraduate entrance exams, vocational skills training). Gaotu launched the Graduate Entrance Exam Pad, Offcn introduced the AI Employment Learning Machine, and Zhengbao Accounting Online School unveiled the Zhengbao Accounting Learning Machine, reflecting the market's expansion beyond K12 to a full lifecycle approach.

③ Accelerated Penetration of Live Services: The lack of parental supervision functions and a closed service loop within products represents a major pain point for learning tablets. Manufacturers are addressing this through AI study rooms and remote live teacher services. While the former model is resource-intensive, the latter offers a lighter and more cost-effective solution.

Live learning services encompass live 1v1 learning planning, online Q&A, classes by renowned teachers, guided learning and practice, detailed exam question explanations, and study companionship, providing a closed-loop educational service based on learning tablets. This service is poised to benefit from the current summer vacation period and, as prices decrease, could compensate for traditional learning tablets' lack of a closed loop, becoming a new growth area.

Brands and Models of Live Learning Services in China's Learning Tablet Market

Information Source: Collated by RUNTO

V. Market Forecast:

Full-Year Sales to Reach 6.79 Million Units, with Continuous Upgrades in Scenarios, Functions, and Services

RUNTO anticipates future market trends from multiple perspectives.

Scenario-wise, learning tablets are gradually expanding their age group coverage to adults, encompassing scenarios like postgraduate entrance exams, vocational skills, and employment counseling. They may also strengthen integration with other smart devices, forming a "learning IoT matrix" with smartwatches and printers to automate the entire process from homework printing to completion and correction.

Functionally, the declining cost of calling large AI models is transforming AI features from "gimmicks" to "rigid demands." According to industry chain information, the China Electronic Video Industry Association is actively developing standards for "AI Learning Machines" to standardize competition and guide product design, R&D, and marketing.

Service-wise, live learning services featuring 1v1 learning planning, online Q&A, and classes by renowned teachers offer a new direction for industry growth, further enhancing product capabilities.

As the year progresses, the third batch of 69 billion yuan in national subsidy funds is being disbursed, with the fourth batch of 69 billion yuan expected in October. Unlike other categories, with official inclusion in 2025 and uncertainty in 2026, China's learning tablet market is anticipated to grow at a higher rate in H2 than H1.

Based on H1 growth momentum and promotional models like back-to-school and Singles' Day in H2, RUNTO predicts that in 2025, sales of learning tablets in China's online and offline omnichannel market will reach 6.79 million units, marking a 14.6% year-on-year increase.