Does OPPO's 'Built-in Fan' Phone and Its Bet on AI and Mid-to-Low-End Market Pay Off?

![]() 08/04 2025

08/04 2025

![]() 460

460

As large AI models gain traction in edge devices, smartphone manufacturers are opting for active cooling solutions.

Do smartphones need built-in fans in the AI era?

OPPO's K13 Turbo series, featuring a 'built-in fan' active cooling system, has recently garnered significant attention. According to OPPO's official data, the daily activation volume of the K13 Turbo series increased by 380% on its first sales day compared to its predecessor.

As temperatures rise and the demand for smartphone performance soars, OPPO's decision to introduce the 'built-in fan' to the mid-to-low-end market with the K13 Turbo series could be seen as a test run. However, the substantial increase in daily activations compared to the previous generation validates, to some extent, the market feasibility of the active cooling fan solution.

Given OPPO's recent decision to abandon self-developed chips and its declining domestic market share, will increasing its focus on AI and fiercely competing in the mid-to-low-end market help it regain lost smartphone users?

1

Do AI smartphones need active cooling?

As early as 2019, Nubia's Red Magic 3 pioneered the use of a built-in fan for active cooling in smartphones, positioning itself as a gaming device. At the time, Red Magic 3 made quite an impression.

However, since then, major smartphone manufacturers have overlooked or 'shelved' built-in fans for active cooling for several years.

The primary reasons include: first, it requires carving out a significant space inside the smartphone, which is challenging due to the limited internal space. Second, it is difficult to pass dust and waterproof certifications because built-in fans for active cooling must have intake and exhaust vents. Thirdly, the addition of fans may increase the thickness of the smartphone, and repairs can also be an issue.

From current reviews, OPPO K13 Turbo Pro's L-shaped back-in, side-out fin solution doubles the airflow compared to Red Magic's through-flow solution while reducing volume occupation by about 70%. In terms of specific gaming performance, taking "Honkai: Star Rail" as an example, the OPPO K13 Turbo Pro outperforms the Redmi Turbo 4 Pro when the fan is turned on. From a performance and internal solution perspective, built-in fans for active cooling seem feasible.

Source: JiKeBay

Currently, the internal cooling structure of smartphones consists of multiple layers of VC vapor chambers, graphite heat dissipation films, copper foils, thermal grease, rear covers, and frame assemblies. The goal is to dissipate the heat generated by heat sources, essentially belonging to 'passive cooling'. Thanks to the popularization of built-in cooling devices like VC vapor chambers in 2021, coupled with continuous system optimizations, the performance of various smartphones has significantly improved.

In 2022, with the release of the Snapdragon 8 Gen 2 and MediaTek Dimensity 9200, Android smartphone processors began to catch up with or even surpass Apple's A-series processors. Manufacturers started to pursue full-frame operation for high-load games like "Genshin Impact", "Honkai: Star Rail", and "Honkai: Star Rail". Gaming performance became the primary battleground for smartphone manufacturers to showcase their devices' capabilities.

On the other hand, as smartphone performance improves, game developers have also enhanced graphics quality. At the same time, relevant reviews have extended their focus from gaming load frame rates to other indicators such as power consumption and heat generation.

However, the biggest issue with passive cooling is heat dissipation, which ultimately relies on passive contact with air, resulting in inefficiency. Active fan cooling solutions, on the other hand, form air convection inside electronic products to remove heat more quickly. Compared to traditional passive cooling methods, active cooling has advantages in thermal management capabilities. It can effectively prevent chips from downclocking due to high temperatures and, to a certain extent, unleash the performance potential of chips, supporting higher sustained power output.

With the increasing penetration of large AI models in edge devices, mainstream passive cooling solutions cannot meet the rapidly growing cooling demands of the industry. Therefore, the research and development of active cooling technology have been favored by capital.

According to Hardcore Tech News, Raymin Semiconductor has secured tens of millions of yuan in Pre-A+ round funding from Yida Capital and Hopu Capital. This is the third round of funding Raymin Semiconductor has received within a year, bringing its annual funding close to RMB 100 million. Li Bing, founder and CEO of Raymin Semiconductor, explained the company's focus on the cooling sector, stating, "From a market demand perspective, due to the rise of large AI models, there is an urgent need for cooling both cloud and edge chips."

Yao Bo, investment director at Yida Capital, analyzed that "cooling issues have become a consensus and urgent core pain point within the industry, and existing passive cooling solutions can no longer meet the rapidly increasing cooling demands."

Meanwhile, the industry has also made new breakthroughs in active cooling technology. According to Fast Technology News, at Computex Taipei 2024, Frore Systems launched AirJet PAK, the world's first plug-and-play, autonomous, solid-state active cooling module. It brings revolutionary cooling effects to various fields and devices, making them faster, quieter, lighter, thinner, and shock-resistant and dust-proof.

From relevant reviews, after being retrofitted with AirJet PAK, the MacBook Air M2 15-inch model maintains the same thickness but increases its CPU power consumption from 14W to 20W, with a 13% improvement in CineBench scores, reaching the level of the MacBook Pro 13-inch model while producing only 26 decibels of noise.

On June 16, AWinic Electronics announced the launch of its newly developed ultra-low-power, high-voltage 180Vpp piezoelectric micropump liquid cooling drive product, bringing liquid cooling solutions to mobile devices. The product has completed verification testing with multiple customers and is planned for mass production in the fourth quarter of 2025.

Like OPPO, the wind of active cooling has blown into the smartphone industry, with many smartphone brands planning to incorporate active cooling solutions into their new products. Previously, bloggers revealed that Huawei is already testing an active cooling solution with a built-in fan. The Huawei Mate 80 series may be the first to feature a cooling fan and support IP68-level dust and waterproofing, using active cooling to enhance the performance limits of Kirin chips.

Source: Digital Chat Station

Not only OPPO and Huawei but also mainstream domestic smartphone manufacturers like iQOO and OnePlus have been reported to be increasing their investments in active cooling by incorporating fans into their phones.

Northeast Securities believes that active cooling can unleash the unlimited potential of edge AI. The true value of the design of micro fans/micropump liquid cooling lies in paving the way for edge AI. The continuous full load characteristics of large language models during inference precisely require the stable output guaranteed by fans. As the performance race shifts from 'peak benchmark scores' to 'endurance', active cooling may become a required course for flagship smartphones.

Source: Northeast Securities Co., Ltd.

In the lives of ordinary people, even non-gamers need to pay attention to their smartphones' cooling systems. High temperatures in summer, long periods of high-specification video recording, and intense photography can place a heavy burden on a smartphone's cooling system. While it remains to be seen how many manufacturers will follow suit and implement this built-in fan solution in the market, OPPO has indeed become a pioneer in the 'cooling' race among smartphones.

As OPPO's K-series smartphone, the K13 Turbo Pro accurately targets the niche market of "high performance, long battery life, and limited budget." However, as a typical "one-sided student," the K13 Turbo Pro excels in gaming performance and battery life but compromises on sleek design and imaging performance.

The 380% increase in daily activations compared to the previous generation suggests that the precise positioning of the A and K series for different audiences may help OPPO solidify its market position and continue to expand its territory in the mid-to-low-end smartphone market.

In the fiercely competitive mid-to-low-end market, can OPPO achieve its goals?

2

Can OPPO break through by betting on AI and fiercely competing in the mid-to-low-end market?

It is worth noting that OPPO's K13 Turbo Pro directly competes with the Redmi Turbo 4 Pro. The OPPO K13 Turbo Pro starts at RMB 1,999, with a subsidized price of RMB 1,699. The Redmi Turbo 4 Pro is priced at RMB 1,888, with a subsidized price of RMB 1,614, leaving a price difference of just over RMB 80 after subsidies. The competition between the two in the mid-to-low-end smartphone market has been going on for quite some time.

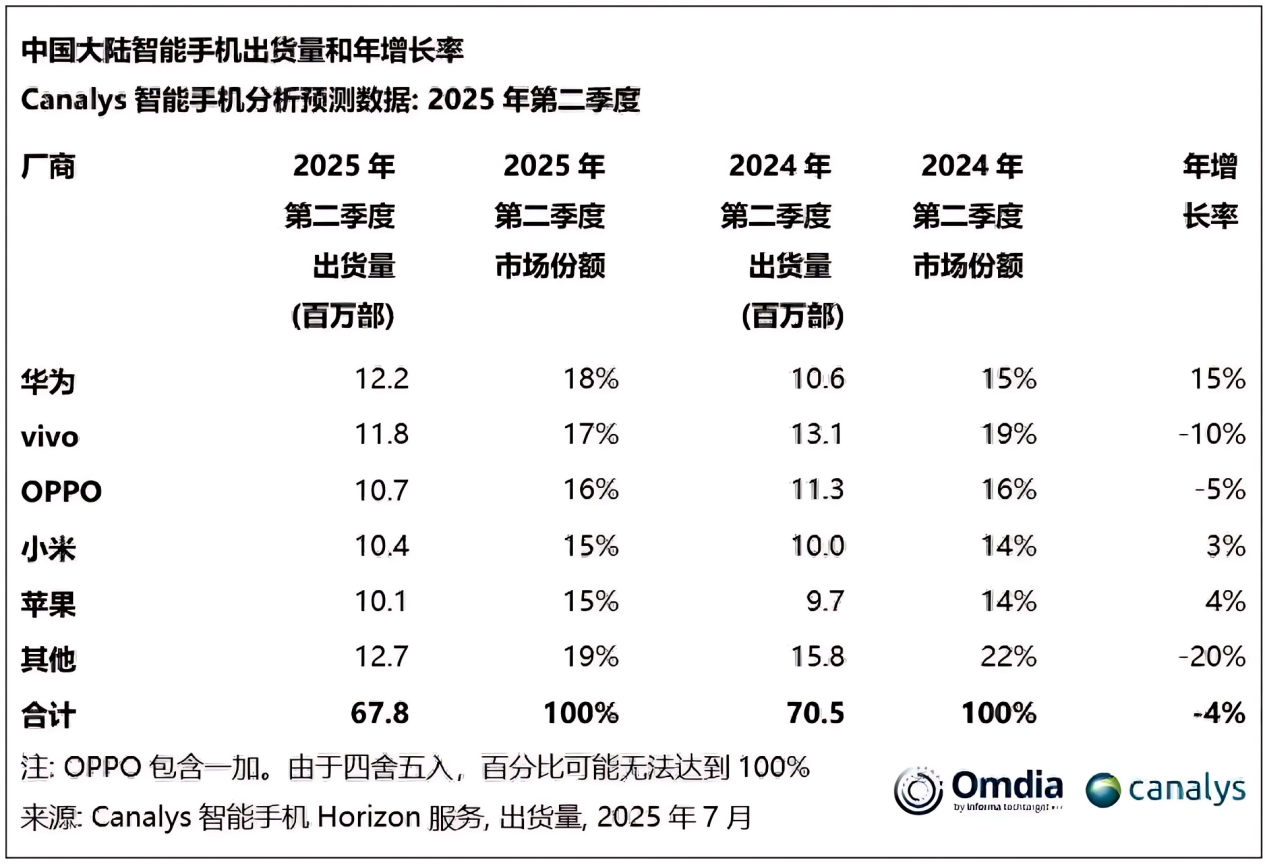

According to Canalys' Q2 2025 forecast data, OPPO ranks third with a 16% market share but has seen a 5% decline in shipments compared to the same period last year. While OPPO outpaces Xiaomi in market share, the gap in shipments between the two is narrowing.

Source: Canalys

Back in 2016, OPPO sold 99.4 million smartphones annually, jumping to the top four globally and number one in China with year-on-year growth rates of 132% globally and 109% in China. This trend continued until 2018, when OPPO topped the Chinese smartphone market with annual sales of 76.37 million units.

Leveraging its combined advantages of super fast charging and celebrity endorsements, OPPO expanded aggressively in third- and fourth-tier cities. However, as Xiaomi and other manufacturers intensified their offline layouts, OPPO's advantages diminished. At the same time, years of being labeled as a "factory girl phone" and "high price, low specs" made it difficult for OPPO to make breakthroughs despite its impressive sales figures. In 2019, OPPO's annual market share declined.

To change the "high price, low specs" label and break into the high-end market, OPPO shifted its marketing strategy, quietly reducing variety show sponsorships and celebrity endorsements while strengthening its technological approach. Taking the popular variety show "Who's the Murderer" as an example, OPPO sponsored it for five consecutive seasons starting from the second season. However, when the seventh season premiered, OPPO quietly withdrew from the sponsorship list.

In December 2019, OPPO's founder and CEO Chen Mingyong delivered a speech titled "Creating a New Ecosystem of Universal Interconnection" and announced that OPPO would invest RMB 50 billion in research and development over the next three years, focusing on cutting-edge technologies such as 5G/6G, AI, AR, and big data, including core underlying hardware technologies as well as software engineering and system capabilities.

At the same time, OPPO made changes in its management. In 2020, OPPO's management underwent continuous "upheaval" with Liu Bo being appointed as President of the China region, reporting directly to CEO Chen Mingyong. Shen Yiren, the former Global Marketing President, took a sabbatical, and his position was taken over by company veteran Liu Lie, who also concurrently served as Chief Marketing Officer for the China region. Additionally, Liu Zuohu returned and was appointed Senior Vice President of OnePlus Holdings, the parent company of OPPO, responsible for product planning and experience across the OnePlus portfolio.

The high-end route is often associated with self-developed chips. Taking Huawei as an example, in 2019, Huawei launched six chips in one go, ranging from the world's first 7nm chip to one supporting dual-mode 5G. The differences in self-developed chips allowed Huawei's share of the smartphone market to continuously climb, achieving the number one spot in the 5G smartphone market in 2019.

However, compared to Huawei HiSilicon's 20-year layout, OPPO did not have high sales and profits to support the research and development of self-developed chips. At the same time, for a company like OPPO with a single business, investing a large amount of financial resources every year to gamble on an uncertain future may not be truly necessary. In May 2023, OPPO's chip design subsidiary Zeku announced its dissolution.

At the time, OPPO responded that facing the uncertainties of the global economy and smartphone market, after careful consideration, the company decided to terminate the ZEKU business. Affected by the economic environment and prolonged user replacement cycles, OPPO's shipments fell to their lowest point since 2014 in 2022, with a year-on-year decrease of 22%.

Under the pressure of revenue, OPPO found it difficult to support such a huge capital expenditure and ultimately chose to "cut off its arm to stop the bleeding," which may have been a wise move under the circumstances.

However, abandoning self-developed chips is almost equivalent to abandoning high-end positioning. Therefore, OPPO has set its sights on the mid-to-low-end market and AI smartphones.

However, in the mid-to-low-end market, OPPO faces formidable competitors like Xiaomi and vivo. On March 28, 2023, during the launch of the Redmi Note 12 Turbo, Xiaomi specifically designed a performance challenge, benchmarking the entire process against OnePlus's newly released Ace 2V and Ace 2, proving that its frame rates and power consumption perform better in gaming scenarios.

So, what does OPPO have to compete with other manufacturers? The "OPhone" Find X8 suggests that OPPO seems to be betting on "what young users like." Young people like taking beautiful photos, so OPPO added soft lighting, film filters, and more; they like sharing Live Photos on social platforms, so OPPO integrated with Apple's HEIC format; they like straight screens and dynamic islands, so OPPO added those features. The list goes on.

Although it has been dubbed the "OPhone," OPPO Find X8 has demonstrated remarkable sales success in the Asia-Pacific, European, and other regions, according to 36Kr. Sales on the first day in key markets like Singapore, Thailand, Indonesia, Italy, Spain, and Malaysia have surged by 1 to 2 times compared to its predecessor, positioning it as the Find series product with the highest sales volume in the same period within the Chinese market.

OPPO's Chief Product Officer, Liu Zuohu, candidly expressed, "Our goal is to attract Apple users. To put it bluntly, we aim to offer Apple users an alternative option."

For a company like OPPO, which focuses on a single business line, another target sector it is currently aiming for is AI smartphones. In an internal letter in 2024, Chen Mingyong stated that AI smartphones will represent the third stage of the smartphone industry, following feature phones and traditional smartphones. However, most AI-related functions in OPPO's smartphones, such as search, voice recognition, and AI document handling, are already standard features in current smartphones or can be achieved through third-party applications.

Array

Array

Array

Array

Array

Array

Array

Array