HarmonyOS Surpasses 10 Million Users as iPhone 17 Faces Subsidy Dependency

![]() 08/08 2025

08/08 2025

![]() 666

666

Source: Sourcebyte

September 9, a date leaked by a German operator, is rumored to be the release date of the iPhone 17. However, the market isn't buzzing with anticipation; instead, a subtle sense of fatigue prevails.

Cook appears intent on squeezing the last drop from the toothpaste tube, but the market offers little leeway to Apple and its CEO. This meticulous strategy maximizes profits in stable markets but backfires in fiercely competitive environments.

As Huawei's HarmonyOS ecosystem takes shape and evolves at a visible pace, Apple's incremental upgrade approach seems outdated and unambitious.

A technology giant with a market value once nearing $4 trillion can't perpetually rely on subsidies to bolster performance.

01

'Exceeding Expectations' Propped Up by Subsidies

Apple's latest financial report boasts impressive figures. For the fiscal third quarter of 2025, total revenue hit $94.04 billion, a nearly 10% year-on-year increase, far surpassing market expectations of $89.53 billion. Revenue in Greater China amounted to $15.37 billion, up 4.35% year-on-year, reversing two consecutive quarters of decline.

On the surface, Apple achieved a 'better-than-expected' performance, but it's propped up by subsidies. 'Government subsidies do apply to some of our products, and they are clearly helpful,' Cook admitted during the earnings call.

Simply put, Apple's growth is subsidized, and the data supports this: government subsidies offer a 15%-20% discount on Apple products, making iPhones, iPads, and other devices seem more cost-effective.

Counterpoint Research points to the crux: Apple timed its price adjustments well before 618, leveraging this 'price war' in the Chinese market alongside official subsidies to produce this seemingly stellar report.

Cook's statement at the earnings call sparked controversy: 'Apple isn't keen on being first in the industry but can transform existing innovative products into hits and sweep the globe.'

This provides a definitive answer to the long-standing question of Apple's absence from the foldable screen market. The supply chain confirms that Apple's first foldable iPhone will enter mass production in Q4 2025, with an official launch scheduled for Q3 next year.

However, China's foldable screen market is fiercely competitive. The IDC report notes that the average price of foldable phones in China was 8,500 yuan in 2024.

As technology and the market mature, Apple's foldable phone may struggle to become a hit and capture market share.

Moreover, Apple's 'exceeding expectations' isn't built on product strength but on external forces like subsidies. When a tech giant needs price cuts and subsidies to sustain growth, it's a dangerous sign.

Victory purchased with money ceases to be victory.

02

HarmonyOS's 'Flywheel' is Already Spinning

While Apple complacently basks in a subsidy-supported financial report, Huawei's HarmonyOS has crossed the 'life-and-death line.' On July 30, Huawei announced that HarmonyOS 5 terminals surpassed 10 million.

Screenshot from Weibo @Huawei Terminal

Behind this milestone is a rapidly spinning ecosystem flywheel.

Application Ecosystem Boom: The WeChat HarmonyOS version has over 10 million installs with a 4-star rating. More than 50 Tencent apps are adapted, and 'Genshin Impact' has launched a HarmonyOS beta. Yu Chengdong, Huawei's Executive Director and Terminal BG Chairman, revealed that 98% of the top 3,000 apps are adapted.

Developer Influx: 8 million registered developers with over 30,000 native apps in development. From 'Zheli Ban' to major banks, HarmonyOS is deeply embedded in core sectors like government, healthcare, and finance.

Hardware Ecosystem Synergy: From smartphones to PCs to automobiles, HarmonyOS's distributed capabilities seamlessly connect devices. The Huawei MateBook Fold's launch directly challenges Apple's Mac territory.

Regarding price, while the MateBook Fold's starting price of 23,999 yuan is high, many netizens deemed it 'acceptable' or even 'lower than expected.'

'10 million users → application optimization → influx of new users' forms a virtuous cycle, ensuring exponential growth. According to Canalys, Apple's Chinese market share fell to 13% in Q1 2025, ranking fifth. In Q2, Huawei reclaimed the top spot with a 18.1% share, after several years.

While Apple's AI remains stuck in the 'PPT' stage, HarmonyOS 5.1 offers tangible intelligent experiences:

1. AI Peek Prevention Mode: On subways, the system detects peepers and blurs the screen content.

2. Dim Light Scanning: In extremely dark environments (-20 lux), it accurately recognizes payment codes from 15 meters or at a 30-degree angle.

3. Xiaoyi Intelligent Agent: Connected to Pangu large model 5.0, snapping a photo of the Forbidden City's red wall brings up the building's history and best tour route.

HarmonyOS is no longer a 'spare tire' but a genuine third pole, competing with iOS and Android.

This is what Apple should truly fear.

03

Old Debts Unpaid, New Ones Accumulating

In this scenario, if Apple persists with its incremental upgrade strategy for the September 10 release, subsidies might still be needed to save the day.

The biggest 'old debt' is AI.

In 2024, when Cook described Apple Intelligence as 'revolutionary' at WWDC, he might not have foreseen it becoming Apple's biggest marketing blunder in recent years.

To this day, in China, the world's largest and most competitive single market, Apple's AI functionality is virtually non-existent. Users spend tens of thousands on an 'AI flagship' only to find core functions unusable. On social media, 'PPT-level AI' has become an indelible label for iPhone 16.

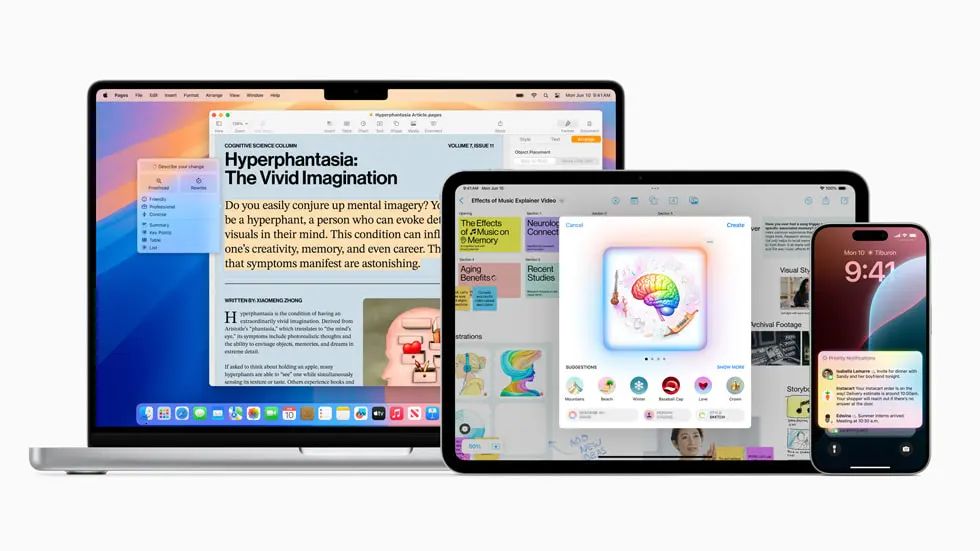

Screenshot from Apple's official website

This has tarnished Apple's reputation for user experience.

Apple hasn't repaid this debt yet.

According to the 'Global AI Trust, Attitude, and Application Survey Report (2025),' Chinese respondents' trust and acceptance of AI are significantly higher than the global average. Over half (58%) of global respondents actively use AI tools, with 31% using them weekly or daily. China's AI workplace application rate is 93%, with half (50%) of users normalizing its use, demonstrating a significant lead.

Deeply educated by AI, Chinese users are addicted, with daily high-frequency AI usage focused on high-compute functions like speech-to-text and real-time translation.

Without mature AI products, Apple hopes developers will invigorate the market.

At this year's WWDC, Apple announced opening local large model interfaces to developers. Compared to OpenAI's rich plugin system and Hugging Face's model community, Apple's 'openness' is limited. Apple has a long way to go in model tuning flexibility and ecological scalability to build an attractive AI development ecosystem.

Apple's App Store has 6 million developers. If 10% develop AI-based apps, it could spawn tens of thousands of innovative tools, significantly enhancing user stickiness. Renowned tech journalist Mark Gurman believes, 'Apple is using developers' creativity to offset its technological shortcomings. It's a gamble, but it's the only option.'

However, given the trend of AI application startups like Manus withdrawing from China, even a groundbreaking product might struggle to reach Chinese users due to current regulatory restrictions.

If iPhone 17 fails to deliver revolutionary upgrades in core experiences like AI, imaging, and communication, merely iterating on chips and tweaking design, it adds to the existing 'debt.'

Rumors about iPhone 18, next year's model, featuring under-screen 3D face recognition and 2nm chips, abound, exacerbating consumer dissatisfaction. Apple has new technologies but is reluctant to unveil them all at once.

Will Apple need another '618'-style promotion then?

For a global tech giant once nearing a $4 trillion market value, relying repeatedly on price subsidies to drive flagship sales is ironic.

September 9 looms, and Cook's time is running out.

The market no longer awaits functional tweaks but proof that Apple can still lead technological trends.