From "Genius" to "Cornerstone": Cook's Fourteen-Year Tenure of Stability at Apple

![]() 10/19 2025

10/19 2025

![]() 496

496

Author/Proton

Editor/Jiajia

In November 2025, Tim Cook, having reached the mandatory retirement age of 65, will step down from his role as Apple's CEO. As Steve Jobs' successor and the longest-serving CEO in Apple's history, Cook has delivered an exceptional performance: since assuming leadership in 2011, Apple's market value has soared by 1,100%, with revenue and profit increasing by 832% and 361%, respectively.

Cook's success is rooted in his decision not to emulate Steve Jobs. While many critics argue that Apple has lost its edge, failing to produce groundbreaking products like the iPhone 4 or iPad and instead releasing incremental iPhone updates that they label as "creatively stagnant," Cook has redefined Apple's growth trajectory. He has transformed Apple from a company primarily focused on hardware to one driven by an ecosystem that seamlessly integrates hardware with services.

This unique strategy, which diverges from Jobs' approach, has ushered Apple into a "Golden Age" of stability—shifting innovation from "lightning-striking" breakthroughs to "sun-like" sustained brilliance.

If Apple under Jobs was a "temple" of geek culture, representing the pinnacle of global manufacturing and design, then under Cook, it has evolved into a commercial empire, symbolizing consistent revenue and profit growth as the world's most profitable company.

Thus, Cook stands as the architect and helmsman who guided Apple from a tech-faith "temple" to a highly profitable commercial "empire."

【1】Stepping Up Amid Doubts

On August 24, 2011, when Steve Jobs resigned and strongly recommended Tim Cook as CEO, Apple's stock price dropped by 5% on the same day, reflecting severe doubts about Cook's capabilities.

Apple faced a dual threat from global competitors:

In the smartphone market, HTC surpassed Apple in the U.S. in the third quarter of 2011, while Samsung became the global leader in shipments.

In the tablet market, Amazon launched the Kindle Fire at a mere $199, compared to the iPad 2's starting price of $499.

All players vied for dominance in the post-Jobs era, raising questions: How could Apple maintain its leadership in consumer electronics without Jobs?

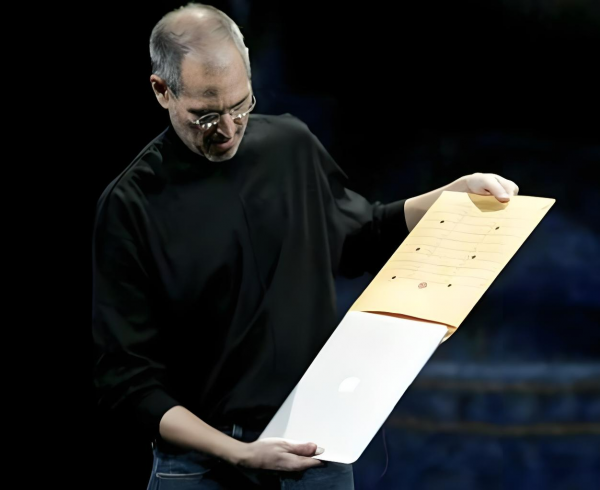

Historically, Apple's revival depended on Jobs' geek spirit and revolutionary products like the MacBook (emerging from a paper bag) or the iPhone (redefining smartphones). These era-defining products propelled Apple to global tech icon status.

(Source: Internet)

(Source: Internet)

Many believed Jobs' successor should mirror his passion and creativity—a star striker in soccer terms.

However, Cook's style was the antithesis: disciplined, even rigid, with a routine of "rising at 4 AM, working out at 5 AM, and reading emails by 6 AM" that he maintained for decades.

"Cook isn't the goal-scoring forward; he's the quiet guy who finishes everything and goes home," said Joe O'Sullivan, former Apple operations chief. Cook resembled a professional manager more than a passionate entrepreneur.

Critics argued that his focus on processes and efficiency might stifle innovation—a fatal risk for a company built on creativity.

Cook's divergence from Jobs' mold intensified skepticism.

In late 2011, Business Insider predicted ten ways Cook would "ruin Apple," ranging from a talent exodus to misguided retail hires.

Under Jobs' halo, few believed in Cook—or Apple's future.

【2】Reinventing Apple, Driving Growth

All doubts vanished by 2016.

Unlike Jobs' stubbornness in "telling consumers what they need," Cook prioritized listening to the market. This approach yielded Apple's best-selling iPhone 6 and 6 Plus, while securing market share in new categories.

In 2011, as all smartphone makers pursued larger screens (5-6 inches for Android rivals like Samsung and HTC), Apple remained arrogant, sticking to 3.5 inches. Jobs even vowed that Apple would never make phones "too large for one hand."

Under Cook, Apple bowed to market demands. The 2014 iPhone 6 series adopted 4.7-inch and 5.5-inch screens, catering to entertainment needs like gaming and video.

The iPhone 6 series became a global hit, selling 224 million units—the third-highest in smartphone history—and propelling Apple to the top smartphone supplier in China, up from sixth place.

The iPhone 6 epitomized Cook's Apple: shifting from relentless innovation to supply chain optimization and consumer-centric design.

Subsequent launches like the Apple Watch, AirPods, AirTags, and even the Apple Vision Pro prioritized practical results over "redefining" products:

By mid-2023, Apple Watch sales reached 229.3 million units, ranking fourth behind the iPhone, iPad, and AirPods. By the second quarter of 2025, cumulative revenue exceeded $100 billion (Counterpoint Research).

AirPods dominated the 2025 first-quarter wireless earbud market with 18.2 million units (23.3% share), becoming the global "earbud king" (Canalys).

AirTags, a simple Bluetooth tracker, sold 20 million units in eight months after its 2021 launch, popularizing a niche category.

(Source: Hexun.com)

(Source: Hexun.com)

Cook's Apple lacked "wow" products or revolutionary innovations but became the most profitable in history.

When Cook took over in 2011, Apple's revenue and profit were $47 billion and $25.92 billion, respectively. By 2024, these figures soared to $391 billion and $93.7 billion—up 832% and 361%.

"Only Jobs could create Apple, but only Cook could make it what it is today," said Warren Buffett, praising Cook as Apple's best CEO for propelling it to a $3 trillion valuation.

【3】Reshaping Apple for Long-Term Prosperity

In *The Three-Body Problem*, Liu Cixin describes a "Stable Era" when the Trisolaran planet orbits a single star, ensuring environmental stability and societal prosperity.

Cook brought Apple such an era—a "Stable Age" built on predictability and a solid foundation.

He shifted Apple's focus from betting on unpredictable "disruptive products" to becoming a precision-engineered, stable, and value-generating machine through internal and external restructuring.

Supply Chain Mastery: Cook fortified Apple's operational moat. By introducing contract manufacturers and other lean strategies, he slashed the iPhone's design-to-production cycle by 40% and reduced inventory turnover from one month to just five days—second only to McDonald's globally.

The 2020 Apple Silicon transition boosted Mac energy efficiency by 40% and ended reliance on external chip suppliers.

(Source: Internet)

(Source: Internet)

Strategic Repositioning: Under Jobs, hardware like the iPhone and iPad drove revenue. Cook transformed Apple into an "ecosystem company," weaving services like the App Store, Apple Music, iCloud, and Apple Pay into a seamless "hardware + software + services" network. This ecosystem boosted user loyalty and created high-margin revenue streams. Services revenue surged from $3 billion in 2011 to nearly $100 billion today.

Innovation Shift: Under Cook, Apple's innovation pivoted from creating "0-to-1" breakthroughs (like the original iPhone) to expanding and monetizing its existing ecosystem ("1-to-N").

While Cook's Apple faces criticism for diminished innovation, it is now healthier, more stable, and resilient from a business perspective.

Since 2011, Cook has evolved Apple from a "cult" of standalone products into an ecosystem, embedding predictable, long-term prosperity into its DNA.

Great enterprises need not just lightning-fast breakthroughs but also a sun-like persistence in brilliance. Cook's legacy is an Apple operating in a "Stable Era"—steady, powerful, and resilient beyond product cycles. This is his triumph and his enduring gift to Apple.

END