Samsung and its peers only want to serve OpenAI, disdaining the petty cash from PC builders.

![]() 10/30 2025

10/30 2025

![]() 407

407

Source: Byte Source

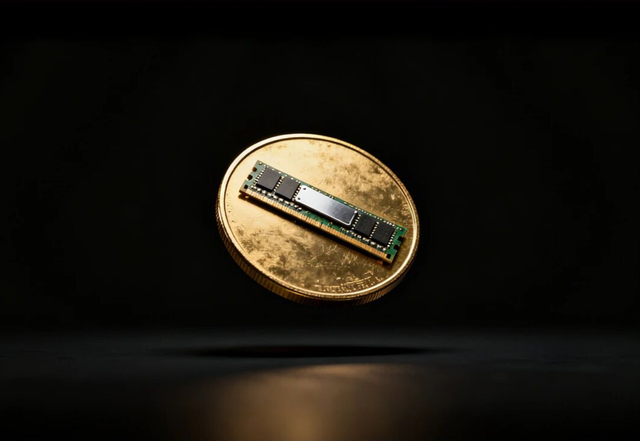

An ordinary DDR4 memory module has unexpectedly become this year's 'investment product.'

Since October, memory prices have skyrocketed, leaving many merchants in Huaqiangbei regretting not stocking up earlier in the year.

Currently, DDR4 product prices remain 'high and stable' with fluctuations, yet no significant signs of price reductions have emerged.

Observations by Byte Source reveal that not only memory but the entire PC assembly market is experiencing price hikes. Even mechanical hard drives, long dismissed by outsiders, have seen a 20% price increase.

Unlike previous cyclical trends, this surge is driven by an explosive demand for AI computing power. Driven by the global computing arms race, memory giants like Samsung, SK Hynix, and Micron have made strategic moves to align with tech giants, disrupting the consumer market's supply-demand balance.

In this market trend, memory giants have reaped substantial profits, while Huaqiangbei distributors have also benefited through stockpiling. Ultimately, only PC builders bear the brunt, silently enduring the consequences.

01 Early Signs

Memory prices have not been rising for just a day or two.

Starting in February this year, market rumors emerged suggesting that Micron, Samsung, and SK Hynix might halt DDR4 memory production by the end of the year. Additionally, Samsung reportedly set the final order deadline for DDR4 in June.

Subsequently, memory prices surged.

According to TrendForce data, the average spot price for DDR4 16G 3200 was $3.97 in early April. The price curve shows that by the end of May, the product price exceeded $6, and from June 12 onwards, the price curve began to 'soar.'

The trajectory of events unfolded as predicted by market rumors. In April, Samsung announced it would gradually cease DDR4 memory chip production to focus on higher-end, more profitable DDR5, LPDDR5, and HBM memory. Two months later, in June, Micron executives confirmed plans to discontinue DDR4/LPDDR4X production. Micron executives stated that the company had notified customers that DDR4 products would enter the phase-out stage.

This directly fueled the price surge in the third quarter. TrendForce research indicates that in the third quarter of 2025, DRAM prices soared by 171.8% year-on-year, surpassing the price increase of gold, which rose by around 110% during the same period.

Such a market trend has shocked the entire industry.

Chen Li, Chairman of ADATA Technology, stated that he had never witnessed such a market trend in his thirty-year career.

Even employees previously laid off by Huaqiangbei memory distributors have been gradually 'recalled' by their former employers.

'I never expected this turn of events—being laid off in midlife and then rehired,' one recalled employee admitted to Byte Source. After being unemployed at home for over half a year and contemplating a career change, they were rehired by their former employer.

Although DDR4 has entered the latter half of its product lifecycle, it still holds significant potential in niche markets such as industrial and consumer sectors. Due to the low storage performance requirements in these markets and the evident stability and compatibility advantages of small-capacity DDR4 and LPDDR1-LPDDR4x products, they still have ample room for growth.

Dongxin Semiconductor stated in its latest annual report that with the number of IoT terminal devices surpassing 10 billion and the demand for storage upgrades in traditional devices, the niche DRAM market exhibits strong resilience against cyclical fluctuations, distinct from the standard storage market. It is projected to maintain a compound annual growth rate of 5%-7% over the next five years.

02 Blame It on AI

The escalation of the AI arms race has fundamentally altered the supply-demand dynamics in the storage industry.

Domestically, Alibaba plans to invest over 380 billion yuan in the next three years to build cloud and AI hardware infrastructure; Tencent plans to increase its AI investment in 2025, with estimated related expenditures approaching 100 billion yuan.

Overseas, the fervor is even more intense, with the 'Stargate' project alone sending shockwaves through the entire tech industry.

On January 22, shortly after taking office, the Trump administration announced the ambitious 'Stargate' initiative aimed at securing U.S. leadership in AI.

Screenshot sourced from X

The ultimate goal of the 'Stargate' initiative is to establish a computing power network comprising hyperscale data centers, customized AI chips, and quantum computing simulation technologies, with a scale and strategic significance comparable to the 'Manhattan Project' during World War II.

The project plans to construct 25 supercomputing centers, with the first site in Austin, Texas, already deploying over 1 million NVIDIA Blackwell architecture GPUs, achieving a computing power density 15 times that of traditional data centers. By 2026, the network's computing power is projected to account for 35% of the global AI computing power market, forming a 'dimensional strike' against competitors.

To meet project demands, OpenAI procures 900,000 DRAM wafers monthly, accounting for nearly 40% of global production.

Subsequently, tech companies like Meta and Google have ramped up their supercomputing center construction. For instance, Meta recently secured financing close to $30 billion to build data centers in rural Louisiana, USA.

According to Cybersecurity Ventures, the global data center storage volume is projected to reach approximately 100 zettabytes (ZB) in 2025, an astronomical figure.

For companies like Samsung, SK Hynix, and Micron, these lucrative orders from tech giants represent a windfall. In comparison, the petty cash from the consumer market pales in significance.

Therefore, they have successively halted consumer-grade DDR4 production, shifting their focus to higher-specification flash memory chips like HBM to meet the computing power demands of tech giants.

Under such industry dividends, Samsung, SK Hynix, and Micron are essentially reaping profits effortlessly.

According to Jeff Kim, Head of Research at KB Securities in South Korea, if the current price surge continues, the profitability of non-HBM memory chips may even surpass that of HBM next year.

He estimates that Samsung's standard DRAM business operating profit margin was around 40% from July to September, while its HBM business reached 60%. Micron Technology predicted last month that both its HBM and non-HBM businesses would maintain healthy profit margins in 2026.

03 Impact on Hard Drives

The data center's demand for storage has also driven up the prices of mechanical hard drives, which do not rely on flash memory chip production capacity.

The price hike for mechanical hard drives began on September 12 when Western Digital publicly notified customers that the surge in demand for HDDs from AI and cloud service providers had reached unprecedented levels across all capacities.

Simultaneously, shipment delays were announced, with some delays extending up to 10 weeks. Subsequently, Seagate and Toshiba followed suit, gradually increasing the prices of all HDD products.

Although solid-state drive (SSD) prices have declined compared to their early days, the current cost per terabyte (TB) remains higher than that of mechanical hard drives. According to IDC, by 2027, 90% of global data center storage capacity will still be provided by mechanical hard drives, primarily due to their significant total cost of ownership (TCO) advantage.

Cost control remains a core consideration for data center operations. Currently, AI computing power investment accounts for over 40% of enterprise IT expenditures, putting pressure on storage budgets. Mechanical hard drives utilize workload tiering technology to separate low-frequency access content, such as model parameters and checkpoint data, from high-speed storage, helping hyperscale data centers save over 30% in storage expenses.

For ordinary PC builders, this situation is nothing short of catastrophic. Memory, solid-state drives, and mechanical hard drives are all surging in price. Combined with the already exorbitant graphics card prices, the cost of assembling a desktop computer priced around 5,000 yuan has increased by over 1,000 yuan.

Previously, the shortage in the consumer market caused by cryptocurrency mining was ultimately paid for by PC builders and ordinary consumers.

When Bitcoin prices soared, 'miners' worldwide crazy (fēngkuáng, meaning 'went crazy') scrambling to purchase graphics cards. NVIDIA, a company that should have served gamers, made a decision that went against its traditions.

While proclaiming, 'Gamers are our core users,' NVIDIA quietly launched 'professional mining cards' with disabled video output interfaces, specifically designed for mining. With a mere 90-day warranty, it was clearly a one-time deal.

During the mining craze, NVIDIA reaped substantial profits. In 2017, its gaming business revenue surged, and its stock price skyrocketed from $14 billion to $175 billion.

In 2020, the second mining craze arrived. NVIDIA almost replicated its actions from four years ago—launching the CMP series of professional mining cards once again, prioritizing production for miners despite facing backlash from gamers. It even acted as an 'official scalper,' openly selling cards at inflated prices on its official Weibo account (the RTX 3080 Ti was advertised at 1XXX9 yuan, higher than the suggested price of 8,999 yuan).

Once again, history repeats itself. In the face of massive orders from ordinary consumers and tech giants, capital has made the most pragmatic choice.

Some images are sourced from the internet. Please notify us for removal if there is any infringement.