Will AI Large Models Overturn E-commerce Giants like Taobao, JD.com, and Pinduoduo? Probably Not

![]() 10/30 2025

10/30 2025

![]() 450

450

The intriguing aspect of the AI large model sector is its duality: on one hand, products like Doubao, Tencent Yuanbao, Wenxiaoyan, Kimi, and DeepSeek have yet to establish a clear and reliable profit model; on the other, celebrities, experts, and influencers are fervently promoting AI courses. While platforms struggle to monetize, a plethora of AI courses priced at 9.9 yuan, 19 yuan, or 99 yuan are flying off the virtual shelves.

In November 2022, following the sensation caused by OpenAI's ChatGPT, the entire AI large model industry was set ablaze. Nearly all tech firms launched their own AI large model products, with hundreds flooding the Chinese market in a short span. Data reveals that as of August 31, 2025, a cumulative total of 538 generative AI services have completed filing nationwide, with 263 generative AI applications or functions having completed registration.

In today's information-rich era, many tech companies fear being left behind in the AI race. Uncertain about the viability of their products, they are nevertheless determined not to miss out.

Nearly three years have elapsed since ChatGPT's debut, and domestic AI large model products have been in the market for over two years. Now, they face a pressing question: how to generate revenue and whom to charge?

ChatGPT began charging users on February 1, 2023. Data indicates that from the start of 2025 to August 2025, the ChatGPT mobile app has raked in $1.35 billion in revenue, marking a year-on-year surge of 673%. OpenAI's total revenue for 2025 is projected to reach $13 billion, with 70% derived from consumer business.

Beyond ChatGPT, AI large models like Google's Gemini and xAI's Grok have also adopted charging models for end-users.

However, the domestic AI large model industry has taken a different path from the outset compared to products like ChatGPT, Gemini, and Grok. Initially, some products did experiment with charging models, but soon, a deluge of free AI large model products emerged, locking in the user-charging model. Everyone had to rely on business-to-business (B2B) charges, but the scale of B2B revenue was constrained, resulting in a significant revenue gap compared to products like ChatGPT, Gemini, and Grok.

Products like Doubao, Tencent Yuanbao, Wenxiaoyan, Kimi, and DeepSeek have been offering "free water" to users for over two years. From a business perspective, the ultimate goal of any product is to generate profit. No company will indefinitely sustain an unprofitable product. In the long run, companies like Tencent, ByteDance, Alibaba, and NetEase cannot afford to continue offering free services indefinitely. Many tech giants' new ventures initially promise free services and no charges for an extended period, but when the time comes, they implement charges without hesitation or resort to a barrage of "annoying" small ads. In any case, they won't remain free forever.

E-commerce, gaming, and advertising have traditionally been the three main profit models in the internet industry, with value-added services being the fourth. Apart from these, internet giants find it challenging to identify new profit avenues. When it comes to AI large models, an awkward situation arises: should they start displaying various small ads now? However, in a fiercely competitive industry, once the user experience declines due to ads, users will inevitably switch to competing products. Therefore, users can still find relatively good products without intrusive ads.

Products ultimately need to generate revenue. So, what can be done?

Recently, netizens discovered that Doubao, an AI product under ByteDance, has started integrating with e-commerce. After users input questions into Doubao, the results page displays recommended products with links to Douyin Mall, allowing users to shop with a single click.

If AI large models recommend products and links in their results, and users can directly jump to relevant e-commerce pages to complete purchases, does this imply that AI large models will overturn traditional e-commerce models like Taobao, JD.com, and Pinduoduo? After all, AI is perceived as much "smarter" than humans. Perhaps in the future, users' shopping paths will shift from AI large models to e-commerce, rather than directly purchasing on apps like Taobao, JD.com, and Pinduoduo.

A decade ago, entrepreneurs in the burgeoning internet industry had the audacity to discuss "disruption." However, by 2025, even giants like ByteDance, Tencent, and Alibaba hesitate to claim they will easily "disrupt" a mainstream industry. Now, if a startup claims "disruption," it is likely to be dismissed as mere "internet jargon."

According to Guo Jing's observations in the internet circle, different products exhibit varying situations in "AI" e-commerce.

Doubao: When queried for "purchase link recommendations," it prompted users to choose JD.com or Tmall as the purchase channel, with purchase links displayed below. However, it's uncertain if it was an API call issue, but the system-recommended links showed "the product has expired and does not exist." When asked to recommend "Douyin Mall links," the system recommended Douyin Mall links, not prioritizing Douyin product links as mentioned by netizens. It requires basic chat interaction before recommending relevant links, and further jumping to third-party links is necessary to complete purchases.

Kimi: It also necessitates adding "purchase links" to the query before the system will push relevant purchase links. During testing, there was also an API interface mismatch issue. When opening the system-recommended links, the product pages were clearly inconsistent with the original links, and many products were offline.

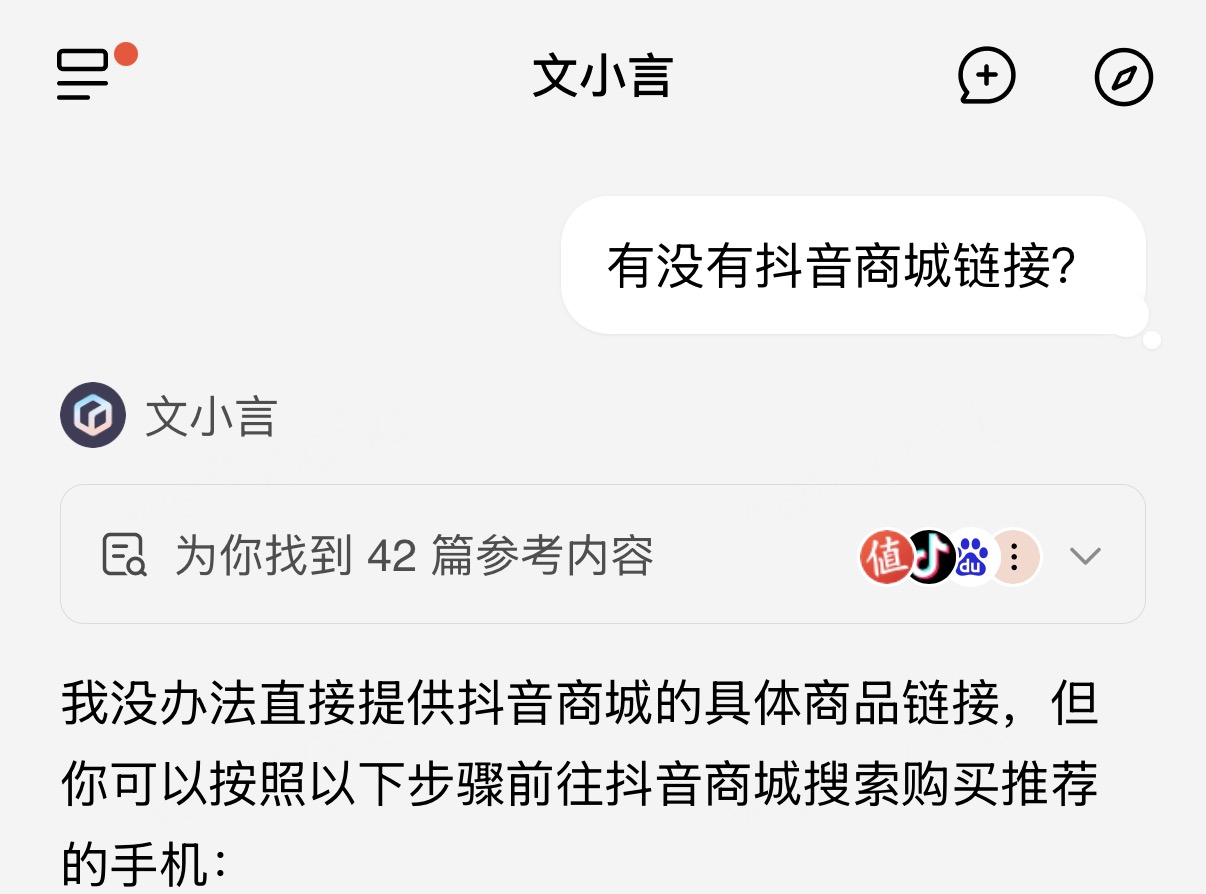

Wenxiaoyan: The system recommends links to JD.com's self-operated products. However, when queried for "Douyin links" and "Taobao links," the system indicated that it could not directly provide Douyin Mall and Taobao links, and users needed to follow its instructions to use them.

Tencent Yuanbao: Does not provide e-commerce link jumps.

From the testing of the above four products, the so-called "AI e-commerce" appears somewhat misnamed, or rather, their "AI e-commerce" is not what people imagine. If we delve deeper into specific utility, it becomes even more negligible.

Firstly, interface call and matching issues. In the PC era, search engines served as the gateway to websites. In the mobile internet era, major internet companies are reluctant to be constrained by any "gateway" products. The reason why 91 Wireless was valued at $1.9 billion back then was largely due to the "gateway" value of app stores. However, in the mobile internet era, all internet companies have realized that there should be no "gateways" or "toll fees." Each company pursues its own path, and major apps have become "information islands," isolated from each other.

No internet company dares to fully open its platform data to another. Everyone is on guard.

In other words, any large model product like Doubao, Tencent Yuanbao, Wenxiaoyan, Kimi, or DeepSeek must first obtain permission from Taobao, JD.com, and Pinduoduo to use their interfaces. Otherwise, there will only be a disconnect, with AI large models recommending users to search for products on Taobao, JD.com, or Pinduoduo.

The first step is to obtain interface authorization. The second step is to achieve accurate link matching. In today's world where major internet companies view data as core assets, getting them to open their interfaces is quite challenging.

Secondly, the difficulty of "comprehensive consideration." For example, Doubao has a closed-loop path: Doubao - Douyin Mall. The interface call and matching between them are not problematic. However, as a normal user, when shopping online, they may simultaneously compare products on Taobao, JD.com, and Pinduoduo, and may also look at platforms like Douyin Mall, Vipshop, and Suning.com. Users need "comprehensive consideration," and in this case, a single closed-loop path cannot meet user needs. Similarly, Alibaba's Tongyi can directly call and match Taobao's interface, but if asked to provide shopping needs for JD.com, Pinduoduo, or Douyin Mall, it cannot meet them.

Constrained by the fact that major apps are "information islands," AI large models can only achieve closed-loop AI e-commerce on a single platform and cannot achieve multi-platform closed loops.

There's also the issue of specific effectiveness. According to Guo Jing's observations in the internet circle, the products recommended by AI large models to users are mostly based on "past" results. Whether it analyzes dozens or a hundred or two hundred results, the final recommendations are based on "past" content. For certain issues, this recommendation method may be acceptable, but for shopping needs, it can cause significant problems. For example, for "phone recommendations," the system may recommend the latest iPhone 16 series, while Apple has already released the iPhone 17 series. The same issue can occur with Huawei, Xiaomi, OnePlus, and other manufacturers, where the system still recommends older products while new generations have been released. For users, an AI large model product recommending outdated products is simply misleading.

When shopping online, consumers are primarily concerned about two things: product price and authenticity. If AI large model products only recommend specific product models, it's not very useful. Users are more concerned about the price and where to shop online for the best deal. Another concern is authenticity. As genuine consumers, it's difficult to balance these two points, let alone AI large models.

Whether it's Taobao, JD.com, Pinduoduo, or other e-commerce platforms, the current online shopping environment is highly mature. AI e-commerce, apart from appearing "somewhat legitimate" in terms of path, is not very useful because the core issue remains: "where to buy good and cheap products."

In the best-case scenario, platforms like Doubao, Tencent Yuanbao, Wenxiaoyan, Kimi, and DeepSeek can conveniently jump to specific online shopping links, but how many people will actually do so is another question. After all, changing users' online shopping habits developed over nearly 20 years is no easy feat.

If the path from AI to e-commerce seems unreliable, the path from e-commerce to AI appears more effective. Currently, users' online shopping habits still rely on keywords like "phone" or "charger." With the help of AI, users can have more suitable descriptions of their needs. For example, "I am a XXX-year-old male, XX tall, XXX weight, and I want to buy a XX-colored down jacket priced around XX yuan. Please recommend one."

Currently, e-commerce platforms are still somewhat "dumb." Even if "men's style" is entered in the keywords, "women's style" content still appears in the recommendation feed. The presence of such ineffective content indicates that the platform's understanding of words needs improvement, and hopefully, AI can make them smarter.

Consumers can shop on e-commerce platforms by "conversing with AI," which is more precise and efficient than conventional shopping.

Embedding AI large models into e-commerce platforms, rather than embedding e-commerce links into AI large model platforms, seems like a more viable approach.

The path of AI large models making money through e-commerce seems unviable. Asking those who sell AI courses may not yield a satisfactory answer.

Written by Guo Jing. WeChat public account: Guo Jing's Internet Circle