How long can Tencent Music continue to 'harvest' its remaining user base as its monthly active users keep declining year after year?

![]() 11/19 2025

11/19 2025

![]() 432

432

Nowadays, the environment of China's digital music market has already undergone significant changes. The exclusive copyright barriers for online music have been dismantled, making it difficult for Tencent Music to rely on its financial advantage to accumulate exclusive copyrights and suppress competitors.

Author/Wuzi

Produced by/Xinzhaicaijing

Tencent Music has once again proven that music streaming services can be a 'profitable business.'

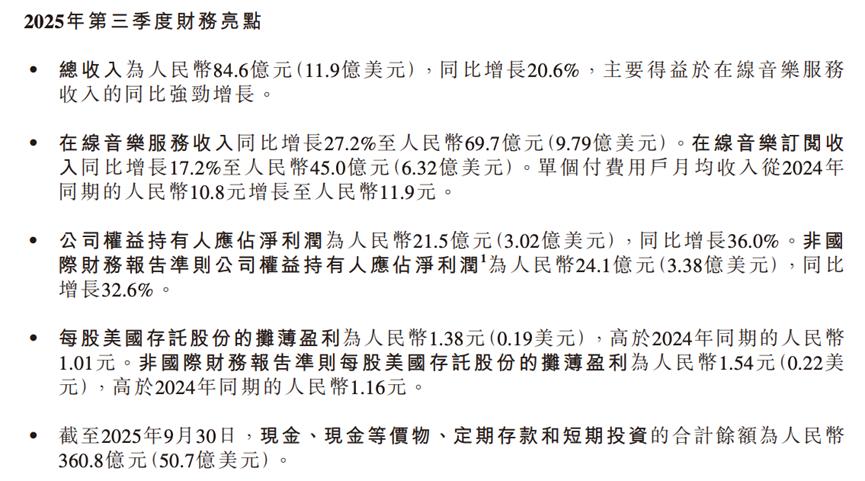

Source: Tencent Music's Q3 2025 Financial Report

After the Hong Kong stock market closed on November 12, 2025, Tencent Music released its Q3 2025 financial report, showing revenue of 8.46 billion yuan, a year-on-year increase of 20.6%, and net profit of 2.48 billion yuan, a year-on-year increase of 27.7%.

Source: Baidu

However, after delivering strong financial results, Tencent Music's stock price experienced a sharp decline. On November 13, its Hong Kong stock price closed at HK$75.6 per share, down 10.69% in a single day. In fact, looking at the longer term, since September 2025, Tencent Music's stock price has been continuously declining, with a cumulative drop of nearly 30%.

It is well known that the capital market cares not only about a company's current performance but also about its long-term competitiveness and vitality. The fact that Tencent Music delivered strong financial results yet its stock price weakened may be due to some investors with a pessimistic outlook on its future taking advantage of the positive sentiment to sell their holdings.

Although Tencent Music has become the leader in China's digital music market, its market position is not entirely secure. This is because ByteDance's Spark Music is rapidly rising with its 'algorithm + low-price' strategy. Against this backdrop, Tencent Music's ability to maintain positive growth is largely due to its continuous extraction of 'residual value' from its remaining user base.

For internet platforms, continuously expanding their user base is the top priority in daily operations. Focusing solely on the remaining user base means that Tencent Music will face growth limitations in the future.

I. Tencent Music's Aggressive 'Gold Mining' Yields Profit Margins Exceeding Spotify's

Due to its early start and successful entry into the capital market, Spotify was once considered the 'mentor' for domestic music streaming platforms. When it went public in 2017, Tencent Music invested heavily to acquire a vast amount of exclusive music copyrights and then told a paid music business story similar to Spotify's.

In recent years, by continuously deep cultivation (deepening its presence) in China's music streaming sector, Tencent Music has surpassed Spotify, exploring new growth points beyond simple paid models.

Source: QQ Music

Around online music subscriptions, Tencent Music has created a multi-tier membership system to meet the needs of different users. In addition to standard membership, Tencent Music has focused on offering higher-priced super memberships, which provide subscribers with exclusive skins, Dolby sound quality, early access to digital albums, and other services or benefits.

Furthermore, in mid-2025, Tencent Music launched a fan interaction subscription product called Bubble, priced at 28 yuan per month for continuous subscription. After subscribing, users can receive text, images, voice messages, and other updates from their idols in real-time.

Beyond music streaming, Tencent Music has also extended its reach into the upstream music industry chain. According to Tianyancha data, in Q3 2025, Tencent Music's non-subscription revenue from online music services reached 2.47 billion yuan, a year-on-year surge of 50.61%. This was mainly due to Tencent Music organizing and hosting numerous large-scale tours domestically and internationally for artists such as G-Dragon, Fiona Sit, and Tia Ray.

Driven by a series of innovative business models, Tencent Music's performance has steadily improved. Financial reports show that in the first three quarters of 2025, Tencent Music's revenue reached 24.26 billion yuan, a year-on-year increase of 15.8%, and net profit reached 9.07 billion yuan, a year-on-year increase of 80.3%.

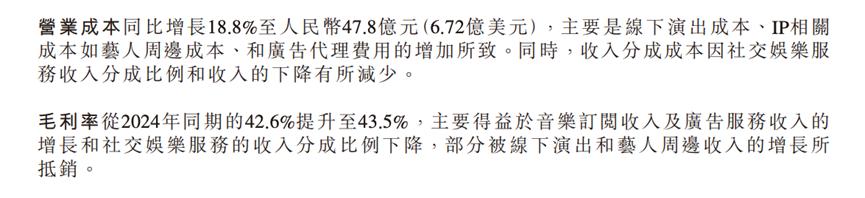

Source: Tencent Music's Q3 2025 Financial Report

More importantly, although Tencent Music's user base is currently smaller than Spotify's, its profit margins have surpassed those of Spotify. Financial reports show that in Q3 2025, Tencent Music's gross profit margin was 43.5%, 11.9 percentage points higher than Spotify's, and its operating profit margin reached 32.03%, 18.43 percentage points higher than Spotify's.

II. Behind Strong Performance, Tencent Music 'Exploits' Its Remaining User Base

After a series of diversified strategies, Tencent Music has indeed developed a balanced business portfolio. However, it is important to note that Tencent Music has not achieved its strong performance through the simultaneous growth of multiple businesses but rather by 'exploiting' its remaining user base to sustain growth.

Financial reports show that in Q3 2025, Tencent Music's monthly active users for online music services reached 551 million, a year-on-year decrease of 4.3%, marking the 16th consecutive quarterly decline.

Source: QuestMobile

QuestMobile's '2025 China Mobile Internet Autumn Report' shows that in September 2025, the monthly active users of Tencent Music's music apps all declined year-on-year. Among them, Kugou Music had 210 million monthly active users, down 8.1% year-on-year; QQ Music had 190 million monthly active users, down 2.8% year-on-year; Kuwo Music had 113 million monthly active users, down 8% year-on-year; and WeSing had 36.92 million monthly active users, down 16.6% year-on-year.

Although during the same period, Tencent Music's paid user base reached 126 million, a year-on-year increase of 5.6%, a longitudinal comparison shows that since Q3 2023, its paid user growth rate has declined for eight consecutive quarters.

Against the backdrop of a shrinking user base and a plateauing paid user base, Tencent Music has turned its attention to its remaining user base.

In the past few years, Tencent has not only introduced a multi-tier membership system to encourage users to subscribe to higher-cost super memberships but has also repeatedly raised the prices of basic memberships.

Source: QQ Music

In July 2023, the continuous monthly subscription price for QQ Music's luxury green diamond membership increased from 13 yuan to 15 yuan, a 15.38% increase. Six months later, the automatic renewal monthly subscription price for QQ Music's luxury green diamond membership also increased from 11.4 yuan to 15 yuan, a 31.58% increase.

Although the overall user base has peaked, by deeply excavate the 'residual value' of its remaining user base, Tencent Music has achieved higher returns. Financial reports show that in Q3 2025, the average monthly revenue per paid user for Tencent Music was 11.9 yuan, a year-on-year increase of 10.2%.

This means that even if the paid user base stops growing, Tencent Music's performance can still achieve double-digit growth through price increases. However, the capital market is not optimistic about Tencent Music's ability to sustain performance growth through price increases, as it faces challenges from a major competitor.

III. ByteDance's Aggressive Entry Poses Challenges for Tencent Music

The continuous decline in Tencent Music's monthly active users over the past few years is partly due to the disappearance of mobile internet traffic dividends and partly because ByteDance has attracted a large number of price-sensitive users with its low-price advantage.

QuestMobile's statistics show that in September 2025, the monthly active users of Spark Music and Tomato Music (a music streaming app under ByteDance) reached 120 million and 38.23 million, respectively, with year-on-year surges of 90.7% and 92.4%, far exceeding the growth rates of competitors.

Source: Spark Music

It is understood that both Spark Music and Tomato Music are music streaming apps developed by ByteDance. Unlike music apps such as QQ Music, Kuwo Music, and Kugou Music, which charge high membership fees, Spark Music and Tomato Music offer extremely low membership prices and frequently run promotions to give away free VIP access.

Against the backdrop of Tencent Music's focus on extracting 'residual value' from its remaining user base, ByteDance provides users with lower-cost music streaming services, naturally diverting market influence away from Tencent Music.

What makes Tencent Music even more anxious is that ByteDance's music streaming services not only have a price advantage but also a more competitive business model. As is well known, ByteDance's core strength lies in its algorithmic recommendations, which have enabled it to create revolutionary products such as Toutiao and Douyin (the Chinese version of TikTok).

Source: Spark Music

In the music streaming sector, ByteDance continues to leverage its algorithmic recommendation strengths. When users open Spark Music, they can filter music in a way similar to browsing Douyin. As usage time increases, Spark Music's understanding of user preferences becomes more accurate, continuously improving the recommendation experience.

It is foreseeable that as playlists and algorithms increasingly align with personal preferences, these intangible assets will significantly enhance user stickiness and gradually evolve into Spark Music's core competitiveness.

Admittedly, Tencent Music has previously faced challenges from NetEase Cloud Music but ultimately succeeded in breaking through by relying on exclusive copyright resources to become the industry leader.

However, the environment of China's digital music market has already undergone significant changes. The exclusive copyright barriers for online music have been dismantled, making it difficult for Tencent Music to rely on its financial advantage to accumulate exclusive copyrights and suppress competitors.

Previously, Douyin defeated Tencent's Weishi (a short video app) through algorithmic recommendations. Now, a similar challenge lies ahead for Tencent Music. If it fails to quickly come up with effective countermeasures, Tencent's music business may once again be defeated by ByteDance.