The AI hardware market is experiencing explosive growth

![]() 01/26 2026

01/26 2026

![]() 330

330

Inside the temples of a pair of AI glasses lies a flattened smartphone—a vivid metaphor used by the industry to describe current AI hardware. At CES 2026 in Las Vegas, over 50 manufacturers showcased their new smart glasses, with Chinese brands occupying a prominent position. Less than two weeks after CES 2026 concluded, the excitement from the event had already spread throughout the entire industry chain. Smart glasses were included in the national subsidy catalog for large-scale equipment updates and trade-in programs, becoming one of the four major subsidized categories alongside smartphones and tablets.

Data from market research firm IDC shows that shipments in China's smart glasses market surged by 62.3% year-on-year in the third quarter of 2025. Global tech giants and Chinese internet companies are rushing into the AI hardware sector at an unprecedented pace, with products like Alibaba's Kuake AI Glasses, ByteDance's Doubao Mobile Assistant, and Baidu's Wenxin Yiyan Glasses being launched in rapid succession.

Meanwhile, investment sources indicate that OpenAI is aggressively recruiting hardware engineers from Apple, planning to launch its own AI hardware product in what is seen as an attempt to create an 'AI version of the iPhone.'

01

The Panorama of AI Hardware

When discussing AI hardware, the focus should not be limited to the eye-catching form of glasses. In reality, it represents a complete ecosystem spanning from foundational infrastructure to front-end interactive terminals. This ecosystem can be clearly divided into three layers: the 'foundational layer' providing core computing power, the 'terminal layer' serving as the capability carrier, and the 'integration layer' tailored for specific scenarios.

In the foundational layer, AI chips (such as NVIDIA GPUs and Google TPUs) act as the invisible engines of the entire intelligent era, delivering robust computing power for training and running large models. The terminal layer is flourishing with diversity—beyond AI glasses on the verge of explosion, familiar devices like AI PCs and AI smartphones are undergoing profound self-revolution, evolving from tools into intelligent agents capable of proactively understanding and executing tasks. Smart speakers and earphones are integrating more powerful models, while cutting-edge explorations like AI Pins, smart rings, and even humanoid robots point toward a future of more seamless and embodied interactions.

At the integration layer, AI transforms into professional scenario-based solutions, ranging from intelligent driving computing platforms in automobiles to AI quality inspection cameras in factories. However, among all terminal forms, AI glasses are rapidly moving from geek gadgets to the center stage of mass consumer electronics. Especially at this year's CES, they have become more than just products—they symbolize tech companies' struggle for dominance in defining the next generation of computing platforms. This concentrated explosion is not accidental but an inevitable outcome of technological, market, and ecological evolution reaching critical junctures.

02

AI Glasses: On the Eve of Explosion

At this year's CES, Chinese exhibitors numbered 942, accounting for approximately 22% of the total. The clearest signal from the event was that AI is transitioning from the digital world to the physical realm. NVIDIA founder Jensen Huang systematically elaborated on the concept of 'Physical AI' for the first time at the conference, emphasizing the deep integration of AI technology with hardware to enable understanding and interaction with the physical world. This shift provides a strategic direction for the development of AI hardware.

China's AI glasses industry is experiencing unprecedented policy and market dual drivers. In late December 2025, the National Development and Reform Commission and the Ministry of Finance jointly issued the Notice on Implementing Large-Scale Equipment Updates and Consumer Goods Trade-In Policies in 2026, explicitly including smart glasses in the subsidy range for new digital and intelligent product purchases. This marks the first direct national-level support for smart glasses.

Globally, Counterpoint data shows that global smart glasses shipments surged by approximately 110% year-on-year in the first half of 2025. Market forecasts are even more optimistic: Morgan Stanley predicts that global AI glasses shipments could reach 35 million units by 2028, while Citi forecasts a compound annual growth rate of 105%, with shipments reaching 112 million units by 2030.

Leading manufacturers showcased diverse technological approaches at CES 2026: Thunderbird Innovation launched the X3 Pro Project with eSIM support, enabling AI glasses to connect to the internet and make calls independently of smartphones for the first time. Lingban Technology unveiled the screenless AI glasses Rokid Style, weighing just about 38.59 grams, targeting daily wear comfort. XGIMI, renowned for its smart projectors, also announced its entry into the AI glasses track (literally 'track' or 'sector' in Chinese, referring to the market segment), launching the 'MemoMind' brand. As more companies enter, the smart glasses market is exhibiting unprecedented vitality, marking the industry's transition from conceptual verification to large-scale application.

Alibaba formed the Kuake AI Glasses Industrial Ecosystem Alliance with Qualcomm, Luxshare Precision, Doctor Glasses, and other companies. Smart glasses manufacturer XREAL signed strategic cooperation agreements on the AI/AR industry chain with Longcheer Technology and Jingsheng Mechanical & Electrical. Companies like Goertek, AAC Technologies, and Sunny Optical have also made significant progress in core technologies such as micro-displays and optical waveguides.

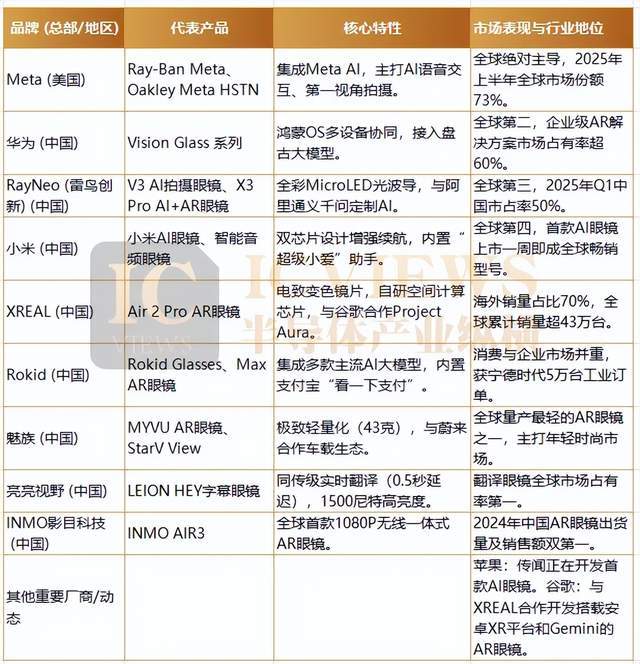

From a regional market perspective, significant differentiation exists. Overseas, especially in North America, Meta dominates with its Ray-Ban series, holding a 73% market share in the first half of 2025. In contrast, while China's overall market share still lags, its growth momentum is extremely strong—shipments exceeded 1 million units in the first half of 2025, accounting for 26.6% of the global market, with active performance by local brands emerging as a formidable force.

The competitive landscape features a distinct 'one superpower, multiple strong players' dynamic. Meta temporarily holds the 'one superpower' position globally, while numerous Chinese brands constitute the 'multiple strong players' camp (literally 'camp'). These Chinese participants can be primarily categorized into three groups: first, consumer electronics giants like Xiaomi and Huawei, with the former focusing on cost-effectiveness and the latter building a full-stack ecosystem; second, vertical-domain brands like Thunderbird Innovation and Rokid, exceling in self-developed optics and dual-line layout (literally 'layout') in consumer and enterprise markets; third, cross-border entrants like NIO, Alibaba, Baidu, and ByteDance, focusing on vehicle-device integration or ecological service extensions.

In terms of product strategy, mainstream manufacturers generally adopt a 'dual-track' approach. On one hand, they launch smart glasses focused on AI photography and audio interaction (such as Ray-Ban Meta) to lower price barriers and drive market adoption. On the other hand, they actively develop AI+AR glasses with integrated display capabilities (such as Ray-Ban Display) for higher-order productivity, entertainment, and interaction scenarios, paving the way for future form factors.

This technological and market evolution is directly reflected in a broad price stratification. Current market prices range from basic functional products costing a few dozen dollars to high-end AR glasses nearing a thousand dollars, forming a multi-tiered landscape. In 2025, the Chinese market exhibited two major trends: AI audio photography glasses are exploring the mid-to-high-end price range above 1,500 yuan, while AI+AR glasses, while maintaining their high-end share, are also adjusting their internal product structures. Through rapid iteration (such as generational upgrades of Meta's Ray-Ban series) and systematic tiered pricing strategies (such as Thunderbird Innovation covering the entire range from 1,000 yuan to nearly 10,000 yuan), the industry clearly maps out a path of technological advancement and value enhancement.

03

Acclaim But Difficult Sales

The AI glasses market presents a paradoxical landscape: on one hand, explosive growth in shipments and enthusiastic capital pursuit; on the other, multiple practical bottlenecks in user experience, ecosystem construction, and mass production capabilities. This surface-level prosperity intertwines with inherent challenges, sketching the genuine growing pains as the industry bridges the gap between early adopters and the mainstream market.

At the hardware performance level, the industry is generally trapped in the 'impossible trinity' dilemma of 'lightweight design, long battery life, and high performance.' Pursuing an ultra-thin appearance inevitably requires compressing battery space, sacrificing battery life. Meanwhile, powerful on-device AI computing power and real-time interaction capabilities lead to significant power consumption and heat generation. For instance, Meta's Ray-Ban Meta smart glasses see their battery life plummet to just about 30 minutes during continuous AI dialogues, directly embodying this contradiction. This fundamental conflict further manifests as specific user experience pain points (such as discomfort during wear, poor photography quality, and unstable connections) and high cost structures. Optical displays (accounting for approximately 43% of costs) and main control chips (about 31%) are the two major cost centers. Currently, the cost-effective Birdbath optical solution dominates over 90% of the market share due to its technological maturity. However, the high costs of optically superior technologies like waveguides and full-color Micro-LED, seen as the future direction, are key constraints hindering the popularize (literally 'popularization') of high-end products. Technological advancements showcased at events like CES 2026 offer possibilities for future cost reductions.

Beyond hardware contradictions, fragmented ecosystems and privacy concerns pose another layer of soft obstacles. Unlike Meta overseas, which can integrate with its own social platforms, domestic brands rely on different large models (such as Alibaba's Qianwen and Huawei's Pangu) and systems, creating 'data silos' with high adaptation costs for developers and inconsistent user experiences. A deeper challenge lies in the first-person, unobtrusive photography nature of AI glasses, which makes privacy and security issues unprecedentedly prominent. Yet, the industry still lacks unified behavioral norms and technical standards.

Secondly, supply chain maturity is another major bottleneck restricting industrial scale and stability. While AI glasses can leverage parts of the mature consumer electronics supply chain, stringent requirements for low power consumption, miniaturization, and high performance result in low manufacturing yields in several key segments (such as special optical components, micro-batteries, and highly integrated chip packaging). This directly leads to difficulties in ramping up production and unstable market supply. A typical case is Sharge Technology, which, after high-profile launching China's first mass-produced AI photography glasses in late 2024, immediately faced a dilemma where production could not meet order demand, highlighting the vast chasm between 'launch' and 'stable delivery.'

04

Internet Giants: Collective Entry

The influx of internet giants into the AI hardware track (literally 'track' or 'sector') stems from their competition for the next generation of human-computer interaction interfaces.

ByteDance collaborated with ZTE to launch the Doubao Mobile, whose built-in system-level AI assistant, 'Doubao Mobile Assistant,' gains global control across applications, performing various operations under user voice commands. Recently, Anker Innovations and Feishu (a ByteDance subsidiary) jointly released the latest AI hardware—the Anker AI Recording Bean. Anker handles hardware R&D, while Feishu provides software AI adaptation and services, focusing more on software and AI capabilities, as well as open interfaces that allow device recordings to directly integrate into the Feishu ecosystem. Recording files are automatically imported into Feishu and precipitate (literally 'precipitated' or 'stored') as Feishu documents. Currently, the underlying large model technology for the Anker AI Recording Bean is still supported by Doubao. The AI Recording Bean resembles a round button, supporting both Bluetooth and Wi-Fi transmission modes. Users can wear it directly on their collars or sleeves or attach it to the back of their phones using magnetic accessories.

Alibaba adopts a 'software and hardware synergy' strategy, penetrating through software products like the Kuake Browser while launching hardware products such as the Kuake AI Glasses and DingTalk A1, forming a two-pronged approach of cross-device ecological collaboration and vertically segmented hardware ecosystems. Baidu, leveraging its Xiaodu smart hardware matrix, focuses on home AI scenarios, building an 'active whole-house AI system' that proactively judges user needs based on voice, image, location, and behavioral data.

Yue Yang, co-chief analyst of the electronics team at Huachuang Securities, points out that system-level innovations in AI mobile assistant systems could become a new revolutionary wave, akin to the upgrade from DOS to Windows in computer systems or from Symbian to Android in mobile systems. Such system-level innovations are reshaping the fundamental modes of human-computer interaction.

The need for commercial monetization is also a key driver for internet companies to layout (literally 'layout') hardware. Luo Yiyang, a senior analyst covering the electronics industry at TF Securities, notes that for large model companies, hardware represents a critical path for technological commercialization. Amid widespread commercialization difficulties faced by large model firms, hardware provides a clear monetization channel.

Thus, when giants like Alibaba, ByteDance, and Baidu—armed with traffic and models—enter the fray by manufacturing glasses, phones, and even recording beans, they are no longer vying solely for hardware sales. This is a 'land grab' for the next generation of interactive interfaces—whoever defines the standards for software-hardware integration and captures users' round-the-clock attention and data may become the indispensable 'ecological hub.' Hardware, at this moment, is merely the tangible shell carrying this ambition.