iPhone Air Price Plummets by 2000 Yuan: Apple Phones Tumble from Their Lofty Perch

![]() 01/30 2026

01/30 2026

![]() 357

357

The iPhone, once the undisputed king of the smartphone realm, now finds itself embroiled in the cutthroat red ocean of price wars.

On January 23, 2026, the Apple Store's Tmall flagship outlet officially declared its participation in the "Tmall Chinese New Year Shopping Festival." In this event, the iPhone Air witnessed a direct price slash of 2000 yuan. The 256GB variant, when combined with national subsidies, is now available for a mere 5499 yuan.

The following day, JD.com's self-operated flagship store for Apple products also announced a 2000 yuan coupon for the iPhone Air. After stacking national subsidies and trade-in benefits, the lowest price for the 256GB model drops to just 5099 yuan.

Admittedly, Apple has only significantly reduced the price of the iPhone Air this time, with the iPhone 17 series maintaining its firm price stance. Nevertheless, the substantial price drop of this new flagship model still underscores, to a certain extent, Apple's deep-seated anxieties.

Due to a lack of competitive edge, the iPhone Air struggles to persuade consumers to pay a premium based solely on its brand. It can only rely on price concessions to boost sales. As competition in the smartphone market intensifies, not only is the Air model facing significant downward pressure, but Apple's digital series phones are also struggling to remain unscathed.

01. Sales Fall Short of Expectations: iPhone Air Already Discontinued

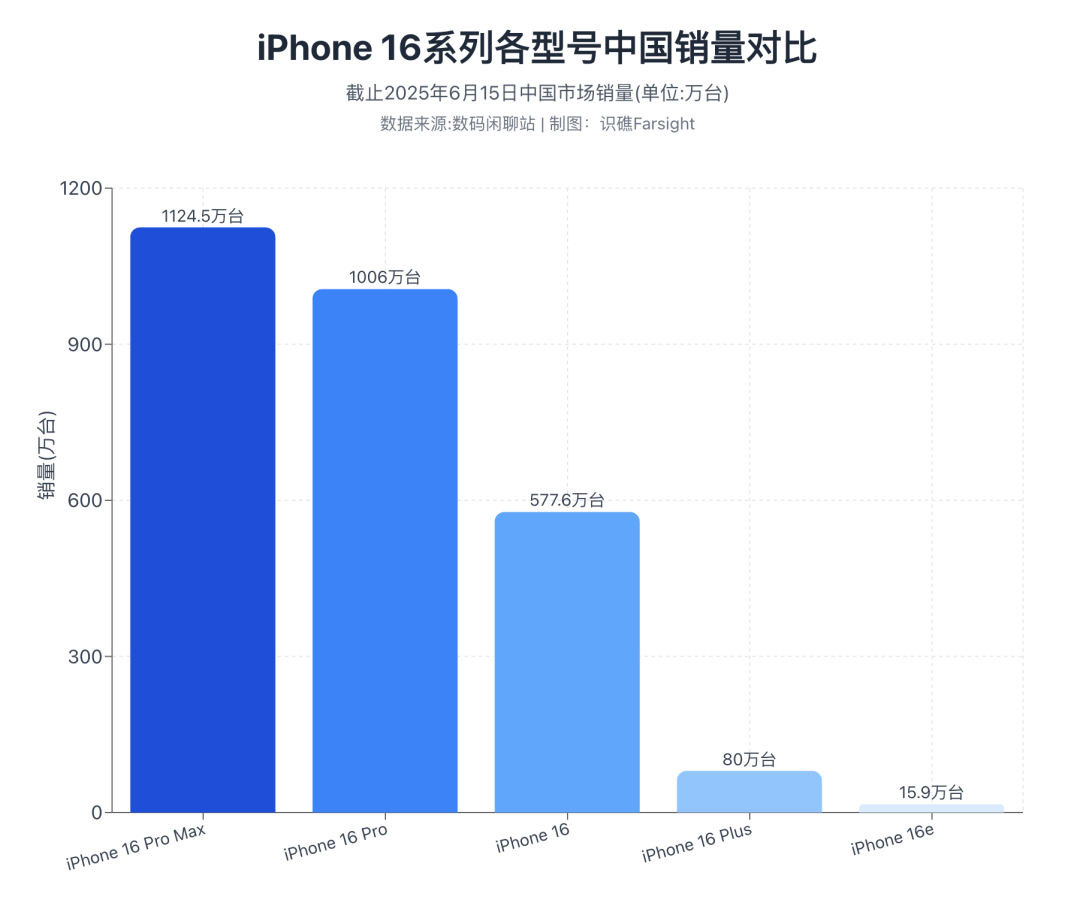

Apple's decision to launch the iPhone Air was primarily driven by the poor market performance of the Plus series phones. Data released by digital blogger "Digital Chat Station" reveals that as of June 15, 2025, in the Chinese phone market, the sales volume of the iPhone 16 Plus stood at approximately 800,000 units, accounting for a mere 7.11% of the iPhone 16 Pro Max.

In light of this, Apple opted to launch the iPhone Air, which emphasizes an ultra-thin design, to replace the Plus model. In September 2025, Apple held its autumn new product launch event and introduced the lightweight flagship iPhone Air. With a thickness of just 5.6mm and a weight of only 165g, it is dubbed the "thinnest iPhone ever," starting at 7999 yuan.

Although the iPhone Air offers an exceptional grip, its configuration has notable shortcomings to achieve its ultra-thin design. It is equipped with only a 48-megapixel primary camera, lacking ultra-wide and telephoto lenses. It features a single speaker, with sound emanating solely from the top earpiece, lacking stereo immersion. It is powered by a 3149mAh battery, which easily causes battery anxiety during heavy use.

Due to these configuration shortcomings that fall short of a flagship positioning, the iPhone Air failed to achieve instant popularity. On November 23, 2025, Nabila Popal, Senior Research Director at IDC, stated externally that the sales volume of the iPhone Air was only about one-third of Apple's highest expectation.

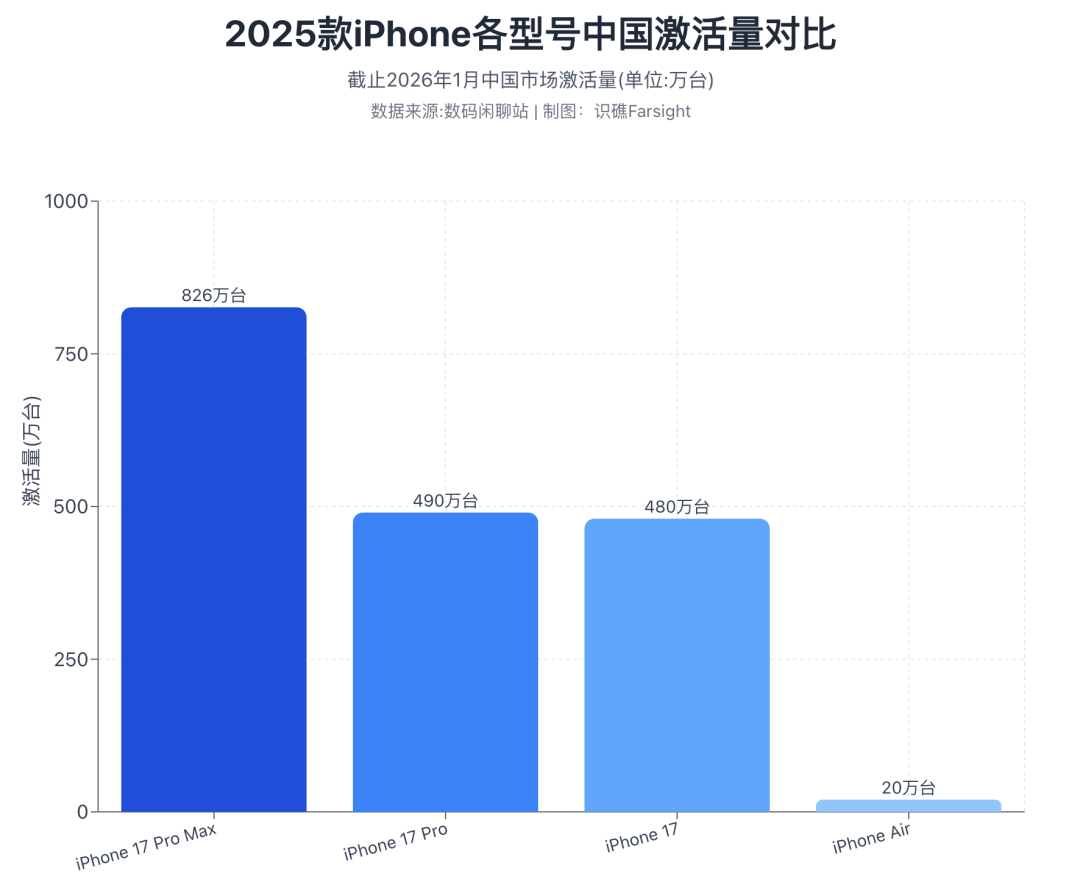

On January 24, 2026, "Digital Chat Station" reported that the cumulative activation volume of the iPhone Air is currently less than 200,000 units. In comparison, the activation volumes of the iPhone 17 Pro Max, iPhone 17 Pro, and iPhone 17 during the same period are approximately 8.26 million, 4.9 million, and 4.8 million units, respectively.

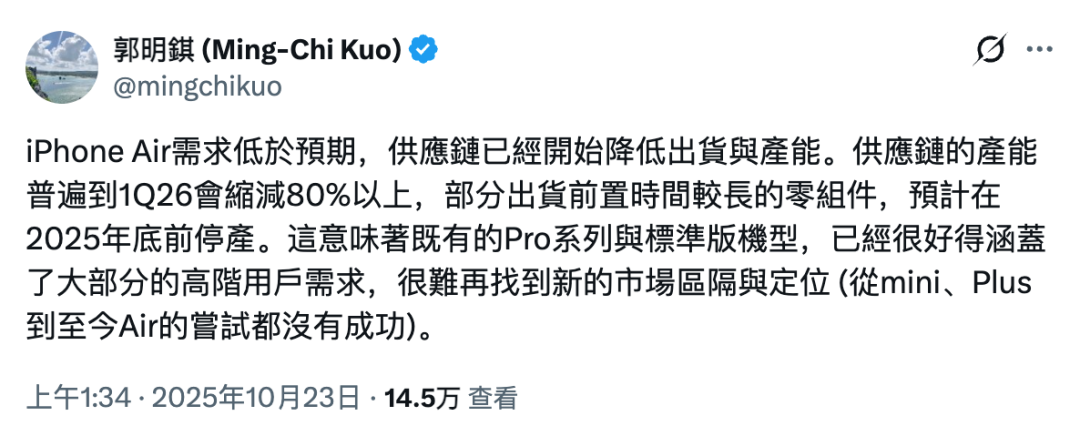

To mitigate losses promptly, Apple has requested its supply chain to halt production of the iPhone Air. In November 2025, The Information, citing informed sources, reported that Apple had significantly reduced the production volume of the iPhone Air, with Luxshare Precision and Foxconn both ceasing production of the model around November.

In response, Ming-Chi Kuo, an analyst at TF International Securities, commented, "The existing Pro series and standard models have already well met the needs of most high-end users, making it difficult to find new market segments and positioning. Attempts from mini, Plus to the current Air have all failed."

From this perspective, the significant price drop of the iPhone Air this time around is not just a routine promotional tactic but rather a desperate choice by Apple to clear inventory amid sales pressure.

02. Behind the iPhone 17's Hot Sales: Apple Gains Breathing Room Through 'Involution'

Despite the poor sales performance of the iPhone Air model, Apple may not necessarily be dissatisfied with its 2025 phone business lineup. This is because, driven by the iPhone 17 series, Apple's phone sales have climbed against the trend.

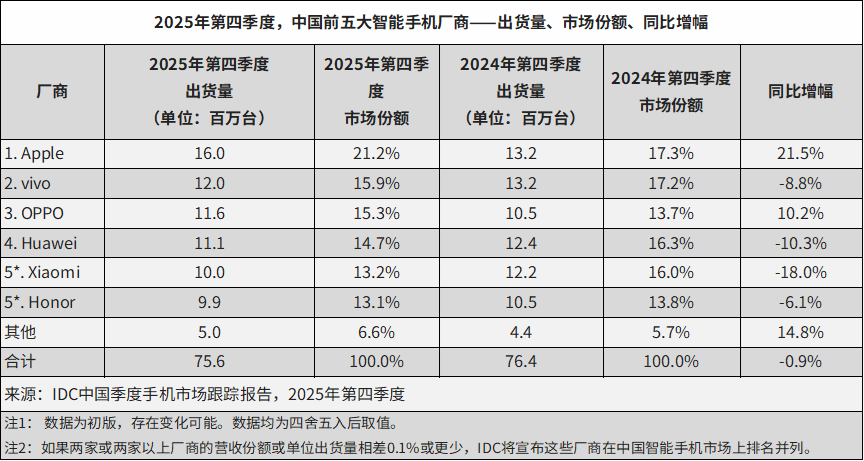

IDC data shows that in Q4 2025, in the Chinese phone market, Apple's shipment volume reached 16 million units, up 21.5% year-on-year, ranking first, with a growth rate leading the top five smartphone brands.

Due to its outstanding performance in the fourth quarter, even though China's overall smartphone shipment volume fell by 0.6% year-on-year in 2025, Apple's phone shipment volume still increased by 4% year-on-year, reaching 46.2 million units, ranking second, just behind Huawei.

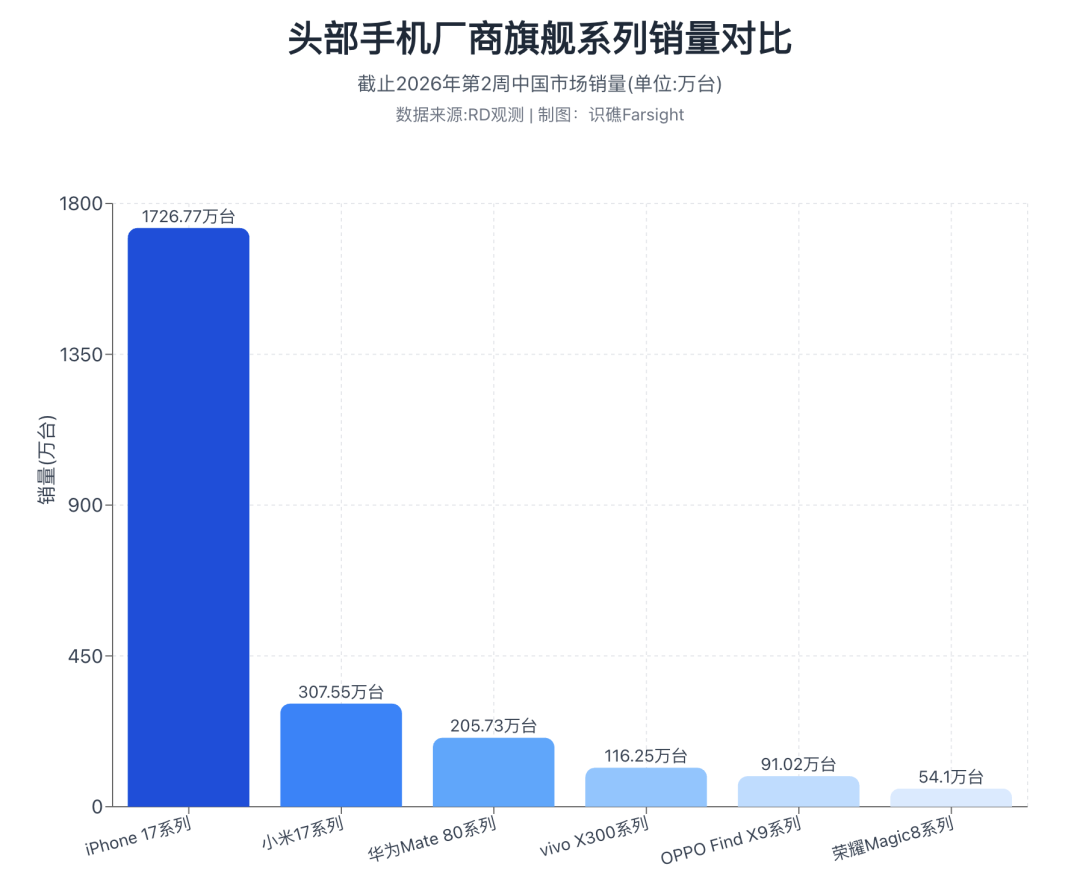

The rapid climb in Apple's phone sales in Q4 2025 is, of course, due to the market popularity of the iPhone 17 series. Data released by "RD Observation" shows that as of the second week of 2026, the sales volume of the iPhone 17 series was 17.2677 million units, far ahead of competing flagships.

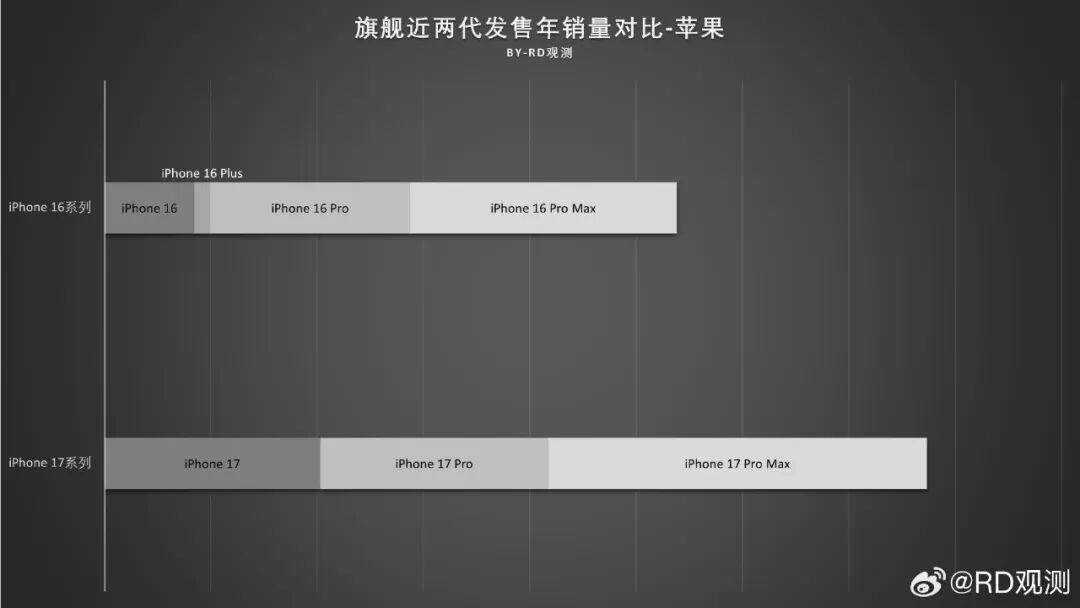

However, it should be noted that, when compared horizontally with the iPhone 16 series, the sales volumes of the Pro and Pro Max models of the iPhone 17 series did not see significant growth, with the difference mainly reflected in the standard model.

On January 12, 2026, Counterpoint released a research report showing that the sales volume of the iPhone 17 standard model in the Chinese market was almost double that of the iPhone 16 standard model during the same period.

Data released by "Digital Chat Station" shows that as of January 2026, the sales volume of the iPhone 17 standard model has reached 4.8 million units. In comparison, as of April 2025, the sales volume of the iPhone 16 standard model was only 4.41 million units.

Although the iPhone 17 standard model has become a hit, the evolutionary path of this product hides concerns that cannot be ignored. Previously, due to its deep commercial moat, the iPhone series had been evolving at its own pace, with product configurations neatly arranged.

For example, to highlight the flagship positioning of the iPhone Pro series, the screens of the standard and Plus models had not supported high refresh rates and were equipped with only the previous generation's flagship processor.

Although the aforementioned product strategy was conducive to maximizing profits, it severely weakened Apple's market competitiveness by reducing consumers' sense of gain, especially in the context of intense competition among Android flagships.

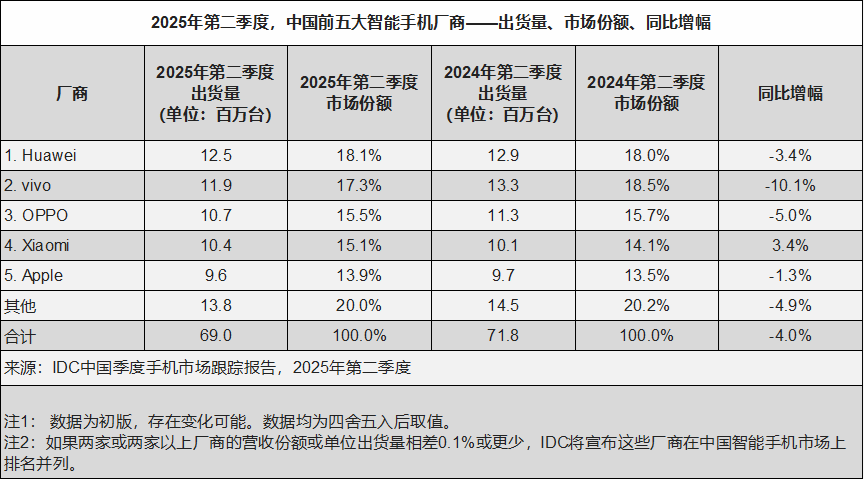

IDC data shows that in the Chinese phone market from 2023 to 2024, Apple's shipment volumes fell by 2.2% and 5.4% year-on-year, respectively. In Q2 2025, Apple's shipment volume was only 9.6 million units, down 1.3% year-on-year, ranking fifth and on the verge of falling into the "Others" category.

To regain market share, the iPhone 17 standard model no longer adheres to its "entry-level" positioning but incorporates numerous flagship-level configurations.

In terms of screen, the iPhone 17 standard model aligns with the other three flagship models, featuring an LTPO screen that supports a 1-120Hz ProMotion variable refresh rate, full-screen AOD, and a peak brightness of 3000 nits. In terms of performance, although the iPhone 17 standard model is not equipped with the A19 Pro processor, it does not use the previous generation's processor either but instead adopts the A19.

Although the iPhone 17 standard model has won the market by stacking underlying configurations, this also indicates, to a certain extent, that Apple has lost its dominance in the competition. To attract consumers' attention, it has to follow the footsteps of Android flagships and engage in 'involution'.

In response, Li Nan, the former Vice President of Meizu Technology, pointedly stated, "The current success of the iPhone 17 series is mainly due to a surprise attack. However, if the Android camp responds actively, even if the 17 loses, the 18 and 19 will inevitably be defeated sooner or later."

03. New Products 'Besieged' by Android Flagships: Apple Urgently Needs to Reshape Its Competitiveness

There was a time when the iPhone was considered the innovation benchmark in the smartphone market. Whether it was the multi-touch technology of the original iPhone, the Touch ID of the iPhone 5S, or the full-screen gestures introduced by the iPhone X, they all inspired numerous smartphone manufacturers to follow suit.

However, nowadays, Apple's innovation and product definition capabilities have been surpassed by domestic smartphone manufacturers. For example, as a lightweight flagship, the iPhone Air has numerous shortcomings, whereas the Honor Magic8 Pro Air offers a "super Pro experience."

The Honor Magic8 Pro Air was released on January 19, 2026. With a body thickness of only 6.1mm and a weight of just 155g, it is equipped with a 5500mAh high-energy-density Qinghai Lake battery, stereo dual speakers, a full-focal-range triple camera, and supports ultrasonic fingerprint recognition, IP68+IP69-level water and dust resistance. After national subsidies, it starts at 4499 yuan.

Due to its powerful product configuration and relatively low price, the Honor Magic8 Pro Air has outperformed the iPhone Air in the market. Official data shows that the first-day sales volume of the Honor Magic8 Pro Air exceeded that of the iPhone Air.

In response to the iPhone Air's price drop, Lin Lin, the Head of Honor China's Smart Life Business Division, commented, "Although the iPhone Air has seen a significant price drop, I personally estimate that its sales volume will only see a short-term slight increase and will not change the overall sales trend... because it goes against the needs of the vast majority of users... It may have a brief resurgence in a very short time but will then completely fade away... It's not a price issue..."

Not only is the lightweight flagship being "dimensionally reduced" by domestic manufacturers, but Apple's upcoming foldable phone is also unlikely to surpass domestic flagships such as the OPPO Find N5.

It is reported that Apple plans to launch its first foldable iPhone in September 2026, featuring a horizontal inward-folding design, a 7.8-inch inner screen, a 5.5-inch outer screen, the removal of Face ID in favor of side Touch ID, and support for only eSIM. The starting price for the Chinese version may reach 15,000 yuan, with the high-end version exceeding 20,000 yuan.

On January 8, 2026, digital blogger "Dingjiao Digital" cited sources close to Apple, stating that Apple had purchased and disassembled the OPPO Find N5 for research, making numerous samples internally and "finding it difficult to surpass OPPO in terms of crease flatness."

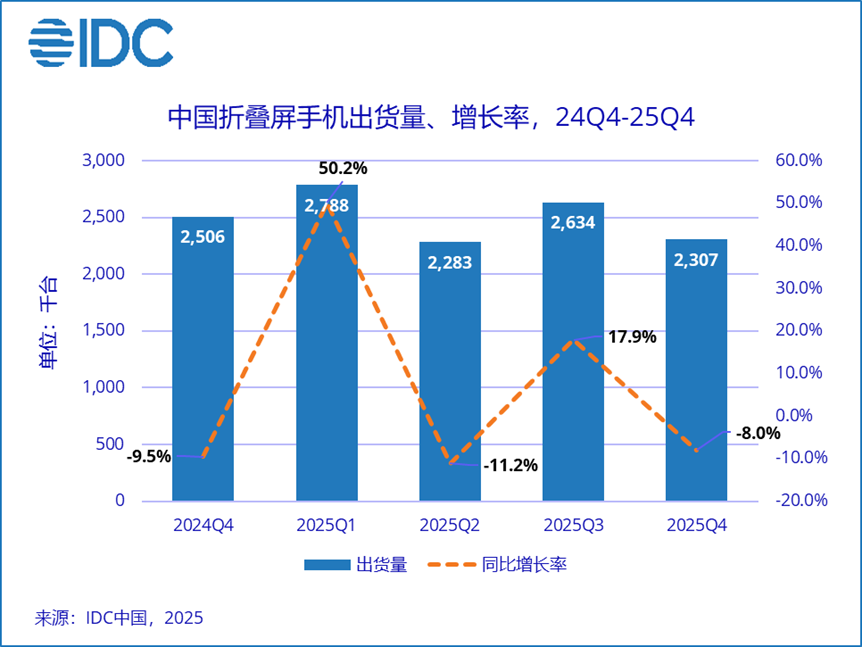

On the other hand, from a market perspective, due to Apple's late entry, the demand for foldable phones has started to slow down. IDC data shows that in 2025, China's foldable phone shipment volume was approximately 10.01 million units, up only 9.2% year-on-year, a significant decline from the previous year's 30.8% growth rate.

Against the backdrop of narrowing market dividends, the foldable iPhone lacks significant technological advantages and is priced high, with its expected sales volume not looking optimistic. In June 2025, Ming-Chi Kuo stated, "Investigations into several components indicate that the annual shipment volume of this model (foldable iPhone) will be in the millions for both 2027 and 2028."

It is evident that the core challenge Apple faces currently is not just temporary market fluctuations but the fact that, as competition continues to intensify, its long-accumulated commercial moat is gradually drying up. In this context, actively participating in price and configuration 'involution' can only win short-term breathing space and is ultimately a temporary fix rather than a permanent solution.

For Apple, the key to breaking the deadlock does not lie in passively responding to competition but in using technological innovation as the core driving force to solidify the value barrier of its high-end brand.

However, having become accustomed to 'making quick money,' Apple may find it difficult to swiftly shift to a path that is 'difficult but right.'