**In-depth Analysis of Financial Reports: Who Among JD.com, Alibaba, and Pinduoduo Wants to Dominate 618 the Most?**

![]() 06/26 2024

06/26 2024

![]() 598

598

Author | Meng Xiao

For more financial information | BT Finance Data Hub. The article consists of 5008 words and is estimated to take 13 minutes to read.

"This year's 618 seems particularly quiet, but the three e-commerce giants have still announced impressive 618 data."

618 was not as bombastic as before, with overwhelming advertisements everywhere. People around didn't seem particularly excited about 618, and the number of packages at the express delivery station downstairs didn't increase significantly. The boss said, "There was an increase, but it wasn't too obvious."

JD.com announced decent data for this year's 618, with over 500 million users placing orders. 83 brands accumulated over 1 billion yuan in sales, and over 150,000 small and medium-sized merchants saw sales growth of over 50%. Alibaba reported that 365 brands broke the billion mark on Tmall's 618, and over 36,000 brands doubled their sales. Live streaming, as Taobao's strength, naturally released relevant figures. This year's live streaming performance was impressive. After being far surpassed by Pinduoduo in market value, JD.com and Alibaba regained some ground in this year's promotion. During 618, Taobao had 34 live streaming sessions with sales exceeding 100 million yuan, a year-on-year increase of 53%, while 47 stores achieved sales of over 100 million yuan. JD.com's live streaming orders increased by over 200% year-on-year during the same period.

Pinduoduo, with the highest market value, was relatively low-key, hardly releasing any data, only releasing some product-specific figures. For example, home appliance brands achieved a year-on-year growth of 103% in sales scale during 618. Live streaming is not Pinduoduo's strength, and the company did not disclose relevant data in this regard.

The three e-commerce giants are all claiming how well they performed, but the cumulative sales of comprehensive e-commerce platforms and live streaming platforms reached 742.8 billion yuan. Last year, this figure was 798.7 billion yuan, a year-on-year decrease of 7%. In terms of channels, the total sales of comprehensive e-commerce platforms reached 571.7 billion yuan, a year-on-year decrease of 6.9%. As none of the three companies have released specific sales figures, according to StarChart data, Tmall occupies the top position in comprehensive e-commerce platforms, followed by JD.com, and Pinduoduo ranks third. This suggests a possibility that the orders of all three may have increased, but at lower prices, leading to a decline in total sales.

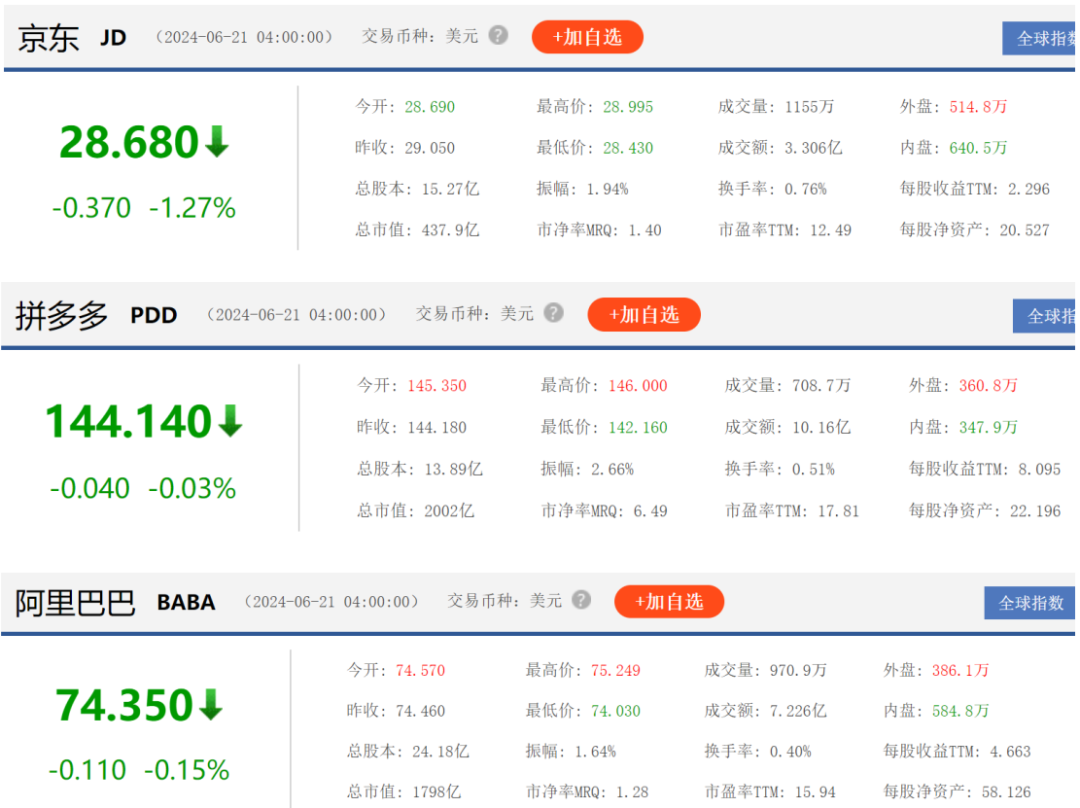

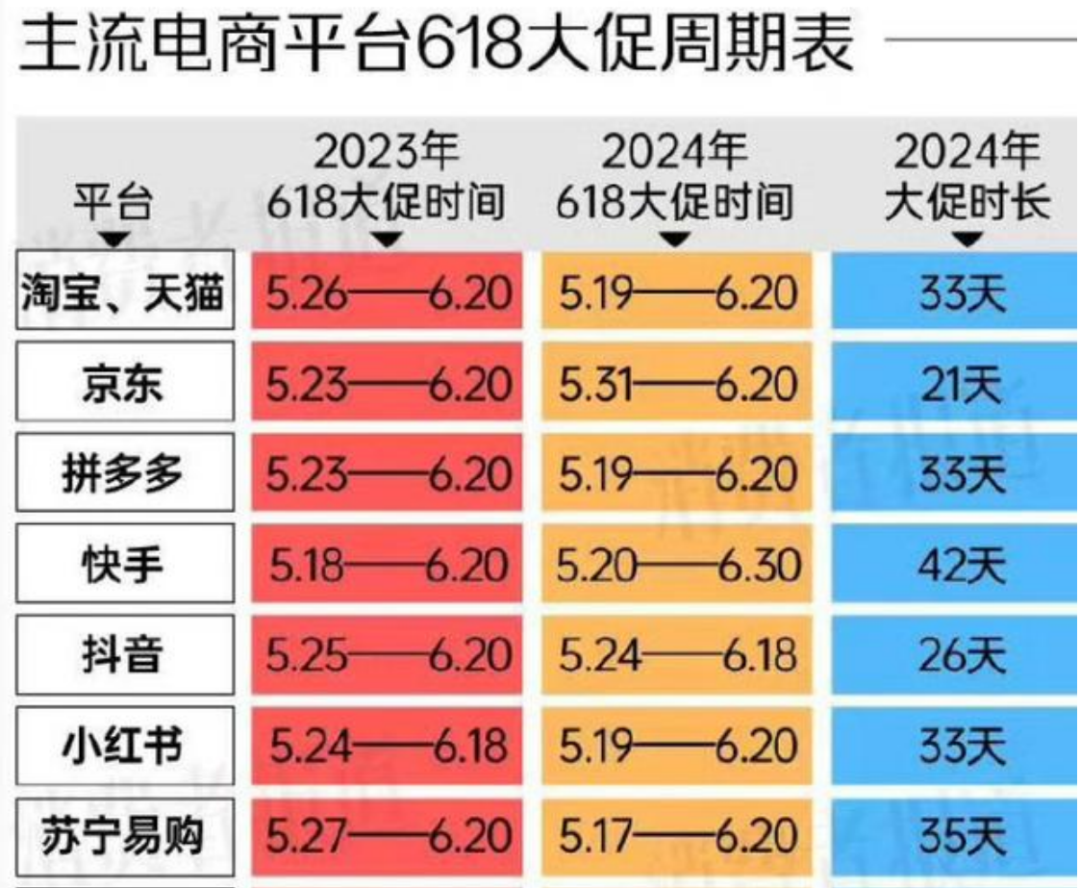

It's worth noting that this 618 performance report, while seemingly satisfactory, is actually quite "watered down" compared to previous years. This is because 618 had the longest statistical period in history. Pinduoduo entered 618 on May 19th, Tmall on May 20th, and JD.com on May 31st, meaning that 618 statistics included at least 10 more days of sales data compared to last year. Taking Tmall and Pinduoduo as examples, the entire 618 promotion lasted for a month. Compared to last year's 20-day sales, there was an overall decline of about 7%. This situation has led to a lack of investor confidence. In the two trading days after 618, the stock prices of the three e-commerce giants all declined to varying degrees.

As of the close of June 20th, JD.com's share price fell by 1.27%, Pinduoduo by 0.03%, and Alibaba by 0.15%. They fell by 0.65%, 2.78%, and 0.12%, respectively, in the previous trading day. JD.com's market value is only 43.79 billion US dollars, evaporating 117.6 billion US dollars from its high of 161.4 billion US dollars. Alibaba's total market value is 179.8 billion US dollars, evaporating 586 billion US dollars from its peak market value of 765.8 billion US dollars. Currently, Pinduoduo, with the highest market value of 200.2 billion US dollars, has also fallen by 95 billion US dollars from its peak, making it the e-commerce giant with the highest market value among the three.

It is evident that 618, such a "big promotion," has lost its glory and can no longer be a lifesaver for the three e-commerce giants.

1

The First Decline in 16 Years for 618

618 holds special significance for JD.com and Liu Qiangdong.

It is reported that Liu Qiangdong and his first love Gong Xiaojing founded JD.com in Zhongguancun on June 18, 1998. JD.com's official website also mentions that Liu Qiangdong founded JD.com with an initial capital of 12,000 yuan on this day. JD.com's listing date on the Hong Kong Stock Exchange was also June 18th, and even its stock code is 09618.HK.

Meanwhile, 618 is also the anniversary of JD Mall's establishment. In 2008, JD.com launched the first 618 shopping festival. At that time, JD.com introduced the "618" mid-year promotion on its website for the first time, presenting it in a pre-sale format and supplemented by flash sales to attract consumers. From flash sales to group buys, from brand specials to full-store discounts, it became one of JD.com's most important promotional nodes throughout the year. At this time, 618 became a genuine shopping carnival that many consumers had to pay attention to. After 2011, JD.com's 618 gradually evolved into a shopping festival for the e-commerce industry, with other e-commerce platforms participating. 618 is no longer just JD.com's "big promotion" but the overall "big promotion" of the e-commerce industry. 618 has grown from a simple promotional activity into a landmark event for JD.com and even the entire e-commerce industry.

In 2017, JD.com first announced its 618 sales figures, which reached 119.9 billion yuan in the industry's terminology. It truly showed off its strength, and the myth of one trillion yuan overnight began to emerge. 618 has also become the main arena for e-commerce competition, with more and more e-commerce platforms participating and disclosing their performance. At this time, the sales of major mainstream e-commerce platforms were basically growing, and they were willing to show investors their strength. However, since 2022, slowing growth has become a common phenomenon among major e-commerce platforms. Based on low or declining growth rates, they began to no longer disclose specific sales figures.

After 16 years of development, this year's 618 actually saw some innovation, with various platforms abandoning the previously widely criticized "tricks" and canceling the pre-sale system that had been used before. However, as of June 20th, major e-commerce platforms still have not released specific GMV data, instead replacing them with more vague growth rates. The intuitive feeling is that this year's 618 was relatively "dismal." A straightforward figure, on May 19th, Tmall's Li Jiaqi beauty live stream started pre-sales, and the beauty category achieved a GMV of about 2.7 billion yuan, a decline of 46% from the nearly 5 billion yuan in the same period last year.

Compared to previous years, this year's 618 "big promotion" lasted longer. Public data shows that the average duration of 618 among seven mainstream e-commerce platforms exceeded 30 days, with Kuaishou having the longest span, reaching 42 days. JD.com had the shortest duration of 21 days. Both Alibaba and Pinduoduo lasted 33 days, with Alibaba extending by 7 days compared to last year and Pinduoduo extending by 4 days. Only JD.com shortened by 8 days.

But even with the extended 618, overall sales showed the first decline since the establishment of 618, with both the entire network and comprehensive platforms experiencing a 7% decline. This is the first decline in 16 years of 618. Based on consumers' current consumption habits, this year's decline in 618 may only be the beginning. Under this background, e-commerce promotions seem to be losing their meaning, and the myth of one trillion yuan overnight is fading away. Consumers' consumption habits are gradually becoming more rational.

2

Consumption Rebound Has Nothing to Do with "Big Promotion"

The three years affected by the pandemic and the uncertainty after the initial lifting of restrictions have caused the consumption environment to be relatively turbulent in previous years. However, compared to previous years, the overall consumption environment has improved this year, with consumption experiencing strong rebound. According to National Bureau of Statistics data, in May 2024, domestic online retail sales reached 2.0313 trillion yuan, a year-on-year increase of 15%. In the first five months of 2024, food, clothing, and daily necessities grew by 19.6%, 9.0%, and 10.8%, respectively, all in a rapid growth phase.

Meanwhile, according to the "618 Consumption Insight Report (2024)" data, the overall online retail sales from May 31st to June 18th reached 1.14912 trillion yuan, a year-on-year increase of 10.5%. Among them, physical goods online retail sales were 994.99 billion yuan, a year-on-year increase of 7.8%. However, the total sales of major e-commerce platforms have actually declined by 7%, meaning that while the consumption environment has improved and consumer willingness has increased, this wave of consumption dividends has nothing to do with e-commerce.

In the past, 618 was a shopping festival for the entire nation, with consumers even staying up all night to participate in limited-time flash sales. However, with the emergence of low-priced platforms like Pinduoduo, consumers no longer need to wait for 618 to enjoy discounted prices. It's almost like every day is 618, naturally reducing consumers' anticipation of 618. After more than a decade of development, 618 has transformed from a traditional e-commerce festival into a nationwide carnival, penetrating into various industries. Offline supermarkets, local life, and other areas have gradually begun to experiment with online sales. The traditional "limited-time flash sales" played by e-commerce in the past has lost its appeal.

According to data from the Qualcomm Transportation Department, the package volume during this year's 618 actually increased significantly. From May 20th to May 26th, the first week of the 618 promotion, the national express delivery volume reached approximately 3.593 billion packages, a week-on-week increase of 7.29%, with an average daily business volume of 513 million packages. However, in the third week of the 618 event, the cumulative collection volume of postal express deliveries decreased by 3.31% week-on-week, and the cumulative delivery volume decreased by 0.73% week-on-week. Even with the week-on-week decline, the package volume still showed a significant increase compared to the same period last year. In the same period of 2023, the average daily package volume was 400 million packages, representing a 25% increase in package numbers compared to the same period last year.

While the package volume has increased significantly, the overall sales have declined, indicating that the average order value of major e-commerce platforms has declined sharply. The platforms have unanimously engaged in price wars. For example, the "618 Consumption Insight Report (2024)" shows that the average prices of men's shoes, women's clothing, men's clothing, and women's shoes during the event decreased by 18.4%, 9.6%, 9.5%, and 2.8%, respectively. Among them, the decline in the average price of men's shoes was the most astonishing. However, this is only a year-on-year decline in the prices of some products. Overall, most products have seen price decreases, with very few price increases. Wang Bao, an e-commerce practitioner, did not participate in this year's 618 promotion. He had originally planned to participate, but the platform forced him to reduce prices by 5%, which was unacceptable to him.

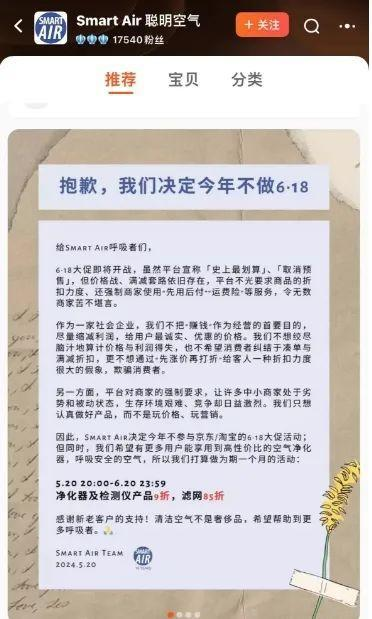

"Originally, we rely on high volume and low profits. Our profit margin is around 3%. If we reduce prices by another 5%, I'll be losing money while making a fuss. It's better not to participate." Regarding consumers' declining interest in big promotions like 618, Wang Bao believes that daily price wars among various e-commerce platforms have already driven prices to the extreme. "In fact, for consumers, it's already like 618 every day. Consumers' interest in such so-called big promotions is waning." Merchants like Wang Bao who choose not to participate in 618 are not isolated cases. Many merchants find it unprofitable and time-consuming, so they directly choose not to participate.

In fact, low-price strategies are eroding merchants' interests. Many merchants are under increased pressure under the coercion of low-price strategies, and some may even face losses. Some merchants have反映that platforms disrupt the market by monopolizing resources and forcing price reductions, leaving merchants unable to set their own prices and severely compressing their profit margins. Coupled with platform requirements for discounts, free shipping, and other promotional offers, the platforms profit, but merchants' operating costs will increase sharply. Some netizens have complained online that their friend's women's clothing online store had sales of nearly 10 million yuan during 618, which seems impressive. However, after deductions for refunds, returns, and other costs, the final estimated loss was about 600,000 yuan.

3

Who is Most Hurt in the E-commerce Battle?

Currently, mainstream e-commerce is dominated by Alibaba, JD.com, and Pinduoduo, with changes at the top level of two of them. After JD.com's Double 11 in 2023, JD Retail CEO Xin Lijun retired, and JD.com Group CEO Xu Ran took over the position. Soon after, Alibaba followed suit, with Alibaba Group CEO Wu Yongming succeeding Dai Shan as the CEO of Taotian Group. Both are group CEOs personally overseeing e-commerce operations, showing the importance they attach to this business.

With two CEOs at the helm of e-commerce operations, there are actually no good solutions, and price competition has become a clichéd yet inevitable move. Price wars are an obvious fact. Media reports indicate that in early June, searching for "cheaper than JD.com" on the Taobao app would redirect to a comparison page with the prominent phrase "always lower prices" at the top