Poor sales of joint ventures should blame the lack of new cars

![]() 07/02 2024

07/02 2024

![]() 744

744

After the scores of the college entrance examination have been gradually released, it becomes clear that the underlying logic in China is screening, not selection, and the automotive industry is no exception.

"Honda will soon have a car as large as the L9 from Lixiang Auto, which will use plug-in hybrid technology and also offer features such as 7 seats, large sofas, and color TVs." Although no spy photos have surfaced yet, the accurate information provided by our sources has proven that leading joint venture automakers are breeding the next round of counterattacks.

With fluctuations in sales, the public opinion field has entered the usual speculation that "XX is going downhill, it's not good." It's not surprising that the public would speculate, because from a sales perspective, most are declining, and the previous ranking order of best-selling models has been broken, revealing new consumption patterns. On the other hand, although the entire industry has been shouting the slogan of transformation since 2018, the upgrade amplitude of new models and the number of new cars launched are still insufficient.

Moreover, a new trend is emerging. With the initial pause of the price war and the difficulty of the entire industry recovering in the short term, more and more automakers are turning to the next logic, using an unconventional number of new cars to overwhelm their competitors and break through the siege with a sea of cars.

The main reason for the poor sales of joint ventures is the small number of new cars from LOOKAR

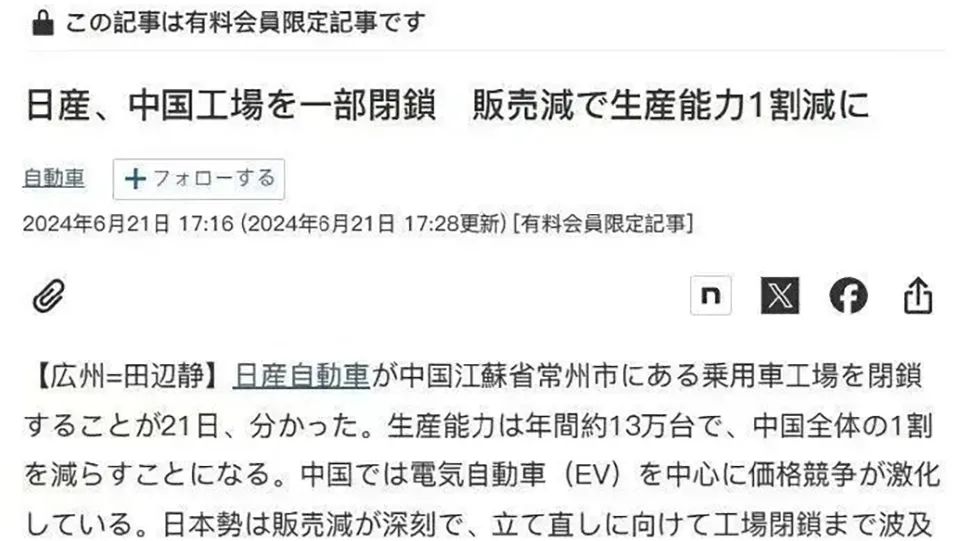

Layoffs, factory closures, fluctuating sales, the rise of new energy vehicle sales, and the decline of fuel vehicle sales have collectively created a new understanding of Chinese car consumption. The current main tone of public opinion is that buying a joint venture car is not as good as buying a domestic car, buying a fuel car is not as good as buying a new energy car, buying a pure electric car is not as good as buying a plug-in hybrid/extended-range car, and buying a car with intelligent driving assistance is not as good as buying a Huawei car.

From a sales perspective, indeed, all patterns are changing. As 2024 is truly halfway through, the results left behind from January to May are mainly:

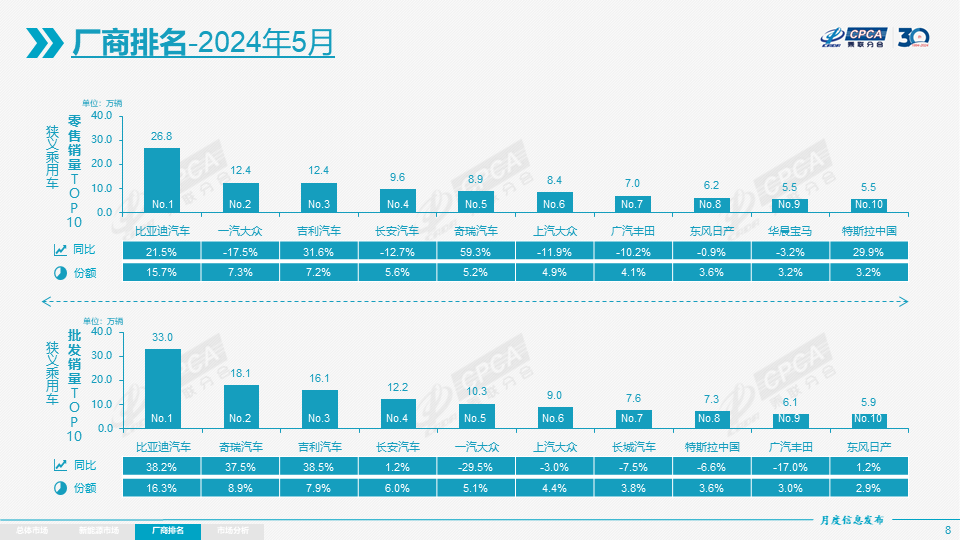

1. In terms of wholesale sales, Japanese and American cars are being rapidly replaced by domestic cars. In the TOP 10 lists of 2023 and 2024, GAC Toyota and SAIC-GM disappeared, while Great Wall Motors (384,000 units) and Dongfeng Nissan (280,000 units) filled the gaps. Moreover, the Matthew effect in the wholesale sales segment is becoming more significant, with significant growth in sales among the top 4 in the TOP 10. BYD sold 270,000 more vehicles than the same period last year, while Tesla saw a decline of 27,200 vehicles among the 5th to 10th places.

2. In terms of retail sales, Japanese and American cars are still being surpassed, but the protagonists differ from wholesale sales. In retail sales, FAW Toyota and SAIC-GM fell out of the top 10, and GAC Toyota's sales ranking dropped from 6th in 2023 to 7th, selling 50,000 fewer cars.

3. The variables in new energy retail sales are even greater. Geely doubled its sales from January to May 2024, replacing Tesla with 242,000 vehicles, while Tesla slipped to third place. Changan grew by 108.8%, and the booming Wenjie brand surged from outside the list to 7th place. Nezha and NIO left the TOP 10, replaced by Great Wall and Chery.

The main reason for the change in sales figures is the further erosion of fuel vehicles. According to data from the China Passenger Car Association, the total market volume of traditional fuel vehicles from January to May was 4.82 million units, a year-on-year decrease of 9%. In contrast, sales of new energy vehicles reached 3.895 million units, and in some weeks, the number of new energy vehicles insured exceeded that of fuel vehicles. Therefore, joint venture brands that have been in the fuel vehicle market for over 20 years have lost their basic market share.

Of course, human groups' judgment of a matter is not only about the current situation but also about forward-looking prospects. After the gradual failure of direct price cuts, only the launch of new cars can better stimulate consumers, and this level of competition has also intensified.

The transformation of joint venture cars basically continues to follow their global pace. Taking SAIC-GM on June 25 as an example, it was said in the live broadcast that many automakers launch new cars every 2-3 years, but SAIC-GM won't launch them until they finish testing, and the standards are there.

Breaking down the German brands, FAW-Volkswagen has major new cars in 2024, including the Magotan replacement and the mid-cycle facelift of the Golf. SAIC Volkswagen has more, totaling 3 models, including the Passat, Tharu XR, and the new Polo. Plus Volkswagen Anhui, which has completed its acquisition, will also launch the Volkswagen ID.UNYX and other models, totaling 8.

BMW's numbers are not large. Apart from the all-new 5 Series/i5, more focus is on the localization of new-generation models in 2025. The largest number of new cars introduced is in the M segment, with a total of 10 new models, but they obviously cater to a small consumer group.

Among the entire German brand segment, Mercedes-Benz has the clearest vision. In 2024, it will launch more than 15 major new products in China, including the Maybach EQS SUV, GLC plug-in hybrid, and long-wheelbase E-Class plug-in hybrid. Therefore, it is evident that in public opinion, Mercedes-Benz's reputation is still good.

Japanese brands other than Honda have also basically maintained a similar pace. FAW Toyota has 3 models, including the Crown, Prado, and a pure electric crossover. GAC Toyota also has 3 models. In addition to the Camry replacement, its self-incubated Platinum brand is testing large-size pure electric sedans and SUVs. Dongfeng Nissan has 2 models, one is the Infiniti QX60-derived Tanlu for fuel vehicles, and the other is the first of four locally developed new energy vehicles, but no further news is available.

Honda's changes are relatively significant. In 2024, Dongfeng Honda will mid-cycle facelift the Civic, and the remaining 3 models are all new energy vehicles. GAC Honda has not announced much, only mentioning the update of the second new energy vehicle under the e:NP brand, without releasing much more information.

LOOKAR's sea of cars strategy from Chinese brands, dragging down competitors and killing joint ventures?

Life is all about having something to look forward to, and the classic trope of "hoping for plums to quench thirst" during a march applies. Different companies set KPIs or OKRs to motivate efficiency or performance improvement, so the number of new cars represents the explosive ability of the brand system and gives people who want to buy cars something to look forward to.

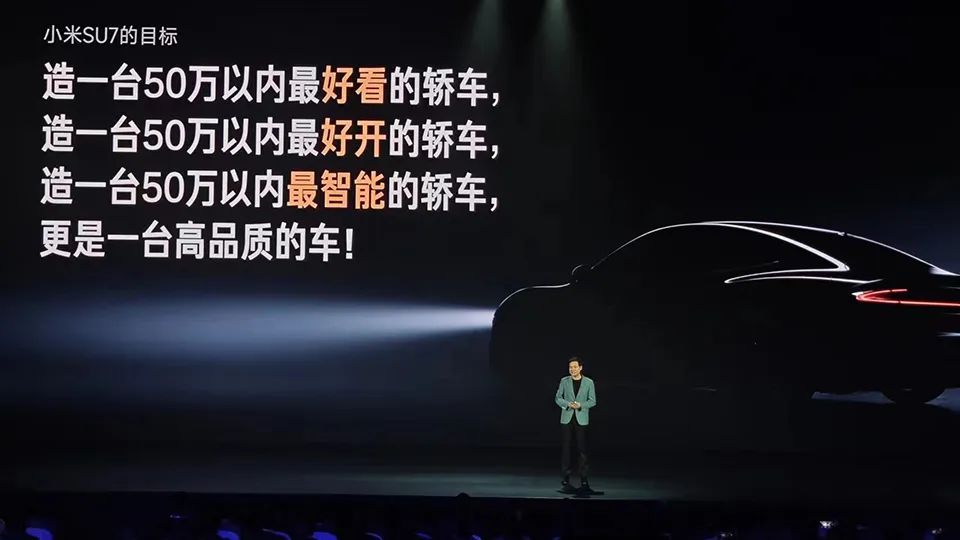

There are numerous examples. The Wenjie M9, starting at less than 470,000 yuan, has gained tremendous popularity due to Yu Chengdong's redefinition of luxury cars within 10 million yuan. Lei Jun's Xiaomi SU7 announcement also generated significant buzz, especially the claim that it is the fastest mass-produced car under 500,000 yuan.

This frequent marketing approach is beginning to be widely used among Chinese brands, and large transformation manufacturers with better R&D reserves are also exerting explosive power.

As a result, the current situation is that domestic cars are launching new models at more than twice the efficiency compared to joint ventures, forming a sea of cars strategy.

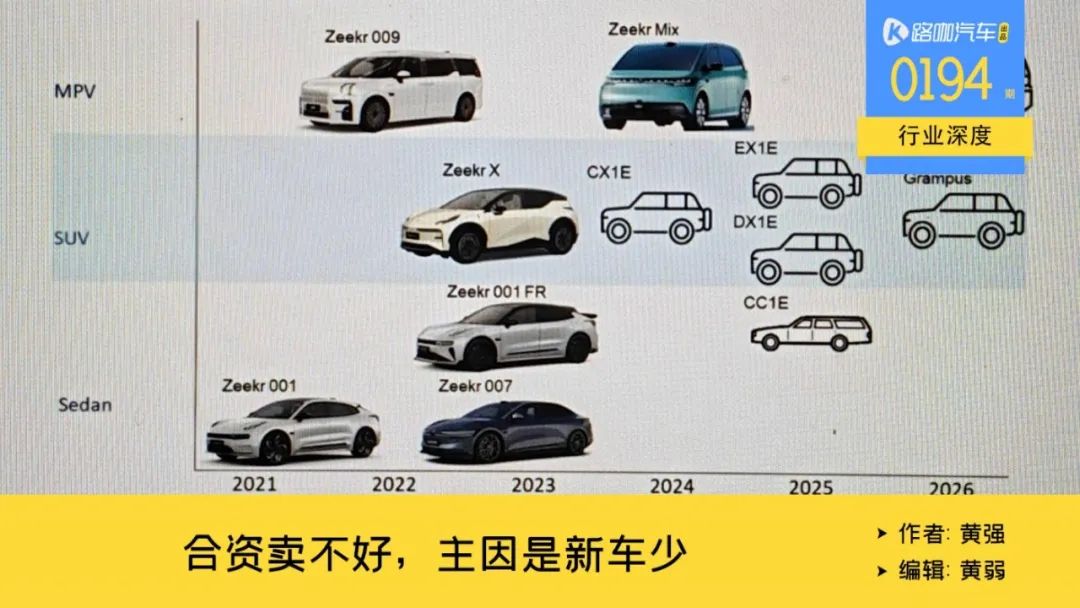

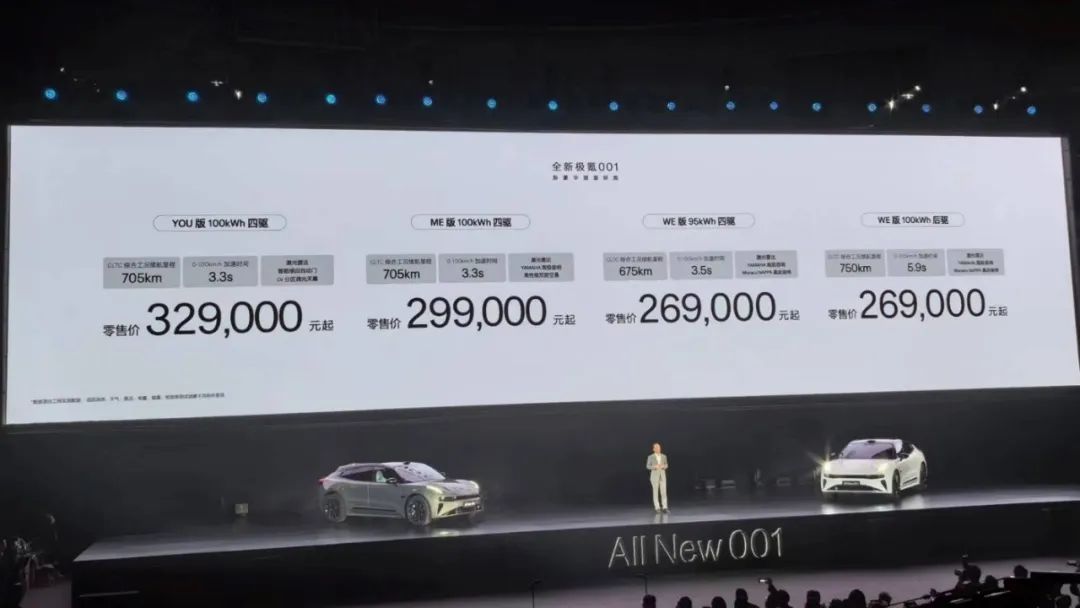

For example, the latest planning revealed by Zeekr shows that in 2024, in addition to the Baby Bus MIX, the CX1E, the biggest rival to the NIO ES6 and the Zhijie R7, will hit the market. And 2025 will be an even bigger year for products, with the EX1E, DX1E, and CC1E, which can be understood as pure electric rivals to the Wenjie M9, competitors to the off-road vehicle king, and new players in the pure electric travel car segment, respectively.

Moreover, although the number on the chart is similar to that of joint venture brands, the actual explosive power is much higher. The Zeekr 001 is not shown on the chart, but the Zeekr 001 underwent a near-generational facelift in February this year, meaning that Zeekr has the ability to achieve a major upgrade every 2 years, ultimately leading to a surge in orders and successfully sniping the Xiaomi SU7.

Coupled with the launch of the Zeekr 009 Glory Edition and the listing of the Zeekr 007 at the end of December 2023, which directly brought sales into 2024, and the introduction of an enhanced rear-wheel-drive version in April to compete with the Xiaomi SU7 launch, a simple calculation shows that Zeekr actually launched 5 major new cars in China in 2024, which equals the combined total of North and South Volkswagen.

Such cases are actually everywhere. For example, new news from Shenlan Auto, new news from Huawei, and new news from BYD.

Shenlan Auto will launch 3 new models in the second half of 2024, plus the launch of the G318 in the first half, resulting in at least 4 new products in a single year. Among them, one of the new models is the Shenlan S05, which is smaller than the current Shenlan S7 and uses pure electric and extended-range technology. The entry-level version is likely to cost less than 120,000 yuan. The current Shenlan S7 and Shenlan SL03 are expected to be launched in a renamed manner for the next generation. Huawei's intelligence will empower the new cars, so this brand, which has only been launched for over 2 years, has announced 4 major new products in 2024, twice as many as Dongfeng Nissan.

Even more exaggerated is the rumored news about BYD's 2024 new car plan. With the emergence of the fifth-generation DM, almost every model can undergo significant changes or even a generation change.

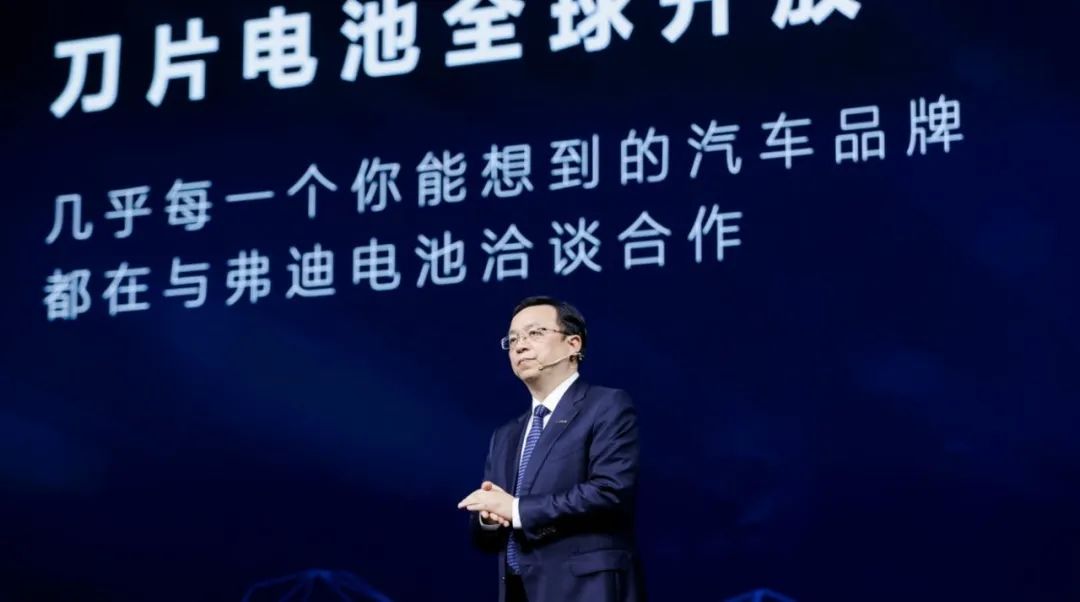

First, the most significant news is that BYD's second-generation Blade Battery will debut, possibly as early as August 2024. Therefore, any new car equipped with the Blade Battery will have new selling points at the level of a generation change, with a number exceeding 20 models. The energy density will approach 200Wh/kg, and lithium iron phosphate can charge and discharge in low-temperature scenarios better than many ternary lithium batteries.

The declaration information of the expected Seal 07 DM-i (the facelifted version of the Seal DM-i) to be launched in September has been released, and the fifth-generation DM equipped with a 1.5T engine will also appear. The maximum power of the drive motor is 200kW, and the maximum power of the internal combustion engine is 110kW. When both are optimally combined, the dynamic performance figure can exceed 400 horsepower, surpassing the 3.0T of the Audi S4. More importantly, the 1.5T engine matched with the fifth-generation DM can be universally used across brands other than BYD.

Furthermore, rumors about BYD Han L and Tang L are also increasing. Tang L may have dimensions similar to the Li Xiang L9, equipped with 6 to 7 seats, but the price is only at the level of the Li Xiang L6. Additionally, HUD head-up display and the 160kW new motor will become standard features for BYD's new cars in 2025.

If BYD is willing to combine its batteries, 1.5T fifth-generation DM, and keep up with vehicle hardware features like refrigerators, TVs, large sofas, and Huawei's technological administrative style, it can create over 40 combinations.

Geely Automobile, another Chinese brand that is advancing alongside BYD, is also seeing significant developments. At the beginning of the year, the Geely Yinhe E8 was launched, and soon after, the Geely Yinhe E5 equipped with Geely's short-blade battery will hit the market. The already launched Yinhe L6 and Yinhe L7 will each introduce pure electric versions, with prices not increasing too much compared to plug-in hybrids, maintaining strong cost-effectiveness. Add to that the Lynk & Co 07 EM-P, the recently debuted pure electric Lynk & Co Z10 in Sweden, and the LEVC brand's executive pure electric MPV LEVC L380. Additionally, there are new cars from Zeekr, making the number of new heavy-hitting models from the Geely Group exceed 10 this year.

Moreover, Changan Automobile is also a player of the same caliber. Avatar 11 and 12 have introduced extended-range capabilities, while Avatar 07 and 08 will use extended-range and be intelligently empowered by the joint venture of Huawei and Changan, featuring new large screens, lower prices, and enhanced interior luxury. The Changan Qiyuan E07, which combines the characteristics of SUVs, pickups, and sedans, will also be launched, introducing yet another new product to the segmented market.

LOOKAR Closing Remarks

The final tally is that FAW-Volkswagen has 2 models, SAIC Volkswagen has 3 models, Volkswagen Anhui has 1 model, Mercedes-Benz has over 6 heavy-hitting new models, FAW Toyota has 3 models, GAC Toyota has 3 models, Dongfeng Honda has 4 models, and Dongfeng Nissan has 2 models.

Among Chinese brands, Zeekr has 5 models, Shenlan has 4 models, BYD easily surpasses 10 models with a slight push, Geely + Lynk & Co has 7 models with a slight push, and Changan is also around the 10-model mark.

Even without discussing whether the replacement strength of joint venture cars is as great as that of domestic cars, even if it is assumed that domestic cars can bring the same attractiveness as joint venture cars, the quantity is still overwhelming.

BYD alone can achieve the ability of the three major Japanese brands to collectively launch heavy-hitting new cars. In comparison, its attractiveness to consumers is evident.

Without precise statistical conversions, the number of heavy-hitting new models from Chinese brands can exceed 40, while that of joint venture brands is 24. The sea of cars strategy is thus formed, similar to the dimensional reduction strike that joint venture cars had on domestic cars in the era of fuel vehicles.

As for the competition between Chinese brands, the logic is to quickly occupy the discourse power and trends in segmented markets by mutually deploying new models. This competition is another topic. However, the good result is that the simple and brutal traditional price war has become ineffective due to the more effective introduction of new cars.

Author: Huang Qiang