Apple's Vision Ignites the Industry! Where is VR's "Old King" HTC Now?

![]() 07/04 2024

07/04 2024

![]() 969

969

This outcome is truly lamentable.

Since Apple officially released its first MR mixed reality device, Vision Pro, last year, the entire XR (extended reality, encompassing AR, VR, and MR) industry has regained its fervor. Despite Vision Pro's sales figures being less than ideal, its more natural interaction, immersive spatial video, and ingenious combination of virtual and reality have sparked a wave of spatial computing in the XR industry.

The wave of technological advancement continues to surge forward, with some companies riding the waves and becoming leaders of the times, while others gradually fade from people's sight amidst fierce competition. HTC, a name once renowned in the mobile phone and VR sectors, seems to have lost its luster.

Image Source: HTC

Recently, a news item caught my attention: During NVIDIA CEO Jensen Huang's visit to his hometown of Taiwan, China, HTC Chairman and CEO Cher Wang visited him and invited Huang to tour HTC, only to be politely declined. It's hard not to feel a sense of regret, as HTC was once at its peak while NVIDIA was struggling with collective lawsuits due to several GPU and mobile chip manufacturing errors.

In just over a decade, the situation has completely reversed. HTC is no longer the giant that once stood on equal footing with NVIDIA, Microsoft, and Google, but has fallen into obscurity. After selling its smartphone business to Google in 2017, VR has become one of HTC's few opportunities for a comeback.

HTC's VR business started strong but has since declined, and its transformation has not been successful.

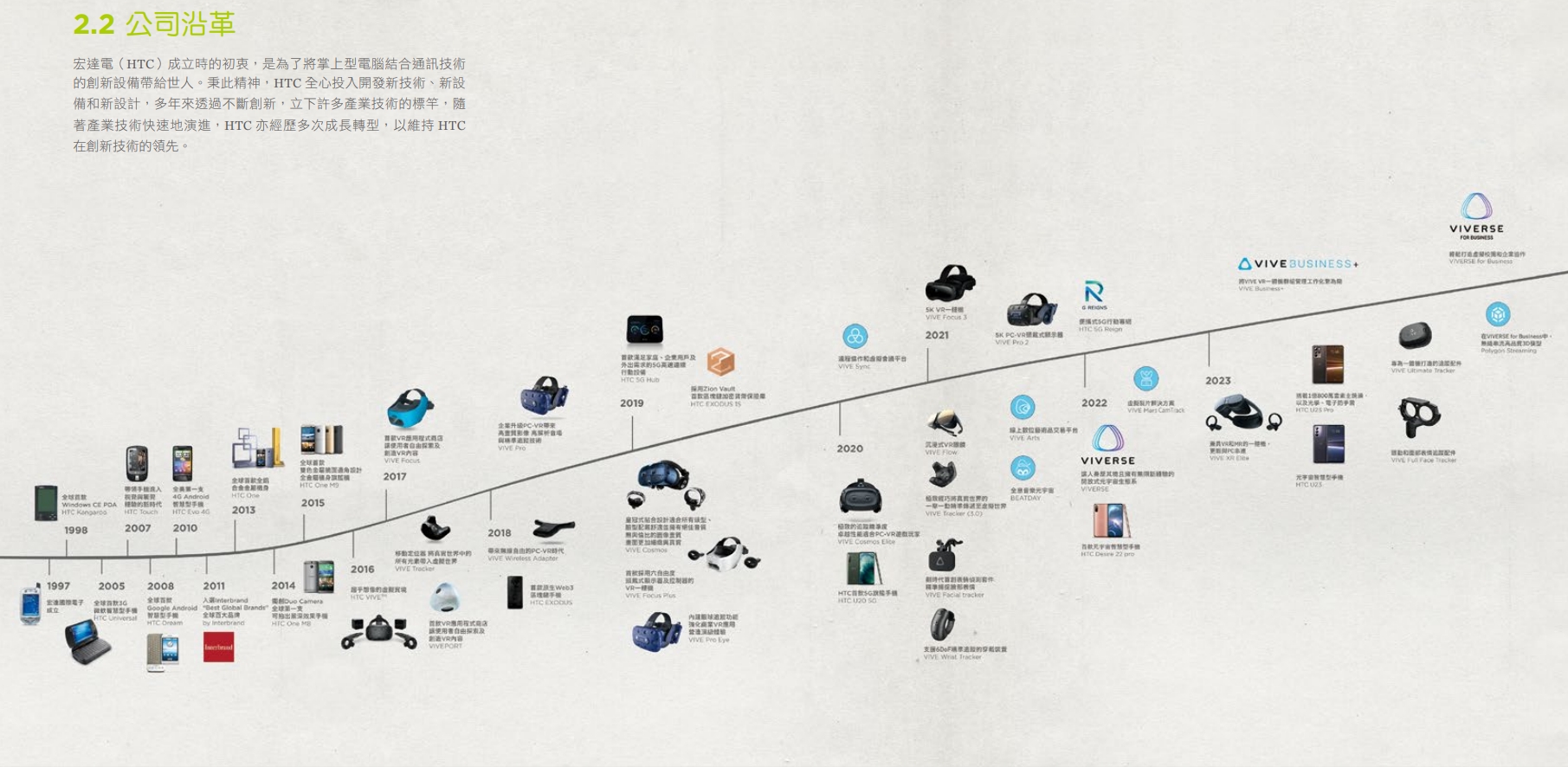

HTC's ability to transform is a crucial factor in its rapid development over a short period. From an initial contract manufacturing giant to a peak smartphone brand and then a full-fledged entry into the VR sector, we can see HTC's determination to seek change. As early as 2014, HTC set its sights on the VR field, which happened to coincide with the hottest initial stage of VR.

At that time, Facebook spent a whopping $3 billion to acquire Oculus; Samsung introduced the Gear VR, which could interact with its flagship phones; Sony also launched PS VR; and Google Cardboard glasses sold over 10 million units during the boom.

With the continued decline of its mobile phone business, HTC also began to officially bet on VR, jointly releasing the first-generation VR headset, HTC Vive, with Valve (Steam's parent company). This VR headset utilized Valve's spatial positioning technology, "Lighthouse," which transformed a room into a digital three-dimensional space, allowing users to move around in the virtual world and manipulate virtual objects using motion-tracked handheld controllers. HTC also used "Lighthouse" technology in subsequent Vive versions.

In the following years, HTC basically released new VR products at a rate of one per year, initially achieving good results. For example, HTC Vive took the top spot in JD.com's VR sales during the 2017 Double 11 shopping festival, and HTC Vive captured nearly 18% of the domestic market share in 2020.

Image Source: HTC

This was due to both HTC's efforts and the timing, as just the year after the launch of HTC Vive, technology giants and startups from both domestic and international markets, including Samsung, Google, Xiaomi, Huawei, Pico, and more, poured into this blue ocean. Mergers, acquisitions, and investments in the VR sector flourished, and a VR fever swept the globe.

As everyone knows, the VR industry quickly experienced another round of downturn. The普遍 high costs and prices of VR devices, the immaturity of VR-related technologies, and the continuous expansion of smartphones all made it difficult for VR manufacturers to sell their products.

HTC could not resist the industry downturn, coupled with constant pressure from competitors. There were rumors that "HTC would sell its VR business and exit the VR market by 2026." HTC quickly issued a stern statement denying the rumor of exiting the VR market in 2026. In the statement, HTC also stated that VR virtual reality, AR augmented reality, and AI artificial intelligence technology would be the three pillars of future technology. In short, with such a huge market potential, HTC definitely would not give up.

HTC's VR business has developed slowly in recent years. It was only at the CES exhibition in early 2023 that HTC launched its first wireless all-in-one headset, the HTC Vive XR Elite. Keep in mind that over the past two to three years, significant changes have taken place in the AR/VR market, with competitors such as Meta's Quest 3, Apple's Vision Pro, and Xreal's AR glasses emerging.

Perhaps, as HTC claims, VR, AR, and AI will become the pillars of future technology. However, the question remains: Can HTC, once a pioneer in VR headsets and even a leader in the VR market, truly occupy a place in this new wave of spatial computing?

Blockchain, Metaverse, AR: What Does HTC Really Want?

In May 2019, HTC announced the closure of its official sales stores on online shopping platforms Tmall and JD.com in mainland China. At this point, HTC basically ended its development in the mobile phone sector, but its other businesses remained active, and we can still occasionally see news about HTC.

However, most of these news items are just riding on trending topics. For example, in 2018, HTC launched the blockchain smartphone EXODUS 1, which claimed to mobilize blockchain technology and expand and improve the blockchain ecosystem, allowing users to exchange and sell only with cryptocurrencies such as Bitcoin and Ethereum. This move created a brief buzz but then disappeared into thin air.

Image Source: HTC 2023 Annual Report

HTC has made similar moves in the past. Many may still remember the metaverse trend in the previous two years, and HTC also actively followed the metaverse hype. At MWC 2022, HTC launched Viverse, an expanded metaverse ecosystem that can be viewed as an integration of its own ecosystem. HTC officially described it as a virtual world that can accommodate people from all walks of life.

To create a better immersive experience, HTC also launched Reign Core, a portable 5G mobile private network solution. Reign Core enables rapid deployment between devices and offers an ultra-low latency network experience.

While HTC was not the first company to venture into the metaverse, its subsequent actions were quite sincere. Unfortunately, the metaverse remains more of a concept than a reality. When industry hardware fails to keep up with expectations, everything can only be considered a bubble. As the metaverse hype subsided, leaving only a mess behind, HTC also returned to silence.

After reviewing HTC's official website and 2023 annual report, I found that the VIVE series of products is still HTC's most important business. In 2023, HTC sold a total of 416,000 units of virtual reality, 5G, smartphones, and smart devices. Although sales were not ideal, HTC still invested 61% of its global revenue in research and development in 2023.

Image Source: HTC VIVE Official Website

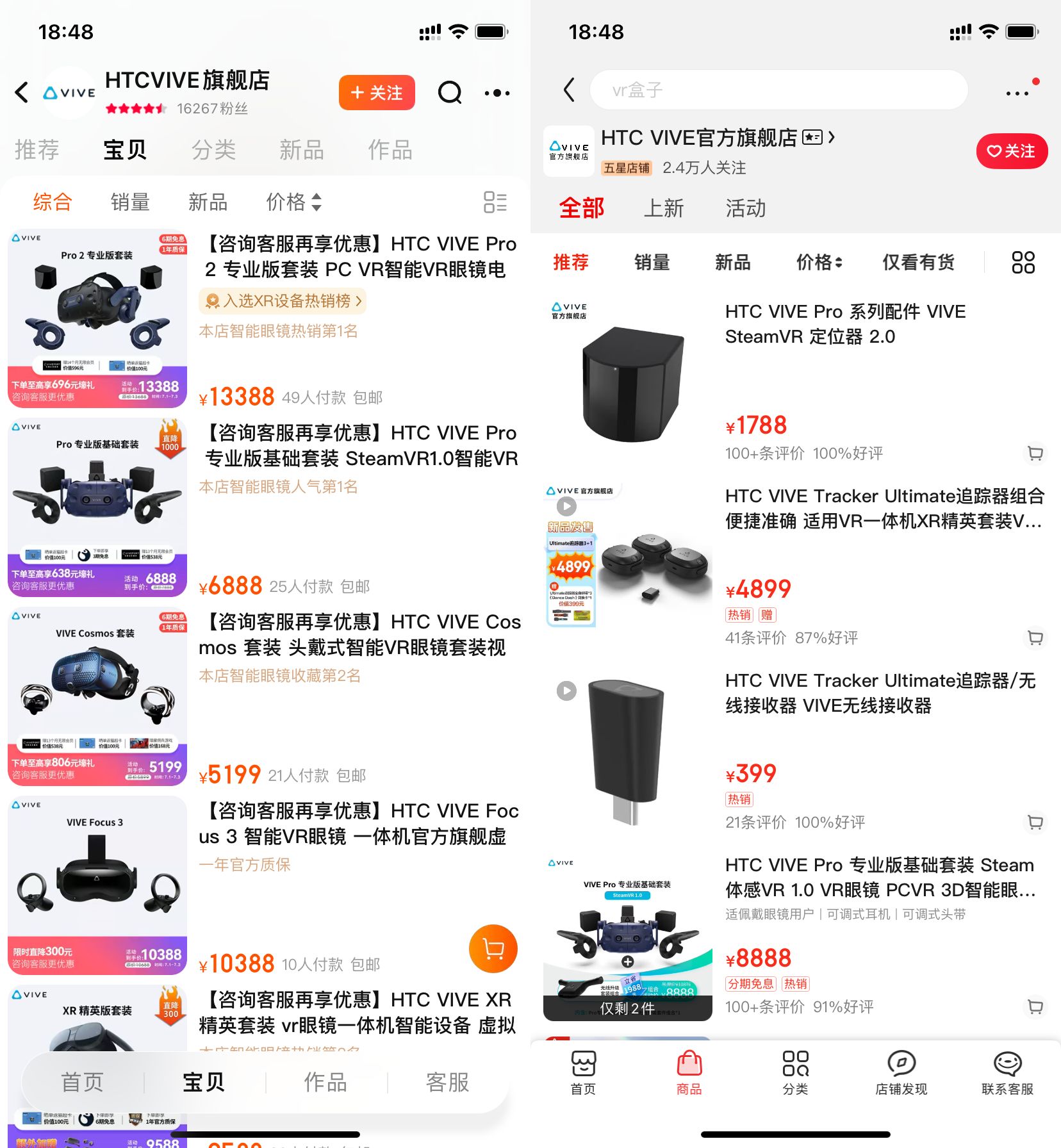

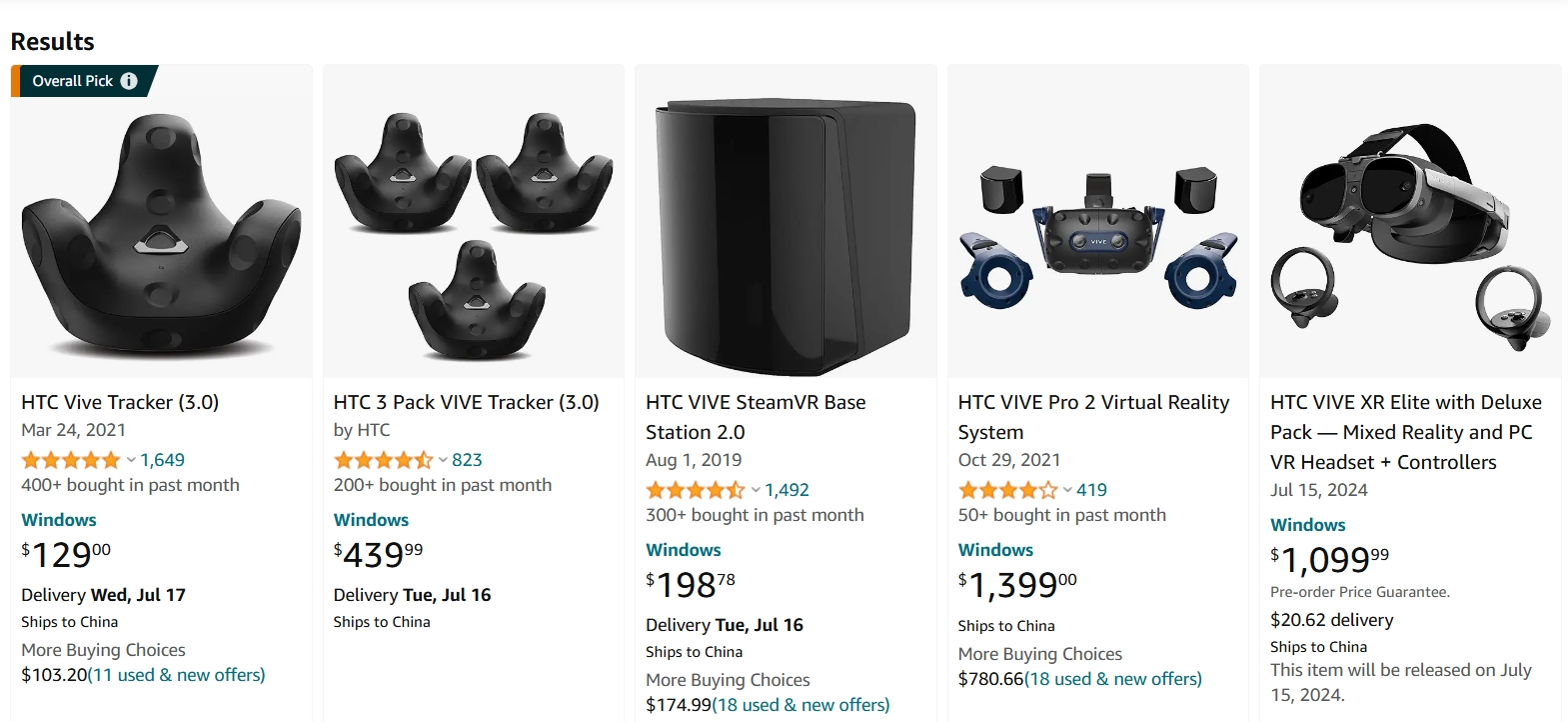

I specifically checked the sales of HTC products on Taobao, JD.com, and Amazon. The results were not surprising, with HTC's product sales being dismal. The product with the highest monthly purchase volume was only 400 units, and most products sold less than 100 units. Not to mention compared to mainstream products like Quest 3 and Vision Pro, even some domestic generic brands sold far more than HTC.

Image Source: Left Taobao / Right JD.com

Image Source: Amazon

HTC got an early start but arrived late to the party. Does HTC still have hope in VR?

From 2015 to 2022, HTC's VR business experienced rapid growth, maintaining a leading position in the global VR market with a market share exceeding 1/3 for several consecutive years. In 2021, HTC successfully entered the top five giants in the global VR field, and in 2022, HTC's VR-related product shipments exceeded 65 million units, making it a leading enterprise in the VR sector at that time.

HTC, with its first-mover advantage, did not seize the opportunity, mainly due to its hardware experience being difficult to support high pricing. As competitors continuously introduced various alternatives, ordinary consumers quickly turned to other brands. After all, HTC VIVE and other alternatives have highly similar functional positioning. If there is no significant difference in experience, most consumers will still prefer cost-effective alternatives.

Image Source: HTC VIVE Official Website

So does HTC still have hope in VR? To answer this question, we first need to examine the current status of the VR market. The VR market is currently full of uncertainties. On one hand, it remains to be seen whether the VR market will undergo periodic adjustments after the MR boom triggered by Apple's Vision Pro, as it has in the past. On the other hand, there are concerns about whether HTC Vive products will be further marginalized. Personally, the actual situation may be quite pessimistic.

From an industry perspective, the current global VR and AR markets are still in a decline phase. According to TrendForce research, global VR and AR device shipments totaled 7.45 million units in 2023, a year-on-year decrease of 18.2%. Among them, VR products saw the most significant decline, with shipments of approximately 6.67 million units, mainly due to the disappointing sales of new high-end devices, and subsequent brands will shift their sales focus to low-cost products. AR product performance remained stable, with shipments of approximately 780,000 units. Apple's Vision Pro, which integrates VR and AR technology, can temporarily support some demand, but due to its high unit price, it has yet to effectively drive AR market growth.

From a product perspective, HTC Vive's product line is primarily high-end positioned. The original Vive was priced at $800 (domestic price of 6888 yuan), and the latest Vive XR Elite is priced at $1099 (approximately 8021 yuan). It falls between the Quest series and Vision Pro, similar to the previous Quest Pro.

Everyone is aware of the impact of Vision Pro's high pricing, and the influence of the Quest series in the cost-effective range is difficult to shake. HTC Vive's product line pricing seems somewhat in between. At this price point, headset manufacturers need to provide a strong driving force to convince consumers to purchase. The problem is that with no advantages in hardware configuration, chips, algorithms, or funding, it is indeed difficult for HTC to stand out.

Image Source: Meta, Left Quest 2 / Right Quest 3

Objectively speaking, HTC Vive's market appeal is no longer what it once was. Users trust newer generation VR headset products like Quets, PS VR, Vision Pro, and Pico more. It is unrealistic for HTC to rely on its VR business to turn things around.

From being the undisputed king of Android phones in the industry to falling into obscurity and selling off teams, patents, and factories, HTC only took a decade, which is indeed regrettable. However, the technology industry is always full of variables. While HTC has fallen from its peak, there is no guarantee that it cannot regain its vitality someday. All we can do is wait for time to tell.