Roborock's cash-attracting ability declines, investors accelerate cash-out and exit

![]() 07/11 2024

07/11 2024

![]() 637

637

Editor-in-Chief | Su Huai

China's service robots are on their way to the global market.

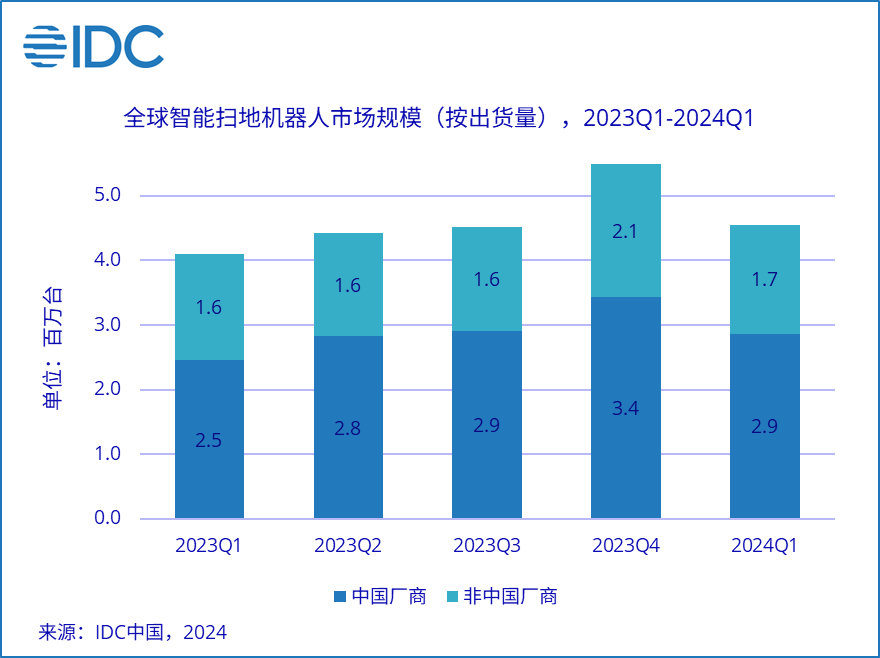

On June 25, IDC's "Quarterly Tracking Report on the Global Smart Home Device Market" revealed that global shipments of smart sweeping robots reached 45.54 million units in the first quarter of 2024, up 11.1% year-on-year. Among them, Chinese manufacturers accounted for over 60% of shipments, with eight Chinese companies, including Roborock (688169.SH), Ecovacs (603486.SH), and Xiaomi (01810.HK), successfully entering the top ten list globally.

The ranking showed that Roborock ranked first among Chinese manufacturers in shipments in Q1 2024, with a year-on-year growth of 18.3%. Thanks to its strong performance in overseas markets, Roborock's overall revenue also increased significantly.

Data from Tianyancha and financial reports showed that Roborock achieved revenue of 1.841 billion yuan in the first quarter, up 58.69% year-on-year; net profit attributable to shareholders was 399 million yuan, up 95.23% year-on-year.

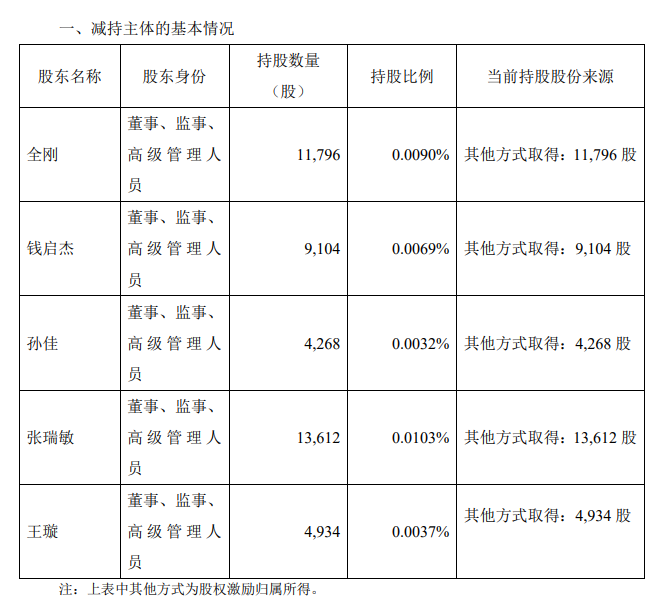

Despite these impressive results, they failed to stop the pace of share reductions by executives and shareholders. On June 15, Roborock announced that senior executives such as Quan Gang, Qian Qijie, Sun Jia, Zhang Ruimin, and Wang Xuan would reduce their shareholdings through centralized bidding.

Image source: Roborock announcement

Just the day before, Chang Jing, the actual controller of Roborock, also reduced his shareholding by 1,315,793 shares through inquiry transfer, decreasing his shareholding ratio from 22.10% to 21.09%.

Yuanmeihui found that the registered capital of Roborock at its inception was 200,000 yuan, of which Chang Jing subscribed to contribute 122,400 yuan, accounting for 61.20% of the shares. Before its listing in January 2018, Roborock's registered capital increased to 10 million yuan, with Chang Jing's contribution reaching 3,099,157 yuan, and his shareholding ratio changing to 30.99%. After Roborock's successful listing, Chang Jing's shareholding ratio became 23.24%.

However, after the end of Roborock's lock-up period, Chang Jing initiated multiple share reductions. According to incomplete statistics, from 2023 to the present, he has accumulated nearly 900 million yuan in profits from reducing his Roborock shareholding, and his shareholding ratio has changed to 21.09%. Based on the current market value, Chang Jing's shareholding value exceeds 10 billion yuan.

In other words, Chang Jing, who has been in business for ten years and invested more than 3 million yuan, has earned 3600 times his initial investment through share reductions and his remaining shares.

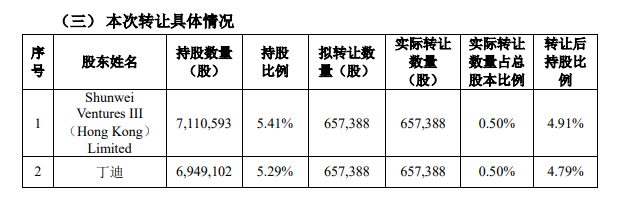

In addition to Chang Jing, Shunwei Ventures III (Hong Kong) Limited (hereinafter referred to as "Shunwei") and Ding Di, the third and fourth largest shareholders of Roborock, also reduced their shareholdings simultaneously on April 19.

According to the announcement, Shunwei has gradually reduced its shareholding in Roborock since 2023, while Ding Di has also reduced his shareholding in 2021 and 2023, with their shareholding ratios decreasing from 6.09% and 5.93% to 4.91% and 4.79%, respectively.

Image source: Roborock announcement

It is worth mentioning that like Shunwei, another Xiaomi-affiliated company, Tianjin Jinmi, also reduced its shareholding in Roborock to varying degrees in 2023.

Recently, Yuanmeihui inquired about share reductions and other issues with Roborock, and the company stated that they were all legal and normal share reductions, but everything was subject to the announcement. However, Yuanmeihui noted that Chang Jing, the actual controller of Roborock, promised not to reduce his shareholding within the next six months two days after the reduction. Additionally, Roborock was also repurchasing shares through centralized bidding.

The outside world is curious about why Roborock, with its promising performance, has repeatedly faced share reductions.

From Rising with Xiaomi to Falling Out

Founded in 2014, Roborock was one of the earliest members of Xiaomi's ecological chain. In 2016, the company launched its first customized and contract-manufactured Mijia smart sweeping robot for Xiaomi, which made it an instant hit.

With its rising popularity, Roborock also saw significant increases in revenue and net profit. Financial reports showed that from 2016 to 2018, Roborock achieved revenues of 183 million yuan, 1.119 billion yuan, and 3.051 billion yuan, respectively; net profits attributable to shareholders were -11 million yuan, 67 million yuan, and 308 million yuan. Among them, Xiaomi contributed revenue percentages of 100.00%, 90.36%, and 50.17%, respectively.

While the first customized product was a huge success, Roborock realized that low-margin OEM manufacturing was not a sustainable strategy. In September 2017 and March 2018, Roborock successively launched two major self-owned brands – Roborock smart sweeping robots and Xiaowa smart sweeping robots.

After 2019, the "de-Xiaomi-ization" process gradually gained momentum within Roborock. However, this move also "angered" Xiaomi, and the Mijia smart sweeping robot business, which was originally contract-manufactured by Roborock, began to flow to emerging Xiaomi ecological chain enterprises such as Dreame Technology. On the eve of its listing in 2020, Roborock's cutting ties with Xiaomi accelerated further, and by 2021, the company's Xiaomi OEM business accounted for less than 2%.

From the results, although "de-Xiaomi-ization" did not have a practical impact on Roborock's fundamentals, its revenue and net profit growth rates slowed down. Even in 2022, Roborock's net profit declined year-on-year.

The curse of slowing growth rates for several consecutive years was not broken until 2023.

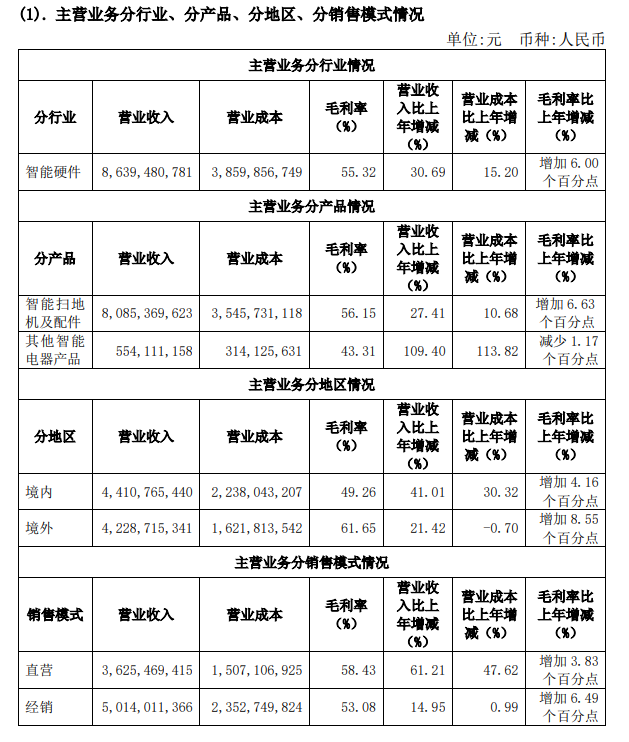

Financial reports showed that in 2023, Roborock achieved revenue of 8.654 billion yuan, up 30.55% year-on-year; net profit attributable to shareholders was 2.051 billion yuan, up 73.32% year-on-year. The significant increases in revenue and net profit were mainly due to the launch of multiple new products by Roborock and growth in overseas markets.

From an overseas business perspective, Roborock achieved overseas revenue of 4.229 billion yuan in 2023, up 21.42% year-on-year. At the same time, IDC data showed that Roborock's sweeping robots ranked first in sales in multiple markets such as Northern Europe, Germany, South Korea, and Turkey in 2023; it ranked second in sales in the North American market.

Image source: Roborock 2023 Annual Report

"Going Head-to-Head" with Overseas Giant iRobot

Roborock's success in overseas markets is closely related to its early positioning as a "born global" company.

As early as 2017, Roborock embarked on its "going overseas" journey. At that time, the overseas sweeping robot market was still firmly dominated by American brand iRobot, especially in 2017, when iRobot's global shipments reached 20 million units.

Realizing that it had no chance of directly competing with iRobot, Roborock chose to find breakthroughs from subtle aspects. At that time, through extensive visits, Roborock learned that American users generally had trouble cleaning corners, so it launched highly targeted and innovative new products.

Although there were breakthroughs in product development, due to iRobot's strong offline channels, Roborock failed to win its first battle in the United States. The turning point came in 2018, when American users' shopping habits shifted from offline to online, providing an excellent opportunity for Roborock, which had yet to establish a solid foundation, to overtake the competition.

In 2018, Roborock launched on Amazon's (NASDAQ: AMZN) US site and achieved online sales of 40 million yuan in the second year, an eight-fold increase year-on-year, successfully leveraging the US market. In contrast, iRobot did not start working with Amazon to share the online market until 2020, by which time it had already missed the opportunity.

To further capture overseas markets, Roborock insisted on starting from user pain points and winning over users through technological innovation. For example, for households with pets, Roborock developed sweeping robots with obstacle avoidance functions. Precisely through these subtle pain point innovations, Roborock managed to carve out a niche under the noses of giants.

Wind data showed that from 2019 to 2023, Roborock's overseas business revenue increased from 581 million yuan to 4.229 billion yuan. By 2023, Roborock's high-end products had far surpassed iRobot.

Magic Mirror data showed that in the US market in 2023, Roborock's market share of high-end products had reached 57%, far exceeding iRobot's 26%.

The successful breakthrough in the US market boosted Roborock's confidence. Leveraging Amazon's online channels, the company gradually expanded into global markets in Europe, Asia-Pacific, and beyond, and its products are now available in over 170 countries and regions worldwide.

After the business on Amazon and other online platforms gradually stabilized, Roborock once again set its sights on overseas offline channels. It partnered with local distributors around the world to enter offline channels such as Best Buy, Walmart, and Sam's Club, while also establishing overseas branches in key regions.

In 2023, Roborock once again entered iRobot's stronghold – officially entering more than 180 stores of Target, a US offline retail chain.

While battling giant iRobot, a large number of leading domestic smart sweeping robot manufacturers also began to flood into overseas markets. Once weak and isolated, Roborock now has the support of its compatriots, and Chinese smart sweeping robots are rapidly increasing their global shipments.

According to IDC data, global shipments of smart sweeping robots in 2023 reached 18.52 million units, with sales of $7.8 billion. Among them, Chinese manufacturers shipped approximately 6.9 million units, accounting for about 37% of global shipments.

Transition to New Energy Vehicles with Mixed Results

The influx of domestic smart sweeping robot manufacturers has caused the once calm overseas market to churn with undercurrents.

The most direct change is that the new product iteration cycle is getting faster and faster. In the past, a new product could last for 3-5 years before being replaced, but now it has shortened to 1-2 years, or even half a year to three to five months for some products. Local micro-innovation and new product launches have become the key to domestic manufacturers such as Roborock capturing domestic and overseas markets and maintaining revenue growth.

Behind the frequent launches of new products is the rapid increase in revenue costs and R&D investment. Financial reports showed that in 2023, Roborock incurred operating costs of 3.883 billion yuan, accounting for 45% of total revenue, up 15.44% year-on-year. Among them, R&D investment was 619 million yuan, up 26.69% year-on-year.

While increasing R&D investment, Roborock also sought to shake off its early over-reliance on "outsourced processing" production mode. Financial reports showed that from 2016 to 2018, Roborock's outsourced processing procurement from Sunwoda (300207.SZ) was 53 million yuan, 331 million yuan, and 985 million yuan, respectively, accounting for 99.68%, 100.00%, and 98.80% of its total outsourced processing procurement.

To diversify risks, in the following years, Roborock shifted its outsourced manufacturing business from Sunwoda to multiple companies, but failed to fundamentally solve the problem of over-reliance.

In the first half of 2023, Roborock's self-built factory began production, and its production mode shifted from fully outsourced manufacturing to a combination of self-production and outsourced processing.

This shift in production mode indicates that Roborock is transitioning from asset-light to asset-heavy operations, which also exacerbates its potential risks. These risks include insufficient operational capabilities of manufacturing centers, quality levels not meeting predetermined plans, production deliveries falling short of expectations, and recruitment difficulties. However, in the long run, especially under the trend of smart cleaning robots shifting from "technological competition" to "price competition," self-production may help enterprises achieve quality improvement and efficiency enhancement, preparing ammunition in advance for price wars.

In addition, Yuanmeihui noted that in addition to focusing on overseas expansion for its main business, Roborock and its founder Chang Jing have also quietly laid out "new businesses."

In 2021, Chang Jing founded Shanghai Luoke Intelligent Technology Co., Ltd. (note: the main entity of Jishi Auto), betting on the new energy vehicle sector and completing six rounds of funding within just three years, including well-known investment institutions such as Tencent Capital, Sequoia China, IDG Capital, and Gaorong Venture Capital.

In 2023, Jishi Auto's first model, Jishi 01, debuted, targeting the large SUV market, but few news updates have been heard since then. In the new energy vehicle sector surrounded by both established and emerging players, Jishi Auto, as a late entrant, appears somewhat lukewarm.

Regarding the initial intention of vehicle manufacturing, Chang Jing has repeatedly stated publicly that it stems from personal interests. However, judging from the timing of vehicle manufacturing, Roborock had just celebrated its first anniversary of listing at that time, and Chang Jing's move may have been to hedge risks and find a safer landing spot.

In addition, in the first half of 2023, Roborock quietly launched a washing and drying machine, which was once seen by the industry as a crucial move in its pursuit of a second growth curve. Financial reports showed that in 2023, Roborock sold 256,317 units of other smart electrical appliances, generating revenue of 554 million yuan, accounting for less than 7% of total revenue; overall, the revenue scale of its new products is still small.

From "domestic competition" to "overseas battles," the domestic smart sweeping robot ecosystem is rapidly shifting from a blue ocean to a red ocean. The constantly changing market and the continuous emergence of new players, especially after Roborock's departure from Xiaomi's ecological chain, have significantly reduced external expectations for "sweeping king" Roborock. This is particularly evident in the secondary market.

As of the close on July 10, Roborock was trading at 367.66 yuan per share, with a market value of approximately 50 billion yuan. However, compared to its high in 2021, it has nearly halved.