"August Upheaval" on Taobao and Tmall

![]() 08/09 2024

08/09 2024

![]() 564

564

This article is written based on publicly available information and is intended solely for information exchange purposes. It does not constitute any investment advice.

What you see is often what others want you to see.

Recently, the entire market has divided into two camps over the issue of "refund only" policies, with heated debates raging. Little do people realize that amidst the clamor, a significant "August Upheaval" is quietly taking place:

Taobao and Tmall announced that they will charge all merchants a "basic software service fee" of 0.6% of the transaction value of each order, while refunding the annual fee for 2024.

This may be a policy adjustment that will significantly impact the financial performance of Taobao, Tmall, and even the entire Alibaba Group for the fiscal year.

Regarding this change in merchant policies, UBS directly stated in a report that the adjustment to merchant policies has a significant positive contribution to Taobao and Tmall's monetization rate, and accordingly raised Alibaba's rating and target price.

Image: UBS raises rating based on Taobao and Tmall's rule adjustments, Source: Gelonghui

It is worth noting that UBS has traditionally been relatively conservative in its evaluation of Alibaba's policies. When the platform's ROI tool was first introduced, UBS did not directly adjust its rating, citing the need for further validation of the new tool's effectiveness. This underscores the significance of the "August Upheaval."

In summary, the rule change from a one-time fee to a percentage-based fee based on GMV will have a direct and positive impact on the annual performance of Taobao, Tmall, and Alibaba.

According to recent estimates by Dolphin Investment Research, a third-party research institution, Alibaba's reform is expected to generate approximately 28.8 billion yuan in additional revenue. After deducting payment fee exemptions and annual fee offsets, the final revenue could reach approximately 10 billion yuan, directly impacting profits by 3-5%.

This calculation is relatively rigorous and well-reasoned, so we will not dwell on the specifics here. Instead, this report will delve deeper into analyzing the considerations, objectives, and sustainability of Alibaba's latest rule adjustments.

01

A Long-Overdue Rebalancing of Interests

First and foremost, it is essential to clarify that basic software service fees are a standard industry practice. JD.com, Pinduoduo, and Douyin have been charging their merchants a basic technical service fee of 0.6% for quite some time. Taobao and Tmall's recent reform, therefore, is not a revolutionary change but rather a targeted improvement.

Prior to this reform, Taobao and Tmall imposed annual fees ranging from 30,000 to 60,000 yuan to raise the barrier to entry for merchants, aiming to filter out those who did not meet basic requirements, such as small sellers lacking supply and service capabilities.

However, it is evident that high supply barriers are no longer the mainstream narrative in the e-commerce market. Whether it's price competition or GMV growth, a broader range of supply is crucial. Moreover, e-commerce consumers have surpassed their initial learning curve, and with the upgrading of consumer service policies (including the controversial "refund only" policy), the power dynamic between consumers and merchants has been profoundly reshaped once again.

Most small and medium-sized merchants that have yet to reach a significant scale should welcome this change, as the elimination of annual fees will enhance the liquidity of new merchants and alleviate short-term pressures.

As such, the mainstream view may be that the first layer of meaning behind Taobao and Tmall's reform is to expand supply by lowering the barrier to entry for merchants—in the low-price competition on the supply side, Taobao appears to be in need of more merchants.

We disagree with this viewpoint. Taobao's so-called shortage of merchants is not an absolute one, and this reform precisely reflects this.

On the one hand, under pressure from short videos and interest-based e-commerce, Taobao and Tmall's long-tail supply has indeed weakened. On the other hand, Taobao and Tmall do not actually lack mid-tier and top-tier suppliers for two reasons:

Firstly, Taobao and Tmall's annual fee policy has always been flexible, with most merchants eligible for annual fee waivers upon completion of certain tasks. According to the "Tmall 2024 Annual Fees and Software Service Fees by Category," most category merchants can enjoy a full annual fee refund upon achieving sales equal to 10-20 times the annual fee threshold. Even if they only achieve half of this threshold, they can still receive a partial refund.

Currently, Tmall's revised refund policy targets merchants with annual transaction values of ≤120,000 yuan (full refund) and will offer Alimama coupons worth 50% of the basic service fee to merchants with annual transaction values between 120,000 and 1 million yuan from September 1 to December 31, 2024.

This increase and decrease in fees are undoubtedly beneficial to merchants with lower annual transaction values. For example, in the apparel category, merchants with annual transaction values below 600,000 yuan will experience a reduction in software service fees. Small and medium-sized merchants with annual sales below 600,000 yuan are not the core contributors to revenue, so direct fee waivers will enhance Taobao and Tmall's appeal to these merchants and boost their long-tail supply.

In fact, major platforms in the market share similar perspectives. JD.com's "Spring Dawn Plan" last year drove a 4.3-fold increase in merchant numbers and doubled the number of third-party SKUs. Offering concessions to meet long-tail demand was seen as one of the countermeasures against short videos and interest-based e-commerce.

Secondly, compared to previous refund policies, the elimination of annual fee waivers for a large number of mid-tier and top-tier Taobao and Tmall merchants and the introduction of new percentage-based fees clearly do not favor merchants.

Mid-tier and top-tier merchants already generate annual sales sufficient to exceed the annual fee threshold. Under the new policy, they will not only incur additional annual fees but also face higher costs as their sales increase due to the percentage-based fee structure.

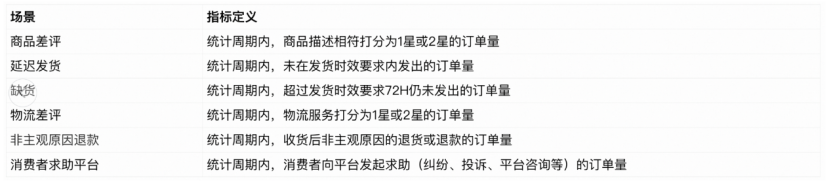

These merchants are precisely the ones that Taobao and Tmall do not lack. Recently, Taobao Group has revised its store evaluation criteria, gradually abolishing the original DSR (seller evaluation system) and replacing it with PXI (Product Experience Index), which affects store search weight from multiple dimensions such as shipping time, stockout status, refund reasons, and consumer disputes.

Image: PXI Product Experience Index diagram, Source: Xiao Viewpoint

Here's an inapt analogy: Compared to other trading platforms, Taobao and Tmall operate more like "real estate." The essence of a store is the store itself, and the value of real estate translates to the value of the store. Unlike short videos or live streaming e-commerce, where the effect outweighs the brand, maintaining the value of a single store requires more costs. To uphold PXI, stores need to invest more in human resources, inventory management, and operations, as well as incurring additional traffic costs to offset inevitable disputes—all non-product costs that cannot be ignored.

This gives Taobao and Tmall leverage over mid-tier merchants: For these merchants, the sunk costs on the platform far exceed the 0.6% basic service fee. They are unlikely to abandon years of investment in their "real estate" projects due to an additional 0.6% fee.

Therefore, in terms of supply-side adjustments, this reform by Taobao and Tmall resembles a rebalancing between long-tail merchants and mid-tier merchants.

Of course, some may question this logic. If the sole objective is to expand supply, why not simply eliminate annual fees to satisfy long-tail merchants and alleviate the burden on mid-tier merchants? After all, Taobao and Tmall's annual fee revenue accounts for only about 2.5% of total revenue (reference Dolphin Investment Research estimates), and the potential revenue growth from supply expansion should suffice to compensate for this loss. Why is there an urgent need to compensate for revenue shortfalls or even generate an additional hundred billion yuan in revenue from mid-tier merchants?

This brings us to the second layer of meaning behind Taobao and Tmall's rule changes.

02

The Underlying Logic Behind Showing Off Strength to the Market

In adjusting its rules, Taobao and Tmall briefly attributed the changes to industry norms. But why did Alibaba, as an industry veteran, choose to follow suit only now?

Image: Tmall's explanation for rule adjustments, Source: Tmall official website

A virtuous person keeps his abilities hidden until the right time to act. In our view, the timing of the rule changes is crucial: Taobao and Tmall's policy adjustments address the most pressing challenge at present—the need for data to support the rationality of various infrastructure projects surrounding the platforms.

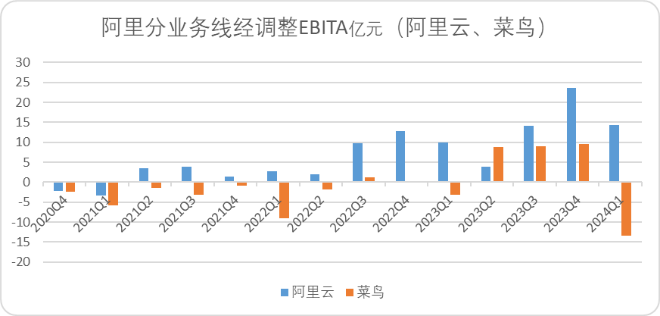

To most people, Alibaba's various business lines (Cainiao, Alibaba Cloud, Ant Group) are infrastructure built around Taobao and Tmall. As e-commerce has grown, these once cost centers have evolved into Alibaba's multi-polar growth points.

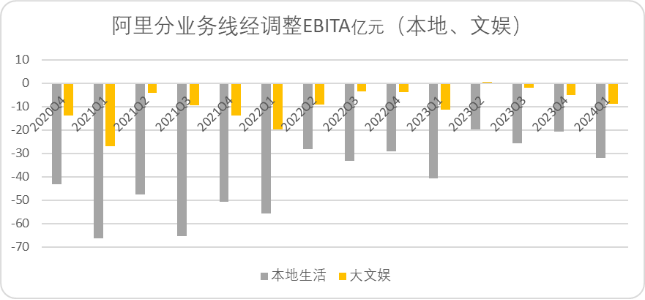

However, a closer look at Alibaba's financial reports reveals that most business lines are still hovering around the break-even point, failing to truly emerge as independent profit contributors outside of the Taobao and Tmall ecosystem:

Local services and digital media & entertainment have long struggled with insufficient revenue; Cainiao, which has shown signs of improvement, has once again fallen into an endless game of increased capital expenditures with its international expansion; Alibaba Cloud, which has also shown slight improvement, relies heavily on DingTalk's migration and has not met market optimism in terms of growth rates.

Image: Alibaba's adjusted EBITA data by business line, Source: Corporate Financial Reports

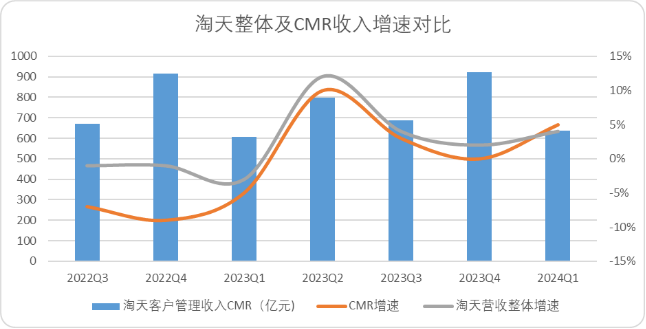

In this context, if Alibaba can demonstrate that a series of business lines have formed effective profit contributions within the Taobao and Tmall ecosystem, it can validate their value (especially Alibaba Cloud, Cainiao, and the payment system). The most intuitive reflection of revenue from services provided to merchants is CMR (Customer Management Revenue). However, CMR has been a relatively weak link for Taobao and Tmall, with its growth rate consistently lagging behind the overall platform's growth rate (only surpassing it by 1 percentage point in the previous quarter). Alibaba will undoubtedly seek ways to bridge the CMR revenue gap.

Image: Comparison of growth rates for Taobao and Tmall, China Commerce as a whole, and CMR, Source: Corporate Financial Reports, Jinduan Research

Additional information from Paidai also supports this point. Internal sources at Alibaba have stated that these fees are primarily used to cover software service costs for partners such as payment processors, ISVs (Independent Software Vendors), and cloud vendors.

Therefore, we tend to believe that the primary objective of this rule adjustment is to bolster Alibaba's weak CMR contributions, especially as rumors of Alibaba Cloud, Cainiao, and Ant Group's spin-offs and backdoor listings intensify, there is an urgent need to demonstrate the value of these business lines to the market:

By simply aligning with industry norms and increasing the fee by 0.6%, CMR has achieved over 28 billion yuan in positive revenue. Excluding exemptions and direct profit contributions, this translates to approximately 10 billion yuan. There is still room for the 0.6% basic service fee to increase, and future growth potential for the take rate remains high.

Alibaba wants to prove to the market that it is not the "god damned retailer" mentioned by Charlie Munger.

By putting some pressure on mid-tier merchants, Alibaba can not only generate significant revenue, lower the barriers to entry for small merchants and boost SKU count, but also demonstrate the value of Taobao and Tmall, as well as its subsidiary businesses, to the market. Why not?

03

Potential Risks That Cannot Be Ignored

There are no perfect plans, and nothing is all-encompassing. This seemingly perfect win-win-win plan actually harbors a potential risk: the attitude of mid-tier merchants towards additional expenses.

A couple of days ago, Professor Bi illustrated the power of sample bias: In a random survey of class sizes, Class A has 20 students, while Class B has 80. If we randomly select 2 students from Class A and 8 from Class B, 2 will say their class has 20 students, and 8 will say their class has 80 students. The average calculated based on this sample (2*20+8*80)/10 = 68 students, but the true average should be 50 students.

This is an example of sample bias and the difference in perception without weighting.

Similarly, this applies to Taobao and Tmall's claim of a "standard 0.6% across the industry." The 0.6% fee can significantly vary in perception among merchants across different platforms.

Let's do a simple math problem to illustrate this:

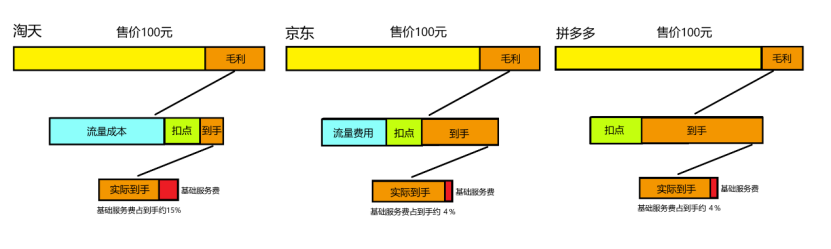

Using the rules outlined in Photon Planet's "Three Types of Games Played by Cat, Dog, and Pig," and excluding fulfillment costs:

Taobao and Tmall charge merchants an annual platform fee of 5-7% (commissions, credit card fees, points, etc.), taking 6% as an average, and a marketing investment of 10-30%, taking 20% as an average

JD.com POP merchants pay around 5% in fees, excluding gross margin protection, with marketing costs of approximately 10%

Pinduoduo charges a commission of 1-5% on its Billion Subsidy program, taking the maximum of 5%, with no traffic fees for low-cost promotions

For a product priced at 100 yuan, if Taobao and Tmall's and JD.com's gross margins are 30 yuan and Pinduoduo's is 20 yuan, after deducting comprehensive service fees and traffic costs, their respective net profits would be 4 yuan, 15 yuan, and 15 yuan.

If all three platforms have a gross margin of 30 yuan, their respective net profits after deducting fees and costs would be 4 yuan, 15 yuan, and 25 yuan for Taobao and Tmall, JD.com, and Pinduoduo, respectively.

Image: Calculating the impact of basic service fees on three platforms based on "Three Types of Games Played by Cat, Dog, and Pig," Source: Jinduan Research Institute

As we can see, due to limitations in its business model, Taobao and Tmall's traffic costs compress merchants' net profits, leading to sample bias. The 0.6% basic service fee has a more pronounced impact on merchants' perceived profits, especially for SKUs with lower gross margins. Therefore, the space for Taobao, Tmall, and JD.com to increase their take rates solely through commission hikes, without altering merchants' traffic expenses, is actually limited.

After all, in a fiercely competitive low-price environment, even the landlord's surplus is dwindling.

Figure: Landlord's family also has no extra food. Lines, Source: Online Image

This is actually the biggest potential problem Taobao may face with future rule changes: The goal of changing the rules is to increase CMR and take rate, and the market operation side cannot do without the logic of low prices, so the only thing that can be adjusted in the future is the traffic cost system. However, if traffic is liberalized, CMR will lose a significant chunk of revenue, creating a dilemma.

The story Taobao is telling now is indeed complete, but the problems may gradually amplify over time. After all, the direct cancellation of annual fees at this stage still has a greater impact than the perceived cost of commission fees. Simply increasing commissions cannot tell a perfect capital story. The future challenge for Taobao may be how to seek a balance between traffic value, product value, and merchant interests in the entire system.

But at least at this stage, Taobao's rule changes align with market preferences and may bring investors unexpected capital returns.