Microsoft Bing: Days of Misplaced Trust

![]() 08/13 2024

08/13 2024

![]() 472

472

Editor|Sun Jing

In just seven months, Microsoft CEO Satya Nadella had a major realization:

The true harbinger of a 'new day' in search wasn't the launch of New Bing, the AI-infused search engine that integrated ChatGPT. Instead, it was the outcome of the U.S. court case addressing Google's search engine monopoly.

According to Nadella during the trial, the presence of Google had made internet search the 'biggest no-fly zone' in Silicon Valley.

Previously launched as a 'challenger,' Microsoft Bing had been locked in a decade-long battle with Google, investing nearly $100 billion, yet it remained firmly under Google's thumb, with a market share hovering around 3%.

As a key architect of Bing, Nadella naturally felt not reconciled to . The emergence of ChatGPT reignited his passion. On the day of New Bing's launch on February 7, 2023, he declared to the world that this marked 'a new day in search,' as AI would reshape the current search market.

Nadella said he had been in the industry for 20 years, waiting for such a moment.

Unfortunately, the AI boost fell short of expectations. After 18 months, New Bing was struggling to maintain even its 'runner-up' position.

The harder Nadella tried, the more frustrated he became, seemingly reaching a nadir of despair.

Just then, a landmark antitrust ruling brought new variables to Microsoft and the search industry.

01

ChatGPT

Failed to Be Bing's Elixir

November 30, 2022, was a thrilling day for tech enthusiasts worldwide.

On this day, OpenAI officially unveiled ChatGPT, a chatbot that surpassed 100 million monthly active users within two months, becoming the fastest-growing consumer app in history.

Concurrently, a dormant dream was awakening: Microsoft's search engine aspirations.

As a significant backer of OpenAI, Microsoft announced the launch of New Bing, integrated with ChatGPT, on February 7, 2023. The refreshed search bar boasted an ambitious tagline: 'Ask me anything.'

Microsoft touted that New Bing could display traditional search results alongside AI annotations and a chat interface. It emphasized running OpenAI's next-generation large language model, tailored specifically for search services, which Microsoft claimed was more powerful than ChatGPT. This model, named 'Prometheus,' enhanced answer relevance, provided further annotations, updated search results, and made findings more useful.

The initial harvest is often the sweetest. Following New Bing's launch, market demand surged. Third-party data from data.ai revealed that Bing's global downloads skyrocketed tenfold overnight, propelling it to the second most popular free productivity app on Apple's App Store, right behind Gmail.

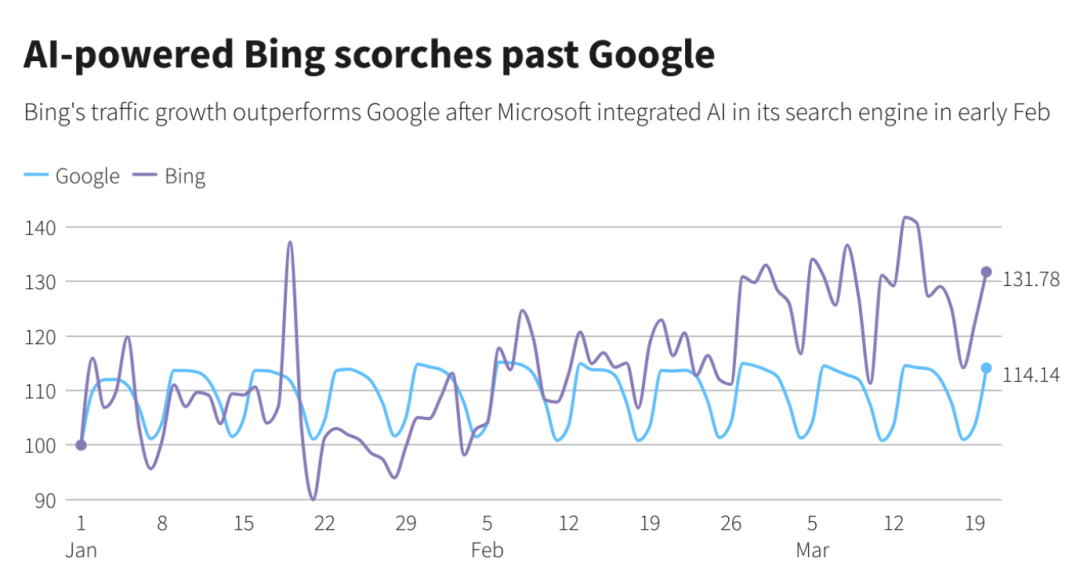

▲As of March 20, 2023, Bing's page views increased by 15.8% since Microsoft introduced its AI-powered Bing search on February 7, while Google's page views declined by nearly 1%.

Source: Similarweb

Microsoft reported that within 48 hours of New Bing's launch, 1 million users had signed up. The following month, Bing surpassed 100 million daily active users, with 'millions of active users' attracted by the AI integration.

Microsoft CEO Satya Nadella told the media, 'AI-powered Bing represents a new paradigm in search. By integrating OpenAI's AI into Bing, we're making Google dance. Today, Microsoft is bringing more intense competition to search.'

Microsoft sounded the battle cry, finally reigniting its search engine dreams after more than a decade of humiliation.

In Silicon Valley and Seattle, everyone knew Bing's tumultuous journey. For years, Bing's conversation revolved around stagnant market share and rumors of shutdown or sale.

Could Bing finally turn the tables with AI's help? Judging by Google's anxiety at the time, it seemed plausible.

The day after New Bing's launch, Google hastily held a showcase in Paris. However, its chatbot Bard, a ChatGPT competitor, stumbled during the demonstration, causing Google's stock price to plummet by $100 billion in a single day. CEO Sundar Pichai sounded the 'red alert' for an emergency crisis internally, even bringing back Google co-founder Sergey Brin after years of seclusion.

As Google scrambled, Microsoft dropped another bombshell – integrating GPT-4 into Office 365, empowering 1 billion workers worldwide. Bill Gates' vision in 'The Road Ahead' seemed to be unfolding: 'Companies in a positive spiral have an innate sense of good fortune, while those in a negative spiral feel doomed to fail.'

Microsoft's CFO optimistically told analysts that each percentage point increase in Bing's market share would generate approximately $2 billion in advertising revenue for Microsoft.

Yet, after a year and a half, the harsh reality was that Bing barely gained any new market share from Google.

In 2023, Bing's global market share was 2.97%. According to StatCounter, by July 2024, Bing's latest share was 3.86%, still below 4%. Ironically, ChatGPT-integrated Bing experienced consecutive monthly declines after February 2023, dipping below 3% global market share before recovering above 3% in August.

For comparison, when Microsoft renamed Live Search to Bing in summer 2009, its global share was 3.5%. In other words, after 15 years, even with ChatGPT's boost, Bing remained stagnant.

Meanwhile, Google's market share fell from 92% in July 2023 to 91% in July 2024, a mere 1% decrease.

▲Source: statcounter

Perhaps even more embarrassing for Microsoft, Aravind Srinivas, founder of the star startup Perplexity, unilaterally sounded the death knell for Google Search on social media platform X at the end of 2023. Ambitiously, he claimed, 'Perplexity is the alternative to traditional search engines.'

If voters in Silicon Valley had to choose Google Search's toughest rival, they would likely pick Perplexity over Bing. Standing behind Perplexity are influential figures like Jen-Hsun Huang, Jeff Bezos, and Masayoshi Son.

Just two years old, Perplexity has already surpassed 10 million monthly active users. In July 2024, Perplexity answered approximately 250 million questions, half of its total search answers for 2023, indicating exponential growth.

Nadella might not have anticipated that as he proclaimed 'a new day in search' and ambitiously waged war against Google, a new generation was writing the 'new day' of the search industry elsewhere.

ChatGPT failed to be Bing's elixir. For Microsoft, Bing seems misplaced trust once again.

02

Bing's Repeated Failures

The Unbeatable Google

Nadella's disappointment was evident in his testimony during the Google monopoly trial.

He acknowledged that AI's ability to reshape today's search market was limited. He also feared that AI would strengthen Google, making challengers' situations even more difficult.

Of course, such 'humility' might also stem from the occasion. If Microsoft could shake Google's market position through legal means, Bing would gain more room to survive.

Since its inception in 2009, Bing was expected to challenge Google with technological innovation and better user experiences.

Nadella claimed that Microsoft had invested approximately $100 billion in Bing, even surpassing Google's investment.

He personally immersed himself in Bing's establishment. In March 2007, then-Microsoft CEO Steve Ballmer approached Nadella, hoping he would lead the team developing online search and advertising businesses (Bing's predecessor). Nadella was warned, 'This might be your last job at Microsoft. If you fail, there's no parachute. You might crash with it.'

▲Left: Nadella Middle: Bill Gates Right: Ballmer

Microsoft needed to establish a growth trajectory beyond Windows and Office, and Ballmer believed search was the future of the industry.

The following year, Microsoft recruited Lu Qi from Yahoo, promising to fully develop its online search business and compete long-term with Google. Lu Qi had overseen Yahoo's search and search advertising – at the time, Yahoo was seen as Google's only formidable competitor.

▲Lu Qi was a sought-after industry giant in Silicon Valley at the time

To learn this unfamiliar to-consumer business, Nadella willingly placed himself under Lu Qi's guidance. Unlike Ballmer's all-in approach, Nadella had other expectations for Bing – he believed it would eventually become a great training ground for Microsoft's 'cloud-first' services. This vision was undoubtedly more far-sighted at the time.

In 2009, Microsoft renamed Live Search to Bing, positioning it as a 'decision engine.' A 'decision engine' displays or pops up relevant information when users type in keywords like weather or flights, even suggesting Facebook friends' content through Bing.

Bing's ambition to challenge Google in search was evident in its historic agreement with Yahoo, where Yahoo gradually abandoned its search technology in favor of Bing's data.

Unfortunately, Bing didn't meet expectations. Within two years of launch, Microsoft had already lost $5.5 billion on Bing's search business. When Nadella became Microsoft's CEO in 2014, he immediately faced questions about whether Bing would be sold.

At the time, Bing was unprofitable, and Yahoo was already considering ending their partnership.

Moreover, the two dominant mobile internet gateways – Android and iOS – were firmly controlled by Google. These two walls seemed insurmountable.

For Android manufacturers, Google Play was a crucial distribution platform, allowing Google to secure its position as the default search engine in Android browsers.

Within Apple's ecosystem, Bing never gave up competing with Google. Nadella's overtures even seemed submissive. He said that during his tenure, he annually prioritized discussing whether Apple would make Bing its default search engine. In 2018, Microsoft even attempted to deepen its partnership with Apple by selling Bing or forming a joint venture, willing to accept years of losses to seal the deal.

However, Bing never replaced Google as the default search engine in Apple's ecosystem. Apple Services head Eddie Cue explained that Microsoft lagged behind Google in search quality, technological investment, and commercialization, hindering substantial negotiations.

In terms of commercialization alone, Google left competitors far behind. In 2022, Google paid Apple $20 billion in search advertising revenue, accounting for 17.5% of Apple's operating profit that year. In comparison, Microsoft's concessions paled in comparison.

During the Google monopoly trial, Nadella emphasized that search was a game where Microsoft struggled to make any breakthroughs, yet it persisted. He argued that Google blocked competitors like Bing through default search contracts.

▲Nadella appearing in court for the Google monopoly trial in Washington, D.C., on September 13, 2023

Source: The Washington Post

However, Google refused to take the blame. Google's lawyers argued that it was a direct result of Microsoft's mistakes in internet search, not Google's market control.

Li Hu, an early Google employee with 20 years in Silicon Valley, told NoNoise that the search market was a winner-takes-all game, hinging on brand power. 'Even if Yahoo had done better, no one cared. Users still instinctively opened Google. Bing did well too, but few used it, and it never gained market share.'

Compared to Google Search, launched in 1998, Microsoft Bing arrived too late, at least 11 years behind.

Worse still, Microsoft's sluggish response to the mobile internet era failed to pave the way for Bing's traffic inflows. In 2005, Google co-founder Larry Page approved a $50 million acquisition of Android, giving Google Search an entry point into the mobile internet era. In contrast, Microsoft's Ballmer dismissed Android and iOS's potential, even mocking the iPhone's lack of appeal to business customers due to its lack of a keyboard. Yet, it was Microsoft's flagship Windows Phone system that ultimately failed.

As a remedial measure, Microsoft spent $7.2 billion to buy another ticket - Nokia.

Bing must have suffered a lot, and Baidu Search will understand the feeling.

The gap is widening.

Of course, Bing is not the only one injured in the search industry. Over the past two decades, Google has been the most widely used Internet search engine in the world, without a doubt. Its market share has remained above 90% for years. In these 20 years, both startups and technology giants have failed in their battles against Google.

Among many competitors, Microsoft is the only one that still seems to have the strength and qualifications to compete on the same level - according to estimates by the UK's Competition Markets Authority, building a company from scratch to compete with Google would cost at least $10 billion to $30 billion.

Despite the slim chances, Microsoft will not easily give up. In order to turn around Bing's awkward situation, Nadella recruited Mustafa Suleyman, co-founder of DeepMind, in March this year and appointed him as Microsoft AI's Executive Vice President and Chief Executive Officer.

A new turning point emerged in early August this year. Google lost a lawsuit over search engine monopoly, and a crack may appear in the impregnable wall.

However, in Microsoft's grand AI strategic layout, Bing's expectations have become increasingly lighter. Currently, Azure cloud services, Microsoft 365 Copilot, and the self-developed 500 billion parameter large model MAI-1 are the focus of Microsoft's competition in the new round of AI.

03

AI Search

Where to Go?

At this time, the search market has also added a new variable - AI search is becoming increasingly popular.

In February this year, Gartner predicted in a report that by 2026, traditional search engine queries could decline by 25%.

When asked whether conversational AI would reshape search or enable competitors to replace Google, Google CEO Sundar Pichai told the media that this new technology could provide "opportunities for both large and small companies to find new markets," but he also emphasized that Google is at the forefront of combining generative AI with more traditional search.

Both large and small companies are waiting for the right moment to seize the new market opportunities.

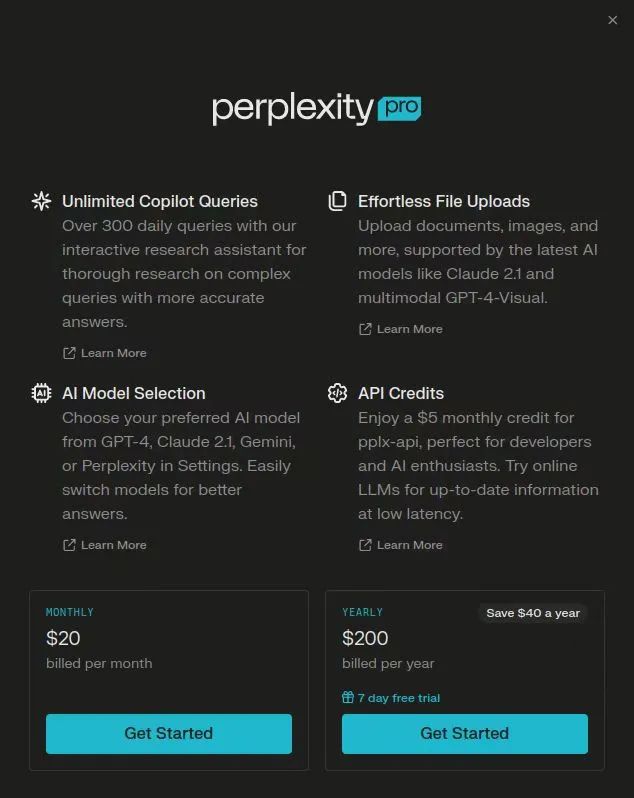

Perplexity, mentioned earlier, has seen its value soar in less than two years. According to a report by The Information at the end of May, Perplexity's latest valuation has reached $3 billion, roughly equivalent to one-tenth of Baidu's valuation.

Perplexity offers users a search experience vastly different from Google: After a user asks a question, Perplexity filters sources, summarizes answers, thoughtfully attaches source links, and allows users to search for information in specific fields based on their needs, with classified storage for efficient retrieval. Another key point is that there are no ads - this is considered one of the mass bases for challenging Google.

However, Perplexity's resolve didn't last long. Recently, the startup announced that its product business model will officially shift from subscription to advertising by the end of September. Perplexity's Chief Commercial Officer, Shevchenko, said, "Unlike OpenAI, we know that our primary profit engine will be advertising."

This means that AI search companies will compete more fiercely with Google.

Interestingly, Perplexity's search engine was initially powered by a licensed version of Microsoft Bing's web index. However, Shevchenko stated that Perplexity will no longer use Bing as its core system but will instead use its proprietary search index and ranking system.

This may be a new signal that Bing does not seem to have gained much from the "wolf-raising plan" but instead nurtured a new potential competitor. The $300 billion advertising market is attracting more young aspirants.

On the other hand, with Perplexity clearly adopting the advertising model, Google simply gains another challenger but loses a potential disruptor. Rather, it is the unreleased OpenAI search product, SearchGPT, that fills the industry with anticipation.

As a fan of OpenAI, Li Hu believes that the biggest variable in the future search market will still come from ChatGPT. "Regardless of the model, ultimately, it depends on what users need. Once ChatGPT secures a partnership with Apple iOS and enters the search field, it is only a matter of time before it replaces Google," he said.

In China, the question of who will be the Chinese version of Perplexity is hotly debated, with the challenge shifting from Google to Baidu. Baidu has attempted to embed AI into its various businesses, and Robin Li emphasized in his 2024 OKR that AI integration is crucial to leading the generational transformation of search experiences.

However, products that break user habits often rewrite logic rather than merely patching up existing products with AI - this is the power of marginal innovation. Although Baidu has reconstructed its search engine with ERNIE Bot, AI search answers currently account for only 11% and still heavily rely on traditional search habits. Baidu needs to continuously explore and optimize its product appeal.

Every prophecy about the final outcome of the future search market needs time to verify. However, there is no doubt that the potential changes brought about by AI and the emergence of challengers will inject new vitality into the search market, which has remained largely unchanged for many years.

After all, when the tide of the times sweeps in, no one wants to be left behind.

(Upon the request of the interviewee, Li Hu is a pseudonym in this article)