Temu headquarters besieged again, white label merchants want to sever ties with Pinduoduo?

![]() 08/06 2024

08/06 2024

![]() 542

542

Written by Leon

Edited by cc Sun Congying

The conflict between retailers and suppliers is an eternal topic in the retail industry, with examples such as Gree Electric's Dong Mingzhu pulling out of GOME, and East Selection attempting to separate from Douyin. However, with the online migration of retail businesses, the conflicts have become less intuitive.

But this time, the sellers on Pinduoduo seem reckless. Temu, the cross-border e-commerce platform under Pinduoduo, has recently been collectively boycotted and protested by many sellers.

To expand public opinion influence and quickly urge Temu to release frozen funds and refund fines, sellers chose a radical approach—sitting in protest and blocking Temu's headquarters with banners.

This is also the second time in a month that sellers have blockaded the headquarters, putting pressure on Temu.

Known for its efficiency, Pinduoduo's Temu overturned the traditional POP store model commonly used by platform e-commerce companies to quickly expand overseas and occupy the market. Instead, it pioneered a fully managed model.

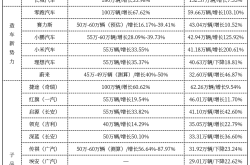

Under the fully managed model, sellers become "suppliers," no longer needing to independently operate their stores, including product selection, pricing, new product launches, marketing, traffic generation, warehousing, and logistics. Temu handles everything, and sellers are only responsible for supplying products and shipping them to Temu's Guangzhou warehouse. In this way, Temu is able to accomplish great things with minimal costs, successfully transforming into a "self-operated" e-commerce platform.

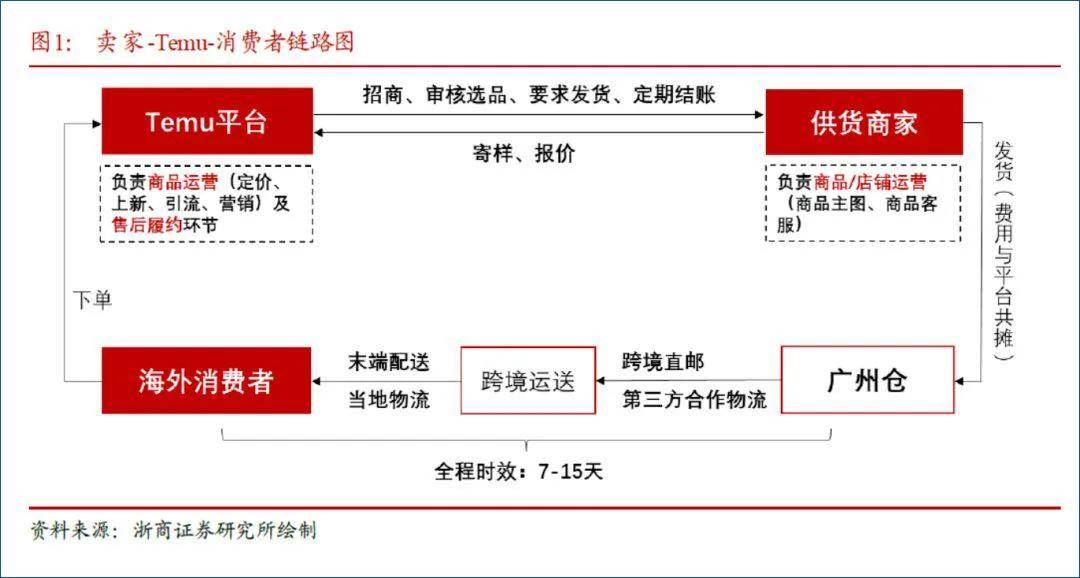

Generally speaking, self-operated e-commerce platforms are responsible for the entire operational process and must also bear related risks after the transfer of property rights. However, under the fully managed model, Temu tends to shift the burden of problems onto merchants.

Frequent fines and hefty penalties have become an unbearable burden for merchants.

Radical rights protection, forcing the platform to refund

On the morning of July 29, at least 200 sellers gathered outside Temu's Guangzhou headquarters at the Aoyuan International Center to protest Temu's unfair terms and demand the return of high fines.

Subsequently, some sellers entered the building and made their way to the 25th floor, where Temu's offices are located, to sit in protest. Other sellers expressed their determination to fight a protracted battle, stating that they had prepared toiletries and would not leave until their funds were released. To avoid conflict, Temu employees were notified to leave work early at 1 pm, leaving the entire office area empty.

According to sellers present at the protest, a director from Temu's Public Affairs Department was supposed to meet with them. He had previously promised during a small-scale communication at the end of June that some of the reserved after-sales funds would be gradually released, but he did not appear this time and was replaced by an assistant. Later, even this assistant disappeared.

As time passed, more sellers gathered outside the Aoyuan International Center, with roughly over 800 people in attendance. According to several authoritative media reports, the total amount of fines and frozen reserved after-sales funds is estimated to be between 114 million and 142 million yuan.

According to reports, one of the protesting Temu sellers revealed that their Temu store had incurred 830,000 yuan in after-sales fines and 1.28 million yuan in frozen reserved after-sales funds since June 2023. Another seller stated that their store's fines and reserved after-sales funds totaled approximately 1.6 million yuan, accounting for 35% of their sales. Without recovering the unreasonable fines, they face significant losses.

Furthermore, some sellers stated that even though they were aware of Temu's arbitrary fines, they were unable to withdraw completely due to the need to clear inventory and the risk of Temu deducting more reserved funds for breach of contract if they stopped supplying products, making it more difficult to withdraw funds.

Around 5 pm on July 30, dozens of sellers sitting in protest in the 25th-floor office area were persuaded to leave by police officers, while a hundred or so people remained downstairs. However, Temu did not provide any new responses, and the sellers had no choice but to leave.

On July 30, some sellers still visited Temu's Guangzhou headquarters seeking solutions. During the exchanges, a small number of sellers discovered that previously registered fines had been fully refunded, but others stated that they were still unable to withdraw funds.

In the evening, an "insider" from Pinduoduo told the media that only a dozen sellers were actually involved in the rights protection incident, mainly from the clothing category, and many of those present were "hired." These e-commerce merchants often engage in false shipments, incorrect sizes, and forged quality inspection labels to clear inventory. After being penalized by the platform, they hoped to draw attention and force the platform to refund them by causing a disturbance.

The platform does not profit from fines, which are paid to consumers instead," the insider concluded. However, they reiterated that these statements do not represent the official position of Pinduoduo but are based on their personal understanding.

It is reported that the area around the Aoyuan Building in Panyu, Guangzhou, has been closed off, and entry requires a pass.

Two conflicts within a month

Since July alone, Temu's Guangzhou headquarters has been besieged by sellers twice.

According to reports, more than a dozen sellers arrived in Guangzhou as early as the end of June to negotiate with Temu multiple times. Their common issue was being frequently fined heavily or having their reserved after-sales funds frozen, with amounts ranging from hundreds of thousands to millions of yuan. Temu failed to provide clear responses, ultimately escalating the situation.

On July 22, hundreds of angry sellers protested outside the Aoyuan International Center, demanding reasonable explanations from Temu. Subsequently, relevant personnel arrived on the scene with loudspeakers to address the sellers, promising solutions and requiring them to register first. However, the handling results were unsatisfactory, leading to the escalation of conflict on July 29.

The entire rights protection incident at Temu's headquarters was actually a long-simmering eruption. As early as October 12, 2023, sellers had already pulled banners outside Temu's Guangzhou headquarters, stating, "Temu does not pay for goods, no money for salaries," but this did not attract widespread attention. Then, in April 2024, sporadic sellers protested at Temu's office location.

Efficient but centralized fully managed model

Backed by China's vast industrial chain and replicating Pinduoduo's model, Temu hit the ground running. Since its launch on September 1, 2022, it has quickly entered more than 70 countries and regions worldwide. On its one-year anniversary, Temu achieved a daily GMV (Gross Merchandise Volume) of $80 million, with a full-year GMV of $18 billion in 2023.

Temu's rapid rise would not have been possible without the support of sellers. However, why have sellers and the platform become fiercely opposed in less than two years? The answer lies in Temu's operating model and logic.

Before Temu, cross-border e-commerce typically adopted the traditional POP store model (third-party seller stores), where sellers independently operated overseas stores, participating in the entire process of product selection, pricing, listing, sales, shipping, and after-sales. This threshold was not low.

As a rising star in cross-border e-commerce, Temu aimed to quickly capture the market and found the POP store model to be overly cautious and inefficient. Therefore, Temu decided to innovate its operating model and introduced the fully managed model.

In simple terms, the fully managed model turns sellers into "suppliers," relieving them of the need to independently operate their stores, including product selection, pricing, new product launches, marketing, traffic generation, warehousing, and logistics. Temu handles everything, and sellers only need to supply products and ship them to Temu's Guangzhou warehouse. In this way, Temu functions as a "self-operated" e-commerce platform.

Under this model, Temu can quickly and uniformly list products in dozens of countries and regions worldwide without having to consider the efficiency of individual stores as in the POP store model. Sellers also save time and operational costs. To attract more white-label sellers, Temu introduced a one-click registration feature similar to Pinduoduo. By October 2023, approximately 90,000 Pinduoduo suppliers had joined Temu.

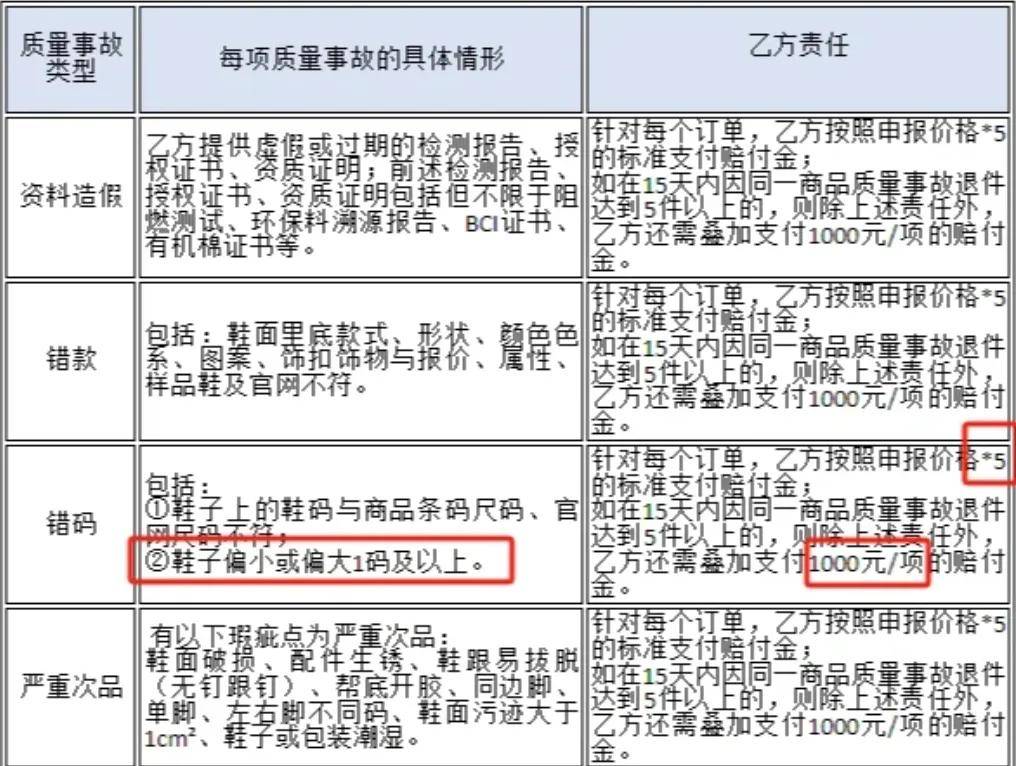

With a strong supply chain in place, Temu began creating best-selling products following a straightforward process: merchant recruitment, quoting, sample submission, review and quality inspection, stock preparation, shipping, listing, and final delivery. To maintain price advantages, Temu requires sellers to offer prices lower than other platforms, with a gross margin of around 20%.

After products are listed, Temu monitors them in real-time. If a lower-priced version of the same product is detected, a "price reduction prompt" will appear in the seller's backend. If the seller refuses, they may face a risk of reduced rankings. Nevertheless, several sellers revealed that for daily necessities and clothing products, sellers can still maintain a net profit margin of around 10%.

Furthermore, during product promotion, Temu closely monitors conversion rates. If a product is popular, it immediately increases supply and turns it into a "bestseller"; if sales are poor, it removes the product from shelves and returns it. Leveraging the low procurement prices of white-label products and aggressive localized marketing (such as advertising during intervals of the Super Bowl in the US), Temu rapidly captured market shares in various countries' e-commerce sectors.

The fully managed model has undoubtedly been successful, with competitors like Alibaba and SHEIN following suit. However, as competition intensified and overseas markets changed, the fully managed model began to show drawbacks, leading to cracks between Temu and domestic sellers due to lost interests.

Temu doesn't pay for the loopholes and drawbacks of the fully managed model

As Temu penetrated the European and American markets, bottlenecks emerged. With white-label products, Temu follows the same low-cost model as domestic Pinduoduo. However, consumers in developed regions like Europe and the US had high expectations of Temu, leading to a rising complaint rate. In February this year, the Better Business Bureau reported receiving over 900 complaints about Temu within a short period, most of which concerned product quality or delivery issues.

In response, Temu implemented harsh penalties, including a five-fold fine rule. Temu's "After-Sales Service Rules" classify quality incidents into various types, such as falsified information, wrong items, wrong sizes, and severe defects. Sellers who violate these rules face a fine of five times the declared price. If more than five incidents occur within 15 days, sellers must also pay a compensation fee of 1,000 yuan per incident.

The controversial aspects of this rule mainly lie in two areas. First, some details are overly stringent, such as the second point regarding wrong sizes, which states, "Shoes are too small or too large by one size or more." Merchants have reported that some customers return products due to personal size misjudgment, leading to penalties for the store.

Secondly, Temu's white-label products, by nature, cannot compete with branded products in terms of quality. While European and American consumers may not understand the difference, Temu certainly does. The platform should bear part of the responsibility for quality inspection during product selection, but Temu shifts this entirely onto sellers, which seems overly harsh.

The final straw for sellers is the "refund only" policy, a controversial measure that has already caused significant controversy in China. However, Temu introduced this policy unchanged without improvement. Although the "refund only" policy is relatively lenient in European and American markets, as the number of such refunds increased, leading e-commerce platforms like Amazon introduced restrictions to reduce merchant losses, but Temu did not follow suit.

Temu's "After-Sales Service Rules" state that Temu has the right to independently judge whether products have quality issues based on information such as merchant stores and product details, using the standard knowledge level of an ordinary person, and to decide whether to support buyers' refund requests. As a result, some sellers have been deducted over 900 times due to frequent "refund only" cases, incurring losses of nearly 140,000 yuan.

Temu's "unfair terms" do not stop there. For example, the "One-Stop Warehousing Comprehensive Service Agreement" stipulates that if merchants exceed the storage time, they must pay a late fee of 500 yuan per day. If the excess exceeds seven days, Temu has the right to dispose of the goods, and the resulting costs will be borne by the buyer.

Furthermore, clauses in the "Temu Platform Seller Service Agreement" such as "If the platform determines that the seller has violated this agreement," and "The seller agrees that the platform may immediately deduct funds from the deposit to compensate consumers or the platform without prior notice to the seller or assuming any responsibility for such deductions" are also very harsh. Sellers cannot join Temu if they disagree with these terms.

So, haven't any sellers taken legal action to protect their rights?

Some lawyers point out that from a legal perspective, the platform's harsh penalty regulations are problematic and suspected of infringing on sellers' rights. However, due to the platform's inherent strength, it is difficult for sellers to actually protect their rights, and they face risks of reduced rankings or store closures.

Meanwhile, Temu has already set barriers for legal rights protection. While Temu's buyer business is primarily operated by Pinduoduo's subsidiary Guangzhou Yucan Information Technology Co., Ltd., the "Temu Platform Seller Service Agreement" clearly states that sellers sign agreements with Whaleco Technology Limited and its affiliates, a company located in the US. The agreement specifies that any disputes shall be submitted to the Hong Kong International Arbitration Center.

Although cross-border prosecutions typically set the arbitration venue outside relatively neutral regions like mainland China, such as Hong Kong, filing a lawsuit in Hong Kong is expensive and time-consuming, with legal fees potentially reaching hundreds of thousands of yuan for a single case. Domestic small and medium-sized businesses are obviously unable to bear such costs.

Temu's transformation, fully managed sellers suffer

In addition to the above reasons, another factor contributing to the frequent fines imposed on fully managed merchants by Temu this year is changes in Temu's own business.

First, Temu's rapid growth has successfully driven significant performance gains for its parent company, Pinduoduo, with revenue reaching 86.8121 billion yuan in the first quarter of 2024, a year-on-year increase of 131%. Consequently, the group has raised its expectations for Temu's performance and set more aggressive targets.

According to insiders, Temu's GMV target for 2024 is $60 billion, which is 3.3 times the $18 billion in 2023. To achieve this goal, Pinduoduo completed the transfer of its elite internal team to Temu in March this year, with the team's management mainly coming from the Duoduo Maicai business. Meanwhile, to seek cluster advantages in the 3C and home appliances sectors, some Temu teams have begun shifting from Guangzhou to Shenzhen.

It is reported that Temu's GMV exceeded $20 billion in the first half of this year, leaving a gap of $40 billion. The performance pressure in the second half is immense. According to market research firm Bernstein, Temu's annual GMV for 2024 is projected to be approximately $54 billion.

In addition to the pressure of growth, Temu also faces potential regulatory risks. Taking the United States as an example, its Congress has repeatedly discussed changing the clause of "tax exemption for personal imported goods valued below $800," aiming to block Temu's low-cost, "small package direct mail" tax avoidance method.

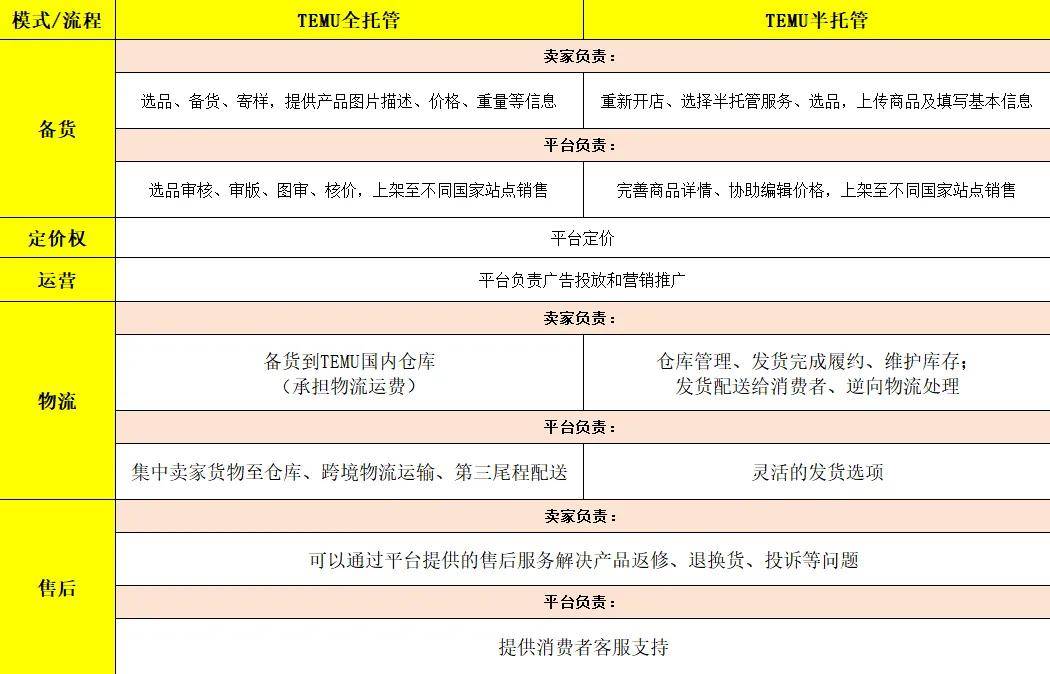

Under these circumstances, Temu swiftly shifted to a "semi-managed" model in March this year, hoping to increase revenue and profits while reducing the risk of penalties from regulatory agencies in various countries.

Compared to fully managed operations, semi-managed operations require more experienced cross-border sellers to participate in operations, including assisting with pricing and listing on different country sites for sale. They must also handle warehouse management, shipping, and inventory maintenance, with overseas warehouses typically being those designated by Temu for cooperation. Additionally, semi-managed products have higher pricing and better quality, not limited to white-label small items priced below $10, thereby helping to broaden Temu's product categories.

Facts have proven that the semi-managed model has been highly effective. Data shows that after Temu launched its semi-managed model in the United States on March 15th, its GMV accounted for 20% by early July. Subsequently, Temu extended the semi-managed model to five European countries and accelerated the recruitment of official partner overseas warehouses, growing from seven to over twenty, paving the way for semi-managed sellers to enter the global market. On the other hand, it imposed strict fines on fully managed white-label sellers.

Does this operational logic sound familiar? Yes, it mirrors Pinduoduo's domestic development trajectory: leveraging low-cost products from white-label merchants to establish the Pinduoduo brand and then transitioning towards branding and flagship stores.

New Rules Needed for Cross-Border E-commerce

On July 30th, the State Council Information Office held a press conference on "Promoting High-Quality Development," which covered cross-border e-commerce. Lu Daliang, the spokesperson of the General Administration of Customs and Director of the Department of Statistics and Analysis, revealed that China's cross-border e-commerce import and export volume reached RMB 1.22 trillion in the first half of this year, up 10.5% year-on-year.

Lu also stated that the vigorous development of cross-border e-commerce poses new challenges to customs supervision and services. Currently, measures are being studied to promote the "inspection before shipment" model for cross-border e-commerce exports and expand the pilot scope of cross-regional returns for cross-border e-commerce retail exports, all centered around "high-quality development" to better meet the needs of consumers and enterprises for "buying and selling globally."

The requirements for high-quality development are multidimensional and multi-faceted, concerning China's overall cross-border e-commerce landscape and posing higher demands on platforms and merchants. Platforms need to comply with national policies and maintain stability in the cross-border e-commerce market, rather than disrupting market stability solely for their own interests.

In fact, some e-commerce brands have already set an example. Taking the Ali Group as an example, it has frequently improved and refined its operational systems recently, such as eliminating the annual fee for Tmall stores, launching new overseas expansion plans, integrating multiple overseas platforms like AliExpress, and establishing an interception mechanism for "refund only" cases, aiming to encourage sellers to join and co-prosper.

SHEIN, a fast-fashion cross-border e-commerce platform, promotes a slogan of "zero entry fee, zero deposit, zero advertising fee" to attract sellers and offers official empowerment training and traffic support.

Additionally, as the cost of acquiring customers in the public domain continues to rise, private-domain cross-border e-commerce has become a new choice for sellers. By operating corporate accounts on social media as the core, continuously producing high-quality content, sellers can eventually direct targeted audiences to their personal traffic pools for monetization.

Returning to Temu and Pinduoduo, disrupting market balance for their own growth is clearly not a long-term solution and may well backfire. In fact, the capital market has already reacted. On July 30th, EDT, Pinduoduo's American depositary shares closed at $123.16, down 3.47%, with its total market value shrinking to $171 billion.