Alibaba unbinds 'only refund' as e-commerce doesn't need another Pinduoduo

![]() 08/06 2024

08/06 2024

![]() 534

534

For internet companies, the only constant may be 'constant change'. Recently, Taobao announced it would optimize its 'only refund' policy, improving merchants' after-sales autonomy based on the new experience score system, and reducing or eliminating after-sales interventions for high-quality stores.

At the end of last year, Alibaba, JD.com, Douyin, Kuaishou, and even overseas players like Amazon and TEMU all introduced only refund services, making 'only refund' almost a standard feature in the domestic e-commerce industry.

However, currently, 'only refund' has not brought a 'bright future' to the e-commerce industry, but instead caused much controversy within the industry, with many merchants complaining about it.

As user traffic approaches its ceiling, e-commerce platforms want to improve consumer experience and expand GMV while also protecting merchant rights and charging for traffic. But you can't have your cake and eat it too. 'Only refund' has disrupted the delicate balance between users and merchants.

Now, half a year has passed, and perhaps it's time for platforms to wake up from their dream of 'learning from and becoming Pinduoduo' and find a development model more suitable for themselves to return to the growth track.

1""E-commerce platforms begin 'correcting' their policies

According to Taobao's new rules, for stores with an experience score of 4.8 or higher, the platform will not immediately support only refunds but will recommend that consumers first negotiate with merchants. For other merchants, the platform will grant varying degrees of autonomy based on their experience score and industry nature.

Additionally, Taobao will provide multiple after-sales service options for merchants to choose from, reducing disputes and losses caused by 'only refunds.' When merchants dispute an 'only refund' and initiate an appeal, the platform will involve a third-party inspection agency. If the inspection passes, the platform will compensate the merchant for their losses.

In short, Taobao is no longer treating merchants with a 'paternalistic' tough stance but hopes to guide merchants and consumers to negotiate on their own. Of course, this communication standard is still biased. The higher the merchant's experience score, the greater their autonomy, encouraging merchants to optimize services in other areas.

In fact, when the only refund policy was first introduced, all major platforms mentioned that they would make comprehensive judgments on buyer requests. For example, JD.com and Taobao mentioned that the platform would use big data to make a comprehensive judgment on merchants before deciding whether to approve an 'only refund' request. Douyin stated that if a product's positive rating is below 70%, the platform has the right to support only refunds or return refunds with shipping included for after-sales applications related to that product's transaction orders.

However, in actual execution, the scales of 'only refund' tipped heavily in one direction. Searching for 'only refund' on social platforms, taking Taobao as an example, some merchants have had orders from years ago refunded without explanation. In some cases, consumers have been approved for 'only refunds' even when they only requested a 7-day no-reason return.

Some merchants stated that the platform automatically intervenes in the after-sales process as soon as it detects keywords, directly sending a 'only refund' popup to consumers. Essentially, there is no 'comprehensive judgment' by the platform, and the initiative mostly lies with consumers.

In fact, the original intention of e-commerce platforms introducing the only refund service was to eliminate low-quality merchants and enhance user experience. However, in reality, this policy ended up conducting 'indiscriminate attacks' on all merchants. While low-quality merchants haven't been eliminated by 'only refunds,' small and medium-sized merchants operating compliantly have been severely impacted by 'professional wool collectors.'

2"""Only refund" deviates from its original intention

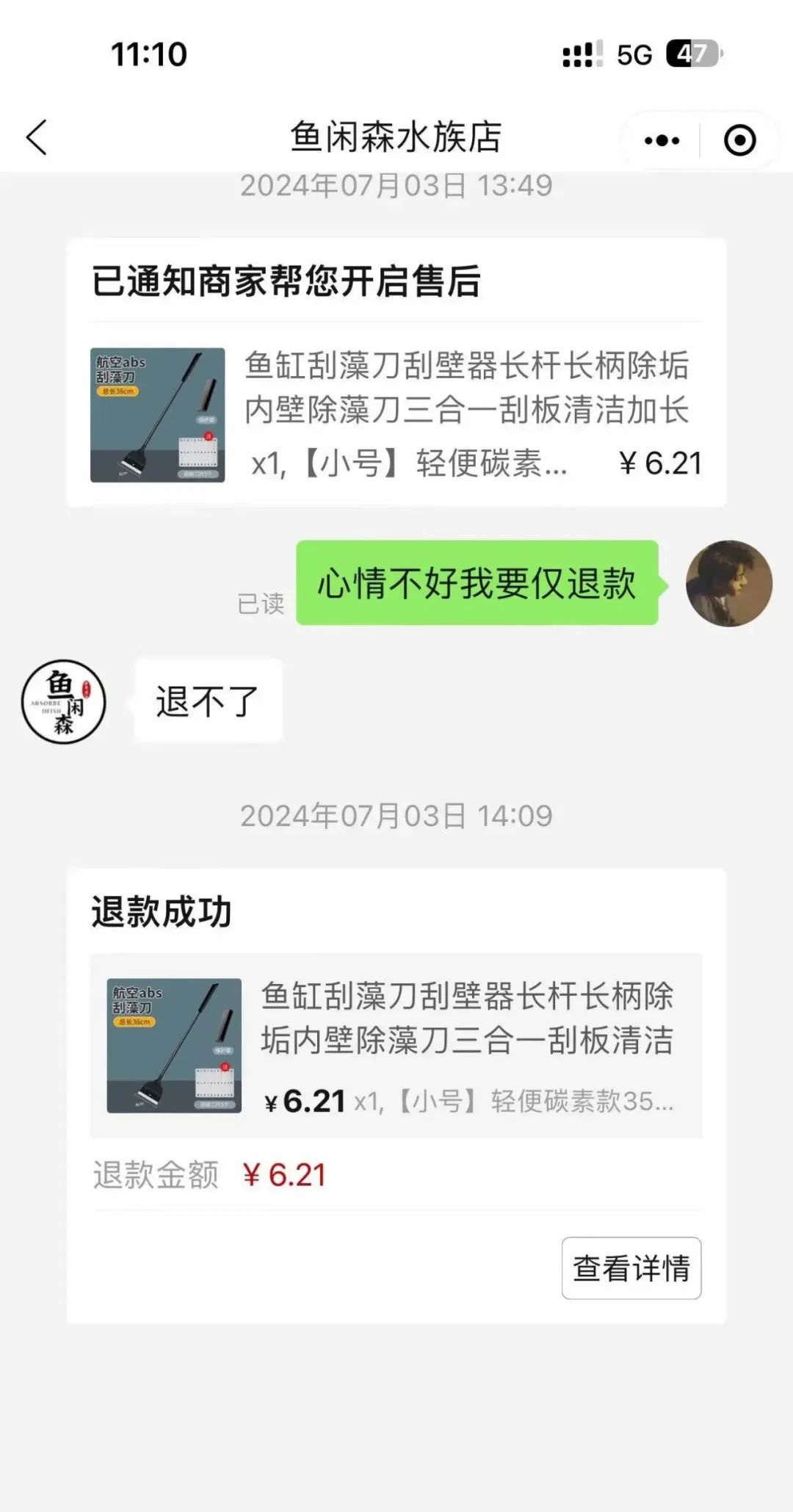

Since 'only refund' became a standard feature of e-commerce platforms, various 'wool collecting' strategies have spawned a complete gray industrial chain. Some people organize paid study groups to teach netizens how to 'get free stuff' by damaging products or complaining about merchants.

Intermediaries sell discounted products on second-hand platforms. Consumers place orders on the official website simultaneously after purchasing from the intermediary. After consumers confirm receipt, the intermediary applies for 'only refund.' At this point, consumers receive the product, the intermediary gets the payment, and only the merchant loses money.

A merchant in the baby and mother care industry stated that in the past, only Pinduoduo offered the 'only refund' service, and there was no 'gray industry awareness' within the industry. There were only two or three 'only refund' cases per year, but this year, there are two or three cases per day on average.

As a result, more and more merchants are unwilling to be passive victims. Some merchants choose legal means to protect their rights and sue 'wool collectors' in court. Others form mutual aid groups to help members recover returned products from faraway places.

In fact, the cost of manpower and materials for merchants to protect their rights is not small. Driving long distances to reclaim products and compensation from buyers incurs significant expenses for fuel, travel, and accommodation. Additionally, merchants who choose to sue must go to the court in the buyer's location, which is also costly.

Moreover, the probability of merchants winning compensation through litigation is not high. One merchant roughly estimated that out of the more than 4,000 court judgments he was aware of, less than 25% favored the merchants. Even if a merchant wins, the compensation ranges from hundreds to thousands of yuan, which, after deducting costs like travel expenses, leaves little remainder.

Ultimately, merchants are merely seeking justice and an explanation. Behind these individual cases lies the fact that merchants are being squeezed by 'only refunds,' leaving them with nearly no profit margin.

During this year's '618' shopping festival, the hashtag #Merchants Complain of High Return Rates of 80%# once trended on social media. Industry insiders stated that once the return rate exceeds 50%, it may already threaten a merchant's survival, and this is still considering cases where products can be retrieved. In cases of numerous 'only refund' orders, merchants lose both money and products.

Just the 'only refund' policy alone has caused much distress for merchants. However, under the principle of 'customer first,' Taobao released what was called the 'strictest ever' customer service standards at the end of July, including fines for slow customer service response, arrogance, impatience, and other issues.

Additionally, Taobao adjusted its evaluation norms and credit scores, eliminating sellers' ability to evaluate buyers, meaning sellers will become more passive in transactions.

However, just as Taobao proposed its strictest customer service standards, it immediately 'unbound' the only refund policy, which is seen as a move to adjust its service system, perhaps finally realizing that the 'only refund' policy was not suitable for its environment.

3""The industry doesn't need a second 'Pinduoduo'

At the end of last year, Pinduoduo's market value surpassed Alibaba's for the first time. Jack Ma even rarely spoke out on Alibaba's internal network, stating, 'Everyone has been great at some point, but it's those who can reform for a better tomorrow and are willing to pay any price and sacrifice who deserve respect.'

After this, Alibaba made more attempts and adjustments in its business development. On the one hand, Alibaba almost suspended all IPO projects. Alibaba CEO Wu Yongming stated that Alibaba would prioritize the development of its three core areas: internet platform business, AI-driven technology business, and global commercial networks.

On the other hand, under the principle of 'more resolute investment and more decisive choices,' Alibaba Chairman Joseph Tsai stated that the primary goal was to win in e-commerce, requiring the restoration of market share and promotion of business growth. Following this, Alibaba made several 'first moves' in e-commerce, including introducing the 'only refund' policy and eliminating the pre-sale system.

Thanks to these efforts, Alibaba's e-commerce business has also started to return to the growth track. Taking this year's '618' as an example, according to Analysys' report, the transaction value of Taobao and Tmall grew by 12%, higher than the average growth rate of comprehensive e-commerce GMV.

However, behind Taobao and Tmall's scale growth, Alibaba also sacrificed much profit. According to Alibaba's Q1 2024 financial report, Taobao and Tmall's revenue increased by 4% year-on-year to 93.216 billion yuan, but their adjusted EBITA slightly decreased, indicating that Alibaba's expenditures on user experience have eroded some of its profits.

Therefore, Alibaba's e-commerce business must not only pursue user scale but also improve profits. Since this year, Taobao's 'Five-Star Price Force' strategy has been weakened, where lower prices no longer guarantee higher traffic. Instead, the weights of GMV (Gross Merchandise Volume) and AAC (Average Annual Consumption) are gradually increased.

Taobao has realized that it doesn't need to become a second 'Pinduoduo' but needs to forge a new path. During Alibaba's Q4 2023 earnings call, Wu Yongming stated that while maintaining Taobao's market richness, Alibaba would provide higher product efficiency for some core, high-turnover products, thereby establishing a unique competitive advantage in Alibaba's e-commerce market.

As a comprehensive e-commerce platform, Taobao caters to various customer price points. To maintain business richness and improve product turnover efficiency, it cannot tilt the scales solely towards consumers but must also consider merchants' acceptance, achieving a balance between merchants and consumers.

From this perspective, Taobao's abandonment of the overly consumer-biased 'only refund' policy is a step towards reasserting merchants' interests. Moreover, unbinding 'only refund' doesn't mean ignoring user experience. It's reported that in addition to introducing the strictest customer service standards, Taobao will further increase merchants' shipping insurance subsidies.

It seems that Taobao has abandoned its 'one-size-fits-all' management approach and shifted to a more comprehensive merchant management system that combines discipline with incentives. By giving autonomy back to high-quality merchants and letting them find ways to attract consumers, the platform can achieve a positive cycle of scale and profit growth.

Going forward, other e-commerce platforms are likely to optimize their only refund policies as well. After all, different e-commerce platforms have different positions, and there is more than one solution to improving merchant quality and consumer experience. 'Only refund' may not be the best answer.

Taobao fired the 'first shot against the trend,' giving the e-commerce industry a reference. Instead of following the herd and competing on price, it's better to regain one's unique advantages. The e-commerce market doesn't need another Pinduoduo but new Taobao, new JD.com, new Douyin, and new Kuaishou. The path that suits oneself is the best to take.