New force sales in July: Lixiang breaks 50,000, NIO breaks 20,000, Xiaomi breaks 10,000 again

![]() 08/06 2024

08/06 2024

![]() 507

507

It's the beginning of a new month, and it's time for everyone to submit their performance reports. Let's first take a look at the performance of the new forces.

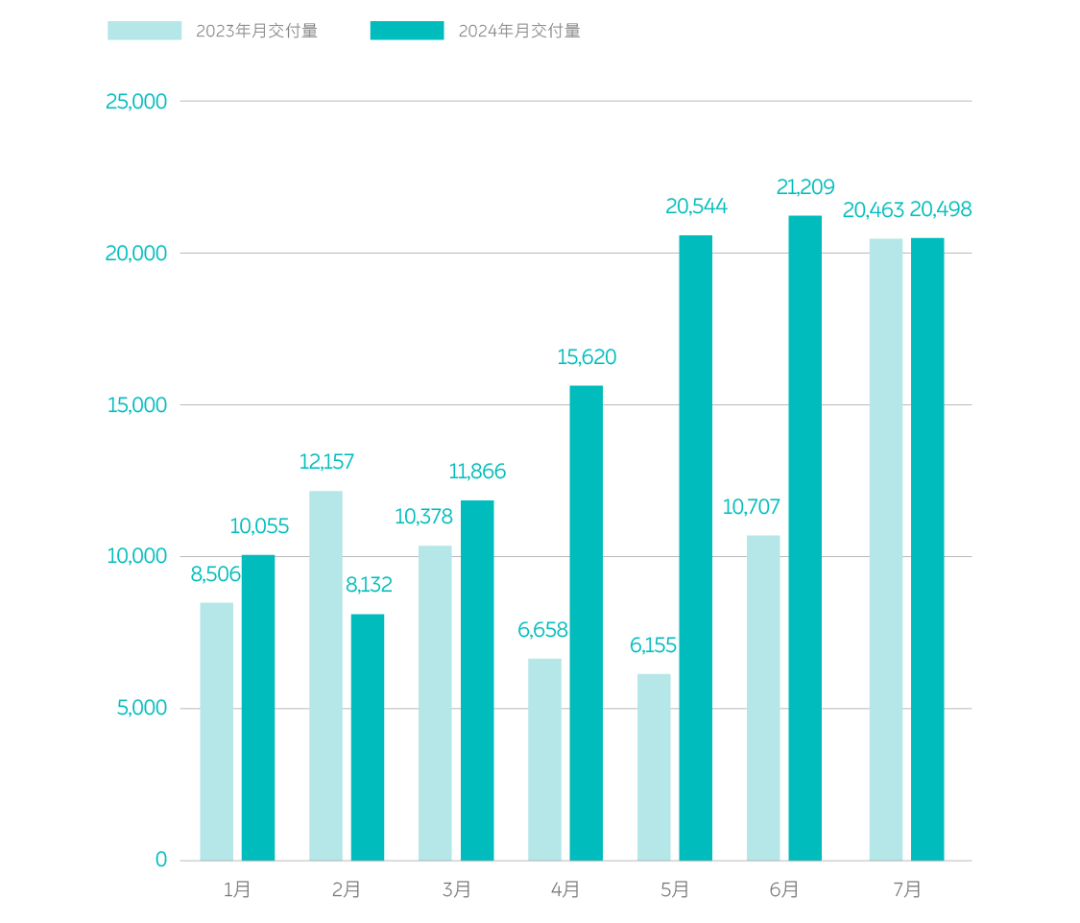

01 NIO: Over 20,000 for three consecutive months

NIO's sales performance is really remarkable. With 20,498 new vehicles delivered in July, breaking the 20,000 mark again, this marks the third consecutive month that NIO has delivered over 20,000 vehicles. Considering NIO's brand positioning and price range, this performance is truly impressive. This is actually the result of a combination of factors. On the product level, NIO completed the switch to the 2024 model line-up in April and May, accompanied by certain subsidies. On the sales side, after a large-scale expansion of the team in the second half of last year, we are now seeing the results of this sales capability (from Q2 to the present).

(Oh, by the way, let me point out a small detail. NIO's sales guidance for the second quarter was between 54,000 and 56,000, but they ultimately sold 57,373 vehicles, exceeding their own expectations.) In terms of battery swap stations, NIO is no longer going it alone. The alliance approach has also allowed more consumers to learn about NIO. Additionally, NIO's deployment of battery swap stations is now more targeted (from a sales perspective), and there are also updates to the BaaS pricing structure. ... In short, this kind of performance is truly outstanding, and NIO is certainly demonstrating its leadership. And speaking of leadership, Leda, NIO's second brand, was originally scheduled to launch the L60 in August, but has now been delayed by another month to September. It seems that the timing of the launch and deliveries will be aligned, with deliveries starting immediately upon launch. So, let's wait and see.

02 XPeng: Urgently needs M03 to boost sales

In July, XPeng delivered 11,145 vehicles, which is not a good performance compared to both year-on-year and month-on-month figures. In the first seven months of this year, XPeng has delivered a total of 63,173 vehicles, averaging less than 10,000 per month. XPeng currently has no issues with its intelligent technology, especially in terms of autonomous driving, which is among the top in China. What it lacks now is products and sales. However, from newer models like the G9 and X9, it is clear that XPeng is making changes, but it will take time. At present, XPeng's sales still need a hit product to boost them, and that product is the upcoming M03. This scene is reminiscent of last year, when the G6 helped XPeng boost sales, and now it's M03's turn.

Regarding the M03, based on the exterior and interior designs that have been revealed so far, I think it looks quite good, and I have no doubt about its intelligent capabilities. What I'm most concerned about now is the final pricing and configuration (a friend of mine is currently torn between the BYD Dolphin 06 and the XPeng M03). After all, competition in this price range is extremely fierce, and price-sensitive consumers attach great importance to configuration and product capabilities. If XPeng wants this product to be a hit, they need to carefully consider pricing and configuration, and avoid repeating mistakes like the previous G9 debacle. Initially, XPeng stated that the M03 would be priced between 100,000 and 150,000 yuan, but later revised this to "all vehicles priced below 200,000 yuan will have the highest aesthetics and intelligence, while also being cost-competitive." I'm not sure if this is to raise consumer expectations or if the actual price will indeed increase further. Let's wait and see.

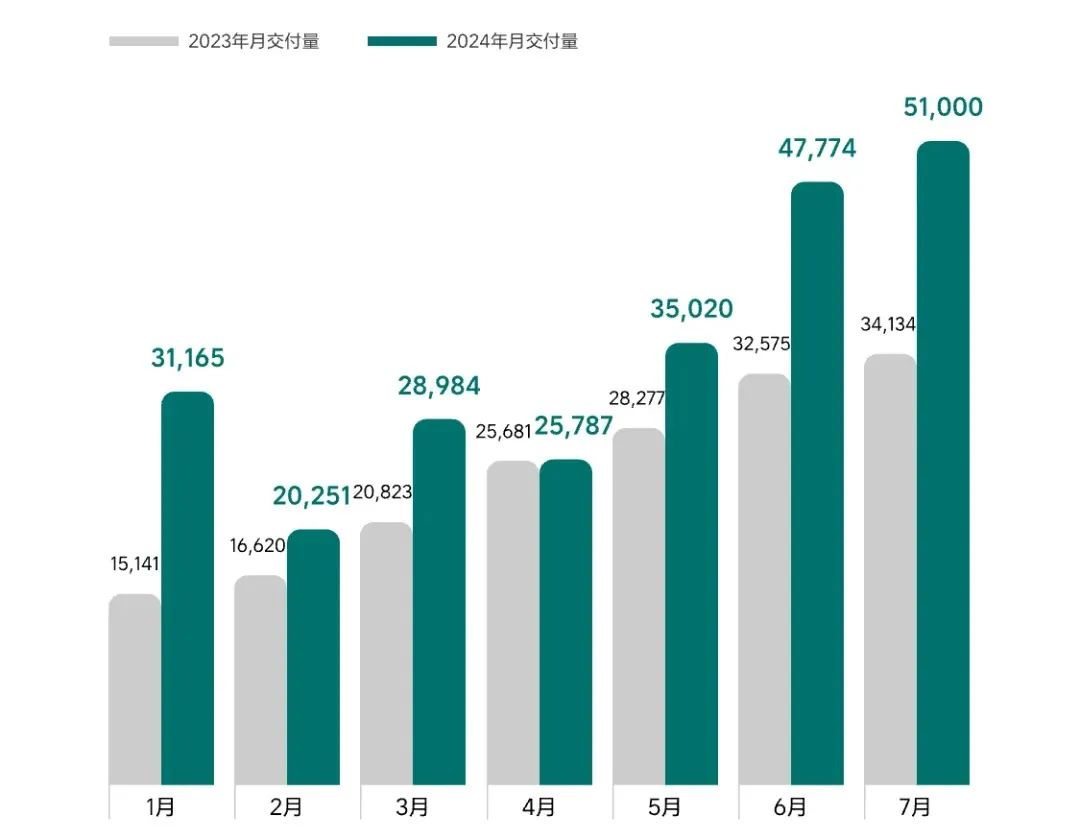

03 Lixiang: Deliveries exceed 50,000, setting a new monthly record

Lixiang now gives the impression of being low-key and focused, quietly pushing forward with determination. In July, Lixiang set a new monthly delivery record of 51,000 vehicles, finally breaking the 50,000 mark with just five models, making it the first new force automaker to achieve this feat. This is truly an extraordinary achievement, especially considering the backlash and misunderstanding Lixiang faced in the past. It's great to see that they have come out on top. Among the 51,000 deliveries, the L6 alone accounted for over 20,000 vehicles, making it a clear hit. With no new models scheduled for release this year, Lixiang's focus will be on selling cars. On the technology front, Lixiang Auto's new autonomous driving technology architecture, based on end-to-end models, the VLM visual language model, and the world model, began rolling out to a thousand test users at the end of July. Chairman Li Xiang said, "We believe that true L3 (supervised autonomous driving) will be delivered to users in mass quantities as early as the end of this year or at the latest in the first half of next year."

The improvement in autonomous driving capabilities is also reflected in sales. "Especially since the launch of Lixiang's Mapless NOA, user interest and recognition of autonomous driving technology have increased significantly. In July, the proportion of NOA test drives in stores doubled, and orders for AD Max models equipped with Mapless NOA features increased substantially." Additionally, Lixiang is accelerating the construction of its charging network to pave the way for the launch of the M789 next year. As of July 28, Lixiang had 700 supercharging stations. Lixiang's goal is to have over 2,000 supercharging stations by the end of 2024, with 70% coverage of national highways and 90% coverage in key urban areas. Therefore, the pace of station deployment is expected to accelerate further. From January to July 2024, Lixiang has sold a cumulative total of 239,981 vehicles, already exceeding the annual sales targets of some new forces/new players. This is likely not the full extent of Lixiang's capabilities, and it should bring more surprises in the future.

04 Leapmotor: Monthly sales hit a new high, delivering 22,093 vehicles

Leapmotor has truly emerged as a dark horse, relying on its exceptional value-for-money proposition. In June of this year, it sold 20,116 vehicles, and in July, it delivered 22,093 vehicles, setting a new high. Leapmotor currently has six product lines: C16, C10, C11, C01, T03. The new C16 model was officially launched on June 28th and, despite being on the market for less than a month, has already received over 10,000 orders, with nationwide deliveries now underway, further boosting Leapmotor's sales.

In addition, it's worth noting that on July 30th, Leapmotor International shipped its first batch of Leapmotor C10 and T03 electric vehicles from Shanghai Port to Europe. Starting in the fourth quarter of 2024, Leapmotor International will also introduce the C10 and T03 models to the Middle East and Africa, Asia-Pacific, and South America, leveraging the channel advantages of the Stellantis Group. With this support, Leapmotor's overseas sales are expected to rise rapidly, pushing sales to new highs. Leapmotor's potential is significant and worth keeping an eye on.

05 Nezha: Delivered 11,015 vehicles across its entire lineup in July

Nezha's sales performance is currently similar to that of XPeng, and both are facing some challenges. Let's break down Nezha's sales figures for the first seven months of this year: January: 10,032 vehicles, February: 6,085 vehicles, March: 8,317 vehicles, April: 9,017 vehicles, May: 10,113 vehicles, June: 10,206 vehicles, July: 11,015 vehicles (PS: The data was obtained using Baidu Wenxin Yiyan, which works quite well. This is not an advertisement.)

In terms of new products, the upcoming Nezha X will soon be launched, and the Nezha S Shooting Brake will also make its debut this month.

It remains to be seen how much of a boost these new and refreshed products will provide to sales. It's worth mentioning that Nezha is indeed ahead of the new forces in terms of overseas market expansion. From January to June, Nezha exported a total of 17,687 new energy vehicles, ranking first among new force automakers and fifth among automakers in terms of new energy vehicle exports. However, it's worth noting that Leapmotor has also started its overseas expansion, leveraging the channel advantages of its partner, the Stellantis Group, which could quickly catch up and potentially erode Nezha's early lead in overseas markets.

06 Xiaomi: Sales exceed 10,000 again, aiming to complete annual sales target by November

Last but not least, we have Xiaomi. Three key points: Xiaomi delivered over 10,000 vehicles in July, expects to continue this trend in August, and anticipates completing its annual delivery target of 100,000 vehicles ahead of schedule in November. It must be said that Xiaomi's automotive capabilities are truly formidable. Lei Jun has truly given the automotive industry a lesson, both in terms of products and marketing.

I just checked the delivery time for the SU7, and it seems that the earliest delivery will be in 19 weeks, which is over four months away. Nonetheless, Xiaomi is still offering incentives for new car purchases this month. Regarding these incentives, it's fair to say that Xiaomi doesn't lack orders. Lei Jun's goal was to deliver at least 100,000 vehicles this year, with an ambitious target of 120,000. Do you think Xiaomi can achieve this?