Alibaba's left and right rushes may just be defeated by itself!

![]() 08/06 2024

08/06 2024

![]() 541

541

Alibaba has changed again! Over the past 20+ years since its establishment, Alibaba has always believed that the only constant is change and has made it one of its corporate values. Recently, Taobao announced the optimization of its "only refund" policy, while Tmall will completely abolish its annual fees, attracting significant attention in the industry.

Although these two changes will not significantly impact Alibaba compared to its previous radical organizational reforms, they still have far-reaching consequences for the now-gigantic Taobao and Tmall.

Notably, Alibaba took the lead in withdrawing from the "only refund" camp just half a year before Taobao, JD.com, and Douyin E-commerce followed Pinduoduo's "only refund" policy by the end of December 2023.

Previously, Wu Yongming, CEO of Alibaba Group and Chairman of Taobao Group, mentioned that Alibaba hopes Taobao Group can "support regaining growth and consolidating market leadership." Therefore, some industry insiders believe that this may signal Alibaba's return to its Taobao and Tmall strategies under the new leadership team, as well as a setback in its efforts to benchmark Pinduoduo and try a low-price strategy.

So, is Alibaba's latest change a timely "stop-loss" of its existing development strategy, or is it forced back to its original form due to its large size and inability to turn around? We may find clues by examining Alibaba's every move in recent years.

The "only refund era" was fleeting, and Alibaba realized its mistake?

Alibaba's 2023 was a tumultuous year. By the end of 2023 alone, Alibaba faced multiple challenges. Firstly, it lost a lawsuit against JD.com over "exclusivity" clauses, resulting in a judgment of RMB 1 billion in compensation. This indicates that as industry regulation tightens, it becomes increasingly difficult for platforms to "coerce" upstream supply chains through various means.

Secondly, besides the previously introduced "1+6+N" transformation, Alibaba boldly appointed veterans like Wu Yongming, leading to diverse opinions in the industry. Additionally, in December 2023, media reported that Wu Yongming, CEO of Alibaba Group and Chairman of Taobao Group, would succeed Dai Shan as CEO of Taobao Group, personally overseeing Taobao and Tmall, highlighting Alibaba's emphasis on its e-commerce foundation.

Thirdly, Alibaba followed Pinduoduo's "only refund" strategy, leading the industry into the "only refund era" and continuing to compete in the low-price segment with giants like JD.com and Douyin E-commerce.

At that time, some media interpreted that while Pinduoduo was the "initiator" of the "only refund" policy, other e-commerce giants followed suit, reflecting the development anxiety and pressure faced by major e-commerce platforms as traffic growth and user increments peaked and consumer spending declined.

However, for Alibaba, targeting a low-price strategy is a risky move. It's worth noting that the trigger for the "Siege of October" incident in 2011 was Alibaba's "low-price strategy" under its C2C model.

At that time, the protest surrounding Taobao Mall (now known as Tmall) against changes to merchant service fees and deposit rules led to small and medium-sized sellers surrounding Alibaba's headquarters. Fortunately, Daniel Zhang, then President of Taobao Mall, did not compromise and insisted on implementing the new rules. Ultimately, Jack Ma intervened by proposing to halve service fees and deposits, bringing the incident to a close. Ultimately, Taobao's low entry threshold was criticized for being flooded with counterfeit products.

It turns out that Alibaba's mandatory upgrade of Taobao to Tmall was undoubtedly correct. Taking Alibaba's Singles' Day performance over the past decade as an example, from RMB 50 million in GMV in 2009 to a staggering RMB 540.3 billion in 2021, its growth has been astonishing.

Looking back now, Alibaba's recent pursuit of low-price strategies similar to Pinduoduo's platform has undoubtedly led it back to the old path of Taobao's C2C era. Moreover, the rapid update and upgrade of policies like "only refund" within just half a year further confirms that its early strategy adjustment to return to Taobao may have encountered obstacles.

Too big to turn around, despite multiple transformations

Historically, reform and innovation have never been easy tasks. Moreover, significant changes that come at a great cost do not necessarily guarantee success. For example, the Ming Dynasty's maritime reform failed due to opposition from the interests of the "million canal workers," with some historians interpreting that the so-called "million canal workers" do not represent actual canal workers but rather interest groups related to canal transport who sought excuses for the failure of reform to protect their interests.

As such, in the nearly 400 years since the Ming Dynasty's demise, the phrase "the livelihood of millions of canal workers depends on this" has become synonymous with interest groups opposing the development of advanced productivity.

In fact, Alibaba's several attempts to change course have ultimately proven futile, much like the Ming Dynasty's maritime reform, due to the resistance caused by the redistribution of interests among various parties.

In 2023, Alibaba, accustomed to change, once again embarked on a major transformation with its "1+6+N" organizational reform. At the time, Daniel Zhang, Chairman and CEO of Alibaba Group, even described it as "the most significant organizational change in Alibaba's 24-year history."

However, various indications suggest that this significant change has already encountered setbacks. As early as November 2023, media reported that changes had already begun to emerge in Alibaba's "1+6+N" strategy, with Alibaba Cloud's spin-off being blocked and Hema suspending its IPO plans.

These changes disrupted the group's strategic transformation plans, and coupled with news that Cainiao's IPO was not meeting expectations and Alibaba's dissatisfaction with Cainiao's valuation at the time, Alibaba decided to postpone Cainiao's listing.

Even more complex, Wu Yongming, the newly appointed leader, boldly outlined Alibaba's future direction, priorities, and implementation paths. For example, he classified 1688, Xianyu, DingTalk, and Quark as Alibaba's first batch of strategic innovation businesses. However, these development plans were not entirely consistent with the previous "1+6+N" strategy.

Against this backdrop, 1688 not only revised its seven-day no-reason return policy but also introduced services such as free shipping, one-item free shipping, and return shipping covered, gradually aligning its platform service standards with those of Tmall's main site.

Alibaba's further improvement of its platform supply chain system, starting with its B2B product 1688, is also seen by industry insiders as Alibaba's trump card. After all, Alibaba, which grew from a B2B platform, has an advantage in upstream supply chain resources.

Furthermore, at the end of February 2024, news that Taote, aimed at competing with Pinduoduo, would fade out of the spotlight and its merchants would migrate back to Taobao trended on social media. It's worth noting that Taote was originally launched to compete with Pinduoduo.

While Taobao and Tmall responded to outside rumors by stating that Taote's business would continue to develop and that they would increase the full supply on mobile Taobao to serve Taote's original market users, the fact that Taote was not included in Wu Yongming's first batch of strategic innovation businesses alongside Xianyu and DingTalk suggests that Alibaba's past attempt to find a breakthrough in performance growth through low prices has been rejected.

According to analysis, Alibaba's repeated strategic adjustments and even 360-degree turns in its overall direction may be related to the interests of its "million canal workers" (analogous to its various stakeholders). The inability to reconcile these conflicting interests has led to Alibaba's repeated failures.

Three major obstacles to Alibaba's internal transformation

Observations suggest that Alibaba's several reform attempts have faltered midway, primarily due to the redistribution of internal and external interests resulting from its internal transformation, which has impacted existing interest groups. In summary, there are three major obstacles facing Alibaba's internal transformation, making its reforms difficult or even regressive.

Firstly, from the perspective of Taobao and Tmall's core C-end users, the rise of various short video and live streaming e-commerce platforms in recent years has threatened Alibaba's position in the e-commerce sector. This has forced Alibaba to closely follow consumer demand to compete with other platforms. The "only refund" policy emerged as a distorted product of platform operating rules under such intense competition.

According to data from the Ministry of Commerce and the National Bureau of Statistics, China's online retail sales reached RMB 7.1 trillion in the first half of 2024, up 9.8% year-on-year, compared to a 13.1% year-on-year growth in the same period in 2023.

According to Alibaba's latest financial report, its revenue in Q1 2024 was RMB 221.874 billion, up just 7% year-on-year, while its net profit was RMB 919 million, down 96% year-on-year. Moreover, since Q1 2021, Alibaba has maintained single-digit growth in all quarters except Q2 2023, when it achieved 13.9% revenue growth.

Furthermore, breaking it down to Taobao Group, its performance was even more disappointing. In Q1 2024, Taobao Group's revenue grew by 4% year-on-year to RMB 93.216 billion. Compared to RMB 45.746 billion in Q4 2022, Alibaba's net profit level hit a new low.

While Alibaba attributes its poor performance to heavy investments in three key areas: core user experience for Taobao and Tmall, core public cloud products and AI infrastructure, and overseas e-commerce, the real reason lies in Taobao's recent low-price strategy.

Taobao has repeatedly stated publicly that prioritizing user experience is its primary goal. Therefore, since the second half of 2023, Taobao has successively implemented policies such as free shipping to Xinjiang, increased subsidies of up to RMB 10 billion, implemented the "only refund" policy, and abolished pre-sales. These moves have come at a significant cost, as Taobao and Tmall previously sacrificed gross margins to pave the way for future growth, which the latest optimization of the "only refund" policy and new merchant fee strategies have now negated.

Secondly, it is challenging for Taobao and Tmall to find a balance between the interests of B-end and C-end users. The fact that Taobao and Tmall followed other e-commerce platforms in implementing the "only refund" policy is evident bias, potentially alienating both consumers and merchants.

As such, Taobao and Tmall's decision to "loosen" the "only refund" policy, enhance merchant autonomy in after-sales based on the new experience score, reduce or eliminate after-sales intervention for high-quality stores to avoid a "one-size-fits-all" approach, and completely abolish merchant annual fees from September 1st is seen as a rebalancing of B-end and C-end interests and a profound reflection on Alibaba's internal reforms over the past six months.

Perhaps the biggest obstacle to Taobao and Tmall's transformation comes from multiple interest groups. Shocking cases of corruption among junior employees may offer a glimpse into the terrifying derivative interests that have grown within Alibaba, a behemoth of an organization.

A typical example is the May 14 report by CCTV's Rule of Law Online about Wang, a junior employee at Alibaba, who accepted bribes totaling over RMB 92 million by leveraging his position to review official furniture flagship stores, shocking the industry.

Moreover, this is not the first time an Alibaba junior employee has been investigated. In 2015, Alibaba announced the permanent closure of 26 Taobao stores due to violations of honest business principles, including bribing junior employees with gifts and cash.

Between 2016 and 2018, Alibaba was repeatedly exposed in cases of junior employee bribery, with suspected amounts often reaching hundreds of thousands of yuan. In fact, as part of its internal transformation, Alibaba recognized early on that corruption was inevitable as it scaled up.

As such, Alibaba established the "Integrity and Compliance Department" in 2012, specifically responsible for corruption investigation, prevention, and compliance management. However, this reform has not eradicated junior employee corruption but has instead exacerbated it.

The scarcity of traffic resources on Alibaba's e-commerce platform makes junior employees with access to these resources lucrative targets for bribes. Especially when Alibaba dominated the market in 2020, such resources were even scarcer. After Taobao's upgrade to Tmall, many Tmall flagship stores quickly rose to prominence due to the platform's traffic tilt towards them.

As a result, Tmall flagship stores became even more scarce. Applying for a Tmall flagship store often involves rigorous reviews, including brand qualification reviews, initial and final audits.

Precisely because of this rigorous review process, junior employees responsible for approvals can reap significant benefits from merchants eager to join the platform. Meanwhile, the business of "creating and selling shell companies" has become highly profitable and even an unspoken rule in the industry, with store fees often reaching millions of yuan, causing immense pain for merchants while enriching some junior employees.

It is said that to expedite decision-making and enhance merchant service experience, junior employees are granted considerable power. As Jiang Fang, Alibaba's Chief People Officer, stated in 2016, "Alibaba is a company that truly delegates power to every junior employee." This delegation of power is necessary because "only by delegating power can we better serve customers and make rapid and effective decisions based on their needs."

However, while junior employees had significant power over traffic allocation early on, several corruption cases led some business units to reclaim some of that power. Nevertheless, cases like Wang's, involving concentrated power over merchant entry approvals, remain relatively rare.

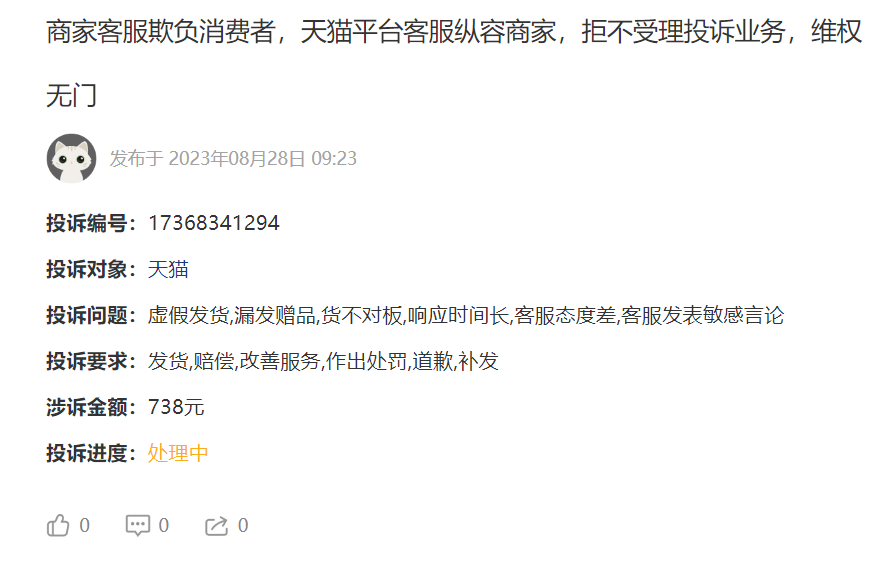

Furthermore, in order disputes, Taobao and Tmall are frequently accused by both merchants and consumers of bias in the handling process. It is not uncommon for merchants to be unfairly banned from the platform or face complaints with no recourse, even when operating their stores legitimately.

Image source: Heimao Complaints

Image source: Heimao Complaints

Thus, it is evident that the interest game on Alibaba's platform is an unfair one.

These various rights and interest disputes may render Alibaba's reform measures futile.

"New regulations" may not be the solution, and "only refund" could be a ruse

Although Alibaba's phased transformation has undoubtedly encountered setbacks, promoting a virtuous ecological cycle within the platform and enhancing core performance indicators such as revenue and net profit remain the main themes of Alibaba's future development.

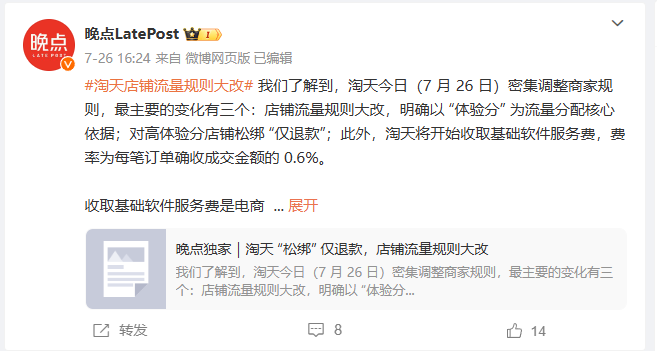

Therefore, Alibaba's optimization of the "only refund" policy has been interpreted by the media as a distraction from the market, redirecting profit-making efforts towards brand merchants, and ultimately shifting the burden to C-end consumers. Taobao's third adjustment is to charge all merchants a 0.6% service fee.

According to some media estimates, assuming Taobao achieves an 8 trillion GMV in 2024, and based on a 60% actual order fulfillment rate, approximately 4.8 trillion orders can be charged, which translates to approximately 28.8 billion yuan at a 0.6% service fee.

Image source: LatePost Weibo

However, this model is also a double-edged sword. On the one hand, while the new regulations can enhance Alibaba's core performance indicators, they will obviously harm the interests of large merchants with substantial order volumes, thereby exacerbating conflicts between them and the platform.

On the other hand, for smaller-scale Taobao-series e-commerce platforms, including second-hand platforms dominated by individual players like Xianyu, even a basic software service fee of 0.6% can pose a significant burden on ordinary merchants, albeit seemingly small. Therefore, this move may also lead to dissatisfaction among some small and medium-sized businesses.

However, from Alibaba's perspective, such changes are imperative, especially after its "ambitious" development strategy encountered setbacks, necessitating a change. According to Alibaba's recent financial report, Taobao's customer management revenue grew by 5%, while GMV grew by 10%, indicating that Taobao's revenue from merchants lags far behind the platform's GMV growth.

Therefore, linking revenue to GMV is the fastest "shortcut" for Alibaba to accelerate its revenue growth. Additionally, merchants' largest expenditure on Taobao is traffic promotion fees, accounting for over 50% of total costs, and in some cases, even reaching 70%. This suggests that Alibaba's revenue from traffic has essentially peaked.

While increasing software service fees is indeed an effective means of revenue growth for Alibaba under performance pressure, it remains uncertain what ripple effects this significant move by the tech giant will have. Only time will tell the true impact and effectiveness of Alibaba's transformation.

Disclaimer: This article is based on publicly available information or information provided by interviewees. However, TechSisi and the author do not guarantee the completeness or accuracy of the information or related details mentioned in this article. Under no circumstances should the information or opinions expressed in this article be construed as investment advice to anyone.