Video account e-commerce in this year: from private domain to public domain, from social media to algorithm

![]() 08/06 2024

08/06 2024

![]() 460

460

In 2023, the e-commerce GMV of video accounts reached 320 billion yuan, which was less than one-tenth of Douyin's, but it was still remarkable to achieve this from scratch in just one year. More impressively, various data on video accounts continued to show strong growth momentum.

This leap made video accounts not only the "hope of the entire Tencent" in the words of Pony Ma but also a major contributor to Tencent's advertising revenue growth in the Q1 financial report.

The reason for its high esteem is likely that video accounts have successfully integrated both short videos and e-commerce, not only regaining face for Tencent but also potentially creating another profit center.

In terms of e-commerce, live streaming e-commerce is the most critical aspect, accounting for over 90% of GMV in 2023, similar to Douyin's case. Live streaming e-commerce is undoubtedly the dominant force in scenario-based e-commerce.

Earlier, the market generally compared video account live streaming e-commerce directly with Douyin and Kuaishou, which seems reasonable at first glance as they are all short video platforms. However, the difference between video accounts and Douyin/Kuaishou lies in their traffic sources:

The traffic entry points for Douyin and Kuaishou's live streaming e-commerce are relatively simple, mainly short videos. In contrast, video accounts have more diverse traffic sources, including not only the main site but also private domain traffic such as group chats, small windows, and Moments.

Using Pony Ma's words about "doing short videos for acquaintances' social networking," this private domain traffic is crucial for video account e-commerce to complete its cold start. However, Tencent now intends to shift video account e-commerce from private to public domains, aligning with Zhang Xiaolong's public statement several years ago that public domain traffic should account for over 80%. It seems that the role of private domain traffic is about to diminish.

But is that really the case?

1

Private domain that has made outstanding contributions

When it comes to private domains, another short video platform that almost got sued by broadcasters to the CSRC cannot be overlooked. However, Kuaishou, which has always emphasized private domain operation, lags behind in terms of average order value, not only compared to its long-time rival Douyin but also less than half of the newcomer video accounts.

Average order value refers to the average transaction amount corresponding to each transaction record (e.g., a receipt), typically calculated by dividing total consumption by the number of transactions.

According to WeChat Open Class, the average order value of video accounts in 2023 reached 205 yuan, significantly higher than Douyin's 130 yuan and Kuaishou's 88 yuan.

The high average order value of video accounts is closely related to their private domain transaction attributes.

According to WeChat Open Class, private domain traffic accounted for 50% of live streaming e-commerce in 2021 and 30% in 2022. Compared to Douyin and Kuaishou, a larger proportion of video accounts' transactions come from private domain attributes, with much traffic originating from sources like WeChat groups.

This transaction chain inherently carries a certain level of trust, enabling relatively better sales of high-price products. WeChat Open Class mentioned that pets and green plants topped the list with an average order value of 213 yuan, followed by clothing and home furnishings (172 yuan), food and fresh produce (160 yuan), and household cleaning supplies (152 yuan).

Attentive readers will notice a commonality among these high-price categories: they all possess white label and non-standard product attributes. Under these labels, platforms cannot compare prices, reducing the pressure to compete on low prices.

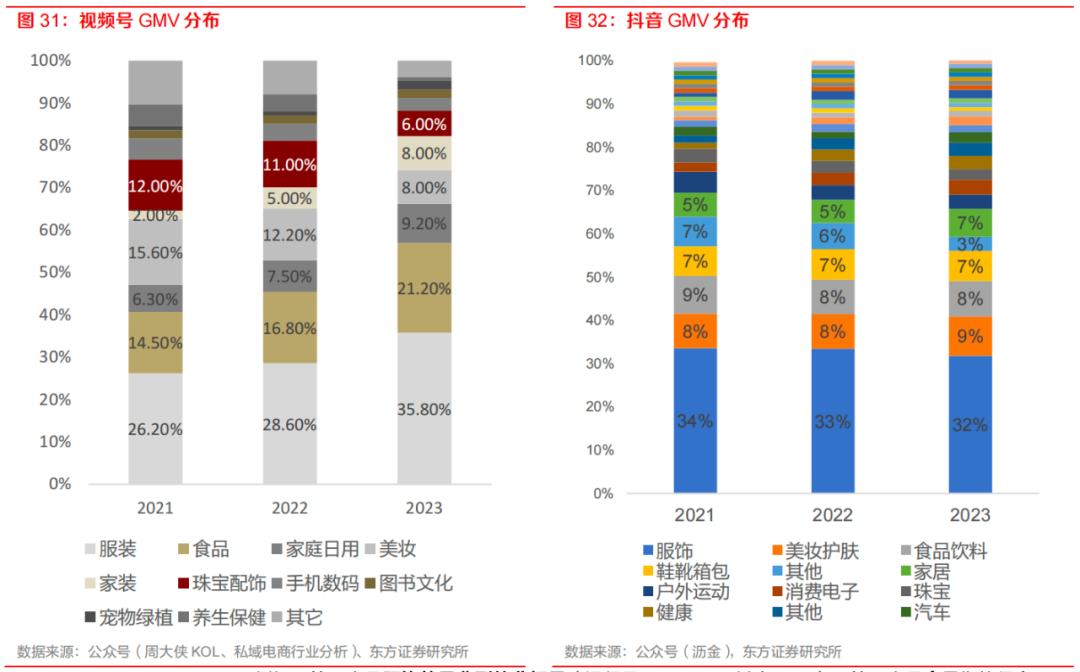

Oriental Securities once analyzed the GMV distribution between video accounts and Douyin and found that typical white label, high-price, and non-standard products like clothing, snacks, and jewelry sold better on video accounts. Weimob data also supports this view, with 85% of video accounts' GMV in 2023 contributed by white label merchants.

However, judging from video accounts' official support policies, the future e-commerce ecosystem of video accounts will continue to enrich in two directions: vigorously supporting industrial belt merchants to broaden the product offerings of white label merchants on video accounts and introducing more branded merchants to improve the quality of the product offerings.

Especially the latter has already shown initial results, with the contribution of branded merchants to GMV rising from 10% to 15% between 2022 and 2023.

Factors influencing video accounts' high average order value include not only transaction attributes but also user net worth.

Ignoring private domain transaction attributes and focusing solely on transactions sourced from public domains like video accounts, the differences between video accounts, Douyin, and Kuaishou are not as pronounced. According to Questmobile data, both in terms of spending power and willingness to spend, Douyin outperforms Kuaishou, while WeChat falls in between.

Moreover, as video accounts' DAU expands, their user demographics will gradually align with those of WeChat as a whole. If white label products continue to dominate GMV, it could easily lead to mismatches between products and target customers. Taking Pinduoduo's 10 billion subsidy program as a reference, although intended to attract new users at a low cost, rounds of subsidies have immediately improved consumers' perception of Pinduoduo.

Video accounts may not necessarily follow Pinduoduo's subsidy model, but the product offerings of branded merchants must expand. Different methods may be employed, but the outcome must be consistent.

As for private domain traffic that has made outstanding contributions, WeChat's actions over the past year have made its stance clear.

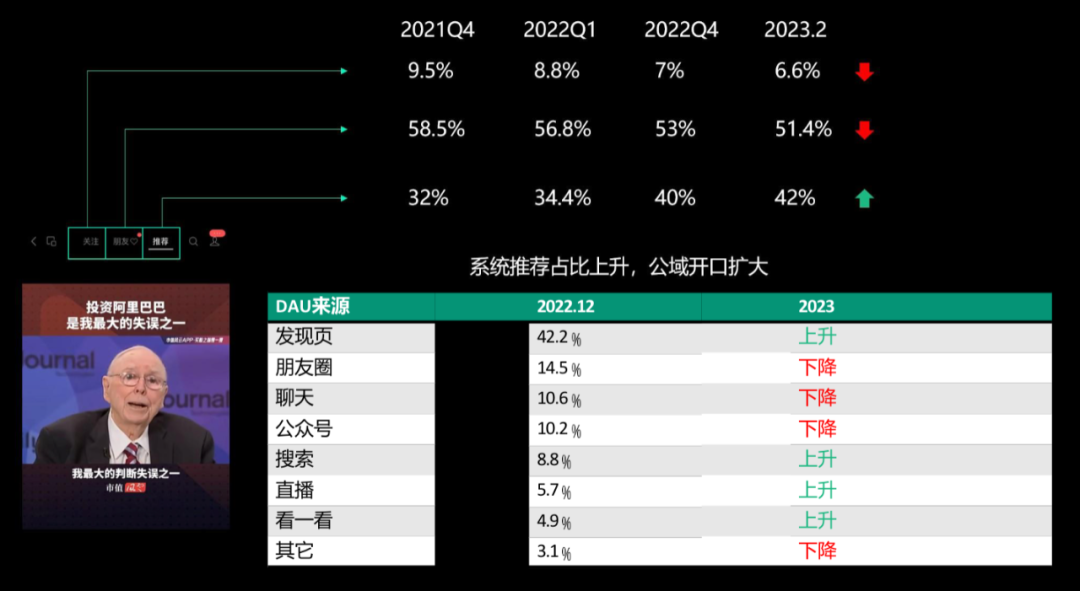

On the one hand, it is reducing the weight of private domains while encouraging merchants to direct private domain traffic to public domains. Specifically, looking at the traffic pool, the proportion of recommended traffic emphasizing algorithm optimization has risen from 26.4% in 2021 to 42.5% in 2023. Data from Growth Black Box also shows a decline in DAU from Moments, chats, and official accounts, while the proportion from discovery pages, searches, live streams, and other system recommendations is on the rise.

However, under the dual distribution mechanism of social media and algorithms, the private domain ecosystem remains a unique advantage of video account e-commerce compared to other e-commerce platforms.

In the view of Wang Yuanyuan, General Manager of the Weimob Marketing Video Account Merchant Operation Center, video accounts, as an "account" integrated with the WeChat ecosystem, enable WeChat's unique social media communication chain to provide video accounts with a lower starting threshold, more controllable costs, and better user engagement and conversion during dissemination.

2

Accelerating private domain conversion

At the end of May this year, Tencent officially announced a relatively inconspicuous organizational restructure: incorporating the video account live streaming e-commerce team into the WeChat Open Platform (including mini-programs, official accounts, etc.) team, with the original video account live streaming e-commerce team now reporting to the head of the WeChat Open Platform.

On the surface, this is not a major structural adjustment, merely eliminating the previously independent video account live streaming e-commerce team. However, in reality, Tencent aimed to address the increasingly apparent conflicts of interest between the mini-program team's WeChat Mini Store and video account e-commerce.

It's not a secret that WeChat live streaming e-commerce and Mini Store were able to cold start and achieve 320 billion yuan in GMV within a year largely due to the conversion of existing WeChat mini-program merchants.

Existing merchant conversion involves switching the links to mini-stores originally shared in groups to live streams or video account mini-store links.

To incentivize merchants to proactively switch and smoothly implement cold start tasks like content e-commerce supply chain setup and merchant onboarding, the video account live streaming team also offered matching public domain traffic incentives, contributing to the overall growth in merchant GMV.

Faced with tangible benefits, many former mini-program merchants transformed into video account merchants, resulting in a threefold increase in video account GMV in 2023.

This organizational restructure is clearly intended to accelerate this process. The integration of teams under the new structure implies deeper integration between video account transactions and mini-program transactions, potentially leading to accelerated traffic support and GMV conversion from existing merchants.

Moreover, this conversion transaction chain is also beneficial to Tencent.

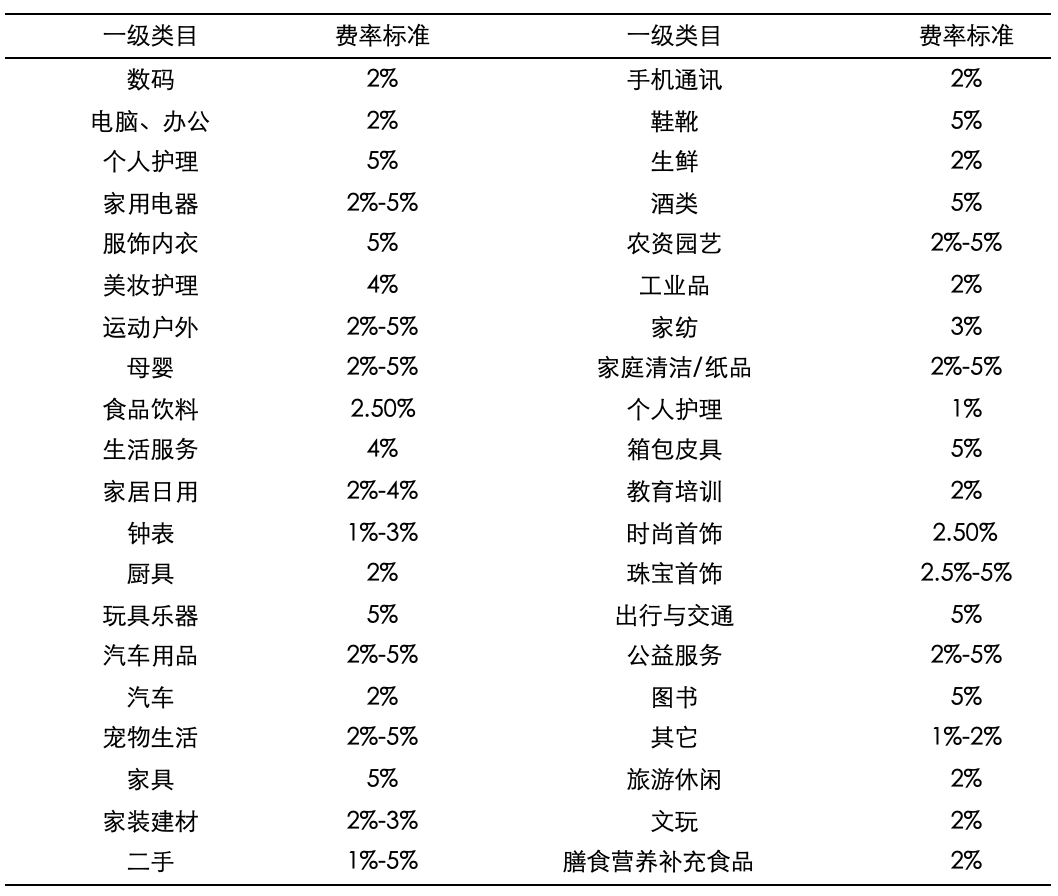

Originally, transactions on mini-programs only required a 0.6% WeChat Pay handling fee for withdrawals; after switching to video account mini-stores or live streams, merchants must also pay an additional technical service commission ranging from 1% to 5% of the nominal price in addition to handling fees.

Technical service fees for video account merchants

However, not all of the approximately 3 trillion yuan in mini-program e-commerce GMV can be converted. It is more challenging to convert the GMV of platform-based e-commerce mini-programs like JD.com, Pinduoduo, and Meituan Select.

Of course, don't assume that Tencent's accelerated conversion means abandoning private domains; quite the opposite is true.

In May this year, video accounts enriched the Mini Store Sharer function. Merchants can link their Mini Store's PC end to the personal WeChat accounts of Sharers and bind the personal WeChat accounts to their corporate WeChat accounts. After linking, Sharers can forward the Mini Store's homepage, showcase, products, live streams, and short videos to private domains. Apart from Mini Store-related information, Sharers can also generate exclusive QR codes for store live stream broadcast appointment links and invite users to scan them.

For merchants, Sharers enable more efficient connections with potential fans, thereby improving conversion rates, exposure effects, and sales. To incentivize merchants to use this function, the platform provides merchants with traffic coupons based on transactions generated through Sharers' shared scenarios, according to relevant policies. Sharers can also earn incentives based on transactions generated from their shares, and the number of successfully make an appointment ed users through their shared live stream appointment links will be counted towards their performance.

This proactive model that encourages consumers to engage in social fission distribution fully leverages the subjective initiative of the vast WeChat user base. Among the e-commerce enterprises that have previously leveraged WeChat's traffic, Pinduoduo and Taobao stand out, with the latter contributing approximately 200 billion yuan in GMV to Ali through WeChat traffic diversion in 2016 alone.

Instead of letting outsiders tap into its traffic, WeChat prefers to keep it in-house. Moreover, external circulation conversion from WeChat's private domain to Taobao requires complex operations like link copying and a longer transaction chain. In contrast, WeChat's e-commerce closed loop enables sharing live streams or video account mini-stores directly into groups, resulting in a much higher private domain conversion rate.

Therefore, given identical supply chain conditions, Sharers are more likely to choose WeChat's internal circulation transaction chain for promotion and fission.

3

Is it all about advertising?

Over the past year, video accounts' mentions in Tencent's financial reports have often been linked to advertising.

For example, in Q2 2023, video account advertising revenue was specifically mentioned as 3 billion yuan; in Q3 2023, it was noted that WeChat's internal advertising revenue (including mini-programs, video accounts, official accounts, and other landing pages) increased by over 30% year-on-year, contributing to more than half of WeChat's advertising revenue. In Q1 of this year, online advertising revenue reached 26.5 billion yuan, up 26% year-on-year, driven by search ads and video accounts.

Last month, media reported that video account commercialization would be led by WeChat Advertising, which reports to Tencent Advertising.

This reporting relationship likely formed because Tencent Advertising, with more influence and resources, needs the emerging traffic pool of video accounts to expand advertising load rates, especially as video accounts shift from private to public domains.

Theoretically, video accounts with a heavy private domain presence in the past could not accommodate too many ads. For instance, Langzi, with 80% of its transactions in the private domain, does not include advertising in its video account business model. In contrast, Yireniu, with 60% of its transactions in the public domain, includes advertising in addition to organic traffic.

Taking Douyin and Pinduoduo as references, public domain traffic determines the ceiling for internal advertising, especially for the latter, which has experienced explosive revenue and profit growth with the support of full-site promotion tools.

However, this also means that under the platform's precise algorithm recommendations, merchants' investments will become increasingly certain, while redistributive benefits will practically disappear.

Disclaimer: This article is based on publicly available information or information provided by interviewees, but Decode and the author do not guarantee the completeness or accuracy of such information. Under no circumstances should the information or opinions expressed in this article be construed as investment advice to any person.