No sales to back it up, who dares to say no to the rankings

![]() 08/06 2024

08/06 2024

![]() 605

605

The charm of statistics is fully demonstrated on sales posters.

Recently, the weekly sales ranking of new force brands, which has been released for over a year, has once again been criticized, and doubts have been raised about the significance and data sources of the weekly ranking.

There are increasing voices suggesting the cancellation of the weekly ranking, and several auto companies, including NIO and Geely, have publicly expressed their views, describing the weekly ranking as a low-end and ineffective internal competition.

Although many auto companies oppose the weekly sales ranking, few have much to say about the monthly sales ranking. On the first day of each month, almost all new force brands will release their previous month's sales posters, painstakingly using statistical techniques to package the posters.

Of course, at the beginning of August, despite the rhetoric against inefficient internal competition, auto companies still released their monthly sales posters on time, with specific data precise to the individual unit to highlight the rigor and authenticity of the data.

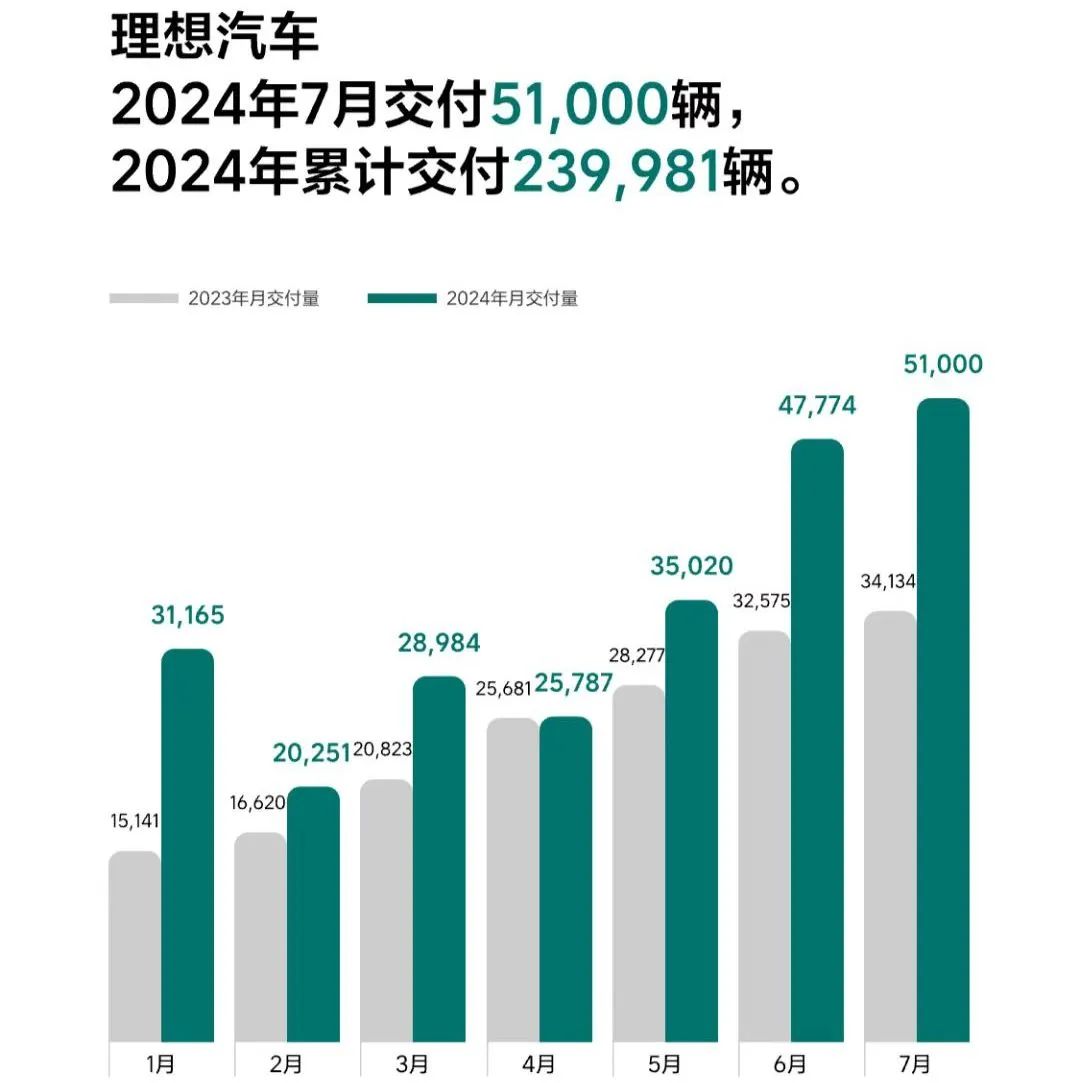

Lixiang achieved its goal

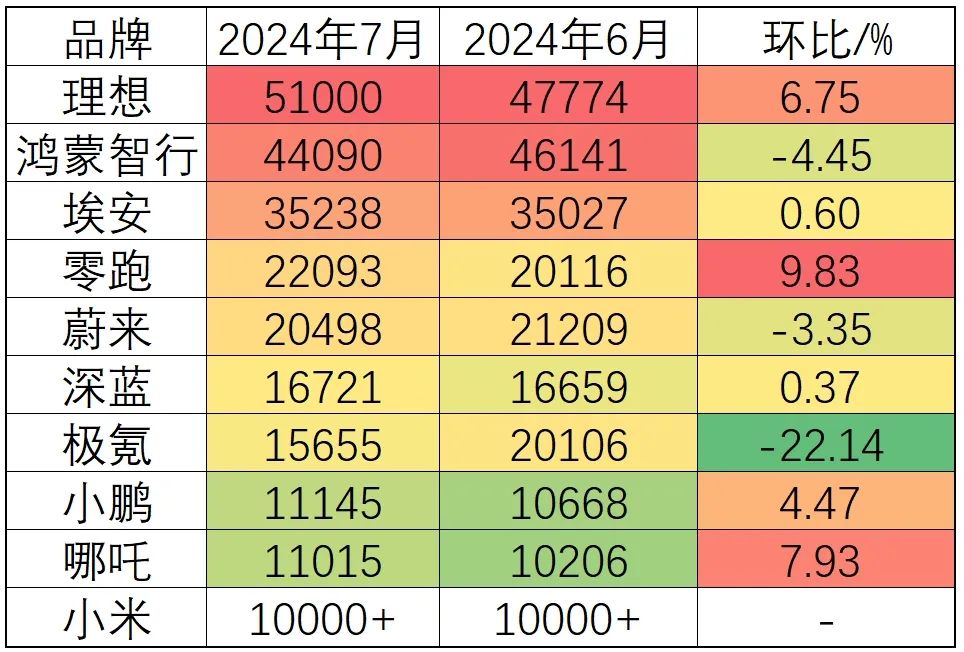

First, let's focus on the top three. After six months of unremitting efforts, Lixiang has finally regained its position at the top of the new force sales ranking, surpassing Hongmeng Zhixing with a record monthly sales of over 50,000 vehicles.

Following the launch of L6, Lixiang's sales quickly recovered from the shadow cast by MEGA. The full family-style lineup of the L series allows consumers to find a suitable model upon entering the store, from 5-seat SUVs to 7-seat SUVs, firmly capturing the consumer group targeting families.

Covering the travel needs of families ranging from three-person households to seven-person households with two children, Lixiang's "mobile home" successfully meets the travel demands of domestic families, becoming the most successful model in the new energy market that focuses on the family concept. Although refrigerators, color TVs, and large sofas have been continuously ridiculed by competitors, these three items are still standard for models targeting family travel.

Just like the existence of the weekly ranking, Lixiang, as the initiator, does not care about outside criticism. After all, since the weekly ranking was released, no brand has presented real data to refute its inaccuracy, and the monthly rankings have consistently shown similar data.

Even Li Bin of NIO, who has been one of the loudest voices opposing the weekly ranking, can only dare to say, "If NIO becomes the sales leader, we will never release the weekly ranking again." It can only be said that under absolute sales performance, any words are merely the excuses of the weak.

Regarding this, Hongmeng Zhixing, which ranks after Lixiang, has the most to say. Having been surpassed by Lixiang by nearly 7,000 vehicles, it has become difficult to regain an advantage in total sales. With Wenjie currently supporting its sales, the competition between Lixiang and Wenjie models has intensified.

The intensity of competition can be seen from the month-on-month growth rate. Lixiang Auto saw a 6.75% increase in July, while Hongmeng Zhixing experienced a 4.45% decline, with sales largely shifting to Lixiang.

In terms of specific model sales, Wenjie's M9 has maintained stable growth, with monthly sales reaching 18,047 vehicles. This seven-seat SUV has significantly impacted Lixiang L9 sales. However, sales of Wenjie M7 and M5 are not optimistic, as the popularity of these two facelifted models has not lasted long.

In particular, the new M5 was unveiled at the Beijing Auto Show and began deliveries on May 15th, just three months ago. However, sales have failed to replicate the success of M7 and M9, failing to exceed 10,000 vehicles per month. As a competitor to Lixiang L6, one can only lament, "If Yu was born, why did Liang also appear?"

At present, if Hongmeng Zhixing wants to surpass Lixiang in sales, it can only hope for the upcoming launch of Enjoy S9 and the simultaneous release of Huawei's ADS 3.0 intelligent driving system. If it can bring breakthroughs in intelligent driving, it may help Wenjie surpass Lixiang in sales.

Meanwhile, the camouflaged version of Hongmeng Zhixing's MPV in collaboration with JAC Motor has recently appeared within the Huawei campus. If Hongmeng Zhixing can make breakthroughs in the MPV market, it will be another blow to Lixiang.

Ranking third is Aion, a brand that sells only pure electric vehicles. With monthly sales of 35,238 vehicles, Aion can be considered the leader in China's pure electric vehicle market. However, as previously mentioned, Aion's biggest problem is that sales have declined significantly compared to 2023.

At the same time, Aion has been plagued by various negative news. Recently, Aion's premium brand Hyperion invited the well-known auto influencer Zhou Hongyi for a live stream, but an unexpected incident occurred during the anti-pinch test. Although all parties, including Zhou Hongyi, responded, it left consumers with an impression of a pinch hazard, further exacerbating the already poor sales of Hyperion.

Aion's second-generation model, AION V, has been launched, with a starting price of 129,800 yuan, directly targeting BYD Yuan Plus in the price war. According to Aion's strategy, new models will be accelerated in the second half of the year. With lagging sales in the first half, Aion has pinned its hopes on the second half, but the pressure for growth remains significant.

As the market enters the second half of the year, competition has not eased due to the summer vacation. Even in the traditional off-season, leading auto companies are still striving to sell cars. Lixiang's record-high sales prove that there is no longer a clear distinction between peak and off-peak seasons in the market.

The struggle among mid-tier brands

The competition among the four auto companies in the middle of the sales ranking is no less intense than that among the top three. Since the beginning of the year, the rankings of Leapmotor, NIO, ARCFOX, and Zeekr have been constantly changing, with none able to break into the top tier. Sales of 20,000 vehicles represent the limit in this tier, and it is uncertain who will break through 30,000 to enter the top tier.

Specifically, in July, Leapmotor successfully stabilized its sales above 20,000 vehicles with the launch of the C16, surpassing NIO. Leapmotor's cost-effective approach has proven successful, with the comprehensive breakthrough of the C series giving Leapmotor more confidence at the negotiating table.

Perhaps due to caution regarding sales, Leapmotor's August purchase promotion for the C16 has not been adjusted compared to its July launch. Even with over 10,000 orders in hand, Leapmotor still hopes to attract more customers through discounts.

Regarding sales breakthroughs, Leapmotor may bring surprises in the second half of the year through overseas expansion. According to reports, on July 30th, Leapmotor's joint venture with Stellantis Group, Leapmotor International, began sales, with the first batch of Leapmotor C10 and T03 electric vehicles being shipped from Shanghai Port to Europe.

It can be said that in overseas expansion, Leapmotor has relied on Stellantis, which will enable it to move faster than other auto companies. Moreover, while the tariffs on Leapmotor's electric vehicles exported to Europe are not yet determined, it can be anticipated that Stellantis' involvement will result in favorable tariff rates.

Leapmotor is opening overseas markets through a new approach and may become the fastest-growing auto company among many overseas brands.

There are not many highlights in NIO's sales. Maintaining sales of 20,000 vehicles is the best state for NIO at present, considering that pure electric vehicles priced above 300,000 yuan are not expected to have high sales. Therefore, NIO's sales growth can only depend on the Lido.

As NIO's first model to enter the mainstream market, the Lido L60 significantly impacts NIO's performance in the second half of the year. Success will prove the competitiveness of the battery swap model in the mainstream market, while failure will deplete NIO's resources and widen its losses.

Meanwhile, NIO may have prepared a two-pronged approach. Recent developments suggest that the third brand, "Firefly," has made new moves, with camouflaged test vehicles appearing overseas. They appear to be smaller than the Lido L60, indicating a lower market positioning.

This indicates that NIO urgently needs more sales to share R&D costs. On July 27th, at NIO Day, William Li once again told the outside world where NIO's money went, but he needs to solve how to earn back these R&D expenses rather than continue to lose money on car manufacturing every year.

As for ARCFOX, sales have not fluctuated much, remaining above 15,000 vehicles, demonstrating its competitiveness in the new energy market. However, a significant breakthrough is still lacking, particularly as the launch of ARCFOX G318 did not lead to a noticeable increase in sales.

Regarding competition, ARCFOX has new cards to play. Relying on its parent company Changan Automobile, ARCFOX has also adopted Huawei's intelligent driving system. The new ARCFOX S07 is equipped with Huawei's Kunpeng Intelligent Driving ADS SE, which, despite being the SE version, is still considered "far ahead" in intelligent driving and may become ARCFOX's next sales growth point.

Zeekr's performance in July was somewhat disappointing compared to the other three, with sales declining significantly to below 20,000 vehicles, making it the most notable decline in the sales ranking.

As a pure electric brand without the battery swap cushion like NIO, Zeekr needs more product highlights to compete in the pure electric market. The sales growth brought about by the facelifted 001 finally showed signs of fatigue after six months.

At present, Zeekr's main models are still the 001 and 007, which is challenging in a continuously evolving market. In particular, the emergence of black horses like Xiaomi SU7 in the pure electric sedan segment has to some extent competed with Zeekr.

Fortunately, Zeekr still has many cards up its sleeve. The pure electric SUV Zeekr 7X has been unveiled by the Ministry of Industry and Information Technology, and the all-new Zeekr 009 has chosen to be listed in Hong Kong, with the simultaneous launch of a right-hand drive version, marking a new stage in Zeekr's overseas expansion.

It can be said that there is not much room for complacency in the middle tier. On the one hand, there is the Matthew Effect at the top, constantly eroding the market. On the other hand, competition must be maintained to prevent being surpassed by brands at the bottom. Caught between the wolf in front and the tiger behind, continuous internal competition is inevitable.

The unsettling tail end

The tail end mentioned here does not refer to the bottom of the sales ranking but rather brands with sales above 10,000 vehicles that have not been able to break into the middle tier, namely Xpeng, Nezha, and Xiaomi.

First, Xpeng's sales are quite interesting. The official poster only mentions that sales have remained above 10,000 vehicles without disclosing specific figures. However, judging from the graph, it appears to be significantly more than the previous month's 10,000+ vehicles. It can only be said that Xpeng has done a good job of manipulating public sentiment.

This also indicates that Lei Jun is no longer concerned about Xpeng's sales. After attending the opening ceremony of the Paris Olympics, Lei Jun traveled to the Nürburgring in Germany for an inspection and shared his experience of test-driving the Xpeng SU7 ultra prototype on Weibo.

It can be said that Lei Jun is currently the least concerned about sales among automakers. With orders in hand, everything has become calm in 2024. More time is spent building his personal racing enthusiast IP and maintaining his popularity, which is the greatest assistance to Xpeng.

Xpeng's sales performance can be described as the worst among the "WEI-XIAO-LI" trio, with barely over 10,000 vehicles sold, making it difficult to compete with Lixiang and NIO. Although He Xiaopeng has always said that domestic internal competition is low-level and that overseas markets are already engaged in end-to-end intelligent driving competition.

However, the domestic market is a brutal battlefield where only those who survive have the right to speak more. Consumers will only remember brands with good sales. Xpeng's new model, MONA, is still in the promotion stage and will not be launched until September at the earliest. It seems that Xpeng will remain in this position for another one or two months.

Nezha Auto has generated a lot of buzz in the first half of the year, but sales have failed to pick up. The Nezha L Red Edition has not pulled it out of the rut, and Zhou Hongyi has been busy maintaining his IP popularity by visiting other auto companies. Nezha's buzz can only be generated by Zhang Yong alone.

Previously, Nezha stated that supply chain issues had led to delivery problems with the Nezha L, but sales have remained above 10,000 vehicles per month despite this. It is unclear which Nezha model is experiencing issues. Although Nezha has been continuously expanding into overseas markets, its domestic competition remains weak, raising questions about its confidence in winning overseas markets.

Although the sales performance of Xpeng and Nezha are average, they are fortunate to maintain a monthly sales volume of 10,000 units, which is the threshold for profitability. Compared to other brands, they still have a chance to turn things around. It can only be said that to achieve breakthroughs in sales, they need to put in more effort than other brands, both in product development and marketing. Lying low is not an option.

With the release of the monthly sales rankings, it's time to welcome the weekly rankings for the new week. Despite ongoing controversies, no one has the power to stop it at the moment, given the significant sales figures of Ideal ONE. Furthermore, there isn't much discrepancy between the weekly and monthly rankings.

Under such circumstances, Ideal ONE can still leisurely release its weekly rankings. Although the voices of opposition are loud, they don't have much effect unless an authoritative department intervenes to stop it.

It can only be said that without sales to back them up, it doesn't matter who speaks out against the weekly rankings.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.