"Fridge, TV, big sofa, who believes it is a big fool"

![]() 08/06 2024

08/06 2024

![]() 671

671

Introduction

Introduction

In today's Chinese automotive market, selling cars based solely on functionality no longer commands a premium price.

To clarify, this is not an article bashing "fridges, TVs, and big sofas." We all appreciate a comfortable driving experience. However, the question we aim to explore is how to stand out and break through the homogenized automotive market.

Li Auto's rise to prominence in the new energy vehicle (NEV) sector is undeniably linked to its product definition centered on fridges, TVs, and spacious interiors, which cater to the preferences of the middle class.

Where there's demand, there's a market. By being the first to market with this concept, Li Auto not only achieved profitability but also dominated sales, boasting of its success despite competition from other players.

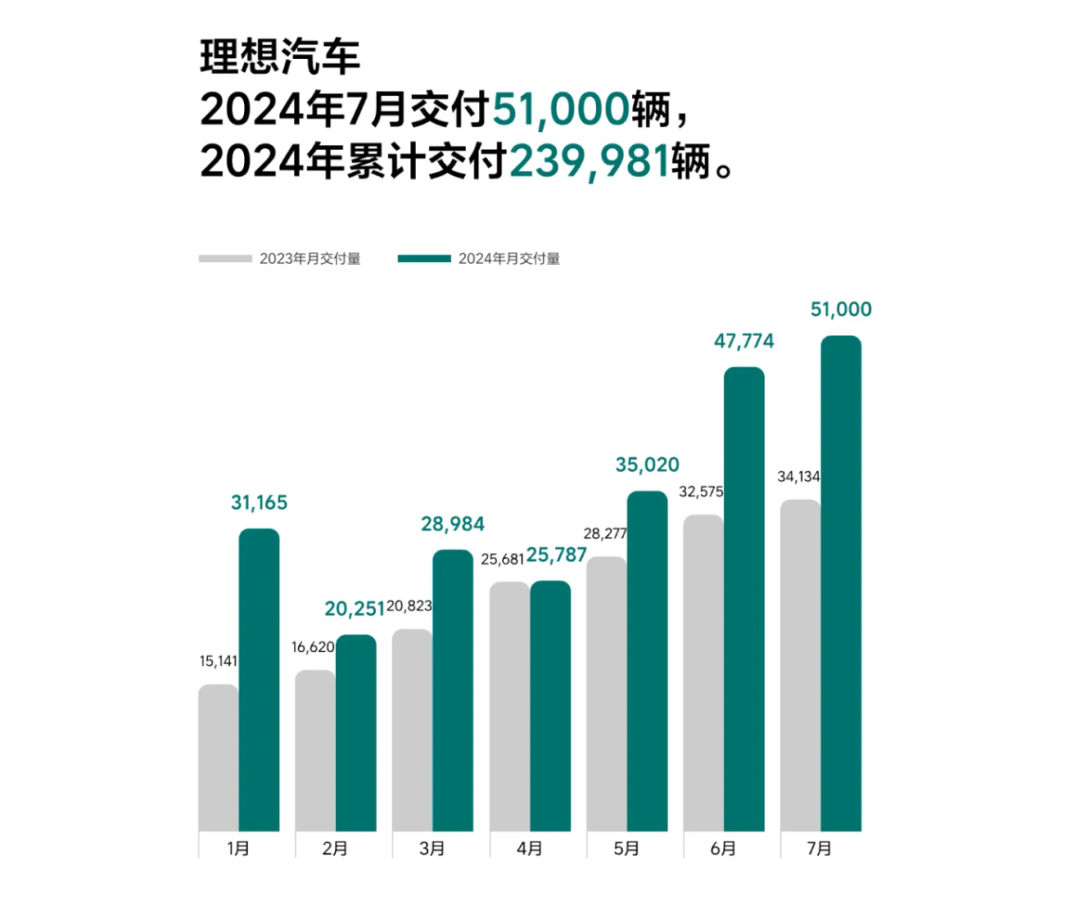

According to data, as of June 30, 2024, Li Auto had delivered a cumulative total of 822,345 vehicles, ranking first among Chinese NEV startups in terms of total deliveries. On August 1st, Li Auto announced its July delivery figures, setting a new monthly record with 51,000 deliveries.

These impressive numbers seem to indicate Li Auto's success, but the question arises: is its winning formula limited to fridges, TVs, and big sofas?

Some argue that these amenities are Li Auto's core technology, while others claim that its success stems from its range-extended electric vehicles, which exploit a loophole in the market.

However, as competitors begin to replicate this strategy, leading to the emergence of various "half-price Li Auto" alternatives, the question remains: where does the more expensive "genuine" Li Auto go from here?

Fridges, TVs, and big sofas are not a universal solution.

Amid the price war, automakers resort to various tactics to gain an edge. Two key factors underlie this prolonged price competition: securing market share and rebuilding the pricing system in the NEV era.

While a shakeup is inevitable, fridges, TVs, and big sofas are far from a universal solution for success in the automotive market.

In fact, the entire industry has been gearing up to challenge Li Auto since NIO C10 introduced its slogan, "A More Ideal Home for Young People."

In recent months, NIO has made significant strides, with its reputation for value and collaboration with Stellantis boosting its brand strength and positioning it as a top contender.

According to the latest data, NIO delivered 22,093 vehicles in July, setting a new record. Notably, on July 30th, NIO International shipped the first batch of NIO C10 and T03 from Shanghai Port to Europe.

These rising figures suggest that NIO is on the right track, offering products similar to Li Auto's but at a more affordable price.

As economic conditions evolve and the middle class shrinks, will consumers turn to NIO or similar cost-effective options with fridges, TVs, and big sofas?

The 100,000-200,000 yuan home SUV segment is fiercely competitive. Neta Auto, too, has regained momentum and embarked on a "half-price Li Auto" strategy.

Recently, Neta launched the Neta L, a mid-size SUV with a starting price of 129,900 yuan, boasting fridges, TVs, and a spacious interior.

It's evident that these amenities are spreading faster than advanced driver assistance systems. In other words, relying solely on fridges, TVs, and big sofas for differentiation has become increasingly challenging.

The NEV era presents both opportunities and challenges for automakers. While user-centricity is essential, what consumers truly desire goes beyond fridges, TVs, and big sofas.

A car is, first and foremost, a vehicle, and only then a comfortable "third space."

While many may pay for the concept of a third space, once it becomes standard, the technological complexity and value of fridges, TVs, and big sofas will be questioned.

So, how can we sell NEVs at a premium in this new era?

Who holds the power to command a premium?

There are many successful and expensive NEVs on the market. People are willing to pay for quality, but the "elite" may not see the value in doing so without the right offering.

Li Auto's L9, for example, commands a premium price of up to 400,000 yuan yet achieves monthly sales of over 6,000 units.

Similarly, AITO's M9, priced above 450,000 yuan, enjoys robust sales of over 16,000 units per month.

While BBA once dominated the luxury market, the NEV era has opened doors for Chinese brands like Li Auto, AITO, and NIO.

Each individual faces the weight of a changing era, but BBA still holds sway in the luxury segment due to its established brand, product line, service network, and consumer perception.

However, the tides of time will not be halted by any individual or company. Seizing opportunities as they arise is crucial for success in today's NEV market.

In the NEV era, all players start on an even footing, and traditional benchmarks are no longer sole determinants of quality.

Xiaomi's SU7, launched just a few months ago, has already achieved monthly sales of over 10,000 units. This success stems from a combination of factors, including design, product quality, pricing, and Xiaomi's brand power and Lei Jun's charisma.

Can Xiaomi's automotive success be replicated? What about Tesla? Personally, I doubt it, but there are certainly patterns to follow in the success of models like Li Auto's and AITO's.

As mentioned earlier, there are commonalities in the success of Li Auto and AITO, with fridges, TVs, and big sofas being just one aspect.

In summary, achieving a premium price for NEVs hinges on three key factors:

First, establishing a strong brand image. Li Auto's success with fridges, TVs, and big sofas, coupled with its reputation for product quality, has helped build its brand. As a pioneer in profitability and appeal to the middle class, Li Auto has made a lasting impression on consumers.

Second, technological prowess enhances brand value. AITO, backed by Huawei technology, exemplifies this. Consumers often choose AITO for Huawei's technology, not just its parent company Seres. Similarly, future models like EnjoyAuto S9 and ZunJie MPV could attract customers with similar strategies.

Lastly, but importantly, excellent service alleviates concerns. Range anxiety and charging anxiety are common NEV concerns. Solutions like 800V platforms, ultra-fast charging, and battery swapping systems add value. NIO's success shows that valuable services and configurations that address consumer needs lead to sales.

Selling cars is challenging, and selling them at a premium even more so. For automakers navigating the tides of change, both building and selling cars are arduous journeys. Focusing solely on superficial amenities like fridges, TVs, and big sofas risks becoming a joke.