Transsion Holdings' "Internal and External Troubles"?

![]() 08/06 2024

08/06 2024

![]() 654

654

Transsion Holdings (688036.SH), known as the "King of Mobile Phones in Africa", has recently been beset by a series of controversies. In the past half-month, the company has been involved in two separate patent disputes. First, it was sued in the Delhi High Court in India for infringing on four non-standard essential patents. More recently, Qualcomm initiated a patent infringement lawsuit against it in the Unified Patent Court in Europe. The escalating patent battle between the two parties has attracted widespread attention.

Securities Star has noted that Transsion Holdings is under immense pressure externally due to Qualcomm's continuous patent lawsuits in India and Europe, while internally, it struggles with declining market share in Africa, slower revenue growth in its African business, and relatively weaker R&D capabilities compared to its peers.

Moreover, as the company's share price continued to decline, its controlling shareholder not only failed to offer assistance but instead reduced its holdings to cash out over RMB 1 billion, with three senior executives, including the company's deputy general manager, profiting by over RMB 80 million. Interestingly, as the company's share price further declined, these three executives, who had previously cashed out RMB 80 million, only contributed RMB 13 million to increase their shareholdings, showing a lack of sincerity.

01

Consecutive Lawsuits from Qualcomm for Patent Infringement

It is reported that in this patent dispute, Qualcomm accused Transsion Holdings of infringing on a patent numbered EP2,232,289 related to "navigation receiver" technology. Currently, this patent has expired in most UPC countries but remains valid in Germany, Italy, the Netherlands, and France.

In response, a Transsion Holdings representative acknowledged the authenticity of the news, stating that the company is actively addressing the matter internally and will communicate with investors in a unified manner when ready.

Securities Star notes that this is the second time Transsion Holdings has been sued by Qualcomm. On July 12, Qualcomm filed a lawsuit against Transsion Holdings in the Delhi High Court in India, accusing it of infringing on four non-standard essential patents.

Qualcomm believes that Transsion Holdings has infringed on its critical patent portfolio by using Qualcomm's patented technologies without proper licenses. Qualcomm emphasizes that while Transsion Holdings has signed licensing agreements with Qualcomm for some products, most of its products remain unlicensed. Qualcomm aims to uphold its patent rights through litigation and restore a fair competitive environment for all licensees.

In response to Qualcomm's allegations, Transsion Holdings stated that it has signed a 5G standard patent license agreement with Qualcomm and is fulfilling its obligations. It also noted that some patent holders do not fully adhere to the principles of fairness, reasonableness, and non-discrimination. In Transsion Holdings' primary markets such as Africa and South Asia, some patent holders demand high licensing fees based on global unified rates despite owning few or no patents in those regions, ignoring regional economic differences and market realities.

From both parties' responses, it is evident that the conflict arises from patent licensing fees.

In fact, patent licensing fees are one of Qualcomm's primary sources of revenue, and the company has previously faced legal battles with companies like Meizu and Apple over patent licensing fees.

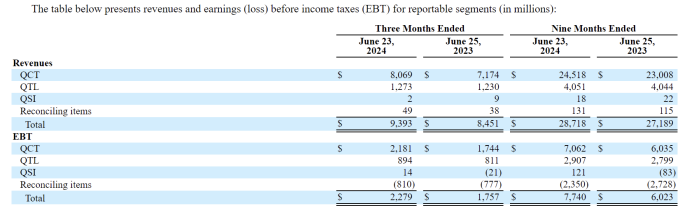

Public information reveals that Qualcomm's primary businesses include its semiconductor business (QCT), focused on chip products, and its technology licensing business (QTL), responsible for patent licensing.

From financial reports, patent licensing fees are Qualcomm's second-largest source of revenue. Qualcomm's fiscal third-quarter 2024 earnings report, released on August 1, showed a 11% increase in revenue to USD 9.393 billion compared to USD 8.451 billion in the same period last year. QTL revenue reached USD 1.273 billion, up 3.5% year-on-year, primarily driven by anticipated sales growth of 3G/4G/5G multi-mode products.

Qualcomm's recent actions against Transsion Holdings likely stem from its significant market potential.

Public information shows that Transsion Holdings is primarily engaged in the design, R&D, production, sales, and branding of smart devices centered on mobile phones. Its main products include TECNO, itel, and Infinix branded phones. The company's sales regions are concentrated in emerging markets such as Africa, South Asia, Southeast Asia, the Middle East, and Latin America.

In 2023, Transsion Holdings delivered impressive performance. During the reporting period, the company generated revenue of RMB 62.295 billion, up 33.69% year-on-year, with a net profit attributable to shareholders of RMB 5.537 billion, up 122.93% year-on-year, achieving growth in both revenue and profit.

In terms of shipments, Transsion Holdings delivered approximately 194 million mobile phones in 2023, a 24.36% year-on-year increase. According to IDC data, Transsion Holdings held a 14% global market share in 2023, ranking third among mobile phone brands worldwide. Specifically, it had over 40% market share in the African smartphone market, ranking first in Africa and earning the title of "King of Mobile Phones in Africa."

Based on the above data, the average selling price of Transsion Holdings' mobile phones in 2023 was over RMB 300. Qualcomm charges patent licensing fees as a percentage of the licensed product's sales price (3.25%-5%). Assuming a 3.25% rate, Qualcomm could potentially collect over RMB 1.8 billion in patent fees from Transsion Holdings. Faced with such considerable potential revenue, Qualcomm is unlikely to let go easily.

Regarding Qualcomm's consecutive lawsuits in India and Europe, market observers believe Qualcomm is applying greater pressure on Transsion Holdings to expedite the signing of a comprehensive 5G standard patent license agreement.

02

Slightly Inferior R&D Capabilities Compared to Peers

Securities Star notes that despite Transsion Holdings' impressive performance, there are underlying concerns. On the one hand, the company's market share in the African smartphone market appears to be declining, and revenue growth from this region is slowing down. On the other hand, while the company has consistently increased its R&D expenses over the years, its R&D capabilities are slightly inferior to those of its peers.

In terms of market share, although Transsion Holdings has consistently held the top position in the African mobile phone market with a market share exceeding 40% in 2023, there appears to be a declining trend over the long term. According to the company's 2019 annual report, its market share in the African market reached 52.5% that year.

Moreover, Transsion Holdings' revenue growth from its African stronghold is also declining. From 2020 to 2023, the company's revenue from Africa was RMB 22.452 billion, RMB 24.238 billion, RMB 20.633 billion, and RMB 22.063 billion, respectively, with year-on-year changes of 18.14%, 7.96%, -14.88%, and 6.74%. Overall, after a negative revenue growth in Africa in 2022, the company's performance recovered somewhat in 2023 but failed to return to previous high growth levels.

In terms of R&D, Transsion Holdings has been upgrading its mobile phones towards high-end models in recent years. The company has innovated several technologies in new hardware materials, such as foldable and rollable form factors, enhancing brand recognition in the mid-to-high-end product line. Furthermore, the company has launched technologies like explorer satellite communication, rollable screen concept phones, all-scenario fast charging, AirCharge wireless charging, AIGC portrait beautification, and digital humans, propelling its products towards the mid-to-high-end market.

To this end, Transsion Holdings has continuously increased its R&D expenses. From 2021 to 2023 and the first quarter of 2024, the company's R&D investments were RMB 1.511 billion, RMB 2.078 billion, RMB 2.256 billion, and RMB 589 million, respectively, representing year-on-year increases of 30.51%, 37.54%, 8.56%, and 10.35%, accounting for 3.06%, 4.46%, 3.62%, and 3.38% of the company's revenue in each period.

Compared to its peers, Transsion Holdings' R&D expense ratio is relatively low among consumer electronics companies. Taking the first quarter of 2024 as an example, Xiaomi and Huawei's R&D expense ratios were 6.9% and 23.3%, respectively, both higher than Transsion Holdings'.

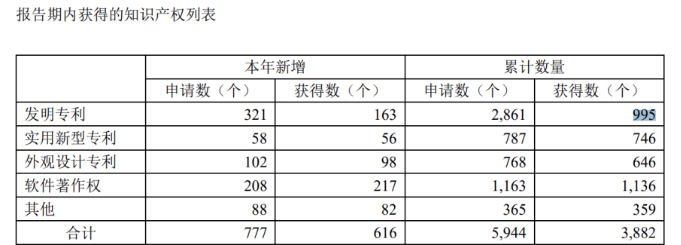

Transsion Holdings also lags behind its peers in patent numbers. As of the end of 2023, the company held 3,882 patents, including 995 invention patents. By the end of that year, Huawei held over 140,000 valid patents worldwide, with over 90% being invention patents, while Xiaomi held over 37,000 patents, far exceeding Transsion Holdings' numbers.

03

Shareholders Seeking Small Increases After Mad Dash to Cash Out

Contrary to its performance trend, Transsion Holdings' share price has continued to decline. After peaking at RMB 125.84 per share on April 18, the share price began to fall. As of the close on August 1, the share price was RMB 77.62, with a current market capitalization of RMB 87.65 billion. Compared to its high, the share price has declined by 38.32%, erasing over RMB 50 billion in market capitalization.

During the share price decline, Transsion Holdings' controlling shareholder chose to reduce its holdings and cash out significantly.

On May 17, Transsion Holdings announced that its controlling shareholder, Transsion Investment, planned to sell 1% of the company's total share capital, or 8.0656 million shares, through a book-building process due to its own funding needs. On May 23, the company announced the completion of the reduction, with the shares sold at RMB 125.55 per share, totaling RMB 1.012 billion in cash-outs.

Securities Star notes that on the first trading day after Transsion Holdings was sued by Qualcomm for patent infringement (July 15), the company's share price briefly fell by over 9% to RMB 71 per share, marking a one-year low.

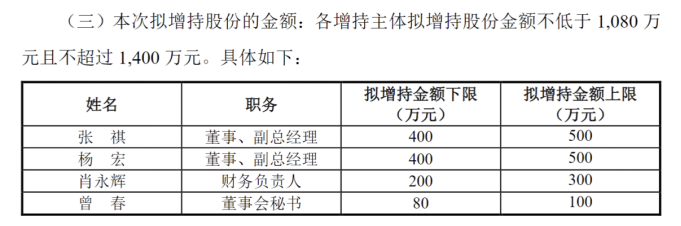

To potentially salvage its declining share price, Transsion Holdings announced an increase plan for its directors and senior executives that evening. The company's directors and deputy general manager Zhang Qi, deputy general manager Yang Hong, chief financial officer Xiao Yonghui, and board secretary Zeng Chun plan to increase their shareholdings through the Shanghai Stock Exchange system within six months from July 16, with a total increase of no less than RMB 10.8 million and no more than RMB 14 million.

Interestingly, Securities Star's equity penetration of Transsion Investment revealed that among the four directors and senior executives increasing their shareholdings, all except board secretary Zeng Chun held equity in Transsion Investment, with Zhang Qi, Yang Hong, and Xiao Yonghui holding shares of 5.2856%, 2.7661%, and 0.3067%, respectively. In other words, during the aforementioned reduction, Zhang Qi, Yang Hong, and Xiao Yonghui cashed out RMB 53.5245 million, RMB 28.01 million, and RMB 3.1 million, respectively, totaling RMB 84.6345 million in cash-outs.

Moreover, Securities Star notes that Transsion Holdings' dividend payments have gradually increased in recent years. By 2023, the company's dividend payments increased from RMB 1.203 billion in 2021 to RMB 4.839 billion, accounting for over 80% of its net profit attributable to shareholders for the period.

From 2021 to 2023, Transsion Holdings' cumulative dividend payments amounted to RMB 7.489 billion. As of the end of 2023, Transsion Investment held a 50.8% stake. In other words, over RMB 3.8 billion of the aforementioned dividend payments went to the controlling shareholder, with Zhang Qi, Yang Hong, and Xiao Yonghui collectively profiting RMB 316 million.

Under the dual actions of dividends and share reductions, Zhang Qi, Yang Hong, and Xiao Yonghui collectively profited RMB 401 million. In the share increase plan, excluding Zeng Chun, the three of them plan to increase their shareholdings by no less than RMB 10 million and no more than RMB 13 million, showing a lack of sincerity. (This article was originally published on Securities Star, written by Li Ruohan)

- End -