Global stock market crashes, Warren Buffett should take the blame! Should we buy the dip?

![]() 08/06 2024

08/06 2024

![]() 621

621

Text & Image | Sister Lying Down

Undoubtedly, Warren Buffett should take some blame for the severe turbulence triggered in the Asian market on August 5. Last week's butterfly flapping in Wall Street caused a major shock in Tokyo.

Following the global stock market's "Black Friday" last week, Asia-Pacific's major stock markets experienced a "Black Monday" on August 5. On that day, stock markets in Japan, South Korea, and Taiwan, China, among others, plummeted, with multiple indices triggering circuit breakers. Notably, the Japanese stock market, which Warren Buffett has touted for years, was heavily hit. By the close, the Nikkei 225 Index plummeted 12%, losing over 4,000 points, and at one point during the session, it fell over 14%, entering a "technical bear market".

To be serious, Warren Buffett should shoulder some responsibility for this mess. Last week, Apple released its sixth consecutive quarter of earnings that surpassed expectations, but it was met with Warren Buffett's "great liquidation." According to Berkshire Hathaway's second-quarter report, the company drastically reduced its holdings in Apple from 789 million shares in the first quarter to approximately 400 million shares in the second quarter, a near 50% decrease.

When Warren Buffett first invested in Apple in 2016, Apple's relative index to the S&P 500 was similar; however, today, Apple's gains have far surpassed the S&P 500, with a second-quarter increase of over 20%, setting a new all-time high. Whether considering profit-taking or share price fluctuations, the reduction in holdings is understandable.

But what about the record-high $276.9 billion in cash on Warren Buffett's balance sheet? Does he believe that current market risks are too high for investing and plans to reinvest in the future? When influential figures like Warren Buffett start leading the charge to repatriate funds, it's generally not good news for the market, compounded by disappointing AI stock earnings, worse-than-expected U.S. employment data, the Federal Reserve's delay in interest rate cuts, and other bad news, the global market is unlikely to fare well.

More importantly, how do we identify whether this crash is a systemic risk outbreak or short-term volatility? And how will it evolve in the future?

01 The Hardest Times Have Begun

The dramatic crash that followed the opening of the Japanese market on Monday was a stock market disaster triggered by immense panic. Among the many reasons for this crash, carry trades have been repeatedly mentioned by many and have become a consensus.

Due to Japan's long-term ultra-low interest rate environment, global capital can borrow low-interest yen and exchange it for other currencies like the U.S. dollar to invest in high-interest assets (such as U.S. stocks), earning not only capital appreciation profits but also attractive spreads between different currencies. As long as Japanese interest rates remain low and the yen depreciates, this carry trade can continue.

However, this year, the Bank of Japan began raising interest rates, particularly narrowing the interest rate spread between Japan and the United States, disrupting global carry trades. The surge in the yen's exchange rate led to global capital deleveraging, with stocks being sold off in succession to repay yen loans.

In Japan, "Mrs. Watanabe" investors (a colloquial term for retail investors) often borrowed yen to invest in U.S. stocks, and foreign investors also exchanged yen for dollars. When the carry trade ends, investors convert dollars back to yen to repay loans, causing the yen to appreciate. Simultaneously, yen appreciation represents stronger purchasing power, and as the Japanese stock market is dominated by globally listed companies priced in yen, appreciation inevitably means declining book performance, leading to stock market declines.

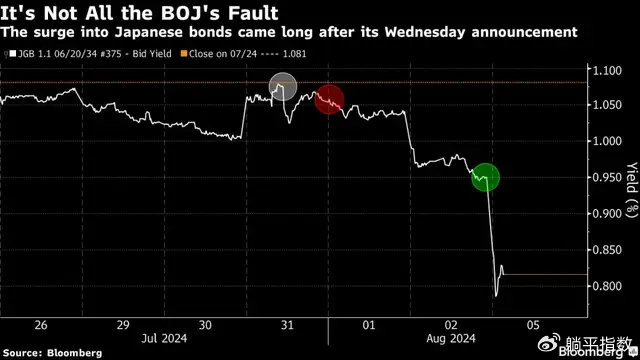

This is a chain reaction, so it's not unreasonable to consider the end of carry trades as a cause of the peripheral stock market crash. However, behind the end of carry trades, other forces influence yen-denominated bond and stock markets, with much greater influence than interest rates themselves.

Here is the 10-year Japanese government bond yield since July 26. The three circles from left to right represent the Bank of Japan meeting, the Japanese market's initial reaction to the Federal Open Market Committee (FOMC) meeting, and its first reaction to U.S. unemployment data. It's evident that market movements are primarily correlated with U.S. unemployment data, with the Bank of Japan's influence limited.

The most alarming factor for the market is the global economy, particularly the recession expectations in the United States.

According to the July Global Fund Manager Survey conducted by Bank of America, confidence in a soft landing for the global economy is high (expected by 68% of respondents), with a hard landing possibility of only 11%. However, as more people anticipate a soft landing, it increases the risk of a hard landing for various assets (like stocks and bonds):

Many investment decisions are based on the assumption that the economic slowdown will be moderate, implying an acceptance of economic weakness. Simply put, regardless of whether it's soft or hard, a landing is inevitable.

Market expectations are supported by data. As the Federal Reserve repeatedly delays interest rate cuts, recently updated economic data reflects both encouraging progress in inflation control and an unexpected slowdown in the U.S. economy.

Last week, the latest employment data showed that U.S. nonfarm payrolls grew by just over 100,000, with unemployment still below 4.5%. Amid mounting negative surprises, the unexpected decline in employment data dealt a significant blow to the entire market. Simultaneously, these data triggered the so-called "Summers Rule," suggesting that a U.S. economic recession is underway.

The Summers Rule states that when the three-month moving average of the unemployment rate exceeds the 12-month low by 0.5 percentage points, it typically indicates that the economy is in recession. This rule has a high prediction accuracy, having been validated in all 11 U.S. economic recessions since 1950, earning it a reputation as a 100% accurate recession predictor.

While Summers himself notes that under the unusual post-pandemic conditions, the rule based on the pace of unemployment rate increases might generate false positives this time, another indicator of growing fears of an economic slowdown is interest rate cut expectations.

In the past three months, expectations for interest rate cuts have steadily increased, but never have market expectations been as high as last week, anticipating a significant forced rate cut by the Federal Reserve due to economic slowdown. This forced rate cut expectation, unlike a proactive one, led to a rare massive crash when the anticipated rate cut finally materialized.

Ironically, the "culprit" behind this situation is the Federal Reserve, which called for rate cuts for the past seven months but hesitated to act, turning the "rate cut narrative" from a positive to a negative, dragging all previously positive economic data into this awkward situation of slowing growth or even recession.

It's known that the Federal Reserve is unlikely to admit it was wrong to resist rate cuts for the past six months and doesn't want to risk cutting the federal funds rate before the September meeting, as it could trigger wider panic. Thus, from this month until the September meeting, it will be a very difficult period.

02 Can the AI Narrative Save the Market?

Returning to Warren Buffett, his reduction in Apple holdings and repatriation of cash added the final straw to an already panicked market, causing funds to frantically withdraw from their previously enthusiastically pursued AI tech stocks, dragging down the entire U.S. and peripheral stock markets.

It's essential to emphasize that while the market expects the U.S. economy to "land" regardless of whether it's soft or hard, in reality, the U.S. economy currently resembles a slowdown rather than a recession. In other words, we don't want to overemphasize optimism about safe-haven assets or pessimism about risky assets. There's still a distance from the current "recession narrative" to actual "recession trading."

For example, several hard indicators of recession like monetary tightening, fiscal austerity, high leverage, and external shocks, monetary tightening is currently present and often the primary cause of recession. However, the Federal Reserve has the ability and incentive to rapidly cut interest rates, and the pressures from other indicators are largely manageable for the U.S.

Thus, the so-called "recession trading" in the current U.S. market is at best in the "recession expectation trading" stage, which could reverse at any time due to positive economic indicators or gradual interest rate cuts, as the market will realize that economic slowdown is manageable, and the probability of systemic risk is low.

After risky assets survive this pressured stage, there's still great hope for renewed growth. Even short-term pressure may drive down overvalued AI tech stocks, presenting excellent buying opportunities. Our strategy during this phase boils down to "buy more when it dips," especially for stocks with more certain earnings.

Take Apple, which Warren Buffett just significantly reduced his holdings in.

As mentioned earlier, Warren Buffett reduced his Apple holdings not because of poor performance or future growth prospects. On the contrary, among stocks disappointing the market with underperforming AI earnings, Apple is the most likely to exceed expectations.

Apple is the only U.S. smartphone company with the opportunity to fully deploy end-side large models on the consumer end.

Regarding overall performance, in Q2 2024 (Apple's fiscal third quarter), revenue grew strongly by 4.9% to $85.78 billion, exceeding analyst expectations of $84.46 billion. Adjusted earnings per share reached $1.40, higher than the expected $1.35 and last year's $1.26. Net income increased 7.9% year-on-year to $21.448 billion, with a gross margin of 46.3%, higher than the market expectation of 46.1%.

This marks Apple's sixth consecutive quarter of exceeding expectations, also the sixth consecutive quarter of growth for the entire smartphone industry. Looking ahead, Apple will release a new generation of iPhones equipped with OpenAI's large model by the end of the third quarter. By then, the pent-up demand from the 700 million existing users who haven't upgraded their phones in the past three years is expected to be unleashed.

From a fundamental perspective, Apple's strategy in generative AI differs from other companies. They invest less capital in related areas but can capture significant potential revenue through existing large models. Although Apple will eventually adopt its proprietary large model, starting with industry-leading models can save time and effort.

Besides Apple, stocks like NVIDIA and Tesla, with certain earnings prospects, may present buying opportunities after the crash. Staying alert to market directions and adopting a "fight and observe" strategy will be the best approach to navigating future markets.

Disclaimer: This article is for learning and exchange purposes only and does not constitute investment advice.