Palantir raises guidance, proving the growth story of AI

![]() 08/07 2024

08/07 2024

![]() 584

584

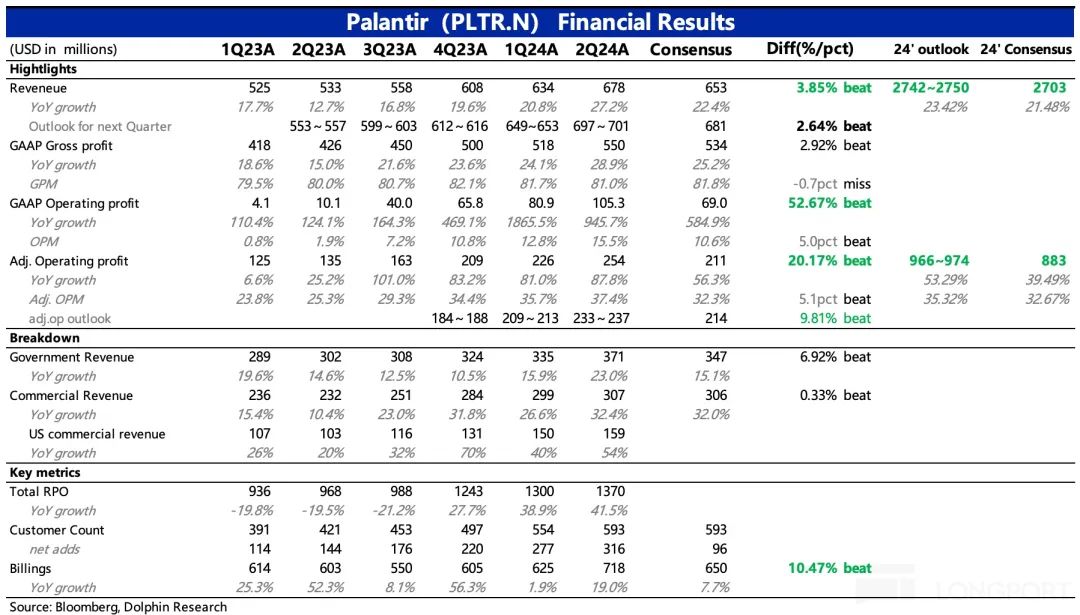

$Palantir Tech.US released its second-quarter 2024 results after the market close on August 6, EST. Overall, Q2 results were solid, though BBG consensus expectations failed to reflect the relatively optimistic true market sentiment (due to limited number of participating institutions and data lag). However, Palantir delivered on the most controversial aspect of growth, and raised its full-year guidance. Concurrently, it optimized operational efficiency, making earnings improvements more pronounced.

Specifically: 1. Confident guidance raise: The biggest positive in the Q2 report was the company's significant upward revision of full-year guidance, which was more substantial than the Q1 raise, making it more convincing than any speculative growth stories in the market. Management expects Palantir's full-year 2024 revenue to be $2.742-2.75 billion, a 23.4% YoY increase at the midpoint, slightly exceeding market expectations. Operating profit guidance was also raised higher due to concurrent operational efficiency improvements, projected at $966-974 million for 2024.

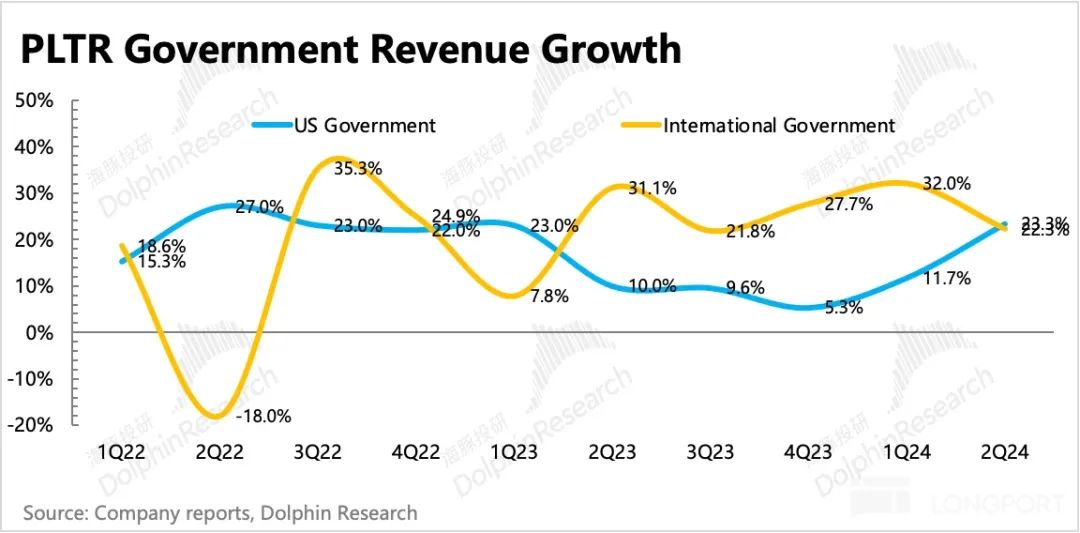

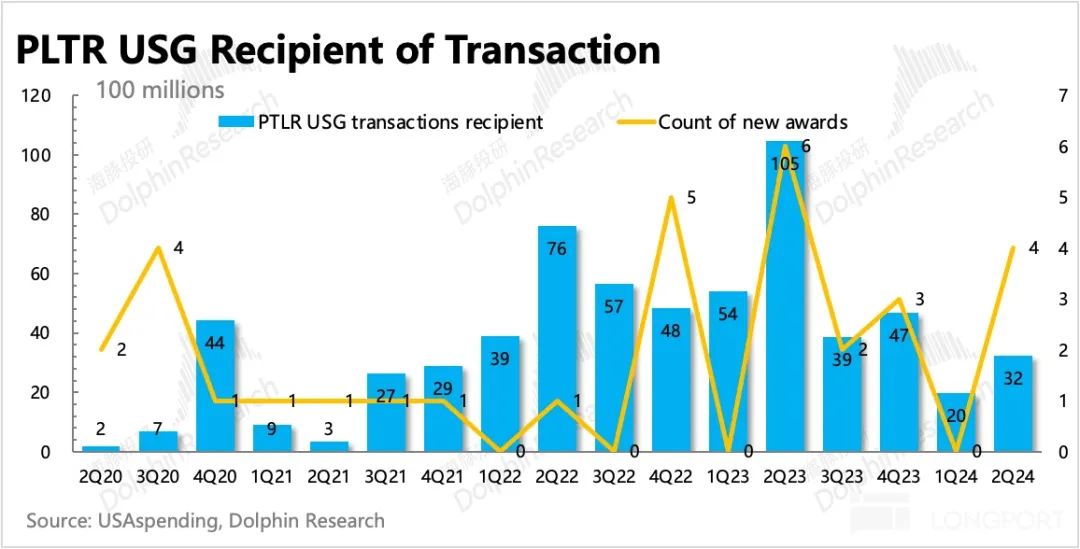

2. Current reliance on government digitalization demand: In the short term, government demand contributes more significantly to Palantir's revenue. Amidst rising global tensions and the digitization needs of defense systems, Palantir has secured multiple US military contracts this year: a two-year $178 million contract with the Army in March (for TITAN deep perception capabilities platform), followed by a five-year $480 million contract with the Defense Department in Q2 (for Maven AI+ computer vision system). As two-thirds of Palantir's government business revenue, accelerated growth in Q2 US government revenue drove overall government revenue growth.

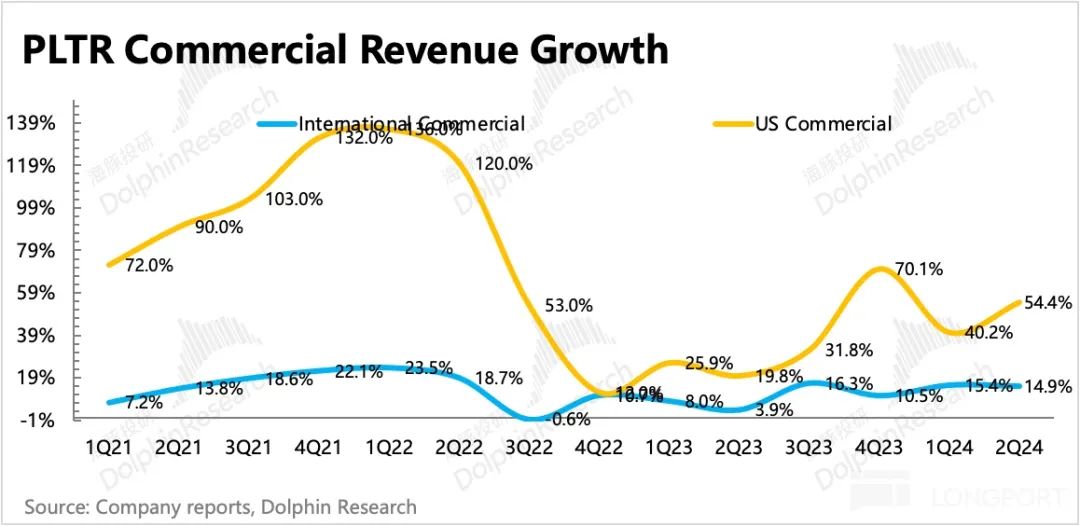

3. Future reliance on commercial AI demand: Relying solely on government revenue would be hard to quell market doubts about the sustainability of high growth. However, given its customized and expensive products, the market also questions how Palantir can effectively scale its product and service revenue. With the emergence of a new AI era, Palantir launched its AIP platform, which, through Bootcamp acceleration, has quickly become a key driver of sustained high growth in commercial revenue within less than a year. Thus, the progress and implementation of AIP are the most critical operational metrics beyond financial indicators for the market.

1) Commercial revenue growth accelerated YoY in Q2 compared to Q1, with the US region, representing AI growth, achieving 54% YoY growth, exceeding the original guidance of 45%. 2) In terms of AIP progress, Bootcamp client numbers increased by 110 net new clients quarter-over-quarter, reaching a cumulative total of 1,025 enterprises, steadily expanding its influence.

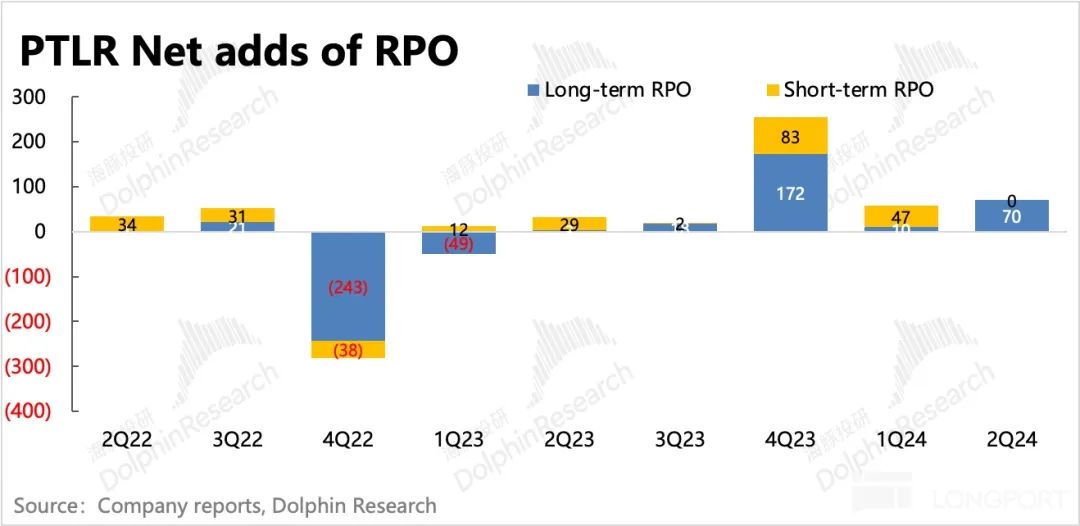

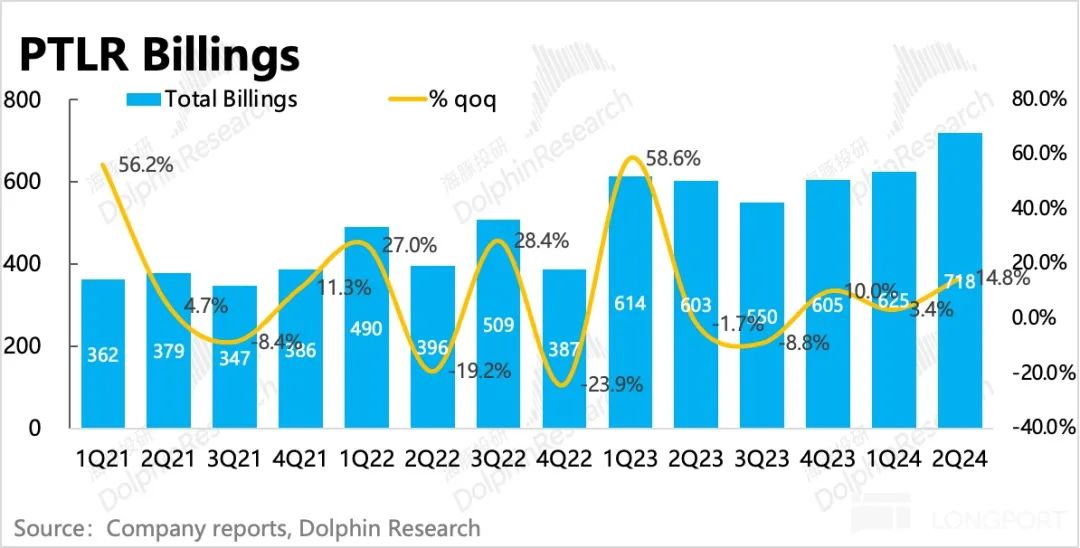

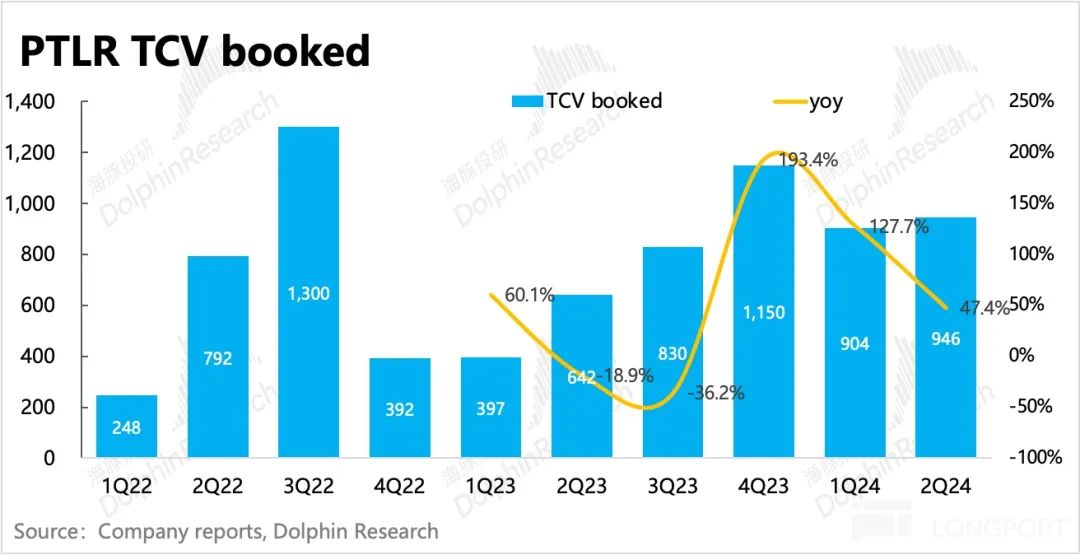

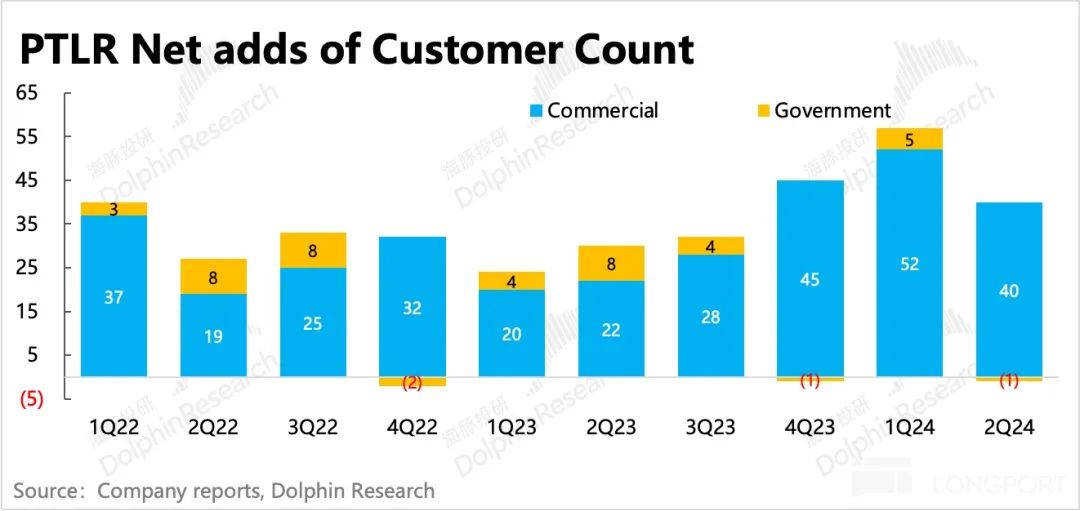

4. Forward-looking indicators also favorable: Palantir primarily provides customized software services, resulting in predictable revenue in the short term, narrow guidance ranges, and high revenue certainty. To better reflect Palantir's true business growth, the market focuses more on contract-related metrics such as TCV (Total Contract Value), RPO (Remaining Performance Obligation), customer count, and Billings. The first three involve contract duration, offering a clearer view of mid-to-long-term growth prospects: all contract-related metrics grew in Q2, with some accelerating quarter-over-quarter. Short-term, the market primarily observes growth trends reflected in Billings: Q2 Billings grew 19% YoY, a significant improvement from 2% in Q1, alleviating concerns about growth sustainability from the previous quarter.

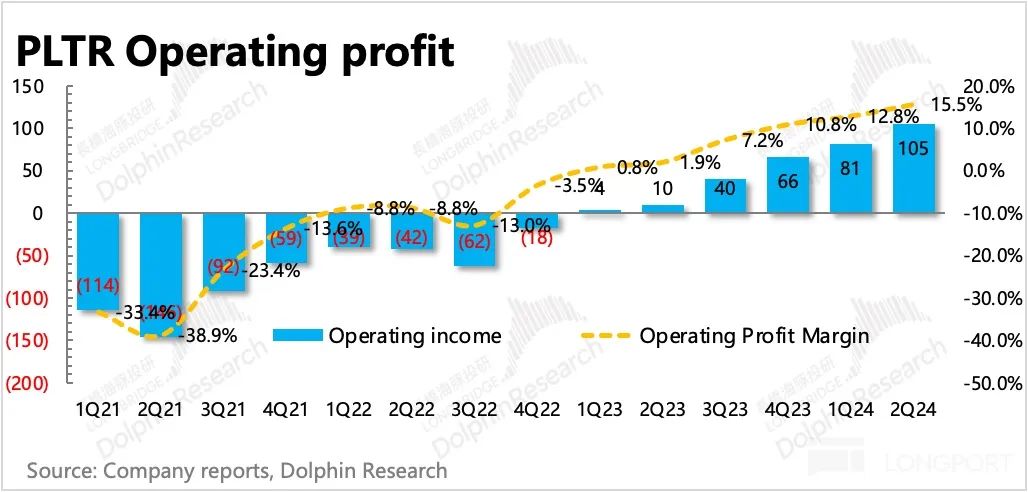

5. Earnings continue to improve, but expenses will accelerate in H2: Palantir is still in the profit turnaround phase (rapid profit growth) in Q2, with operating profit significantly increasing YoY to $105 million (from $10 million last year), also exceeding market expectations. Profit improvement stems mainly from revenue monetization expansion and operational cost reduction. Therefore, with higher revenue guidance, the company's 2024 profit guidance increase is even more substantial, outperforming market expectations.

6. Summary of performance metrics

Dolphin Insights: From both current and marginal performance perspectives, Palantir's Q2 results were solid, at least not disappointing on the core growth front. Marginal expectations suggest that rising global tensions may continue to aid Palantir in securing government contracts, but will economic slowdown affect corporate investments in AI and other technological upgrades? While Palantir may gain market share through its technological advantages (Alpha logic), macroeconomic factors could inevitably drag down growth rates. Glimpses of this can be seen in sporadic indicators (e.g., QoQ decline in newly signed commercial contract value in the US). However, valuation opinions vary. Dolphin believes Palantir's current valuation (post-market $60 billion) implies a 25x P/S, which is still relatively high compared to peers in the short term.

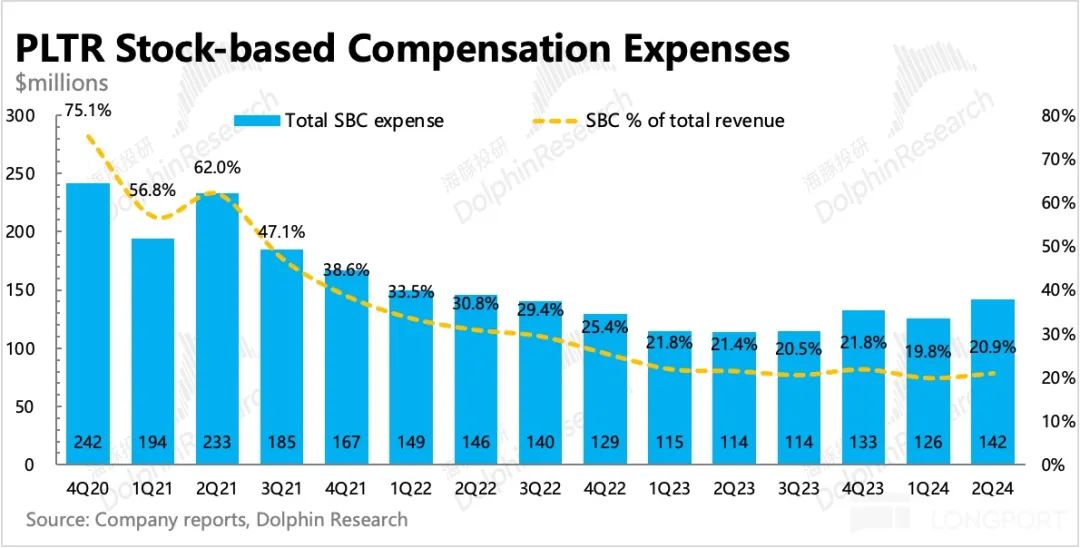

Palantir's high valuation stems from: 1) its first year of positive earnings, with revenue growth + rapid SBC reduction leading to a high GAAP profit growth rate during the inflection point; 2) long-term growth potential from AIP. These two factors drive Palantir's share price. Most Wall Street institutions have low valuation expectations for Palantir, primarily due to concerns about the scalability of its customized products. This "valuation bias" creates significant expectations gaps, leading to both high institutional pursuit and significant short positions, resulting in volatile post-earnings movements. In our previous earnings review, although the stock plunged due to disappointing results, we noted that the long-term forward-looking indicators disclosed in Q1 were not poor, and short-term quarterly fluctuations alone cannot tell the whole story. Thus, both excessive pessimism and overly optimistic linear extrapolations are unfeasible. Combining logical marginal changes is crucial. Moreover, using mid-to-long-term forward indicators as an anchor, when these indicators remain favorable, short-term fluctuations can present opportunities with a relatively favorable risk-reward ratio.

Detailed Analysis

I. Raised revenue guidance implies growth confidence

Q2 total revenue was $680 million, up 27% YoY and exceeding market expectations (~$653 million), with growth continuing to accelerate QoQ. Palantir primarily provides customized software services, resulting in predictable revenue in the short term, narrow guidance ranges, and high revenue certainty.

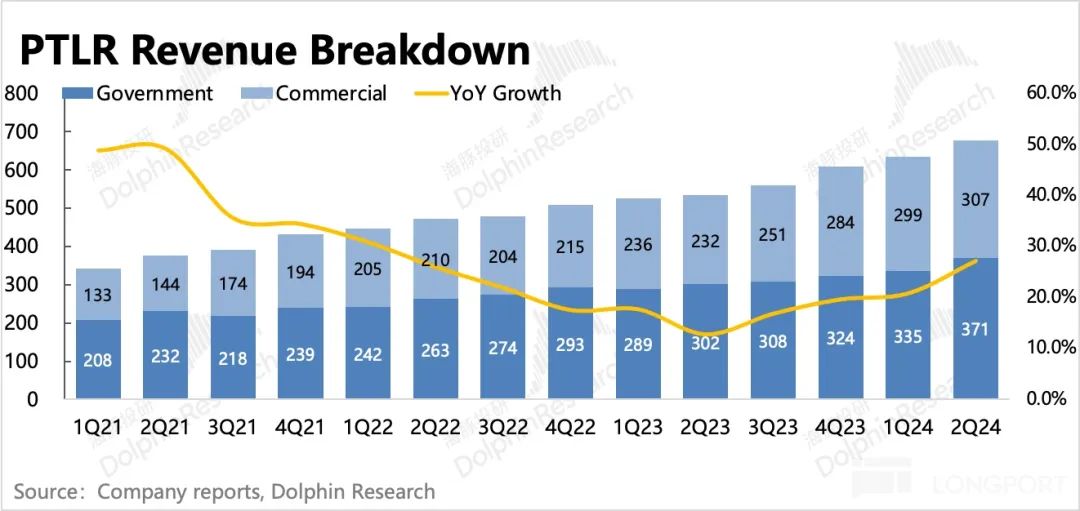

1. Business Segment Breakdown (1) Government revenue remains the primary contributor: Q2 government revenue grew 23% YoY, continuing the recovery trend, primarily driven by US government demand. Amidst rising global tensions and the digitization needs of defense systems, Palantir has secured multiple US military contracts this year: a two-year $178 million contract with the Army in March (for TITAN deep perception capabilities platform), followed by a five-year $480 million contract with the Defense Department in Q2 (for Maven AI+ computer vision system). Palantir has a notable advantage in providing technology for the US government's IT systems, and AI enhancements have generated incremental government demand. The government procurement website also shows a significant QoQ increase in contract sizes for Palantir. With rising global tensions, more system upgrades and customization demands are likely.

(2) Commercial revenue drives growth, catching up with government revenue: Q2 commercial revenue grew 32.4% YoY, also accelerating compared to Q1. The incremental commercial revenue primarily stems from AIP-driven customer demand, with 1,025 Bootcamp participants (110 new additions from the previous quarter). While Bootcamp shortens customer conversion time, deeper customer penetration reflects medium-to-long-term growth momentum rather than immediate short-term financial impact.

II. Contract Overview: Overall Robust Growth

For software companies, future growth potential is core to valuation. Quarterly recognized revenue is a lagging indicator; thus, we recommend focusing on new contract acquisitions, particularly contract metrics (RPO, TCV), Billings, and customer count growth. (1) RPO: Palantir's Q2 RPO was $1.37 billion, up $70 million QoQ. Unlike Q1, Q2 saw a net increase in long-term contracts, truly reflecting growth. (Short-term contract increases may result from long-term contracts rolling over, not necessarily external demand.)

(2) Billings: Q2 Billings were $718 million, up 19% YoY, a notable improvement from Q1. Billings primarily reflect short-term demand fluctuations. Considering Q1, Q2, and historical trends, Dolphin believes seasonal fluctuations do not significantly indicate product competitiveness. However, given Palantir's high valuation, the market is naturally more critical of its performance, paying close attention to this metric.

(3) TCV: Q2 recorded $950 million in new TCV, up 45% YoY but slowing significantly QoQ. US commercial TCV was $262 million, up 152% YoY, accelerating from Q1 but lower in absolute terms. Considering macroeconomic changes, potential slowing in corporate procurement warrants attention.

(4) Customer Growth: The most intuitive medium-to-long-term indicator, customer count increased by 39 net new clients QoQ, 40 of which were commercial.

Combining <1-4>, Dolphin believes the forward-looking indicators collectively demonstrate Palantir's relatively stable short- and medium-to-long-term growth trends. The only concern is the risk of slowing commercial contracts amid unexpected macroeconomic weakness.

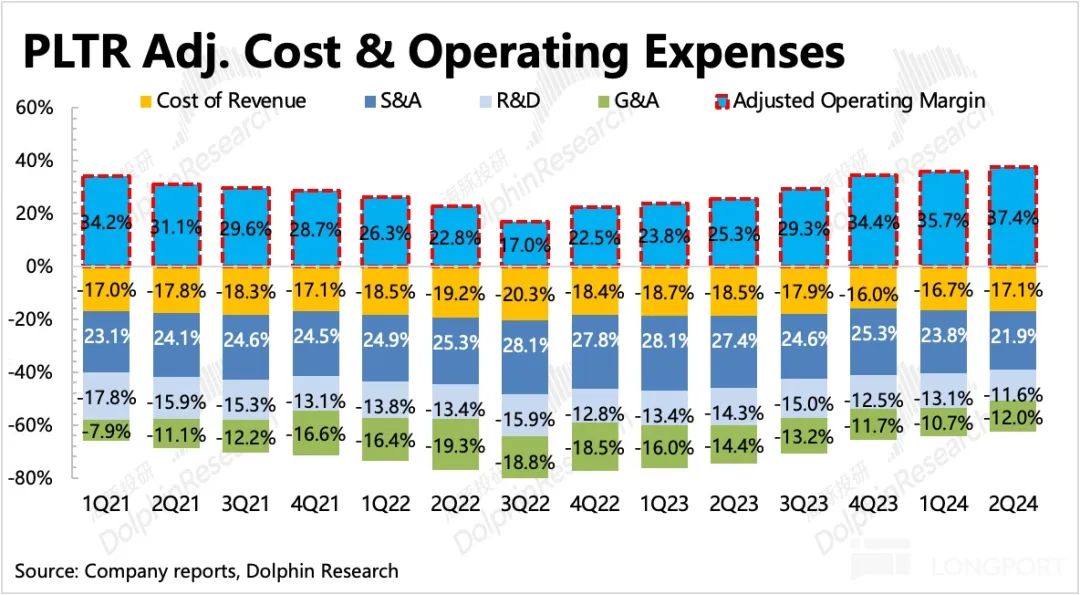

III. Earnings Continue to Improve, but Expenses to Accelerate in H2

Q2 saw Palantir continue its profit turnaround (rapid profit growth), with operating profit significantly increasing YoY to $105 million (from $10 million last year), also exceeding market expectations. Profit improvement stems primarily from revenue monetization expansion and operational cost reduction. Thus, with higher revenue guidance, Palantir's 2024 profit guidance increase is even more substantial, outperforming market expectations.

Expense optimization primarily involves decelerating R&D and sales & marketing expenses (excluding personnel expenses), which declined QoQ. However, personnel expenses seem to be showing signs of renewed net increases—SBC absolute values resumed growth, and their share of revenue rebounded. In the earnings call, management mentioned that expenses would accelerate in H2 but would remain below revenue growth to sustain profitability optimization trends.

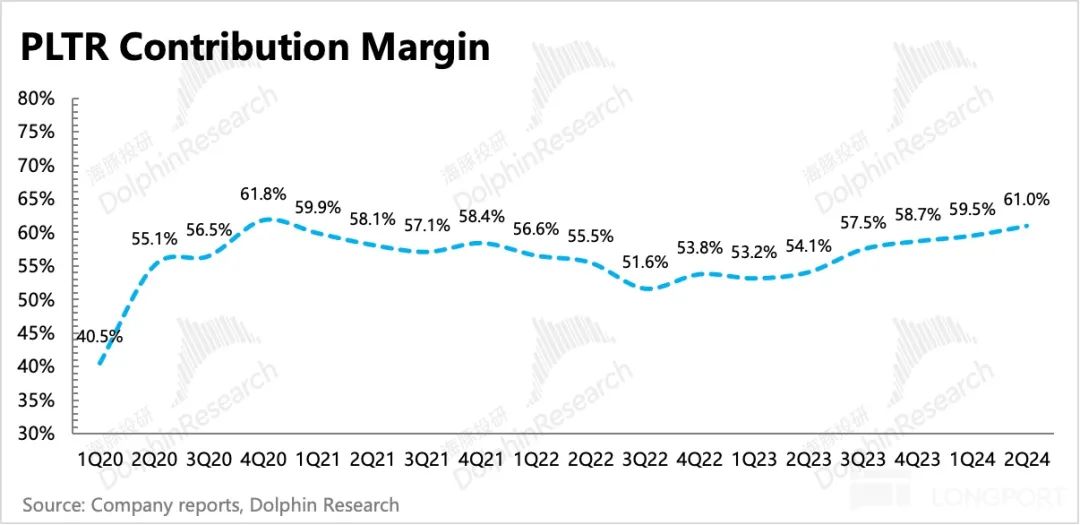

Finally, in terms of the indicator [contribution margin] that reflects the competitiveness of the company's products (the marginal impact of marketing and promotion expenses on revenue generation, similar to the gross margin of consumer goods companies), it continued to increase to 61% in the second quarter, further demonstrating the enhanced competitiveness of the company's products and improved overall monetization efficiency.