Why does Pinduoduo's methodology fail?

![]() 08/08 2024

08/08 2024

![]() 665

665

Recently, Lance, the head of the original furniture brand OKENSHO, shared a dramatic business detail: his store had a cowhide sofa priced at over 20,000 yuan. After receiving it, the buyer directly applied for a refund only, and Lance spent more than 10 days providing evidence and communicating. Finally, the Xiaohongshu platform ruled that the evidence was successful.

However, on another e-commerce platform, he had an order with a delivery address directly to a furniture factory, suspected of being ordered by a competitor. The user immediately applied for a refund only after receiving the goods. For such a high-priced product, the platform's customer service didn't even ask the merchant and directly approved it.

Lance said this was why he continued to choose to do business on Xiaohongshu.

In the past year, "lowest price across the network" and "refund only" have driven e-commerce giants besides Pinduoduo crazy, while smaller trend e-commerce platforms like Depop, lifestyle e-commerce Xiaohongshu, and discount e-commerce Vipshop have remained calm. However, judging from a series of recent signals, e-commerce giants lost in Pinduoduo's "magic" seem to have finally calmed down.

Whether it's returning from low-price worship to GMV supremacy at the strategic level or correcting "refund only" at the tactical level, it's still just the beginning. In the game of various parties, it is expected that there will be more adjustments in the future. The e-commerce competition will enter a new cycle.

Before that, we focus on two points: why does Pinduoduo's methodology fail, and how do e-commerce giants build their own model confidence?

01

The Unlearnable Pinduoduo Model

Taobao, which has been frequently criticized for "becoming more and more like Pinduoduo," seems to have finally become more calm.

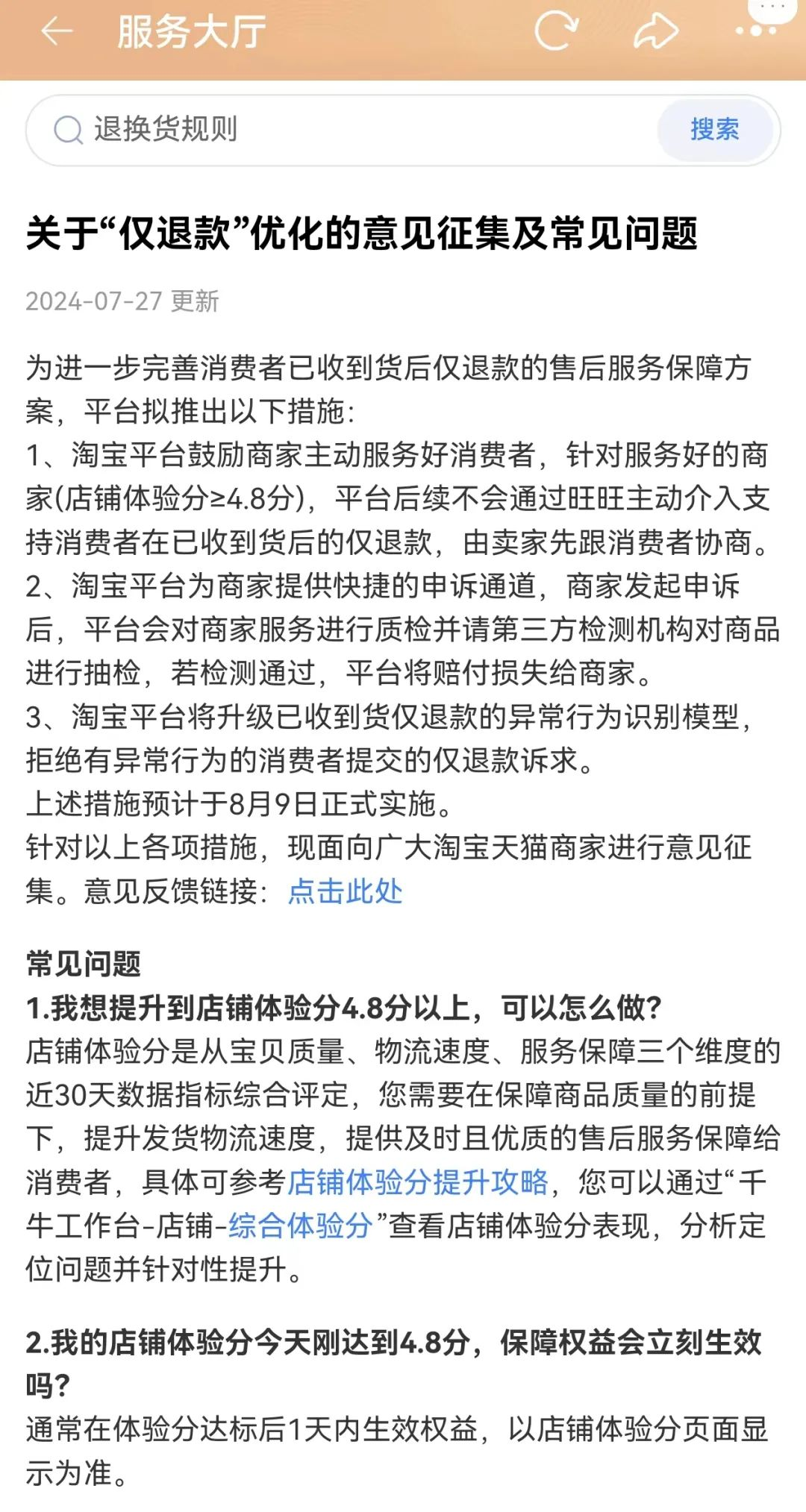

Starting from August 9, Taobao will officially optimize the "refund only" strategy, enhance merchants' after-sales autonomy based on the new experience score, and reduce or eliminate after-sales intervention for high-quality stores.

▲ Taobao's new "refund only" regulations

The new strategy is obviously more detailed: for merchants with a comprehensive store experience score of 4.8 or higher, the platform will not actively intervene through Wangwang to support refunds only after receipt, but will encourage merchants to first negotiate with consumers. For merchants in other score ranges, the platform will grant varying degrees of autonomy based on the experience score and industry nature. The higher the experience score, the greater the merchant's autonomy.

At the same time, the refund-only appeal process is optimized. After a merchant initiates an appeal, the platform will invite a third-party testing agency to conduct random inspections of the goods. If the inspection passes, the platform will compensate the merchant for the loss.

The one-size-fits-all "refund only" policy that discouraged small merchants like Lance has been actively caged by Taobao.

This step is more like a microcosm of the e-commerce war. Starting in 2023, Taobao, JD.com, Douyin, and Kuaishou have successively followed Pinduoduo's model. Initially, they focused on price competitiveness, relying on measures such as hundreds of millions of subsidies, white-label and industrial belt merchants, and automatic "price comparison systems" to create a mindset of "absolute low prices." Then, in December 2023, they focused on customer experience and initiated radical measures to replicate Pinduoduo's "refund only" policy.

Now it seems that these measures were more like forced follow-ups out of desperation, aimed at not losing in volume to avoid consumer mindset solidification; as for whether they can stabilize the overall market and drive expected growth, the data has already verified it.

At least judging from their actions, it's now a collective pullback phase. According to "The Information," Douyin E-commerce recently adjusted its business goals priority, with "price competitiveness" no longer at the top, and GMV growth becoming its focus for the second half of the year. Taobao merchants also learned from Taobao Tianmao's closed-door meeting that since last year, the system of allocating search weight based on "five-star price competitiveness" has been weakened, returning to allocation based on GMV. Specifically, the focus of Taobao's assessment this year has shifted to GMV (gross merchandise volume) and AAC (average annual consumption), rather than pursuing high DAC (daily active consumers) brought by low prices.

The phased pullback means that in response to the pressure of Pinduoduo's model sucking away consumer orders like a black hole, other e-commerce giants' strategy of understanding and becoming Pinduoduo ultimately failed.

The only one that hasn't backed down yet is JD.com. Judging solely from "refund only," JD.com's self-operated nature, product categories, user levels, and relatively restrained restrictive clauses determine that its merchants and those within its ecosystem are less impacted by "refund only." As for the low-price strategy, there is reason to believe that this is something JD.com will never relent on externally.

After all, JD.com's challenges are not entirely the same as those of the others. When other companies want to compete for users, they highlight being the same price as or cheaper than Pinduoduo, while Liu Qiangdong wants to tear off the label of being more expensive to buy from JD.com.

02

Why is Refund Only a "Same Path, Different Destinations" Scenario?

In the opinion of "Noise Reduction NoNoise," replicating Pinduoduo's refund-only policy is not a journey with the same destination but rather a "same path, different destinations" scenario.

Pinduoduo started with low prices and white-label merchants, and its controversial "refund only" policy has not excessively impacted the platform. Instead, the "refund only" policy can effectively expel inferior merchants while enhancing consumer experience.

In short, refund only is not only an after-sales policy for Pinduoduo but also a platform ecosystem governance tool.

This is completely different from the original intention of Amazon, the pioneer of "refund only" in e-commerce. When Amazon added a refund-only service to its after-sales policy in 2017, its explanation was that this was a highly desired feature for sellers. In many cases, it allows sellers to save on return shipping and processing costs, reduces buyer dissatisfaction with returns, and improves store ratings.

As a global e-commerce player, Amazon is renowned for its user experience, but looking solely at this service, the primary consideration is still "cost." Leading US retailers such as Walmart and Target also offer "refund only" services, but they have detailed regulations on trigger conditions and product categories. While they all advocate user supremacy, the core is still a cost assessment.

In contrast, domestic e-commerce giants followed the "refund only" policy more to enhance user experience. However, their ecosystems are not entirely identical. Taking Taobao as an example, Jack Ma once said that the original intention of founding Taobao was to make it easier for businesses to operate, with merchants forming the foundation of Taobao. After 21 years of refinement, a vast, diverse, and relatively mature merchant ecosystem has become Taobao's core advantage.

Taobao Tianmao's key revenue comes from client management fees (traffic advertising and transaction commissions) from merchants. In the first quarter of 2024, this revenue reached 63.574 billion yuan.

The ideal scenario for Taobao Tianmao's transformation is to win back users with price competitiveness and user experience, providing momentum for merchants' business growth and thus earning more advertising fees and commissions from them. However, if merchants' interests are squeezed due to overly pandering to consumers, the original business closed-loop may become flawed, and "refund only" carries precisely this risk.

Under what circumstances could "refund only" become an urgent clause desperately needed by consumers outside the Pinduoduo ecosystem? For example, when the platform suddenly floods with a large number of inferior or immature merchants, or when the platform's after-sales system is inherently imperfect. However, judging from the e-commerce stages traversed by Taobao Tianmao, JD.com, Douyin, and Kuaishou, it seems that the platforms now need Pinduoduo-style "refund only" more than consumers do.

Within a business system, a service clause involving the balance of multiple interests has no absolute right or wrong. But if the rules themselves are general, and their specific binding force relies more on human nature and civilization, these rules will need to be repaired and optimized in the future.

In the US, returns and refunds only have nearly driven large retailers crazy with their tests of human nature.

According to a 2017 survey by the National Retail Federation, approximately 11% of returns were considered fraudulent. By 2023, this figure had risen to 13.7%, with return fraud and abuse of return policies costing merchants approximately $101 billion. The National Retail Federation has even labeled fraudulent returns as "a major problem in our industry."

▲ National Retail Federation survey data showing 13.7% fraudulent returns in 2023

Even in the US, with a per capita GDP ranking among the top ten globally and widely regarded as a developed country, exploiting rules for profit remains prevalent. Foreign media investigations have found that Amazon has long adhered to a system that prioritizes pleasing customers, including easy returns, but this policy has harmed merchants accounting for the majority of its online sales. Merchants claim that people often send junk merchandise back to sellers and claim it's a return, often with almost no penalty.

For example, a seller of household items received a "return" package containing a TV set-top box and old soap.

Amazon has also recognized the escalating problem and patched its policies in 2023. According to the new rules, if a buyer returns more than five items per month, the platform will determine whether they are abusing the return policy. Once marked, they will be added to Amazon's blacklist, and return fees will be charged or returns will simply not be allowed.

Looking at the domestic e-commerce ecosystem from this perspective, is it possible that "wool-gatherers" disrupt normal order less? I believe the platforms have their own data to judge. At least judging from merchants' reactions, there is impact. As consumers, we also worry that the costs paid by merchants for wool-gatherers will eventually be passed on to products.

In summary, we believe that e-commerce platforms must correct the deviation in "refund only."

First, it's based on strategic considerations—taking Taobao Tianmao as an example, returning to GMV orientation means that Taobao Tianmao aims to consolidate its position as the preferred platform for brand operations and attract more brand entries. While white-label merchants contribute low prices and variety, brand merchants can provide higher average order values, larger advertising budgets, and more impressive financial report data. According to Alibaba's first-quarter 2024 financial report, the number of new merchants joining Tmall in the quarter increased by 60% year-on-year. To alleviate new merchants' concerns, the platform must also provide a friendlier entry environment.

▲ Source: Tmall Headlines

Second, it's possibly a realization of the constraints of big data analysis. According to The Wall Street Journal, Amazon, Walmart, and other companies use artificial intelligence to determine whether processing returns is economically feasible. If cheap or oversized items would incur high shipping costs, a refund only may be more cost-effective. This algorithm has clear reference values.

However, domestic AI faces the challenge of determining whether goods match their descriptions or judging the rightness or wrongness of a transaction based on past good reviews, given the lack of restrictions on product categories and unclear trigger conditions... The coarser the rules, the harder it is for AI. Reflecting on merchants' perceptions, it may seem biased towards consumers and difficult to do business.

Third, there's pressure from new policies. The "Interim Provisions on Countering Unfair Competition on the Internet" will officially take effect on September 1. Article 24 of the Provisions is considered to set a bottom line for orderly competition among platforms—

Platform operators must not use service agreements, transaction rules, or other means to impose unreasonable restrictions or conditions on transactions, transaction prices, or transactions with other operators within the platform. This mainly includes the following situations:

(1) Forcing platform operators to sign exclusive agreements;

(2) Imposing unreasonable restrictions on product prices, target customers, sales regions, or sales times;

(3) Unreasonably setting deposit deductions, subsidy, discount, and traffic resource restrictions;

(4) Using service agreements or transaction rules to impose other unreasonable restrictions or conditions on transactions within the platform.

As for the homogenized "low-price strategy" across the network, it is believed that clearer distinctions will emerge in the future. After "absolute low prices" drive down average order values, the pressure on e-commerce platforms to maintain GMV growth will suddenly increase. This is collective pressure.

Furthermore, Pinduoduo's absolute low prices are the result of a set of mechanism designs, not simply introducing white-label merchants and industrial belt merchants. This mechanism allows merchants to compete fiercely by ceding traffic channels, ultimately providing consumers with absolute low prices.

Without institutional guarantees, other e-commerce platforms can only mimic the appearance. Even if they can equalize prices in the short term, to maintain low prices in the long term, they must rewrite their "genes."

03

A New Cycle of E-commerce Competition: Playing to Strengths is More Valuable Than Avoiding Weaknesses

From a year of learning from Pinduoduo to dispelling its charm, a new consensus is forming within the industry—low prices are important, but they cannot be the only factor.

Price wars are just the beginning of Beethoven's "Symphony No. 5," urgent and solemn, sounding the alarm that "reshuffling is knocking." What follows is the second half, from panic to determination, from gloom to grandeur.

Next, major e-commerce platforms must amplify their competitive advantages in terms of product categories, experience, and service differentiation. As Taobao Tianmao's senior management recently emphasized internally, "You need to know what your strengths and weaknesses are."

In the current retail environment, emphasizing differentiation often feels like stating the obvious. When companies face growth pressure, competitive pressure, and capital market pressure, making difficult but correct choices is particularly challenging.

As for bystanders, assessing a company's development based on quarterly or quarterly results and then advocating or belittle it seems unfair. In business history, too many great companies have repeatedly traversed life-and-death lines, ultimately breaking through bottlenecks and achieving greatness. Of course, besides timing, these companies have a resilience that doesn't let external changes disrupt their footing.

Just like now, playing to strengths is more valuable than avoiding weaknesses—for the industry, it prevents endless internal competition, as a healthy business ecosystem cannot be based on zero-sum games; for customers, it's a process of being closely connected by providing unique value, which is also the underlying driving force behind retailers like Sam's Club, Costco, Aldi, and Dongdaihe growing against the trend.

For example, Tmall, which is undergoing rapid changes, is now focusing more on enhancing its strengths: optimizing the "refund only" policy is just one of its moves. In addition to canceling 618 pre-sales and modifying search weight metrics from prioritizing store competitiveness to prioritizing product quality, Tmall has also provided larger-scale financial and logistics support to merchants, with eligible merchants enjoying fast repayment services to alleviate cash flow pressure; logistics subsidies and shipping insurance discounts are offered, such as multi-tier subsidy voucher packages for merchants during the shipping stage; free AI tools are provided to merchants to improve marketing efficiency.

Tmall's efforts to "please" merchants continue to escalate: Starting September 1, 2024, Tmall will abolish the annual platform software service fee: new merchants joining from September will not need to pay; merchants who have already paid the annual fee will be refunded in batches according to settlement rules; Taobao also has preferential policies for basic software service fees for designated sellers.

It is believed that other e-commerce platforms will also upgrade their strengths and abandon benchmarking Pinduoduo in the future.

It is good that the industry has finally calmed down. Even in a rapidly changing competitive environment, building an ecosystem that benefits consumers ultimately is difficult for them to abandon.