China Mobile: Billion Users Dance Together, Trillion Revenue Takes Off

![]() 08/12 2024

08/12 2024

![]() 428

428

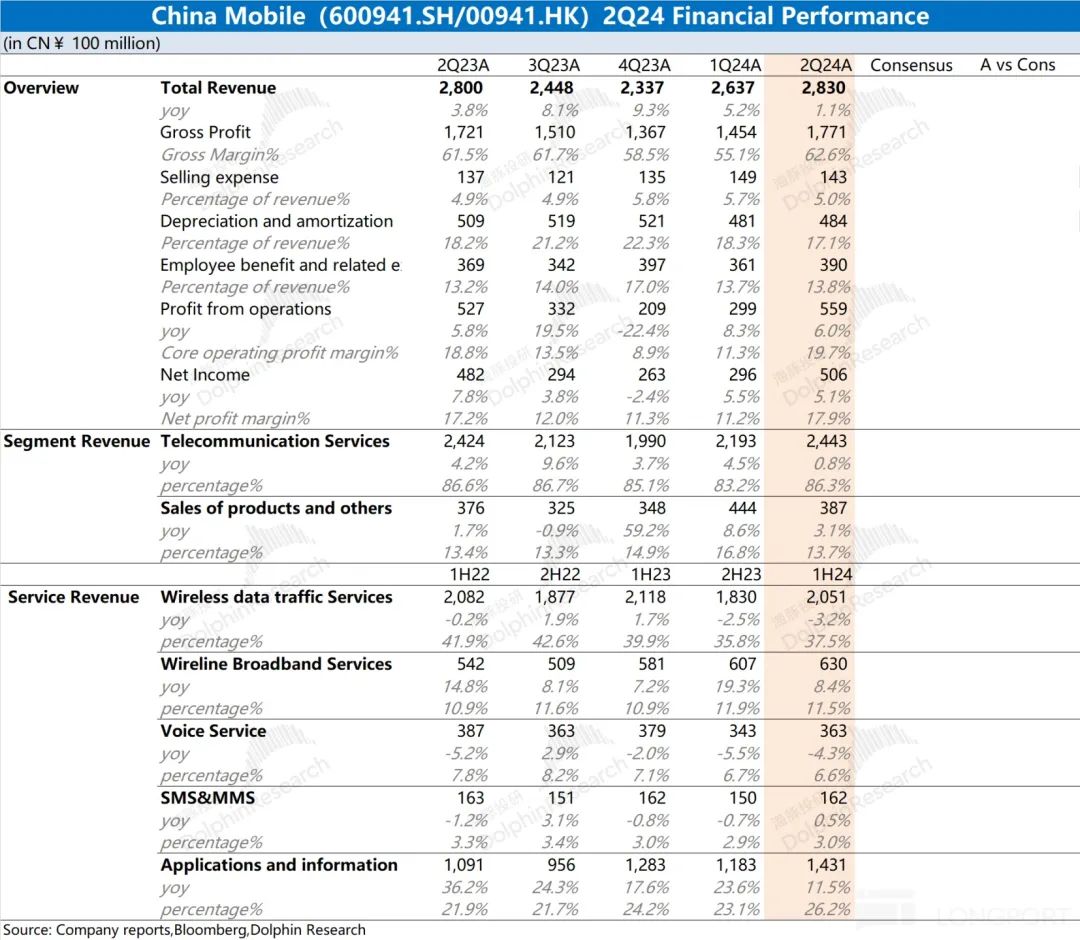

China Mobile (600941.SH/00941.HK) released its second-quarter financial report for 2024 (ended June 2024) after the Hong Kong stock market closed on the evening of August 8, 2024, Beijing time. The highlights are as follows:

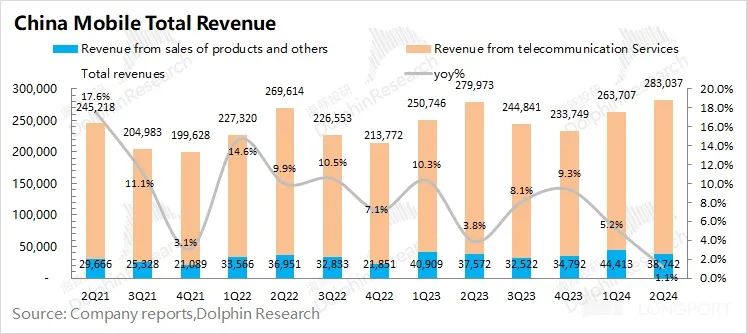

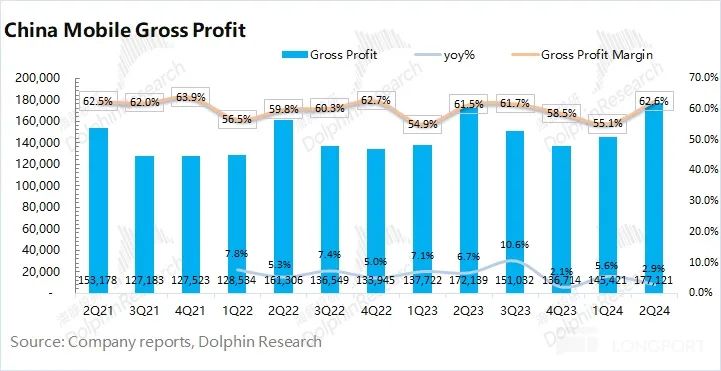

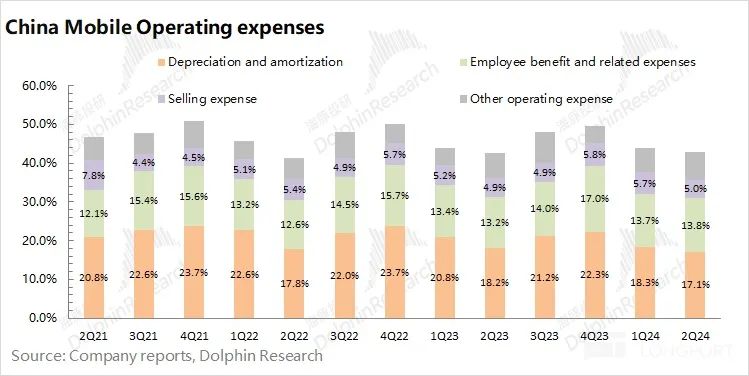

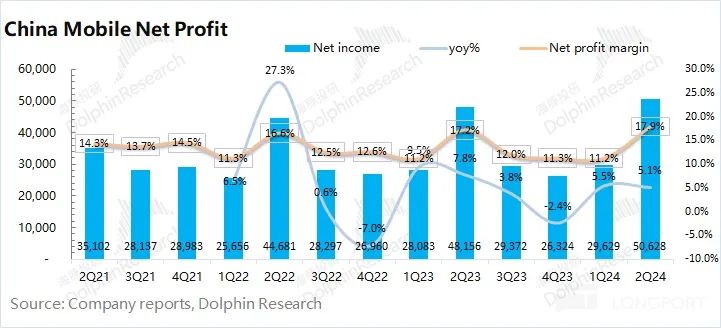

1. Overall Performance: Steady Growth. China Mobile's total revenue for the quarter was 283 billion yuan, an increase of 1.1% year-on-year. The company's revenue growth this quarter was mainly driven by the growth of broadband services and application and information services. China Mobile's net profit for the quarter was 50.6 billion yuan, an increase of 5.1% year-on-year. The growth in net profit was influenced by both revenue and gross margin improvements.

2. Business Segments: China Mobile's current revenue is mainly composed of communication services and product sales, with communication services being the company's primary business, accounting for over 80% of revenue.

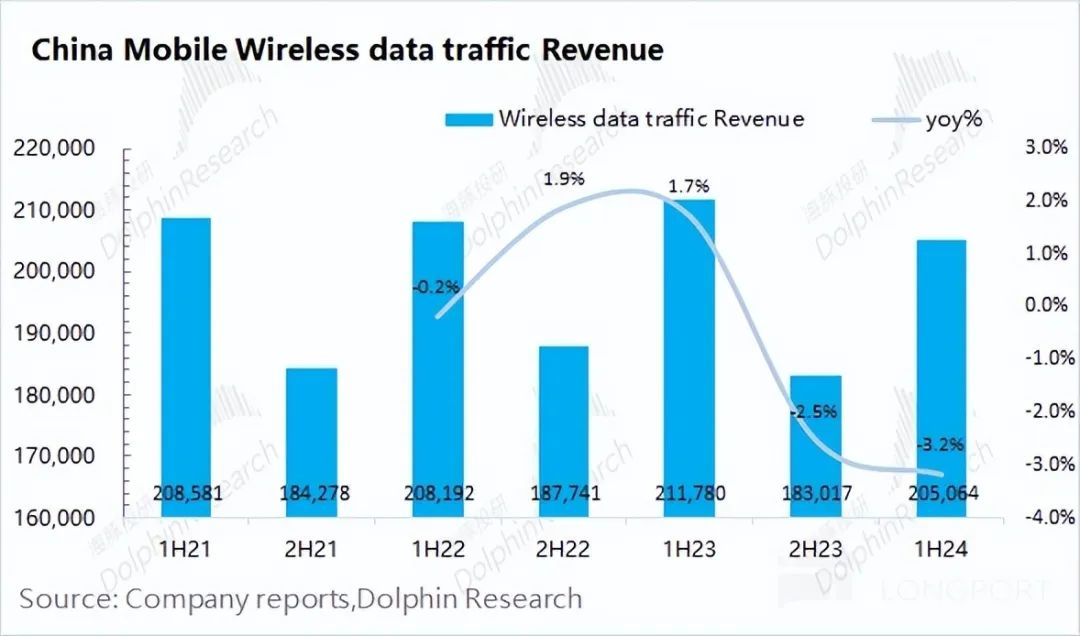

1) Wireless Internet Access: Driven by short dramas, short videos, etc., wireless internet access is currently the company's largest source of revenue. In the first half of 2024, revenue was 205.1 billion yuan, a year-on-year decline of 3.2%, accounting for 37.5% of total revenue. Although usage increased due to demand, revenue from wireless internet access still declined due to declining prices.

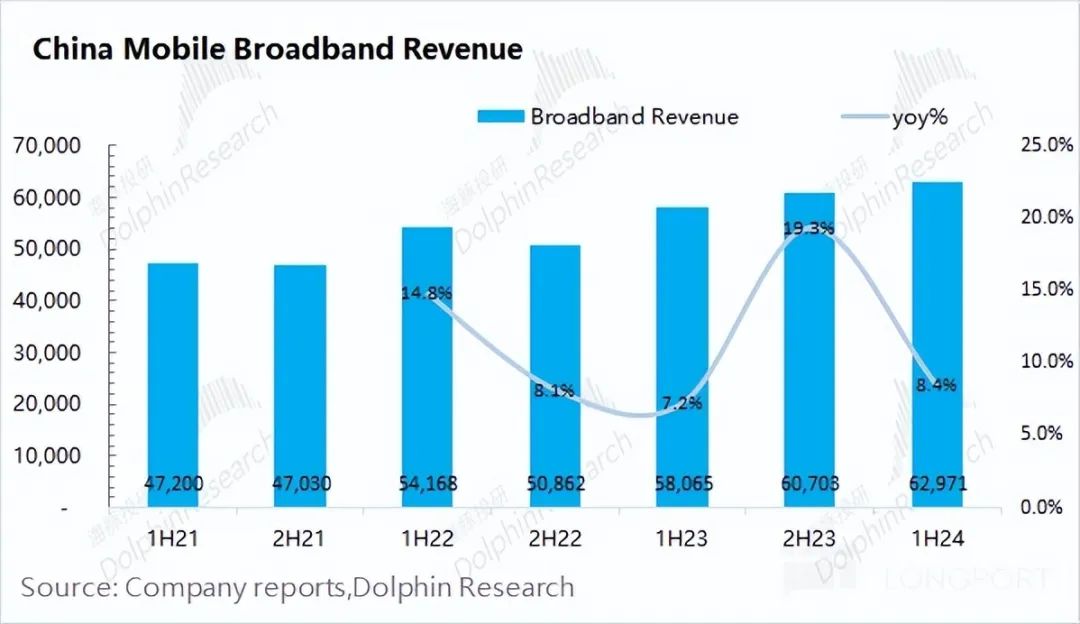

2) Wired Broadband Services: Revenue in the first half of 2024 was 63 billion yuan, an increase of 8.4% year-on-year, accounting for 11.5% of total revenue. The company's wired broadband business continued to grow, primarily due to increased market share.

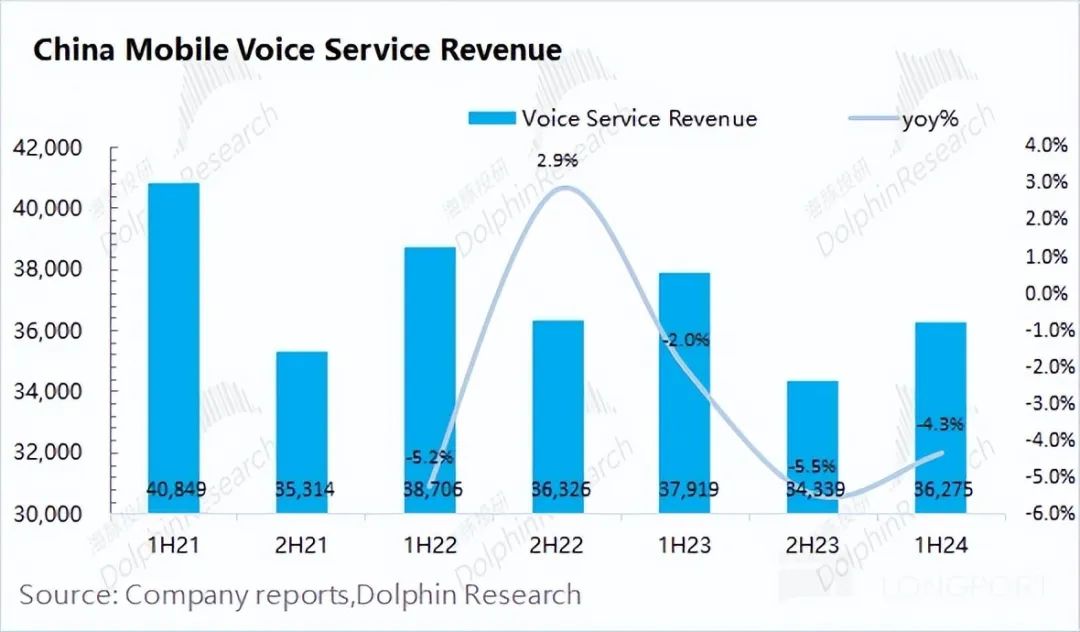

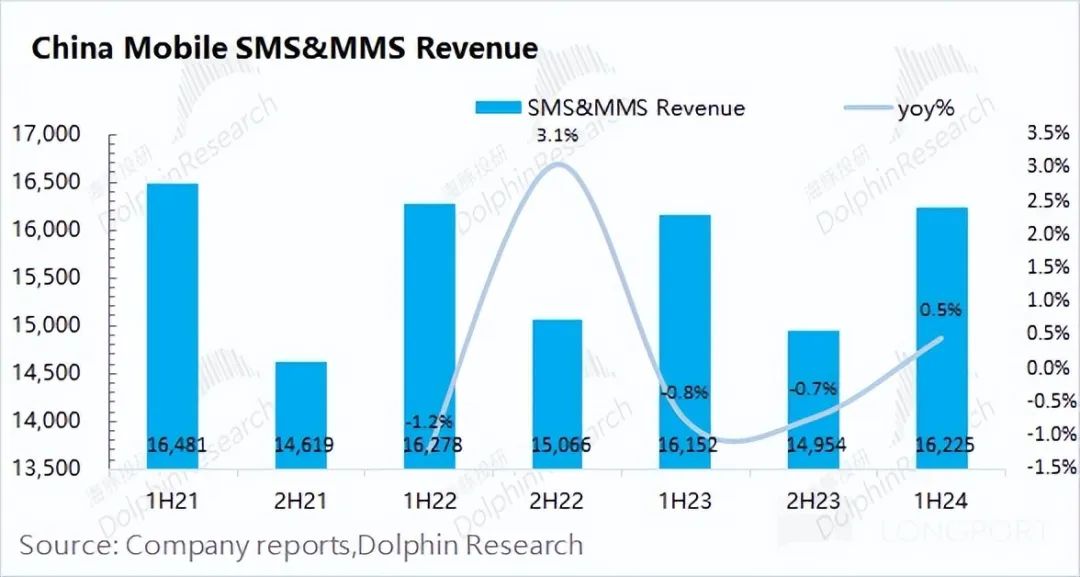

3) Voice and SMS/MMS Services: ① Voice service revenue was 36.3 billion yuan in the first half of 2024, a year-on-year decrease of 4.3%. Under the influence of video and other social software, voice call revenue continued to decline. ② SMS/MMS service revenue was 16.2 billion yuan in the first half of 2024, an increase of 0.5% year-on-year, remaining stable.

4) Applications and Information Services: China Mobile's revenue from applications and information services was 143.1 billion yuan in the first half of 2024, an increase of 11.5% year-on-year, making it the fastest-growing segment. This includes new personal services such as mobile cloud storage, smart home revenue, and IoT revenue.

3. Capital Expenditure: China Mobile's capital expenditure in the first half of 2024 was 64 billion yuan. Combined with the company's annual plan, it is expected that capital expenditure in the second half of the year will exceed 100 billion yuan. China Mobile's full-year capital expenditure plan for 2024 is 173 billion yuan, a year-on-year decrease, with plans remaining unchanged.

Dolphin Insights: China Mobile's Performance Remains Steady

Although both revenue and profit growth have declined somewhat, the company has maintained a steady growth trend. The company's customer base continued to grow this quarter, surpassing the 1 billion mark. In addition, both broadband services and emerging businesses continued to grow.

As the largest domestic operator, China Mobile has the broadest customer base. Whether it's short videos or AI, they both rely on data traffic. Therefore, market demand for data traffic remains robust, which is the company's largest source of revenue. With its leading position, if the company adjusts its pricing strategy, its performance could improve significantly. With a continually growing user base and increasing market share, the company's performance remains relatively manageable.

For investors who follow the company, China Mobile still retains three key investment attractions: stable operations, high dividend yields, and declining capital expenditures. Although the company's growth rate lags far behind emerging growth stocks, China Mobile still appeals to investors with specific preferences. This steady financial report has not affected the company's investment logic.

Below are Dolphin Insights' data charts on China Mobile: Quarterly Performance

Key Business Segments

- END -

// Reprint Authorization

This article is an original piece by Dolphin Investment Research. If you wish to reprint it, please obtain authorization.