Consumer finance is 'big waters, big fish,' traditional financial institutions impacted by internet giants

![]() 08/12 2024

08/12 2024

![]() 522

522

Traffic equals customers, does consumer finance mean 'traffic + license = easy money'?

The end of traffic is lending, but even in lending, some are merely 'wage earners'.

In July, after city logistics leader Huolala and integrated travel platform Fliggy launched lending services, Xianyu, a renowned domestic second-hand trading platform with over 500 million users, 43% of whom are post-1995 and 22% post-2000, also announced the launch of a 'borrow money' service, officially venturing into financial services.

Earlier in the year, after posting multiple financial positions and recruiting for some time, Kuaishou, through the acquisition of 100% equity in Guangzhou Huanju Microfinance Co., Ltd., successfully obtained a microfinance license.

It can be said that neither platforms nor traffic giants have slowed down their push into financial services in mid-2024.

However, while it's often said that the end of traffic is lending, what role do platforms like Xianyu play in the 'lending' process, and how profitable is it for them to be so enthusiastic about this financial business?

Compared to platforms that specialize in 'funneling' lending, what moves have internet giants who have the real capacity to enter consumer finance made in mid-2024, and why have they made these decisions?

01

Traffic platforms make a killing by 'selling water' for consumer finance companies

While apps like Fliggy and Xianyu offer loan options within their wallet functions, giving the impression that almost all platforms with traffic are lending. That's not entirely true. Besides a few internet giant platforms with relevant licenses, most traffic platforms are merely channels that funnel traffic to consumer finance institutions.

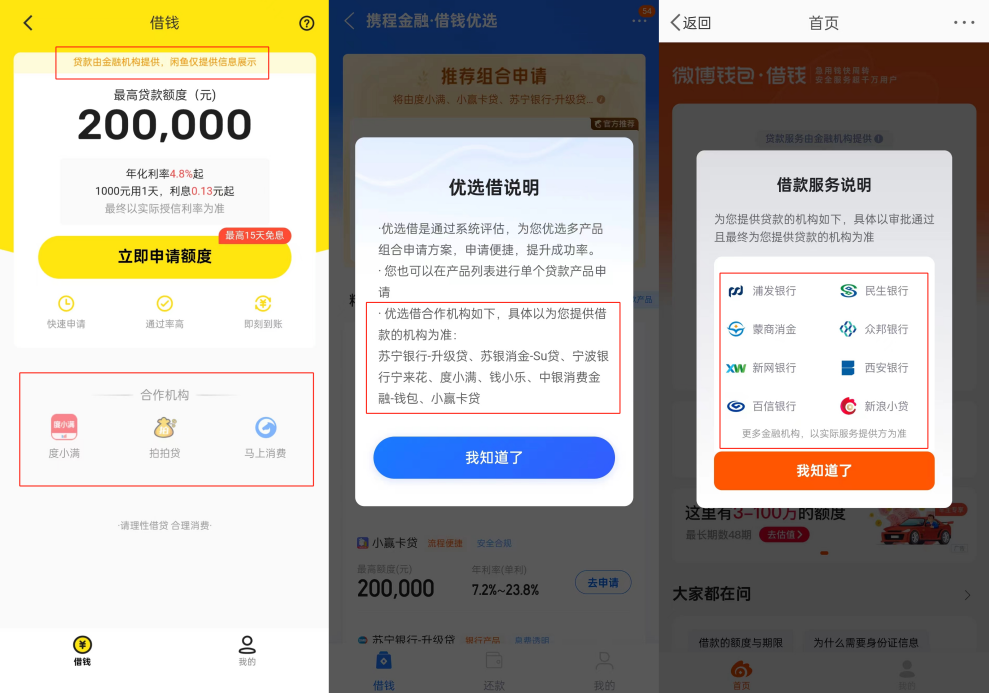

Take Xianyu, which has just ventured into the 'loan' space, as an example. Above the loan amount on the borrow money interface, it is written in small print that 'loans are provided by financial institutions, and Xianyu only provides information display.' Below, it also indicates that cooperating institutions include Du Xiaoman Financial, PPDai, and Majiang Consumer Finance. Upon approval, users can choose institutions like Du Xiaoman Financial or PPDai for disbursement.

Apart from Xianyu, loan options on Ctrip and Weibo are similar, all indicating which financial institutions provide the loan services. Apart from having more cooperating institutions than Xianyu, which is new to the lending game, the rest of the application approval and borrowing processes are almost identical.

Image source: Xianyu, Ctrip, Weibo

The reason these traffic platforms don't directly offer loans is related to current internet finance regulatory policies.

Initially, the first wave of internet platform financial services stemmed from wealth management businesses, thanks to the success of Yu'e Bao. Tencent Wealth, Baidu BaiZhuan, JD Small Fortune, Suning Zero Money, and other 'baby' financial products emerged in succession. However, for platforms with insufficient capital but traffic advantages, 'not panning for gold, but selling water' by providing traffic services to lending platforms and earning related advertising or commission fees became an excellent way to monetize traffic.

In 2016, the General Office of the State Council issued the 'Implementation Plan for Special Rectification of Internet Financial Risks,' stipulating that internet enterprises without relevant financial business qualifications could not rely on the internet to carry out corresponding businesses, further quashing the lending aspirations of platforms with only traffic but no financial licenses.

While many platforms don't directly engage in lending, it doesn't mean they can't earn substantial profits.

In terms of profit-sharing ratios, according to the profit-sharing data published by Su Yin Kai Ji Consumer Finance with platforms like Ant Group, Meituan, JD.com, Didi, and Du Xiaoman Financial, it pays service fees to platforms based on a certain percentage of the interest actually collected, with service fees ranging from 20% to 30% of interest income. Other consumer finance institutions adopting this model have similar profit-sharing ratios.

This means that by leveraging their own traffic, platforms can secure 20% to 30% of the net profits with financiers, effectively becoming full participants at the table rather than merely sipping soup.

Since many consumer finance institutions heavily rely on these traffic platforms for customer acquisition, their high profit-sharing ratios are understandable. Taking Su Yin Kai Ji Consumer Finance as an example, at the end of 2023, loans through its internet platform channels accounted for 94.74% of its total loan balance.

In mid-2024, the demand for loans further surged, indicating that consumer finance institutions' bond issuance pace has reached new heights.

According to Securities Daily, in July, consumer finance companies concentrated issued financial bonds at an unprecedented rate for a single month, with seven companies issuing a combined RMB 11.6 billion in financial bonds. From an annual perspective, this year has also been a big year for consumer finance institutions' financial bond issuance, with multiple companies like Hangzhou Bank Consumer Finance, Bank of China Consumer Finance, Majiang Consumer Finance, and Su Yin Consumer Finance successfully approved for bond issuance. Among them, leading institutions like Zhaolian Finance and Industrial Bank Consumer Finance have frequently issued financial bonds this year, with fundraising scales repeatedly setting new highs.

Driven by such high profit-sharing ratios, consumer finance institutions' heavy reliance on traffic platforms, and the broader backdrop of 'universal lending,' more and more internet traffic portals are venturing into and strengthening their financial services.

02

Are traditional financial institutions inferior to internet giants in consumer finance scale?

While merely serving as a traffic funnel can already generate considerable revenue, for internet giants with stronger capital and technological capabilities, sharing from others' plates is less direct than starting their own lending operations.

This year, after years of funneling traffic and maintaining a vast financial user base, Kuaishou finally obtained a microfinance license.

On April 17, Guangzhou Huanju Microfinance Co., Ltd. underwent a business change, with its sole shareholder changing from Guangzhou Huaduo Network Technology Co., Ltd. to Beijing Yunchi Technology Co., Ltd., a subsidiary of Kuaishou. This marked Kuaishou's official acquisition of a financial license, shifting its relevant business from 'loan assistance' to 'lending,' allowing it to dispense with 'cooperation' with other consumer finance institutions and completing the lending puzzle for typical traffic portals like Meituan, JD.com, Ant Group, Douyin, and Tencent.

As the giants finally gathered, Tencent also quietly accelerated its consumer finance layout.

Tencent's biggest move in the payments sector this year was the expansion of its limited launch of 'WeChat Credit Pay' in March 2020.

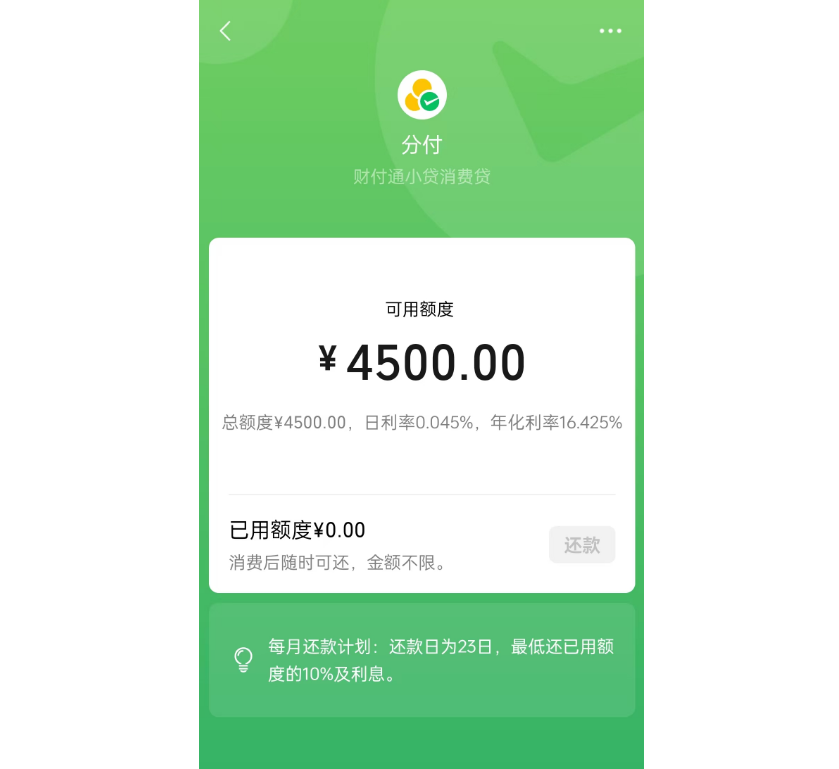

As an installment-like consumer loan product, 'WeChat Credit Pay' can be selected for use during payments after activation, featuring daily interest accrual and flexible repayment, applicable to various online and offline consumption scenarios like WeChat Installments. However, unlike traditional credit payment products like Ant Credit Pay and JD.com Baitiao, WeChat Credit Pay does not offer an interest-free period, accruing interest daily upon use, with daily interest rates ranging from 0.04% (equivalent to an annualized rate of 14.6%) to 0.045% (equivalent to an annualized rate of 16.426%).

Image source: WeChat

According to ZeroHedge Finance, during Tencent's Q3 2022 earnings call, Tencent's management expressed a cautious approach to providing financial services like lending and wealth management, selecting the best customers to ensure outstanding risk control performance and high-quality revenue models, adopting a very low-key stance.

Even so, Tencent's Financial Technology and Enterprise Services have become a primary growth engine and revenue base, with financial technology accounting for only a small portion. If Tencent were to aggressively expand, its profits would speak for themselves.

The reason Kuaishou and Tencent accelerated their financial sector layouts in mid-2024 is likely due to the faster-than-expected growth of other internet giants' financial businesses.

In 2020, after successfully obtaining microfinance and payment licenses, ByteDance continuously increased its lending efforts, injecting additional capital into Zhongrong Microfinance twice the following year, raising its registered capital to RMB 3 billion and then RMB 5 billion. During this period, Douyin's financial business rapidly developed, forcing ByteDance to further increase its registered capital to RMB 19 billion, surpassing Tencent Tenpay Microcredit and Ant Group's Ant Microcredit in registered capital.

In comparison, it has only been a year since China Construction Bank, which invests heavily in individual consumer loans, surpassed the RMB 300 billion mark in individual consumer loan balances. China Merchants Bank, whose consumer loan balances grew by 49.11% compared to 2022, ended 2023 with just RMB 301.54 billion.

Given this context, it's not surprising that Kuaishou, which has just officially ventured into self-funded loans, and Tencent, which has immense potential but a relatively complex and long-standing conservative organizational structure in the financial sector, have chosen to accelerate their related businesses now.

03

Closing Thoughts

Platforms with traffic want to funnel traffic for consumer finance institutions. Platforms that have been funneling traffic for years want to acquire microfinance licenses to lend on their own. As lending scales expand, they want to earn more through consumer finance licenses. This industry development path and pattern have remained unchanged.

However, against the backdrop of policies encouraging consumer finance institutions to issue bonds and lend to boost consumption, and internet giants' increasing loan balances, issues like Tongcheng Finance inducing consumers to take out high-interest loans through deceptive tactics, as exposed by 315, and frequent non-compliance in loan assistance processes and information between some traffic platforms and consumer finance companies have increasingly drawn question from the outside world.

Big waters mean big fish, but also big waves.

Balancing social value and commercial interests, pursuing business growth while fulfilling social responsibilities, and avoiding a repeat of the 'Ant Group moment' may be a long-term challenge facing many consumer finance institutions, internet giants, traffic platforms, and even regulatory authorities.

References:

1. 'The End of Traffic is Lending, and ByteDance is No Exception,' ZeroOne Intelligence;

2. 'Kuaishou Obtains Network Microfinance License! Boosting Financial Business,' Laser Finance;

3. 'Transformation: From Platform Finance to Loan Assistance,' Beijing Internet Finance Association;

4. 'The Loan Assistance World Hidden in Apps,' China Financial News Network;

5. 'This Consumer Finance Company Issues RMB 1 Billion in Financial Bonds, and Its Loan Assistance Business is Already Integrated with Ant Group,' Hegold Finance;

6. 'Kuaishou Obtains Microfinance License, Douyin Hits RMB 300 Billion, How Profitable is Internet Giant Lending?' Radar Finance;

7. 'Alibaba and Tencent Compete in Consumer Credit,' ZeroHedge Finance.