Honda's Strategy Behind Halting Electric Vehicle R&D

![]() 07/18 2025

07/18 2025

![]() 698

698

Introduction

While Honda's decision in overseas markets will not impact its layout in China, it serves as a reminder that transforming in the Chinese auto market requires both perseverance and determination.

Has Honda figured out its electrification strategy yet?

Over the past two years, as Volkswagen, Toyota, and Nissan have presented their electrification solutions, Honda has also attempted to introduce new pure electric vehicles after the Honda e. However, compared to its peers, Honda's transformation strategy seems more reactive to new policies rather than proactive.

Recently, news of Honda halting new electric vehicle R&D has sparked controversy. Many feel that Honda is out of sync with the market's electrification rhythm. When most automakers are actively investing in electric vehicle R&D, Honda appears stubborn.

The automotive industry has reached a consensus on electrification. Regardless of regional markets, electric vehicle development is essential. Long-term perspective is crucial for every automaker.

Even if Honda is stubborn, going against the trend is not advisable. In a commercial environment, stopping electric vehicle R&D often has specific regional motivations.

Recently, Honda wanted to re-embrace hybrid vehicles due to the global deceleration of electrification. Now, Honda claims to stop developing some new electric vehicle models, likely due to the termination of the electric vehicle tax credit policy in the U.S. market. In China, Honda is striving for electrification achievements, presumably related to China's new energy market landscape.

01 Rapid Overseas Market Changes and Honda's Response

In the past two years, news about Honda's transformation plans has been frequent. As the industry invests in intelligence and electrification, Honda has also been active.

One memorable moment was at the 2025 International Consumer Electronics Show, when Honda unveiled the 0 Series concept electric vehicles, including the 0 Saloon and 0 SUV. It was believed that Honda intended to produce these vehicles at its dedicated electric vehicle center in Ohio, indicating that its future plans were finally shaping up to compete with rivals.

However, given the evolving global attitude towards electrification, what automakers claim at each stage is often just a signal for that period.

Not just Honda, but as transformation efforts slow down and support for the electric vehicle industry declines across Europe, major automakers are reintroducing plans to slow down. It becomes evident that electrification has deviated from its original environmental protection goals.

Therefore, Honda's sudden change of heart is undoubtedly related to the broader environment. This decision is inseparable from the current situation of electric vehicle development in the United States.

However, this raises concerns about whether Honda can prepare for its electrification transformation on two fronts.

On one hand, with the end of the 17-year-old U.S. electric vehicle tax credit policy, starting from September 30, the existing $7,500 electric vehicle tax credit and the $4,000 used electric vehicle credit will be canceled. Honda can halt subsequent electric vehicle R&D to stop losses. On the other hand, should Honda take a more positive attitude and actively seek change in other global markets?

Let's not discuss Honda's situation in China. Overseas, it's hard to say whether all Honda's reactions have brought tangible benefits.

On June 16, 2022, Sony and Honda officially signed an agreement to establish a new joint venture company, each holding 50% of the shares, focusing on mobility. The joint venture is named "Sony Honda Mobility Inc." However, by March of this year, the company incurred a loss of 52 billion yen (approximately 2.6 billion yuan) according to its financial report. Although this amount is not significant, the revenue column showing 0 and the lackluster market feedback after unveiling the new Afeela vehicle suggest that the collaboration between Honda and Sony will not yield short-term results.

On the other hand, as Honda Motor CEO Toshihiro Mibe stated at the end of 2023, due to changes in the business environment, the company is shelving plans to jointly develop affordable electric vehicles with General Motors. The Honda Prologue, built on GM's Ultium platform, is unlikely to make a significant impact in the market.

What do these observations indicate? Isn't it just saying that in terms of electrification transformation for overseas markets, Honda's demand for win-win cooperation lacks fertile soil for cultivation? The deviation between General Motors' and Sony's technical support and Honda's automaking philosophy has directly become the root cause of Honda's unsmooth transformation when facing policy shocks and declining consumer demand.

02 The Chinese Market Requires Special Attention

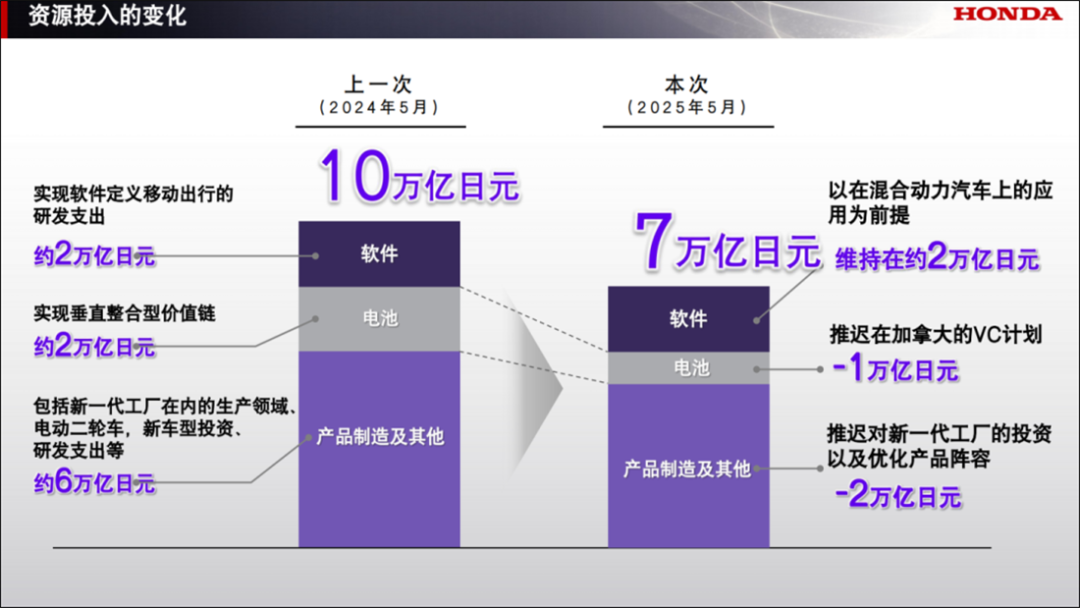

At Honda's financial results meeting in May of this year, given current industrial development, Honda firmly stated that it would reduce investment in electric vehicles and shift more R&D expenditures to hybrid products. The originally planned investment of 10 trillion yen for pure electric vehicle R&D has also been reduced to 7 trillion yen after adjustments.

Meanwhile, from 2027 to 2030, Honda plans to launch 13 next-generation HEV models, promoting a 10% improvement in fuel efficiency and a 30% reduction in hybrid system costs (compared to 2023). The positioning of the Honda 0 brand has also changed, now including Honda's new hybrid models in addition to original pure electric vehicles.

Against the backdrop of these new plans, Honda's decision to halt the R&D of some electric vehicles seems determined and not so unorthodox. However, since the evolution of the world order has taken on different tracks, there are always two sides to the coin.

Overseas, regardless of how Honda reduces its investment in electrification transformation, in China, people are more concerned about when Honda can truly understand the Chinese new energy market. Building cars for Chinese users, rather than following past approaches or catering to changes due to times or policies, is crucial.

This year, as Toyota and Nissan have proven their ability to build electric vehicles that Chinese consumers need, for Honda, keeping up with the pack is more important than ever. In Honda's worldview, purposes like "monetizing technology" and "maintaining brand tone" might come before capturing market share. However, this approach has led to electric products with a uniform Honda flavor but lacking realistic undertones.

From creating the EA6, VE-1, or XN-V/MN-V for new energy credits to the later e:NP1/S1, and now to new vehicles under the Ye brand, at each stage, facing the evolution of the Chinese auto market, the level of new vehicle iteration seems to meet Honda's expectations, but it still essentially has a strong Honda flavor.

When dealing with the evolving needs of Chinese electric vehicle users, Honda is not so much forced to develop new vehicles due to the current situation as it is continuing the R&D approach implemented in the global market, where Honda takes the lead and modifications are made locally. The Chinese market is so special that the speed of consumption changes is instantaneous, and Honda will struggle if it can't keep up.

However, if habits can't be changed, it means that China's new energy vehicle market will be difficult for Honda. So, what does Honda think about this?

In North America, due to new policies zeroing out new energy subsidies, Honda has been tempted to abandon electric vehicle development. Between earning money by doing nothing and spending money aimlessly, it chose the former. But in China, it cannot adopt the same approach.

Everyone can see Honda's market performance during this period. Even if Honda doesn't understand why its competitors are losing money to build electric vehicles, facing the rapid decline in brand reputation and public opinion criticizing the gap between it and Toyota and Nissan, there is nothing for Honda to question.

Building electric vehicles recognized by Chinese users is not a joke nor a slogan used to declare determination. Therefore, regardless of how the overseas market allows Honda to make self-willed decisions, in China, there must be no wavering in comprehensively initiating changes towards electrification and intelligence. In the future, drawing on the experience gained during the R&D process of the P7/S7, Honda needs to unwaveringly delegate authority to the Chinese R&D team, from product definition to technology selection, nothing can be missing.

Editor-in-Charge: Cao Jiadong Editor: He Zengrong