Looking at performance, which companies are truly fake AI

![]() 08/12 2024

08/12 2024

![]() 652

652

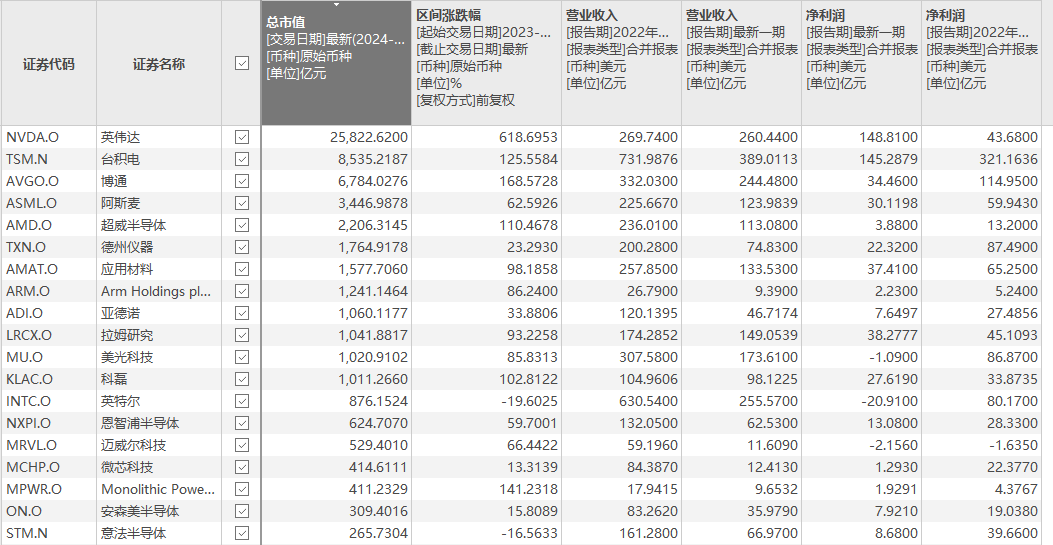

In the year and a half since GPT's debut, the entire U.S. stock market has rallied around AI as the central theme. NVIDIA is undoubtedly the leader in U.S. stocks and has experienced the largest increase in market value.

Despite many fearing NVIDIA's meteoric rise, believing it to be unrealistic, bubbly, and prone to collapse at any moment, closer scrutiny reveals that the company's valuation is justified by its strong performance. Even if the AI bubble bursts, NVIDIA is unlikely to be hit hardest, as it holds a technological monopoly and has earned substantial profits from this wave.

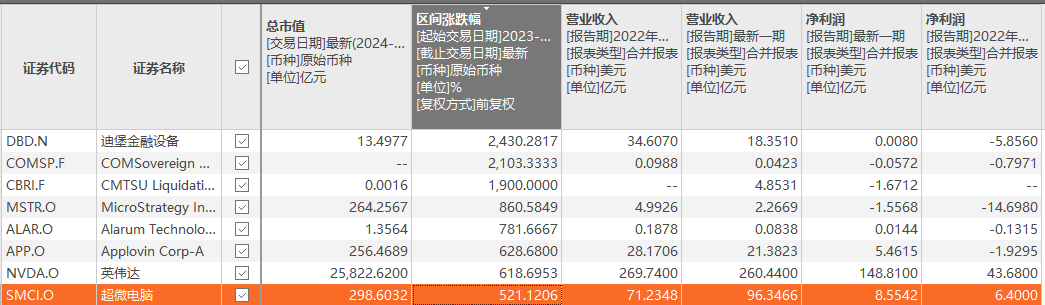

More dangerous are companies loosely associated with AI but riding the Nasdaq's rise. Many such companies exist in A-shares, and many have reverted to their true form this year. The same is true in U.S. stocks, with some already corrected, but many remain lofty. It may be prudent to scrutinize their performance to identify true fake AI companies.

1. Substantial hardware performance growth

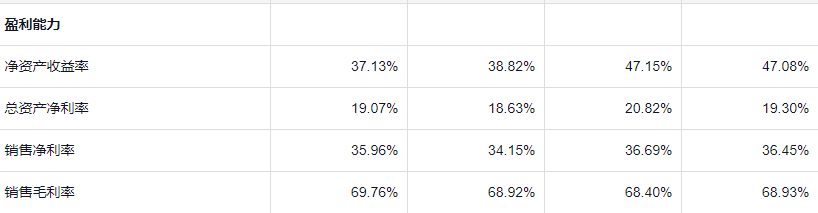

The AI boom began in early 2023, so a company's valuation can be assessed by comparing its cumulative gains with expected revenue and profit growth.

NVIDIA has surged 577% since 2023, a remarkable figure. Its 2022 revenue was $14.8 billion, with a profit of $4.3 billion.

NVIDIA's latest financial guidance for fiscal year 2025 projects half-year revenue of $54 billion, annualizing to $114 billion, a 323% increase from 2022's $26.9 billion. Due to the popularity of AI chips, NVIDIA's current profit margins are significantly higher than in 2022, reaching nearly $14.8 billion per quarter, translating to over tenfold profit growth.

From a PE perspective, NVIDIA is cheaper than it was at the end of 2022, while its PS ratio is higher. However, further declines could push NVIDIA to new valuation lows in recent years.

It's evident that NVIDIA's performance growth has outpaced its stock price gains. Recent concerns about low AI application returns and delays in NVIDIA's new chip shipments have caused a 30% pullback, making its valuation more reasonable. Further declines could bring NVIDIA's PE to its lowest in five years. Nonetheless, NVIDIA's substantial gains over the past few years reflect a significant and unlikely-to-be-reversed increase in intrinsic value.

In contrast, AMD, the second-largest AI chip competitor, has been pushing new compute chip development to gain market share from NVIDIA. While the downstream industry is supportive, AMD's stock has risen 100%, but its revenue growth is poor, with 2024 second-half guidance indicating just a 6% increase from 2022, accompanied by declining profit margins. AMD's growth has been lackluster, with its 6% revenue growth translating into a stock price doubling.

AMD's performance lags behind NVIDIA, with smaller gains and larger pullbacks. Its high-point decline has reached nearly 44%, repeatedly disappointing those hoping for a NVIDIA-like rally.

Companies in NVIDIA's ecosystem, including servers, optical modules, and chips, have also experienced significant gains. However, their performance justifies these gains.

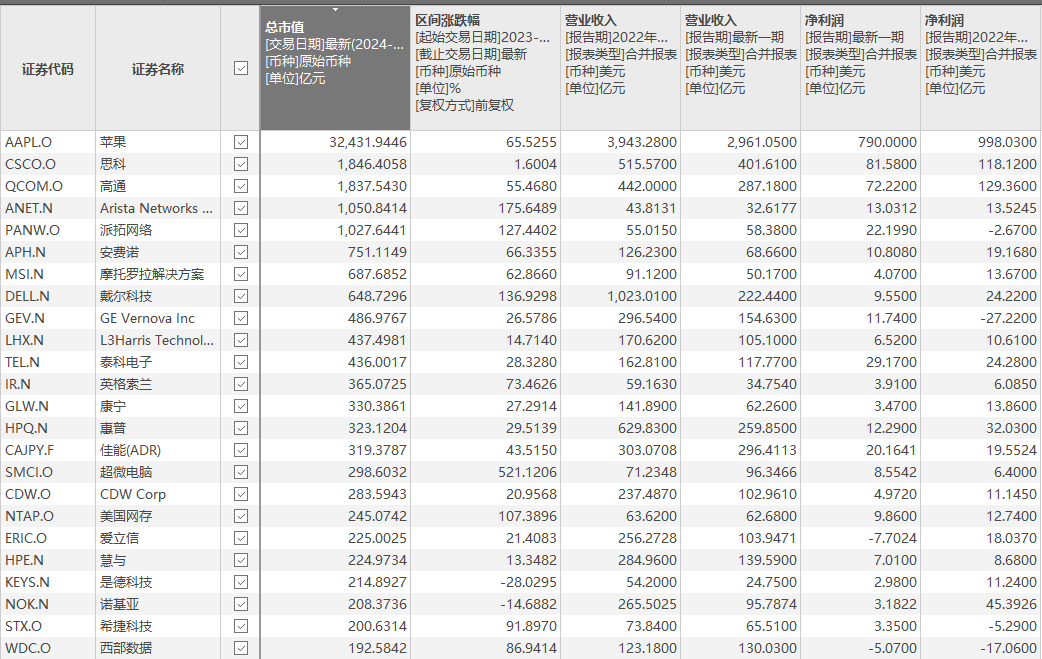

Supermicro Computer (SMCI), a notable AI stock outperformer, has seen its share price soar despite a less-than-ideal business model and competitive pressures. However, its revenue trends are robust.

Over two years, SMCI has risen 521%, peaking higher than NVIDIA before plummeting due to disappointing profit margins. Nonetheless, its 2025 fiscal year revenue guidance of $26-30 billion (midpoint $28 billion) represents a 338% increase from 2022's $5.196 billion, justifying its share price gains.

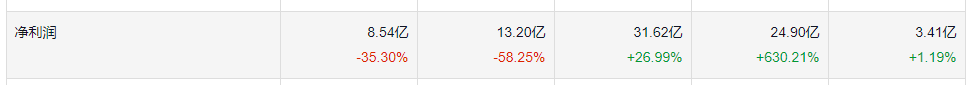

SMCI's 2025 profit margin forecast has declined slightly from 2024 but remains at 8%, translating to $2.2 billion in profits, an increase of 785% from 2022's $285 million.

Given its order backlog and predictable profits, SMCI's valuation appears justified, making it unlikely a fake AI stock. Compute power companies face demand uncertainty but are unlikely to be faulted for profits earned during AI's heyday.

However, even within hardware, there are fake AI companies leveraging the AI concept to drive share price gains, exemplified by AAOI, ANET, VRT, Broadcom, TSMC, and Applied Materials, whose performance fails to match their stock price gains.

Differentiation will emerge between genuine AI beneficiaries and pretenders. For instance, TSMC, with a dominant market position, will likely benefit from NVIDIA's success. Conversely, Broadcom's outlook resembles AMD's, raising concerns about a potential repeat of AMD's performance.

Several considerations arise: 1) U.S. stocks have plunged, and while NVIDIA's valuation has adjusted, forward-looking valuations remain dependent on future quarters' performance. 2) Profit spillovers from leaders like NVIDIA are lagged, posing risks if AI demand falters before these companies report significant growth.

From the hardware industry's performance, it's evident why leaders emerge as such. Companies awaiting profit spillovers face greater risks, transforming into fake AI stocks if they fail to meet expectations. Investors should prioritize logic and select strong performers over weaker ones.

2. Unclear profit trends in software

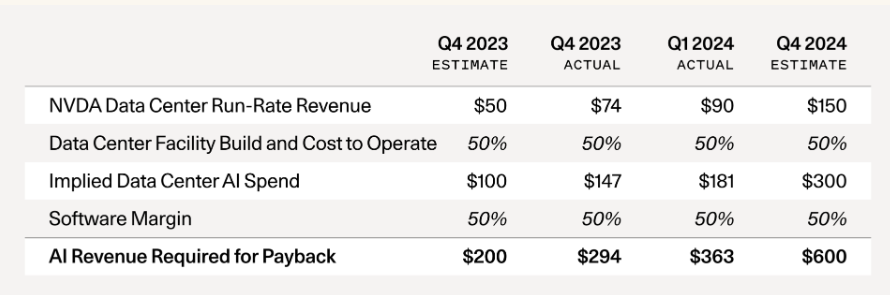

Discussions around the AI bubble often center on mismatched inputs and outputs. Assuming NVIDIA's annualized revenue of $90 billion, equal investments in compute infrastructure and software would require $180 billion in data center construction. With a 50% software industry profit margin, AI would need to generate $360 billion in revenue to justify these investments.

However, software industry revenue growth falls short of these projections. While AI may improve efficiency, its full economic impact remains unclear.

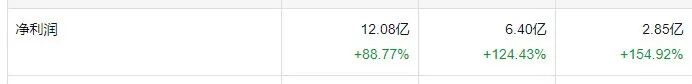

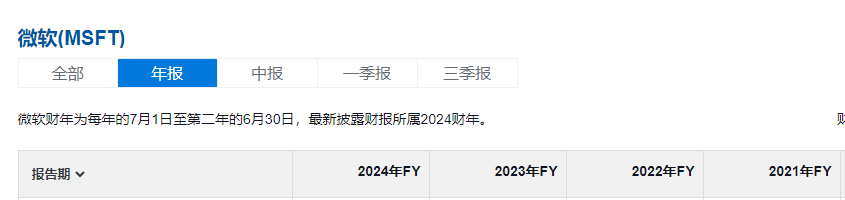

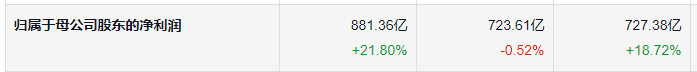

Microsoft, the world's largest software company and owner of OpenAI, has seen revenue and profit margin increases. Its 2024 fiscal year profit increased 21% or $15.4 billion, with revenue up 23%. However, flat next-quarter revenue forecasts suggest 2025 revenue growth of around 15%, implying three-year cumulative revenue growth of just 41%.

Microsoft's share price has risen 70% in two years, but its growth trajectory hasn't significantly changed. Its performance lags its share price gains.

Google and Meta, Microsoft's competitors in the AI race, have seen higher share price gains despite lower revenue growth. Their performance is slightly better than Microsoft's, but neither matches their share price gains in terms of revenue or profit.

While software companies may benefit from AI slower than hardware firms, their future prospects are optimistic. However, Microsoft, Google, and others' latest fiscal year profit margins haven't significantly improved from 2022. Increased compute costs may hinder profit growth, raising questions about AI's ability to boost profitability as expected.

Moreover, Microsoft, the fastest AI adopter, has seen declining profit margins and slowing revenue growth. Meta and Google are still exploring AI integration, with their strong performance attributed to low baselines and inherent business advantages rather than AI. The question remains: Will AI drive sustained growth or lead to a Microsoft-like scenario?

Other software service companies can be considered as pseudo-AI or not belonging to the AI sector, as AI's boom originated from GPT and text-to-image generation, where most software services have seen no logical increase in business. Perhaps only cloud services have slightly benefited from Microsoft's AI infrastructure. However, looking at performance, most companies have seen share price increases greater than revenue growth, from CRM, SAP to NOW, PLTR, all experiencing significant valuation surges.

Despite claims that AI will drive software prosperity, most companies have seen decreasing growth rates since 2022, with AI failing to alter the industry's downward growth trend. Occasional upticks in growth, like Palantir and ServiceNow, lead to significant rallies, but upon closer inspection, they possess P/S ratios over 10 with revenue growth below 30%. The entire software sector is now stuck at a 30% growth threshold, raising concerns.

In this environment, many software service companies with declining growth rates have seen sharp declines, exposing their true nature. Stars like Cloudflare and Snowflake have unwittingly become among the worst-performing sectors in the US stock market, having been expelled from the AI sector. This is the fate of pseudo-AI.

III. Conclusion

AI's development will significantly boost productivity, but without quantitative analysis, it remains mere speculation. If it doesn't drive growth or profit improvement, or if a $100 billion investment yields only $10 billion, it's all hollow. Current performance and share prices suggest the market has expelled some AI stocks, yet significant bubbles persist in hardware and software sectors due to AI hype.

Regardless of whether the boom continues or skepticism intensifies, several key considerations emerge. Delayed benefits and spillover effects pose greater risks. For some leading internet companies, AI may not necessarily boost future performance. A rational attitude towards AI sees it not solely as a positive business driver but as a mixed bag. Using AI integration or related performance as the primary metric for company valuation is clearly misguided.