AI apps expand overseas after fierce domestic competition

![]() 08/14 2024

08/14 2024

![]() 618

618

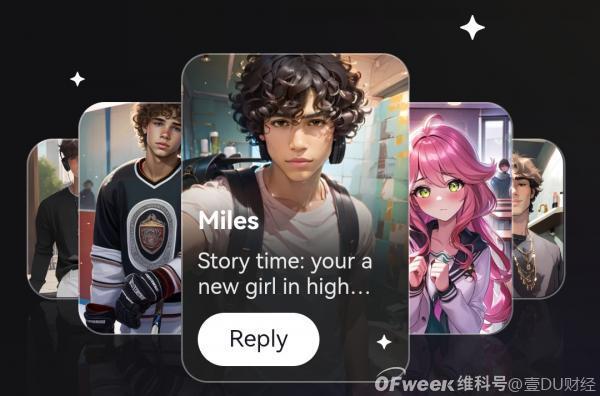

Source: Talkie's official website

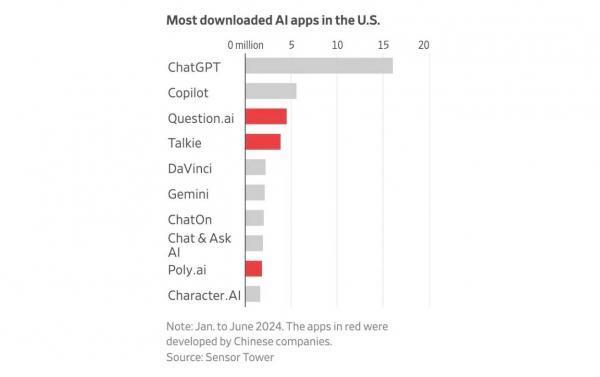

Recently, a surprising revelation came from a statistical chart regarding AI applications.

In Sensor Tower's statistics on AI app downloads in the US market during the first half of the year, at least three of the top ten apps belonged to Chinese companies. Among them, AI education app Question.ai and AI chat app Poly.ai both come from Zuoyebang, a leading education technology company, while the AI chatbot Talkie is from MiniMax, an AI big model unicorn.

Source: Sensor Tower

Since the qualitative leap in AI big models, AI applications have gradually gained momentum.

Coupled with the constant emphasis from internet tycoons like Robin Li and Zhou Hongyi that "AI applications are more important than model competition," mainstream domestic AI players have shifted their focus from model and technology competition to "big model price wars," even intensifying the competition in AI applications.

It seems that AI applications have become a necessary weapon for major companies in the AI 2.0 era.

Strategic competition is one aspect, but market competition is another area where players are exerting their efforts. They are turning their gaze towards overseas markets.

During their overseas expansion, players have come to realize that merely competing domestically is insufficient; they must also venture overseas.

In 2024, AI and going overseas have become two of the few markets with growth potential. With the combined benefits of "AI + going overseas," the sector has attracted internet giants, startups, and individual entrepreneurs, making it increasingly crowded.

As the wave of AI companies going overseas intensifies, what does the global market look like when domestic AI applications are fiercely competing? How can AI apps succeed overseas?

01 Three main forces showcase their prowess; the era of AI's great voyage has arrived

In the first half of 2024, AI product exports have flourished.

Data supports the booming trend of AI app startups and product exports. According to research, there are approximately 1,500 active AI enterprises globally, with 103 from China. Most AI product startups focus on the application layer, accounting for 76%. As of May this year, there were 1,749 AI products with over 10,000 monthly visitors globally, with 71 of them being Chinese exports.

Participants in the AI export wave include mobile internet era veterans, AI 2.0 era unicorns, and emerging startups and independent developers.

The AI export products launched by these "three main forces" primarily concentrate on generative AI areas with notable improvements, such as AI chat companionship, AI image generation, AI video generation, AI search, and AI productivity tools.

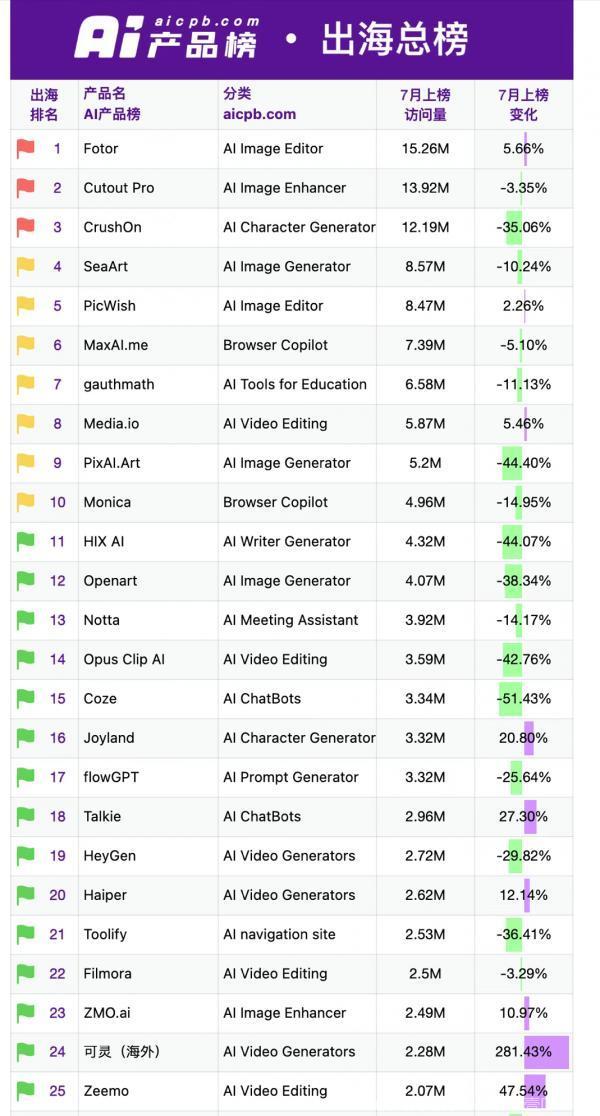

Chart created by Yidu Pro

ByteDance, known as the "App Factory," has continued its similar approach in AI exports, effectively becoming an "AI App Factory." In the AI 2.0 era, it has launched or upgraded seven products and platforms overseas. After integrating AI big models, Gauth ranked among the top ten free education apps on the App Store and Google Play in May this year.

Baidu, which has been striving to rejuvenate itself through AI, launched three AI apps overseas last year: SynClub, WiseAI, and Meira.

Zuoyebang, a leading education technology company spun off from Baidu, has made breakthroughs with its two exported AI products. Question.AI topped the US AI education app charts in the first half of this year, while Poly.AI boasts nearly 6 million monthly active users, earning it the playful nickname of "the education giant not sticking to its knitting."

As a seasoned exporter, Wondershare has released multiple AI products overseas, with Filmora, DemoCreator, and Wondershare Pixcut among the top 25 AI traffic apps last December.

Regarding big model unicorns, ZeroOne, MiniMax, and Darkmoon have all launched overseas products.

MiniMax launched Talkie, an AI role-playing chat app, in the US last June. According to Sensor Tower, its global monthly active users reached 11 million by July this year.

ZeroOne is the domestic big model unicorn with the most overseas app releases. Since last year, it has launched four products overseas: PopAi, Monaland, Shado, and Bingo.AI.

Darkmoon was rumored to have launched two apps, Ohai and Noisee, overseas, though the company has denied these claims. Nevertheless, the connection between these apps and Darkmoon is evident.

Apart from internet giants and big model unicorns, many startups and independent developers are also part of this AI export wave.

For instance, Answer.AI, an AI education product launched by a Chinese team, reportedly surpassed one million registrations within five months of its July 2023 launch.

Another example is FlowGPT, an AI prompt community founded by the post-00s entrepreneur Dang Jiacheng, who created the product demo in just three days. Within a week of its launch, the app registered tens of thousands of users, exceeding 4 million monthly active users by May.

Over the past year, various forces have been competing fiercely in the global AI market, rapidly expanding China's AI potential and influence worldwide.

02 Navigating the treacherous waters of AI app exports

AI big models have gained popularity in recent years, fueling an AI startup boom.

Over the past year, there have been numerous AI "wealth creation" stories. A prime example is AI video star HeyGen, which reportedly grew its revenue from $1 million to $35 million within a year.

ZeroOne's overseas productivity products are also impressive. Founder Li Kaifu stated that nine months after launch, the total number of overseas users approached ten million, with revenue expected to exceed 100 million yuan this year. According to statistics, MiniMax's Talkie generated over $840,000 (approx. 6.03 million yuan) in revenue in its first six months, averaging over one million yuan per month.

CrushOn, which debuted in September last year, topped the AI product charts for multiple consecutive months in the first half of this year. The app reportedly generated $60,000 in monthly revenue. Fotor, ranked third, gained 150 million followers over the past year and achieved profitability early on.

These domestic success stories have attracted countless AI entrepreneurs to overseas markets.

For AI startups venturing overseas, the appeal lies in broader traffic sources. An AI entrepreneur shared on social media that while domestic AI product development can be stressful due to intense competition, including price wars and talent poaching, the global market offers a wider reach, allowing them to capture users in various regions.

Going overseas also means accessing superior big model technologies. ByteDance's Coze overseas version, supported by GPT-4, has attracted users with its intelligent and powerful chat experience.

Moreover, overseas markets exhibit more mature user payment habits, making it easier for AI apps to profit through paid subscriptions. A report examining pricing models for 40 AI products found that 70% of these companies adopt a subscription model.

Lastly, overseas markets offer a more open financing environment. According to research, AI attracted over 20% of venture capital in North America last year, with global AI industry financing reaching 314.9 billion yuan. Overseas financing significantly surpasses domestic levels.

While some dark horses have emerged, many AI export products quickly fade into obscurity or fail before launch.

Baidu's three exported products, for instance, have not performed outstandingly. None of them appeared in the top 50 most visited AI products in July's AI Product Rankings export list.

Notably, according to this list, only the newly launched overseas version of Keling saw a significant increase in visits, while most products showed stable or declining traffic.

AI Product Rankings

Several products, including CrushOn, PixAI.Art, HIX AI, Coze, and CiciAI, saw over 30% month-on-month declines in visits.

Overall, the success rate of AI product exports in creating wealth is low, with only a handful achieving popularity and stable operations.

Successful AI products often result from a team's deep understanding of user needs, accumulation of AI technology, and control over innovation. In contrast, failed products have various reasons behind their demise.

An AI practitioner shared on social media that they attempted three AI projects in 2023 but none succeeded. Some failed due to excessive homogeneity, while others chose the wrong direction from the start.

In the broader global market, while products may easily scale and generate revenue, entrepreneurs also face fiercer competition.

03 The global market seems vast, but not all is gold

In the long run, AI exports are an inevitable trend, with many startups initially focusing on globalization.

As Zhu Xiaohu stated, AIGC represents a long-term opportunity over the next decade, reshaping software, consumer electronics, and consumer applications. Li Kaifu also believes that 2024 will be a year of AI application explosions, and all applications in the AI 2.0 era deserve to be rewritten.

The global AI market has become a "gold mine." Reports indicate that the global AI market was worth approximately $454.12 billion in 2022, growing to $538.13 billion in 2023 and projected to reach $638.23 billion this year.

However, AI development is still in its early stages. Some cautious observers argue that AI has not yet entered the "mobile internet era," and qualitative leaps in AI big model capabilities are akin to laying the internet's infrastructure. The current stage focuses on improving infrastructure and fostering an environment for super apps, with killer apps still some way off.

At this juncture, many players have entered the global AI market, but AI product exports are still in their infancy, and tapping into this gold mine is no easy feat.

Firstly, AI export products must demonstrate their value to target users to rapidly gain traction and retain customers.

Insufficient understanding of overseas user ecosystems and inaccurate grasp of user needs, leading to ineffective product innovation, are significant barriers hindering the development of many AI export products. As AI product homogeneity intensifies, only those that offer genuine value and form closed-loop user experiences can retain and monetize users.

Secondly, commercialization is a challenge faced by all AI products.

Even OpenAI, which sparked the AI revolution, is struggling. Its growth has stagnated, and some analysts estimate annual losses of up to $5 billion.

Beyond OpenAI, retaining users, establishing a commercial closed loop, and achieving profitability remain daunting tasks for many AI export products.

Even those who have earned money face challenges. Many independent developers made their first profits by repackaging AI apps. These quick successes often capitalized on the AI big model's qualitative leap, leveraging micro-innovations to attract users. However, these "small-scale, asset-light, fast-money" approaches are vulnerable to competition from better-funded and organized players.

Furthermore, compliance is a significant hurdle for all overseas enterprises.

According to White Whale Lab, some payment service providers for AI export products have halted cooperation due to risk concerns, hindering product development, particularly in AI chatbots and image generation.

On August 1, the EU's Artificial Intelligence Act came into force, raising the bar for Chinese AI export enterprises. This groundbreaking regulation governing AI imposes requirements on AI-generated audio, video, images, and chatbots, with penalties of up to €35 million or 7% of global annual sales for violations.

Gaining traction, achieving commercialization, and ensuring compliance are like three mountains for AI export enterprises to climb if they want to truly strike gold.

For Chinese AI companies to create the next "TikTok" overseas, they must overcome numerous hurdles.

Images sourced from Talkie's official website. Please remove if infringement occurs.