Model 3 lost again, no excuses this time

![]() 08/15 2024

08/15 2024

![]() 667

667

Introduction

Introduction

In China, Tesla is facing increasing challenges.

"Mr. Lei, I think our Xiaomi SU7 has already surpassed the Model 3. Do you think our Ledao L60 has a chance against the Model Y?"

"You haven't even let me test drive it yet."

"It looks great just from the appearance. Next time, I'll definitely let you test drive it. We put a lot of thought into it."

On May 20th, Beijing time, a special day filled with love, two of China's hottest "traffic magnets" in the automotive industry, Li Bin and Lei Jun, met. Their common target was Tesla, which has made significant profits in China over the past few years.

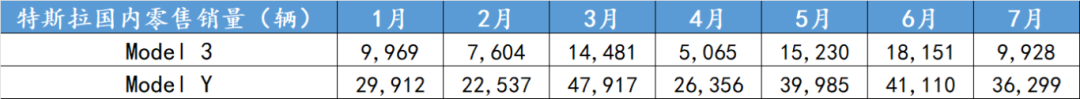

At that time, Tesla, the American electric vehicle maker, was experiencing severe difficulties. In April alone, Model 3 retail sales were just 5,065 units. In contrast, Xiaomi SU7 successfully surpassed it with 7,058 deliveries.

Hence, the opening conversation.

However, in the eyes of many observers, Model 3 is merely experiencing a so-called "shakeup," and it's too early to declare Xiaomi SU7 a definitive winner.

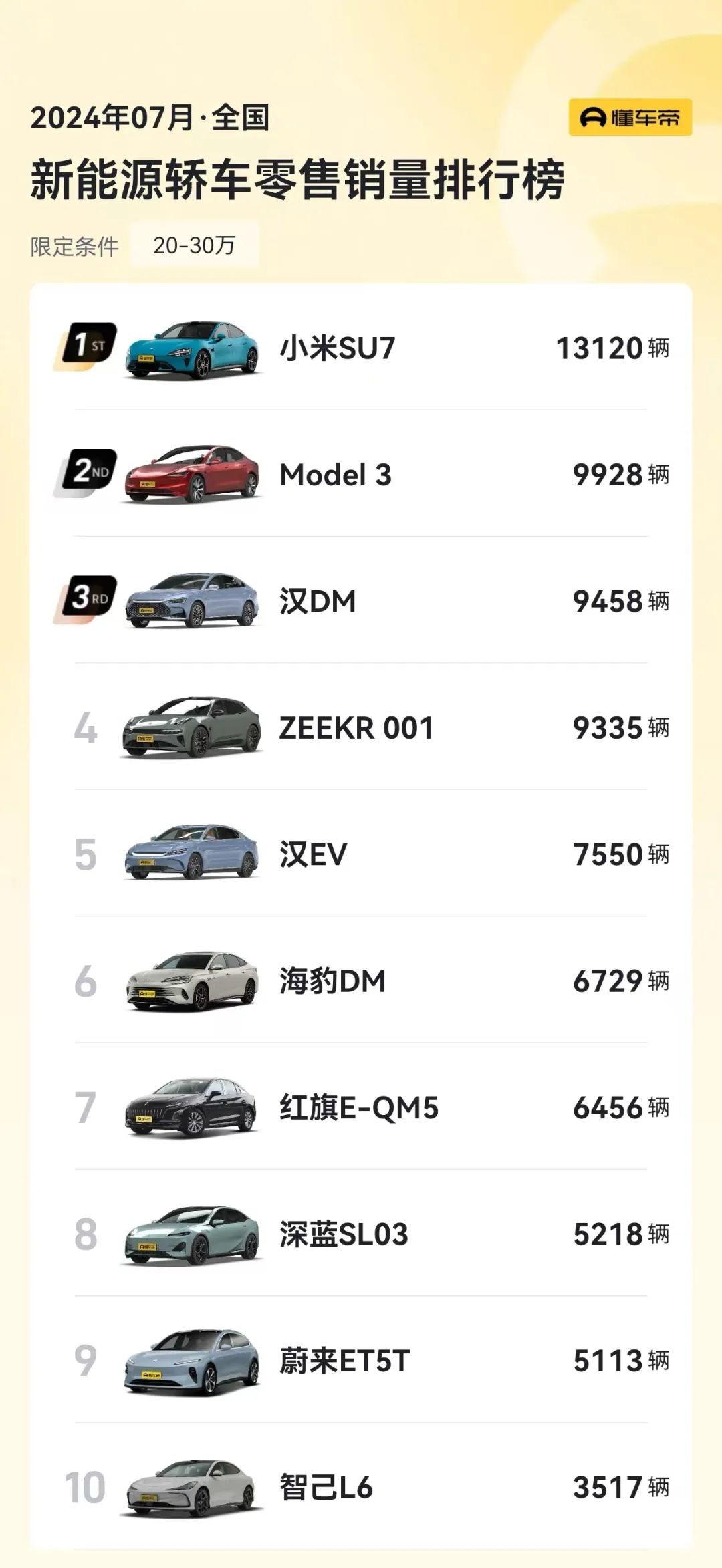

Sure enough, in the following months of May and June, Model 3 sales quickly rebounded to 15,230 and 18,151 units, respectively, while Xiaomi SU7 sold 8,646 and 14,296 units. The victory was back in Tesla's hands, and Model 3 still dominated the 200,000-300,000 yuan new energy vehicle segment.

But in July, the battlefield shifted again. Xiaomi SU7, with 13,120 deliveries, once again outpaced Model 3's 9,928 units, which tend to be weaker at the start of each quarter.

Faced with this alternating lead, some views have become increasingly certain.

Model 3's golden days are gone

First, let's ask a question: "What was Model 3's highest monthly sales figure in China?"

Looking at the data, the peak was 30,919 units in September 2022. Do you think it can return to those heights? The subtitle of this section is probably the answer in many people's minds.

While Model 3 can still be considered an "industry hit," it's far from its former dominant position.

Despite launching a much-anticipated "refresh" version last year and offering incentives like official price cuts and 0% interest for 5 years, the market response has been less than enthusiastic.

Model 3's two monthly losses to Xiaomi SU7 are but a microcosm of its gradual decline.

As mentioned before, Xiaomi SU7's entry into the market is like a raging fire, igniting the dry tinder around Tesla, while other domestic competitors have long been encircling it.

In other words, the collective assault by all parties is what brought Model 3 down from its pedestal.

In addition to Xiaomi SU7, other notable contributors include XPeng P7, NIO ET5, BYD Han, BYD Seal, Nezha S, Leapmotor C01, Deepal SL03, AVATR 12, Zhide S7, Zeekr 007, Geely Galaxy E8, Lynk & Co 07, and Zhide L6. Upcoming competitors like Jiyue 07, Lynk & Co Z10, and XPeng P7+ will also join the fray.

"The competition is fierce, suffocating even."

This phrase aptly describes the 200,000-300,000 yuan new energy vehicle market today. It's becoming increasingly difficult for Model 3 to carve out a share.

Of course, external competition is not the only factor. Internal constraints cannot be ignored either.

Have you noticed a pattern? Many consumers with a budget of over 200,000 yuan who are considering a new energy vehicle often include Model 3 on their shortlist. However, after comparing it with domestic alternatives, they often strike it off without hesitation.

The underlying reason is that Model 3's overall product strength is being rapidly eroded, and its brand luster is no longer as bright as before.

Furthermore, as a global automaker, Tesla's development pace and launch schedule are relatively fixed.

However, in the Chinese market, competitors are eager to iterate every six months to chip away at Tesla's market share.

This "split" environment poses a significant challenge for Tesla and is at the root of Model 3's struggles.

Model Y can't afford to lose

"Model 3 can afford to lose, but Model Y cannot."

If you understand Tesla's current situation in China, you'll grasp the profound meaning behind this statement. Since its peak in 2022, Model 3's sales base has been shrinking, but Tesla's continued success relies heavily on the Model Y, its pure electric SUV.

The numbers speak for themselves. In the first seven months of this year, Model Y contributed significantly to Tesla's sales, with monthly retail figures reaching 29,912, 22,537, 47,917, 26,356, 39,985, 41,110, and 36,299 units, respectively. It even secured the title of "Monthly Sales Champion" for single models in the Chinese auto market multiple times.

So, why is Model Y so dominant?

Frankly, there are few pure electric SUVs in the 200,000-300,000 yuan range that can compete with it. In July, for example, the models immediately following Model Y were the Li Auto L6, AITO M7, Tang DM, Leapmotor C11, and AITO M5, all of which are hybrid vehicles.

Their target customer groups do not entirely overlap.

As a result, Model Y has long enjoyed a relatively untapped niche market, allowing it to capture a significant share of orders.

However, similar to Model 3, I believe Model Y's good days are numbered. Several domestic pure electric SUVs specifically targeting Model Y are set to launch in the second half of the year.

In addition to Ledao L60 mentioned earlier, the most formidable competitors are the Zeekr 7X and Zhide R7. Xiaomi's second model should also not be overlooked.

It's undeniable that these "Four Little Dragons" possess the strength to compete with Model Y in terms of product definition, technological prowess, and brand prestige.

Once they are fully operational and their production capacity ramps up, their combined force will pose a significant challenge to Tesla. Even if they cannot completely overtake Model Y, they should be able to capture over 10,000 orders per month.

Moreover, according to Elon Musk's teasers, the refreshed Model Y will not arrive this year. It seems that the entry of these competitors is akin to "striking while the iron is hot."

Imagining a scenario where Model 3's remaining market share continues to shrink, and Model Y's stronghold becomes tenuous, Tesla's challenges in China will only intensify.

As this article draws to a close, let's end with some data. According to Ideal Auto's weekly sales report, Tesla sold 15,500 new vehicles in the past seven days, ranking second only to BYD among all new energy brands and surpassing BBA to top the luxury brand list.

Faced with such performance, some readers may question the tone of this article and recite the famous line, "Never won online, never lost in sales."

In response, I say, "Just wait a bit longer; time will tell the truth."