The second half of action cameras: GoPro turns left, Insta360 turns right

![]() 08/15 2024

08/15 2024

![]() 617

617

When it comes to action cameras, which brand comes to mind first? I believe most people will say GoPro. From a certain perspective, GoPro has become a synonym for the broad category of "action cameras", just as some elders might call all tablets "iPads". But the problem is that while everyone may first mention GoPro "on paper", based on GoPro's financial reports released recently, the cameras people actually purchase may not necessarily be GoPros.

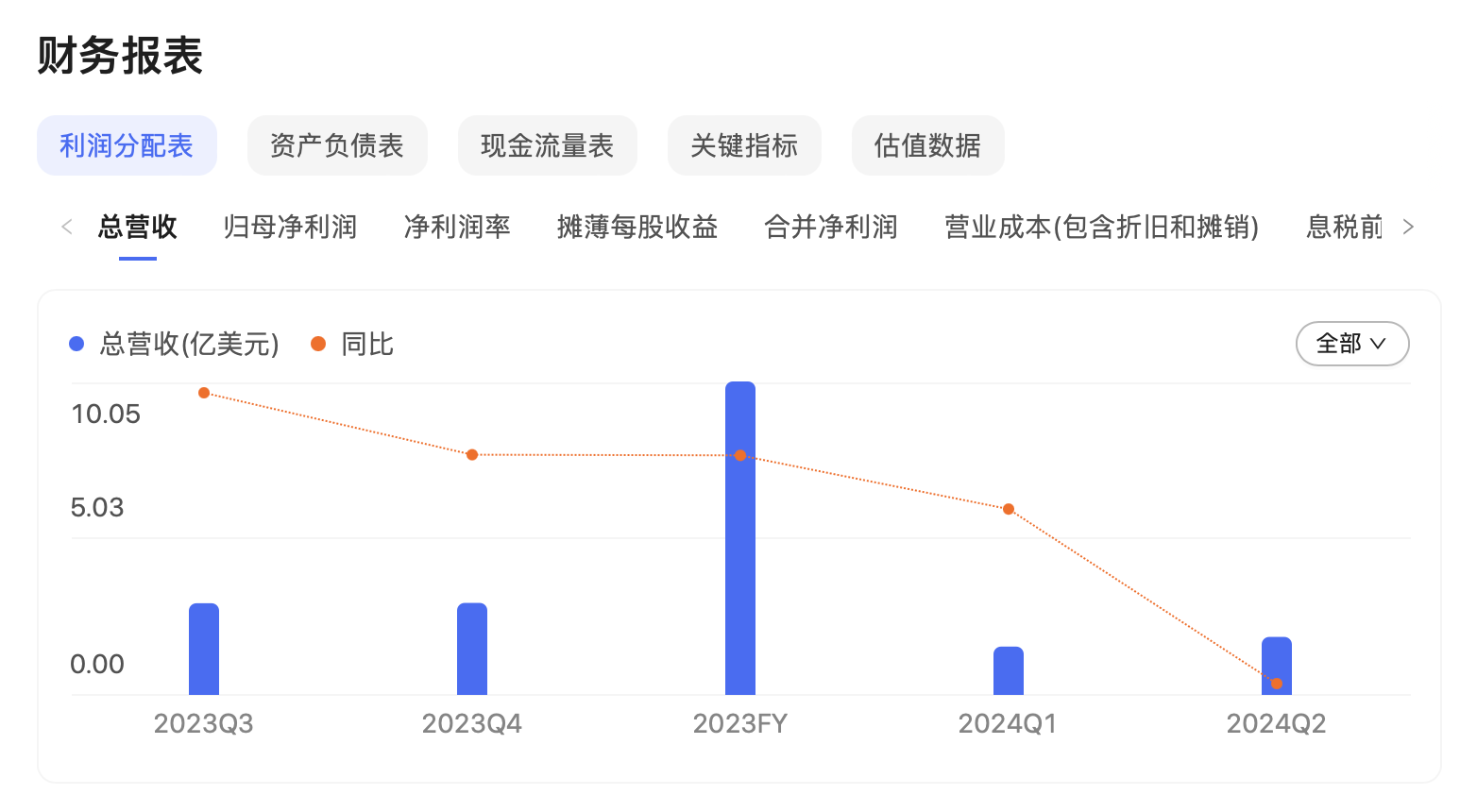

On August 7, 2024, GoPro released its financial results for the second quarter of fiscal year 2024, revealing a total revenue of $250 million for the quarter, down approximately 13.8% from $290 million in the same period in 2023. The net loss was $15 million, compared to a net profit of $8 million in the same period in 2023, marking a significant 288% decline in net profit.

Image source: Baidu Gushitong

In fact, GoPro has experienced consecutive quarters of declining revenue, and since August 7, GoPro's share price has fallen by 9.09%. So where did this disappearing revenue go?

According to a report by 36kr, Insta360's revenue in 2023 approached 4 billion yuan, with a year-on-year growth rate of nearly 100%, marking the second consecutive year of doubled revenue growth for the company. Even on Amazon's "action camera" sales rankings, Insta360's new product, the Insta 360 X4, ranks just behind the GoPro HERO 12 Black.

This same sentiment is reflected in GoPro's financial report. GoPro's financial report shows that it shipped 993,000 units in the first half of 2024, while reliable sources indicate that Insta360 surpassed GoPro in shipments in the same period, taking the top spot in the industry.

Some brands focus on one aspect, while others blossom in all directions

Opening the product pages for GoPro and Insta360, it's easy to see the differences between the two: GoPro hopes to cater to different consumers with a single product and different accessory scenarios, while Insta360 has a much richer product line.

In addition to the Ace Pro and ONE RS mini action cameras that compete directly with GoPro, Insta360 also offers the X4, which focuses on panoramic shooting, the GO 3S, which emphasizes wearable design, the Flow handheld stabilizer for smartphone photography, and the Link for video conferencing. These are just Insta360's consumer products; in the professional field, it also offers multiple professional panoramic cameras for commercial clients.

By providing different products for different scenarios and users, Insta360, a "rising star," has achieved such high recognition in the global market.

Image source: GoPro

In fact, GoPro has also tried to expand its product line in the past, such as with the Karma drone and the GoPro MAX panoramic camera, but mediocre hardware performance, questionable software support, and unexpected design flaws have prevented GoPro from achieving much beyond its wide-angle action cameras. This single-product strategy has also made GoPro struggle to meet the diverse needs of the market.

In contrast, Insta360 has adopted a more diversified product strategy, quickly expanding its market share by segmenting the market and continuously introducing innovative products for different user groups. Through this "blossoming in all directions" strategy, Insta360 has not only grown steadily in the consumer market but has also gradually established its position in the professional market.

Image source: Insta360

This strategic difference has enabled Insta360 to succeed in multiple markets, while GoPro relies more on continuous upgrades to its core product line. However, as consumer needs continue to evolve, Insta360's diversified product strategy is clearly more advantageous and better equipped to face future market challenges.

The consumer demand for action cameras has already changed dramatically

But if we look deeper, GoPro's failed attempts at business diversification are merely symptoms of its decline. The root cause lies with consumers: in simpler terms, the demand for action cameras has fundamentally changed, and traditional monocular wide-angle action cameras can no longer meet consumers' needs for diverse scenarios.

Take GoPro's core product, the GoPro Hero, as an example. Over the years, technological upgrades have only been seen in shooting specifications and software stabilization. In contrast, domestic competitors like Insta360 have already achieved "full-scenario" coverage in the field of video creation:

For creators who engage in daily shooting and don't want to draw attention with a large camera, the compact and wearable design of thumb cameras allows them to capture video footage in a more natural and unobtrusive manner. For cycling enthusiasts, the "rear-view" design of panoramic cameras unlocks richer shooting angles for video content, and many motorcycle enthusiasts around us even use the Insta 360 X4 as a "dashcam."

This is just a glimpse of Insta360's offerings in the consumer action camera market. As a representative of panoramic cameras, Insta360 has also brought panoramic camera technology to the commercial realm. Many people may not know that Insta360 has launched multiple multi-lens panoramic cameras targeted at commercial users. Many large-scale sporting events, concert VR panoramic views, and even VR home tours use Insta360 panoramic cameras.

This diversified product layout is also the reason for Insta360's rapid rise. This multi-faceted product strategy has not only expanded the brand's market share but also enabled it to stand out in the fiercely competitive market.

Today, while GoPro's new product, the GoPro Hero12 Black, is still squeezing out incremental upgrades in specifications, Insta360 has carved out a new market segment with its panoramic and thumb cameras. Against this backdrop, GoPro's crisis seems almost inevitable.

Strategic short-sightedness in product development and a desire for quick success have caused GoPro to lose its early mover advantage. Not only has it failed to expand into new areas, but its core business has also been affected. The staff recruited for expansion years ago have yet to be laid off, highlighting the massive crisis stemming from this decision-making mistake.

In the 2024 action camera market, Insta360 and DJI have emerged as the three major players alongside GoPro, with the combined market share of the three brands approaching 90%. However, GoPro's share is steadily declining, mirroring the steady rise of the two domestic manufacturers. If Insta360 can maintain this growth trajectory, as the brand with the most comprehensive range of action cameras, it has the potential to challenge GoPro's position in the action camera space.

Of course, GoPro, recognizing its crisis, is still actively exploring businesses beyond cameras. For example, in January this year, the company announced its acquisition of the tech helmet company Forcite Helmet Systems. GoPro is planning to develop its own line of GoPro-branded helmets, aiming to "enhance the performance and safety of various types of helmets through technological advancements in motorcycle helmets."

However, from the announcement, it appears that this so-called "helmet collaboration" is essentially a "business invitation" event for GoPro to expand its visibility in the racing industry. Whether GoPro is unaware of this or is aware but chooses not to act, as long as GoPro does not let go of the glorious history it created with the GoPro Hero in the action camera space and actively explore niche areas within this broader category, it is inevitable that it will be surpassed by domestic enterprises.

Source: Leitech