Super App War: Alibaba, JD.com, and Meituan's Final Chapter

![]() 07/02 2025

07/02 2025

![]() 744

744

This article is based on public information for informational purposes only and does not constitute investment advice.

In early 2025, JD.com made a significant move into the food delivery market, lavishly investing in rider social security and merchant commission-free services.

The only "stingy" aspect was JD.com's decision not to develop a standalone app for this new venture. Consequently, when JD.com Food Delivery launched, consumers frequently asked: "I can't find JD.com Food Delivery in the app store; where should I place my order?"

Initially, it was unclear why JD.com insisted on embedding food delivery within the secondary entrance of its main app—a less user-friendly approach for those who do not frequently use shopping apps.

Recently, Alibaba made a similar move: though it did not directly merge independent apps, Wu Mingyong announced that Ele.me and Flying Pigs would be integrated into Alibaba's China E-commerce Business Group, with Taobao Flash Buy's food delivery channel embedded in Taobao's secondary menu.

From a product perspective, Alibaba and JD.com made identical choices, aiming to boost the traffic value of their main apps by leveraging the high-frequency and rigid demand characteristics of instant retail and food delivery.

From an organizational perspective, Alibaba's future will once again shift from decentralization to centralization. Notably, less than two years ago, under Daniel Zhang, Alibaba was still committed to spin-offs, with the "1+6+N" strategy seeming a thing of the past.

After in-depth research, we discovered that the actions of internet giants moving in the same direction are actually the most reasonable choices made after assessing the situation:

1. Today, mobile internet traffic is insufficient to support the proliferation of various apps, necessitating the integration of limited traffic resources through super apps.

2. There are three models of super apps: WeChat, Douyin, and Meituan, with Meituan blazing a third path. Over the past decade, internet players have tried both social networking and content but found no viable solution. Currently, Meituan's generational gap is not significant, prompting others to replicate the "Meituan model".

3. Internet giants have collectively realized that the super app could be the final chapter of the mobile internet, leading to fewer boundaries and more integration and centralization.

01

A Dried-Up Riverbed

Let's start with the most straightforward product-side logic: JD.com and Alibaba hope to drive traffic growth for their main apps through high-frequency and rigid demand food delivery services.

Over the past three years, while live e-commerce has gained significant attention as a new supply model and seems to be thriving, the overall trend of traffic flow, whether for e-commerce or content, has long ceased to be prosperous, with social and content platforms increasingly siphoning off users.

According to Questmobile's "2024 Annual Report on China's Mobile Internet," the number of active mobile internet users in China reached 1.257 billion in December 2024, approaching the natural population ceiling.

While the average monthly usage time exceeded 170 hours, an increase of 3.5%, when examining usage categories, short videos accounted for an average of 62.9 hours, instant messaging for 40.2 hours, and comprehensive information for 24.4 hours, together occupying three-quarters of total usage time.

Another set of data illustrates this more clearly. According to Sensor Tower's "2025 Mobile Market Report," although total usage time and user numbers on mobile internet struggled to maintain growth, new app downloads declined last year, with a total download decrease of 1% on both iOS and Android platforms.

Meanwhile, from a segment-specific perspective, among the top ten categories in terms of total usage time, only social media short videos (represented by Douyin), browsers, and media entertainment showed positive growth, while all other major categories declined. Among overall usage time categories, only social media entertainment (short videos), AI chatbots, books and comics, browsers, and food and beverage delivery showed growth.

Figure: Total usage time and growth rate of various software categories in 2024, Source: Sensor Tower

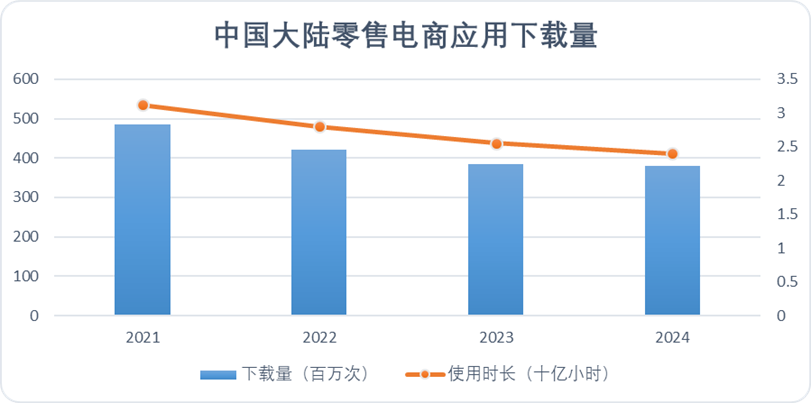

Retail and e-commerce platforms fared even worse. According to Sensor Tower data, retail e-commerce in mainland China experienced a double decline in new downloads and usage time for three consecutive years, with the decline in usage time second only to streaming media and communications.

Figure: Growth trends in app downloads and usage time for retail e-commerce in mainland China, Source: Sensor Tower

This is not just a problem for e-commerce and retail, nor unique to China's consumer market. When examining broader trends, most countries have seen declines in AI, tool software, streaming media, games, and even travel services.

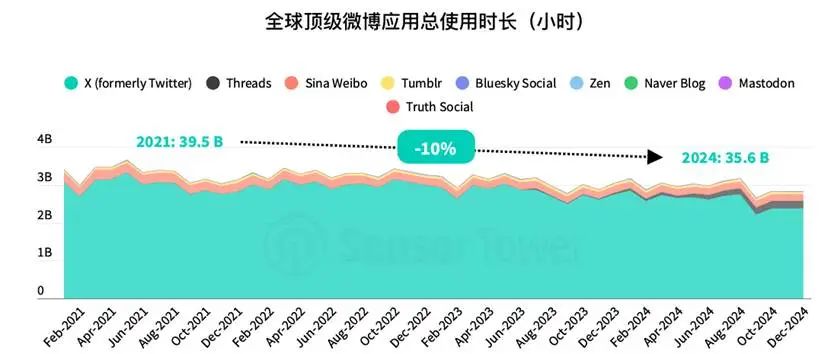

Even the once resilient social media has declined: over the past three years, the total usage time of the world's top text messaging social media platforms, including X, Sina Weibo, Threads, etc., has declined by 10%.

Figure: Total usage time of top global microblogging apps, Source: Sensor Tower

No wonder Musk is also learning from WeChat to create a super app—if we don't create a more centralized super app with concentrated traffic, internet giants' products will follow the old Web2.0 path, gradually losing 80% of their traffic to absolute market leaders. By then, it will be too late to regret.

02

The Third Type of Super App

In fact, there are only two super apps recognized by the market today:

● WeChat, built on traditional communication, maintains the dignity of an open platform and is the first super app in the traditional sense.

● Douyin, with its robust content supply, constantly challenges the boundaries of e-commerce retail and internet services, expanding its territory and becoming the second super app.

In an environment where traffic has peaked, the motivation of internet giants to create super apps is clear, but the path is not obvious. Over the past decade, various giants have tried social communication and short video content, investing heavily but failing to make significant inroads.

Is there a third way?

The answer lies on the surface. As mentioned earlier, only five categories saw overall traffic growth last year:

Among them, AI chatbots, as an emerging product, have yet to explore a stable monetization path; browsers, as a tool product, have relatively few monetization options; book entertainment products, while profitable, have a small overall market size (see: "Freak" Tencent Music); and short videos, with Douyin's dominance, offer poor returns on capital invested in content.

Therefore, there is only one viable answer: rigid daily life services with food delivery as the fulcrum.

Don't underestimate food delivery—it's labor-intensive and asset-heavy. We have previously studied the theoretical logic of instant delivery driving demand growth (see: "The 'S6' Season of China's Internet May Not Be a Torrential Rain"). Today, let's discuss two clearer and more promising logics for JD.com and Taobao to learn from Meituan:

● Over the past three years, only Meituan has withstood Douyin's direct attack, demonstrating the basic framework of a "third type of super app".

● If calculated based on the unit cost of traffic, the rigid demand nature of catering services determines that its traffic cost is much lower than that of traditional retail. Amidst rising traffic costs due to short video siphoning, lower traffic costs are the most significant competitive advantage.

The first point is a basic fact. Whether we like it or not, Douyin's traffic siphoning ability is indeed strong. Both Taobao and JD.com are products most deeply affected by Douyin's super app.

Meanwhile, Meituan not only resisted Douyin's erosion of the offline local market but also achieved the trend of gradually counterattacking e-commerce to realize instant retail of everything, with food delivery and catering as the entry point.

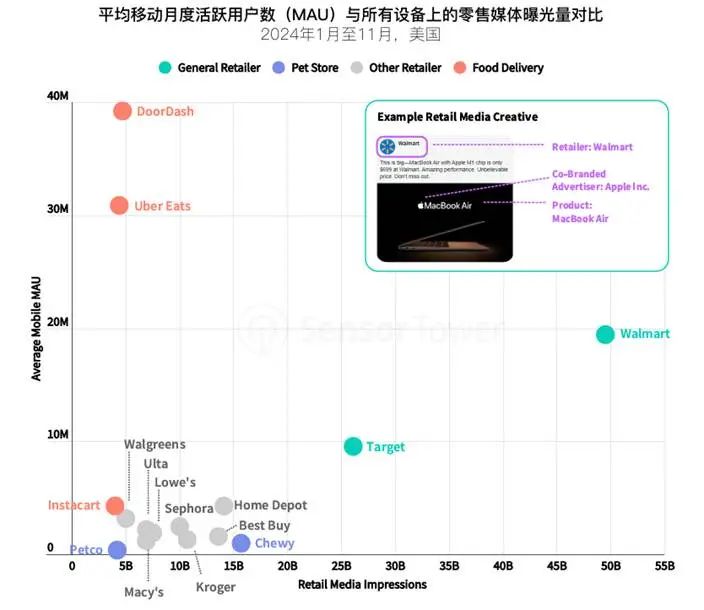

While major apps have not disclosed specific usage duration and user value for the second point, Sensor Tower has statistics on the number of active users and media exposure of major apps under the US retail system, as shown in the figure below:

Figure: Monthly active users and exposure rates of retail apps in the US, Source: Sensor Tower

Among them, large traditional retailers such as Walmart and Target can obtain relatively higher active users through strong marketing exposure, while Doordash (the US version of Meituan) and Uber Eats still obtain significantly more active traffic than their retail counterparts despite weaker marketing exposure.

If we replace this figure with the context of domestic retail, it means that retail paradigms like Meituan do not need to rely on external traffic entry points and will not be constrained by short video traffic siphoning.

Therefore, it is not accidental that JD.com and Alibaba are following Meituan's footsteps. On a riverbed with dwindling traffic, Meituan has proven that taking high-frequency and rigid local services (especially food delivery) as the core and expanding outward relying on strong fulfillment capabilities is a proven and more cost-effective path to building a super app.

This third path is becoming a key direction for giants to break through.

03

The Boundless War

So far, we extend the discussion to a topic: Since creating a super app is a consensus among internet giants based on the theory of limited traffic, should they spare no expense to increase the traffic entry points of super apps? In other words, do super apps have boundaries?

The answer is evident from the giants' actions:

From Meituan's perspective, its product design from the outset aimed for the super app path. Therefore, in Wang Xing's eyes, there are no boundaries for a super app.

As Wang Xing explained in his speech on the eve of the 2018 IPO, Meituan's goal is to be a "Food+ Super Platform." Even though it advocates expanding business lines with "eating, drinking, and entertainment" as the core, Wang Xing has never set limits: "There are no simple boundaries for everything, so I don't think we should set limits for ourselves. As long as we are clear about our core mission—who we serve and what services we provide to them—we will constantly try various businesses."

Of course, there are opposing views that the business contraction of Meituan Preferred is a rebuttal to Meituan's boundaryless theory. However, we believe that the business contraction of Meituan Preferred is purely due to current phased pressure in instant delivery and is a tactical shift rather than a strategic one.

Currently, compared to its competitors, what Meituan lacks is not open rates and entry traffic but more supply and products under the instant delivery system to increase transaction prices. Business centered on grocery shopping can increase open rates and traffic but not transaction prices, which is inconsistent with Meituan's current tactics focusing on instant delivery, hence its temporary suspension.

However, the logic of the super app has never changed. At this stage, as long as it is not a business with heavy capital expenditure and long-term returns, Meituan will still incorporate it into the super app. You can read books, watch short dramas, and even open cloud games to play Genshin Impact through the Meituan app.

From JD.com's perspective, they are acutely aware of Meituan's success over the past three years and understand its tactical moves. In February of this year, the JD.com app was revamped to include a JD.com Life channel, embedding all its local life services within the app.

Additionally, JD.com Group's overall independent businesses, such as express delivery, AI Hui Shou, and the newly launched JD.com Travel, have been integrated into the same app.

Though late to the game, JD.com has implemented the logic of centering everything around the super app. If Meituan has it, their app must have it too; if Meituan doesn't have it but they do, it will also be integrated.

From Alibaba's perspective, its attitude is relatively ambiguous. While it has integrated functions such as Ele.me, Xianyu, and Flying Pigs, it has retained the independence of some businesses.

For example, Alibaba Pictures recently announced a name change to Damai Entertainment. Another example is Cainiao and Hello (now when purchasing bike cards, users are still required to download the independent Hello app), etc.

So does Alibaba have doubts about the super app? Obviously not. Most of Alibaba's business lines are realized through mergers and acquisitions and internal restructuring, leading to stronger historical factors for independence compared to JD.com and Meituan.

For instance, Cainiao and Hello still have strong listing intentions and financing needs and cannot abandon the independence they have painstakingly cultivated at this time.

Despite external factors, Alibaba aims to incorporate as many product offerings capable of driving low-cost traffic into its Taobao app as feasible, integrating Ele.me and Flying Pigs into its organizational framework. This move signifies not only product convergence but also marks Alibaba's strategic foray into the super app arena.

Numerous historical instances underscore that sunk costs represent a significant pitfall in an enterprise's developmental trajectory. The cautionary tale of Kodak's inability to relinquish film, juxtaposed with Netflix's triumph in abandoning DVDs in favor of streaming media, continually underscores a pivotal lesson: in an era of transition, clinging to outdated paradigms equates to a gradual decline.

At its core, the debate surrounding "boundaries" is essentially a struggle for "survival." Amidst the current landscape of dwindling traffic and intensifying competition, we must focus on two fundamental questions:

● Following the ascendancy of short videos, is there another sector poised to independently nurture a new multi-billion-dollar giant?

● Can fragmented and isolated business entities withstand the competitive pressure exerted by short videos?

If the answers are negative, and the ceiling for growth becomes evident, decentralization would lead to obsolescence, whereas centralization fosters vitality.

The era of relying solely on a single popular app or vertical service for growth has waned. The future belongs to a select few players who can seamlessly integrate the highest-frequency demands, the most diverse scenarios, and the most efficient fulfillment into a singular, super entry point.

The battle for super apps represents the climactic chapter for China's internet titans, a gamble worth all the chips.