Oppose Ideal Weekly Sales Ranking, NIO sacrifices margins for sales

![]() 08/15 2024

08/15 2024

![]() 446

446

The cutthroat competition in the new energy vehicle sector is evident to all. We have previously analyzed this phenomenon from various angles, including industry inventory, gross margin, capacity utilization, and pricing, providing a more intuitive understanding of this intense competition.

In an extremely competitive industry, companies find themselves in a whirlpool, with the stronger pull as they approach the center. To escape this vortex, companies must exert every effort, and pricing becomes a necessary but insufficient condition.

Recently, NIO, a representative new energy vehicle company, has criticized Ideal Auto for its weekly sales ranking of new energy vehicle brands, calling it a "low-level competition."

Our concern is not about the validity of the ranking itself (as long as the data is accurate, the ranking is not inherently flawed). Rather, we are intrigued by why NIO is particularly sensitive and has taken the lead in criticizing this ranking. Previously, new energy vehicle companies, though competitors, maintained friendly relationships, reflecting a sense of gentlemanly conduct. However, this recent turn of events is quite surprising.

So, what has happened to NIO? Here are the core points of this article: 1. In a highly competitive market, price wars have become a necessary tactic. NIO has sacrificed margins (reducing gross margins) in 2024 to boost sales and avoid any factors that might hinder sales growth. 2. In recent quarters, R&D expenses have increased more moderately, and the expansion of battery swap stations has slowed, indicating that management is striving to balance financial statements. 3. The mid-year financial report for 2024 is expected to show positive cash flow trends. Whether these moderation measures are temporary or indicative of a new direction, investors hope to see a trend that improves the outlook for sustainable operations.

More Prudent Operations, Full-Force Price Wars

Before delving into the specifics, let's briefly review our previous analysis of NIO:

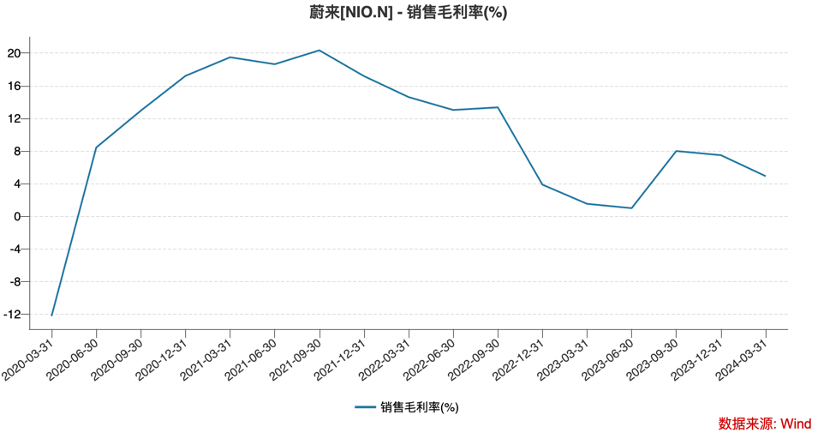

1. Gross margins remain low, indicating that NIO is caught in the throes of intense competition.

2. Its prized BaaS (Battery as a Service) model, which includes battery swapping and rental, essentially boosts sales by expanding the balance sheet (investment in battery swap stations is capitalized and gradually converted into revenue). This model makes NIO heavier than its peers.

3. NIO continues to iterate on its assisted and autonomous driving technologies, with ongoing R&D expenses ensuring that the company stays competitive.

4. Price wars are a hallmark of highly competitive industries. The weight of the BaaS model and substantial R&D investments further erode already slim gross margins, putting significant pressure on overall profits.

As the first successful new energy vehicle company to IPO in the U.S., NIO's financing capabilities have provided ample opportunities for trial and error. However, as the industry becomes increasingly transparent, some issues have gradually emerged, causing considerable anxiety among management throughout 2023 (as evidenced by Li Bin's internal letter urging employees to conserve resources in early 2024).

Market observers are aware of these issues, and NIO's management is not oblivious either. Consequently, multiple measures have been taken since 2024 to redirect the company's course.

In summary: NIO is resolute in waging price wars while striving to cut costs wherever possible.

From a cost perspective, the current situation for new energy vehicle companies is significantly better. Amidst global inflation, raw material prices for vehicles have been steadily declining. For example, the price of lithium carbonate for batteries peaked at over 560,000 yuan per ton in August 2022 but is now below 80,000 yuan per ton. Similar declines have been observed in copper prices.

Under normal circumstances, reductions in raw material costs would naturally translate into increased profits for automakers. However, in a competitive industry, cost savings from upstream raw material price reductions merely become bargaining chips in price wars rather than accumulating as profits.

During the downward cycle of upstream raw material prices, NIO's gross margins did rebound in the first three quarters of 2023 before falling again. If 2023 represented "hopeful competition" within the industry, with companies still harboring expectations for the future and consciously managing gross margins, 2024 has seen a shift towards desperation, with price wars becoming the norm and gross margins plummeting despite declining upstream raw material costs.

It is evident that the relaxation of upstream raw material prices merely passes through automakers, ultimately reaching consumers through lower prices, with automakers subsidizing even more.

From final sales figures, these aggressive discounts (roughly 30,000 to 40,000 yuan) have indeed yielded impressive results.

In Q1 2024, NIO delivered 30,053 vehicles, a year-on-year decrease of 3.2%, which is acceptable considering factors such as the Spring Festival and marketing lags. In Q2 2024, deliveries surged to 57,373 vehicles, representing a year-on-year growth of 143.9%.

From January to July 2024, NIO delivered a total of 107,924 vehicles, up over 43% year-on-year.

In Q2 2024, NIO intensified promotional efforts, pushing monthly deliveries above 20,000 units.

This has directly led to:

1. Increased sales expectations from management, who have become increasingly intolerant of any factors that might disrupt sales. The weekly sales ranking, previously overlooked, has now garnered attention. Recent declines in NIO's ranking may exacerbate management's anxiety.

2. The reality that higher sales often translate into higher losses has forced management to adopt various measures to protect the income statement.

During the downward cycle of upstream raw material prices, NIO's gross margins did rebound in the first three quarters of 2023 before falling again. If 2023 represented "hopeful competition" within the industry, with companies still harboring expectations for the future and consciously managing gross margins, 2024 has seen a shift towards desperation, with price wars becoming the norm and gross margins plummeting despite declining upstream raw material costs.

It is evident that the relaxation of upstream raw material prices merely passes through automakers, ultimately reaching consumers through lower prices, with automakers subsidizing even more.

From final sales figures, these aggressive discounts (roughly 30,000 to 40,000 yuan) have indeed yielded impressive results.

In Q1 2024, NIO delivered 30,053 vehicles, a year-on-year decrease of 3.2%, which is acceptable considering factors such as the Spring Festival and marketing lags. In Q2 2024, deliveries surged to 57,373 vehicles, representing a year-on-year growth of 143.9%.

From January to July 2024, NIO delivered a total of 107,924 vehicles, up over 43% year-on-year.

In Q2 2024, NIO intensified promotional efforts, pushing monthly deliveries above 20,000 units.

This has directly led to:

1. Increased sales expectations from management, who have become increasingly intolerant of any factors that might disrupt sales. The weekly sales ranking, previously overlooked, has now garnered attention. Recent declines in NIO's ranking may exacerbate management's anxiety.

2. The reality that higher sales often translate into higher losses has forced management to adopt various measures to protect the income statement.

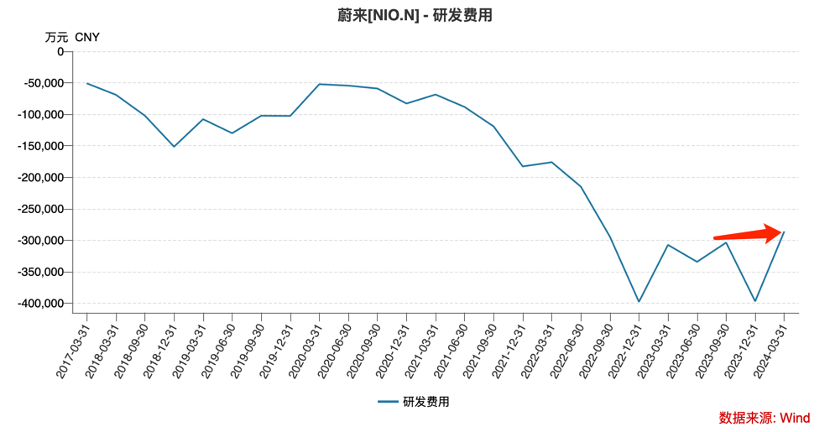

NIO's R&D expenses have always been substantial, exceeding 13 billion yuan in 2023 and showing signs of contraction in Q1 2024 compared to the previous quarter and year. As sales staff strive to boost sales, R&D personnel must also make savings wherever possible.

Moreover, the expansion of NIO's battery swap stations slowed in the first half of 2024. According to official information, there were 2,316 swap stations at the end of 2023, rising to 2,460 by the end of July 2024, an average monthly increase of just over 20 stations. Considering NIO's plan to expand its swap station network by 1,000 stations in 2024, averaging 80 stations per month, the company is clearly adjusting its pace (also iterating on its fourth-generation swap stations) in response to intensifying competition. This is the least damaging option under the circumstances.

Cash Flow Trends Determine Survival

Increasingly frequent delivery data, from monthly to weekly rankings, has made the new energy vehicle industry highly transparent (far more so than the smartphone industry). When Ideal Auto's MEGA deliveries fall short, the market immediately notices, leaving management little room for denial or debate. In such a transparent and popular industry, countless analysts scrutinize every key business node, minimizing information asymmetry in the new energy vehicle sector.

Given this landscape, what should we expect from NIO's Q2 financial report?

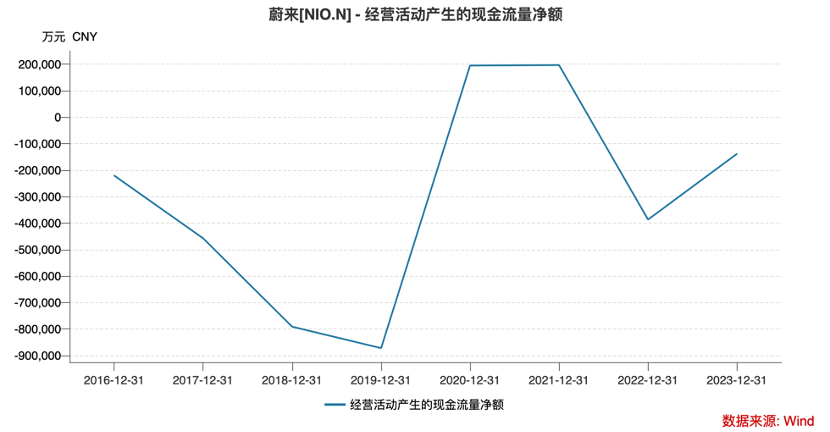

Financial statements encompass three primary components: cash flow, income statement, and balance sheet. Companies at different stages of growth rely differently on these statements. For rapidly growing companies with smooth financing, revenue growth is paramount (crucial for assessing industry potential). However, in an extremely competitive industry with continuous consolidation, cash flow takes precedence. In other words, as long as a company maintains healthy cash flow, even short-term losses can be endured until better times arrive.

NIO's management is well aware of this, issuing $1 billion in convertible bonds in 2023 and signing an $11 billion share subscription agreement with CYVN, an investment arm of the Abu Dhabi government, in June of that year. Despite the high external interest rate environment (the $1 billion convertible bond was split into two tranches with annual interest rates of 3.875% and 4.625%, relatively high for convertible bonds), NIO opted to issue the bonds, underscoring its desperate need for cash.

NIO's R&D expenses have always been substantial, exceeding 13 billion yuan in 2023 and showing signs of contraction in Q1 2024 compared to the previous quarter and year. As sales staff strive to boost sales, R&D personnel must also make savings wherever possible.

Moreover, the expansion of NIO's battery swap stations slowed in the first half of 2024. According to official information, there were 2,316 swap stations at the end of 2023, rising to 2,460 by the end of July 2024, an average monthly increase of just over 20 stations. Considering NIO's plan to expand its swap station network by 1,000 stations in 2024, averaging 80 stations per month, the company is clearly adjusting its pace (also iterating on its fourth-generation swap stations) in response to intensifying competition. This is the least damaging option under the circumstances.

Cash Flow Trends Determine Survival

Increasingly frequent delivery data, from monthly to weekly rankings, has made the new energy vehicle industry highly transparent (far more so than the smartphone industry). When Ideal Auto's MEGA deliveries fall short, the market immediately notices, leaving management little room for denial or debate. In such a transparent and popular industry, countless analysts scrutinize every key business node, minimizing information asymmetry in the new energy vehicle sector.

Given this landscape, what should we expect from NIO's Q2 financial report?

Financial statements encompass three primary components: cash flow, income statement, and balance sheet. Companies at different stages of growth rely differently on these statements. For rapidly growing companies with smooth financing, revenue growth is paramount (crucial for assessing industry potential). However, in an extremely competitive industry with continuous consolidation, cash flow takes precedence. In other words, as long as a company maintains healthy cash flow, even short-term losses can be endured until better times arrive.

NIO's management is well aware of this, issuing $1 billion in convertible bonds in 2023 and signing an $11 billion share subscription agreement with CYVN, an investment arm of the Abu Dhabi government, in June of that year. Despite the high external interest rate environment (the $1 billion convertible bond was split into two tranches with annual interest rates of 3.875% and 4.625%, relatively high for convertible bonds), NIO opted to issue the bonds, underscoring its desperate need for cash.

In 2023, NIO took a series of measures to optimize cash flow from operating activities, including cost optimization (to boost gross margins) and extending payment terms with suppliers. These efforts have been remarkable, enabling NIO to minimize blood loss in an increasingly competitive environment.

However, we must consider whether these measures can be sustained. As suppliers also face survival pressures, extending payment terms further may become difficult (though XPeng managed 217 days of payment terms in 2023, NIO's 188 days still leave room for improvement). Additionally, it remains uncertain whether aggressive discounts will affect the recovery of operating cash flow.

From a cash flow perspective, we hope NIO's mid-year financial report will reveal:

1. A balance between operational profitability, discounts, and efficiency gains. Specifically, highly flexible expenses such as R&D and management should be reduced wherever possible. NIO's mobile phone venture has been largely silent, and while it has not been officially canceled, its prospects seem dim (some media outlets have reported layoffs in this division). It may be prudent to cut losses early and avoid similar mistakes in the future. In a competitive environment, success hinges on pricing strategy and minimizing mistakes.

2. The slowdown in swap station expansion in the first half of the year is unclear whether it's a trend or temporary. Will management accelerate expansion in the second half to meet its annual target of 1,000 new stations? This is crucial for investment cash flow expectations.

3. To date, NIO has launched three brands – NIO, Letao, and Firefly – catering to different price points and target audiences. By diversifying its product lineup, NIO hopes to capture more market share. Once the industry consolidation is complete, these brands will become valuable assets. However, compatibility issues may accelerate the need for swap stations, posing challenges to NIO's capital expenditures in the short term.

With its new brand layout, aggressive discounts, financing capabilities, and efficiency enhancements, NIO has undergone a revitalizing transformation in 2024. Among these strategies, efficiency improvements are the most effective and sustainable. New energy vehicle companies often have deep pockets from the outset, fostering lavish spending habits and ambitious visions among management. Internal management can be lax, and corruption scandals are not uncommon. These are costly lessons learned in the past.

As the industry reaches a pivotal juncture, management must temporarily set aside grand visions and focus on safeguarding the three primary financial statements. If NIO can emerge victorious, the vast oceans await. This advice applies not just to NIO but to all new energy vehicle companies.

In 2023, NIO took a series of measures to optimize cash flow from operating activities, including cost optimization (to boost gross margins) and extending payment terms with suppliers. These efforts have been remarkable, enabling NIO to minimize blood loss in an increasingly competitive environment.

However, we must consider whether these measures can be sustained. As suppliers also face survival pressures, extending payment terms further may become difficult (though XPeng managed 217 days of payment terms in 2023, NIO's 188 days still leave room for improvement). Additionally, it remains uncertain whether aggressive discounts will affect the recovery of operating cash flow.

From a cash flow perspective, we hope NIO's mid-year financial report will reveal:

1. A balance between operational profitability, discounts, and efficiency gains. Specifically, highly flexible expenses such as R&D and management should be reduced wherever possible. NIO's mobile phone venture has been largely silent, and while it has not been officially canceled, its prospects seem dim (some media outlets have reported layoffs in this division). It may be prudent to cut losses early and avoid similar mistakes in the future. In a competitive environment, success hinges on pricing strategy and minimizing mistakes.

2. The slowdown in swap station expansion in the first half of the year is unclear whether it's a trend or temporary. Will management accelerate expansion in the second half to meet its annual target of 1,000 new stations? This is crucial for investment cash flow expectations.

3. To date, NIO has launched three brands – NIO, Letao, and Firefly – catering to different price points and target audiences. By diversifying its product lineup, NIO hopes to capture more market share. Once the industry consolidation is complete, these brands will become valuable assets. However, compatibility issues may accelerate the need for swap stations, posing challenges to NIO's capital expenditures in the short term.

With its new brand layout, aggressive discounts, financing capabilities, and efficiency enhancements, NIO has undergone a revitalizing transformation in 2024. Among these strategies, efficiency improvements are the most effective and sustainable. New energy vehicle companies often have deep pockets from the outset, fostering lavish spending habits and ambitious visions among management. Internal management can be lax, and corruption scandals are not uncommon. These are costly lessons learned in the past.

As the industry reaches a pivotal juncture, management must temporarily set aside grand visions and focus on safeguarding the three primary financial statements. If NIO can emerge victorious, the vast oceans await. This advice applies not just to NIO but to all new energy vehicle companies.