Video account ads surged 80% in Q2, merchants who 'bottom-fished' in traffic investment deserve the credit

![]() 08/16 2024

08/16 2024

![]() 603

603

Traffic investment increased by 80%, and merchants are diving into video account waters.

Written by Chen Jiying

"We believe that video accounts are becoming a third new ecosystem distinct from traditional shelves and interest-based e-commerce, combining private domain formats with offline store layouts," Zhu Chenye, CMO of Anta Group, asserted in an interview. "Video accounts may create new opportunities, leading to increased growth and profitability."

This is also a microcosm of what we have found during our interviews: merchants are accelerating their investments in video accounts with real money.

In the first half of the year, we reported that merchants were entering video accounts on a large scale, and this judgment has been supported by data.

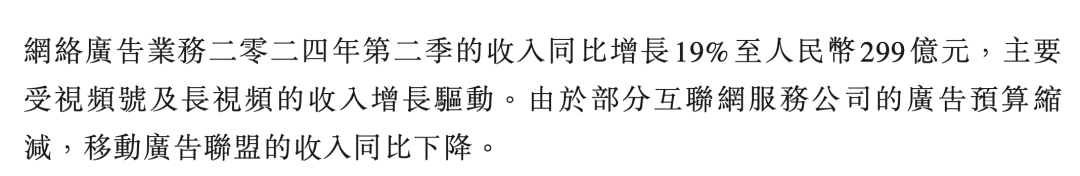

Tencent's Q2 financial report shows that driven by the growth in revenue from video accounts and long-form videos, online advertising revenue increased by 19% year-on-year to RMB 29.9 billion in Q2. James Mitchell, Tencent's Chief Strategy Officer, subsequently revealed during the earnings call that video account advertising revenue grew by more than 80% year-on-year.

Behind the platform's growth, two significant changes have occurred among merchants. First, merchants who are unwilling to be trapped in intense competition are increasingly valuing video accounts for their high average order value, high gross margins, and new incremental characteristics. They generally increase the strategic importance of video accounts, positioning them as a new main venue.

Zhu Yunlong, founder of Xiaodian Research Institute, is even optimistic that "in an overall low-price and intense competition environment, video accounts will be a platform that generates profits. Taking into account brand support, private domain operations, etc., profits from video accounts may be 2 to 3 times higher than those on other platforms."

Second, merchants are pursuing new customers and profits, moving from "testing the waters" to "floodgates open." Behind this is the fact that video account traffic competition has entered the second half. Building on the first half's focus on content service products and capturing natural traffic, merchants are accelerating the circulation and monetization of public and private domain traffic by leveraging advertising traffic dividends.

In this regard, we have also consolidated interviews with industry insiders and merchants to try to restore the current merchant models that have taken the lead in achieving results.

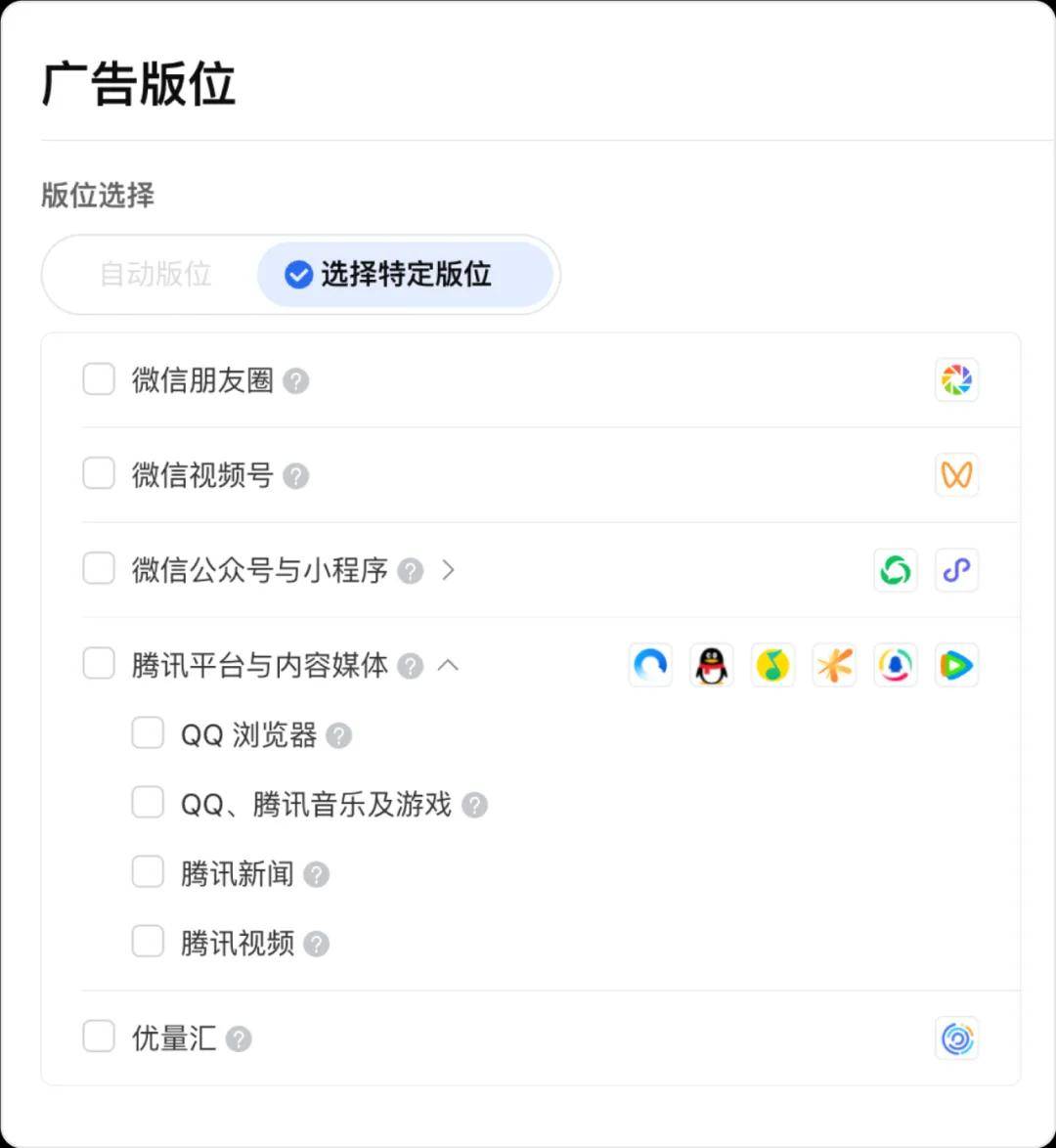

"Seeking short-term dividends and long-term growth across the board" is a consensus among merchants, which coincides with Tencent's thinking – live streaming is more like a WeChat e-commerce system that is not only based on video accounts and live streaming but also connected to all products within the WeChat ecosystem, including official accounts, mini-programs, WeChat Work, and all social and group activities within WeChat.

Merchants expect volume growth on both fronts

Anta executives such as CMO Zhu Chenye have a clear vision for increasing investments in video accounts. "In the first half of 2024, Anta's video account live streaming sales were primarily driven by influencers. In the second half, Anta plans to increase the proportion of store-owned live streaming."

In the first half of this year, Anta's performance remained at the top of the sports and outdoor category across all channels, with video accounts particularly standing out. "The growth rate of video accounts is significantly faster than that of the overall market," Zhu Chenye told "Financial Story Hub".

High growth is not an isolated case. According to WeChat's open classes, the number of top players is rapidly increasing, with the number of brands with GMV exceeding 10 million yuan in the past year growing by 860%.

Apart from the benefits of high growth, attracting new customers is another significant factor drawing merchants.

As an industry leader, Anta has a user base that competitors find hard to match. Finding new users on top of this large base has become a necessity. Thanks to WeChat's vast traffic pool, in video account live streaming rooms, Anta can reach not only young people but also mature women aged 35 and above – a demographic with high income and strong spending power.

Zulijian, which previously focused on the silver economy, has connected with more diverse groups.

According to Zhang Yali, CMO of Zulijian's brand promotion center, "Based on data showing that a large number of women aged 30 to 40 buy Zulijian products for their parents, we have refined a new brand strategy called 'Send Zulijian to Elders.'"

Moreover, the overlap rate of order placers between different entry points and touchpoints within WeChat is low. According to data released by WeChat Ads in May, the overlap rate between video account store link order placers and live streaming ad order placers is less than 10%, while the overlap rate with mini-program link ad order placers is about 30%. In different scenarios, merchants can always find new increments.

The high average order value, repeat purchases, and profit margins of video accounts also make brands content.

LANCY, a mid-to-high-end clothing brand with prices often exceeding 1,000 yuan, has a strong voice on this matter. "One of the biggest challenges for apparel brands selling online is selling full-priced products online, but LANCY has achieved this on video accounts, with full-priced new products discounted by 10-20% selling well," revealed its new retail leader. One customer in Shenyang, who is keen on new products, placed an order worth up to 50,000 yuan. Moreover, the video account user repurchase rate is as high as 60%, "These differentiating characteristics ultimately benefit profit performance."

Rasi (Lescience), a skincare brand that began laying out its video account strategy at the end of 2020, has also noticed this trend, according to its founder Xiao Zong.

In 2021, the average order value on Lescience's video account was 600 yuan, but it has since soared to around 1,100 yuan, even surpassing many big-name skincare brands. "Users of video accounts are not avid price comparers. As long as they find the product valuable, they will place an order. Our standard is that if the average order value is less than 1,000 yuan, the live stream is considered unqualified."

Overall, merchants are currently looking forward to a new cycle of full-scale growth on video accounts – moving from "testing the waters" to "floodgates open," with more comprehensive KPIs covering GMV growth, profit improvement, and new customer acquisition.

From different development cycles, growth-oriented merchants are eager to break through and expand their visibility on video accounts by collaborating with influencers, driving overall GMV growth.

Xiao Zong and his colleagues travel more than 200 days a year, "mainly to meet influencers in different places. For collaborations with GMV exceeding 1 million yuan, we need to meet face-to-face." "We hope to grow into a brand with annual GMV exceeding 1 billion yuan on video accounts."

Established brands, on the other hand, hope to find new incremental opportunities on video accounts, establish a multi-channel layout, create matrix accounts, and achieve synchronized growth in GMV and profits.

Taking Anta as an example, it plans to shift from relying primarily on influencer-driven sales before the first half of 2024 to a balanced approach of "influencers + store-owned live streaming," intending to add 3 to 5 stores to try out regular store-owned live streaming, encourage more salespeople to start live streaming, and explore new e-commerce scenarios.

Traffic investment across the board, merchants 'bottom-fishing' for traffic purchases

Merchants have an urgent need for volume growth, but only a small fraction are ahead of the curve. Achieving autonomous expansion through traffic investment is gradually becoming a consensus.

Interviewed merchants generally stated that as more merchants enter video accounts, competition for natural traffic is becoming increasingly fierce, and the good days of effortlessly harvesting traffic may not last long. Conversely, commercial traffic on video accounts is still in its infancy and relatively inexpensive. Bottom-fishing for commercial traffic as a lever to drive public and private domain traffic is considered an optimal choice.

A new consumer brand analyzed for "Financial Story Hub" that "there is an abundance of commercial traffic on video accounts, and investing in traffic now is akin to bottom-fishing. Leveraging investments to quickly unlock greater dividends is a cost-effective deal."

Xiao Zong echoes this sentiment. He once calculated that the ROI of traffic investment on Lescience's video account could reach 1:6, while the ROI of traffic investment on other short video platforms was only 1:1.2 during the same period. "The price of traffic on video accounts is indeed very cheap."

As more merchants try traffic investment, some common methodologies have emerged. For example, merchants primarily choose between WeChat Beans and ADQ (Tencent's advertising platform) for traffic investment tools, with different positioning and complementary scenarios.

WeChat Beans, as a lightweight heating tool, offers higher precision but is limited to use on video accounts, typically for early traffic generation and repeat purchases from existing customers. ADQ, as a professional advertising tool, focuses more on serving agencies and merchants' monetization and conversion growth demands, with more diverse ad types and scenarios covering both inside and outside the Tencent ecosystem, satisfying new customer acquisition and expansion demands.

Currently, most merchants adopt a combined investment strategy. Zulijian is well-versed in this approach, using WeChat Beans to boost live streaming views, activate old customers, and drive high conversions, while leveraging ADQ to acquire new customers in the public domain and drive profitable growth, achieving monthly GMV exceeding 8-10 million yuan.

The combined strategy is also applicable to influencer live streaming. During this year's 618 shopping festival, Christy Chung's live streaming room became the first to surpass 10 million views on video accounts, relying on a combined investment of "WeChat Beans + ADQ."

However, for merchants, traffic investment is not a straightforward task, requiring both cognitive upgrades and ability optimizations. There are also tricks to the investment rhythm.

In the early days, Anta's performance growth on the WeChat end primarily relied on natural traffic from public domain short videos, which still contributes 30-40% today. As the strategic importance of video accounts has increased, traffic investment has become a standard practice for Anta. "We have tried both WeChat Beans and ADQ."

However, ADQ is more complex than WeChat Beans, and Anta is still exploring ways to improve the precision of traffic investment. "The results have not yet met our expectations," Anta said.

Wu Yanfei, CEO of Yinbao Technology, suggested, "For new live streaming rooms, the system has no account model recorded. When using the ADQ system, it doesn't know what kind of audience to target, so it can't invest. Using WeChat Beans for small investments can first establish an account model. With this model, using ADQ will yield better data. Currently, it takes 3 days to 1 week to establish an account model using WeChat Beans."

Investment should not be rushed – for example, in the early stages, do not rush to verify ROI. Exposure comes before conversion, followed by optimization. Especially when traffic investment is strongly linked to the private domain, long-term ROI can be significantly improved.

Ouding, a mid-to-high-end men's bespoke clothing brand, has benefited from this. Its founder Zhu Jiayong told "Financial Story Hub" that Ouding's first-purchase ROI from public domain traffic investment is only around 1:1, which is not particularly high. However, after private domain precipitation and operation, subsequent repeat purchase ROI can reach around 1:5.

Facing merchants' surging demand for traffic, Tencent is no longer passive. From the beginning of the year, Tencent has been continuously advancing in traffic investment and other infrastructure construction, which can be summarized as the full opening of traffic entry points and the optimization of transaction links.

In January this year, WeChat Ads launched two new ad formats for Moments and new capabilities for advertising on video accounts and Moments, expanding the investment radius from video accounts to the entire WeChat ecosystem. In May, WeChat Ads launched a direct link to video account stores, providing a new path for short video e-commerce merchants to drive traffic. Two months later, the advertising radius was expanded to Tencent's entire ecosystem – other traffic and content entry points under Tencent (such as Tencent News, Tencent Video, etc.) could also promote live streaming rooms, even including an advertising alliance with over 100,000 apps.

The effect of product capability iterations has been confirmed in frontline consumption, in addition to driving an 80% surge in video account advertising.

Yinbao Technology is increasing its traffic investment efforts. CEO Wu Yanfei revealed in a conversation with Baizhun that "before 618, our advertising consumption data was around 10 million yuan. With the influx of brands and increased content, live streaming consumption during this year's Singles' Day may reach around 30 million yuan."

Seek short-term dividends and look to the long term across the board

While the dividends of video accounts have become a consensus among most merchants, some impatient brands have only tasted the waters briefly.

A sports retail brand told "Financial Story Hub," "We have tried it before, but our main venue is not video accounts currently" because "our boss thinks it takes too long to scale up, and the GMV ceiling is low."

Compared to other platforms, WeChat's overall approach is inclusive and decentralized, lacking the overnight success stories that may seem less exciting.

However, the dividends of video accounts have far from been fully realized. Guosen Securities has made quantitative predictions, estimating that video account GMV will increase by about 3 and 5 times in 2024 and 2025, respectively, compared to 2023.

From the perspective of ad load rates, Tencent revealed in May that "video account ad load rates are still in their infancy, at around a quarter of those of other mainstream short video products." As the traffic investment advertising system improves, it will further unlock the dividends of video accounts.

When video accounts are strongly linked with official accounts, mini-programs, Moments, search, and other WeChat domains, they can achieve both scale expansion and long-term compounding effects, avoiding high fluctuations in user engagement and preventing a boom-and-bust cycle.

Recently, Tencent upgraded video account stores to WeChat Stores, essentially meeting merchants' demands for domain-wide and long-term operations. After the official upgrade, WeChat Store information and product details can be circulated across multiple WeChat scenarios, including official accounts, video accounts, mini-programs, and search.

Tencent has also mentioned that it has recently repositioned live streaming to be more like a WeChat e-commerce system connected to the entire WeChat ecosystem, including official accounts, mini-programs, WeChat Work, and all social and group activities within WeChat, enabling the creation of a larger, more meaningful, and higher-ceiling e-commerce ecosystem.

Jian Feng, CEO of ZeroOne Data, a video account service provider, welcomes this development. He asserts that the upgrade of WeChat Stores means that all domain-wide resources within WeChat can support e-commerce growth. By connecting these domain-wide scenarios, merchants can expand their scale and increase their GMV ceiling.

When video accounts are coordinated with private domain scenarios, they can unleash long-term dividend effects.

A brand with over 1 billion yuan in total GMV across all channels revealed that while private domain-linked video account live streaming transactions contributed only the third-highest share of total GMV in the first half of the year, their profits were the highest across all channels, far exceeding those of e-commerce and physical stores.

Xiao Zong echoes this sentiment, stating that due to the effective coordination between the private domain and video accounts, "around 60-70% of viewers in each of Lescience's live streams are returning customers," driving an astonishing annual repurchase rate of 76%. Returning customers have higher average order values, and activating them costs less than acquiring new customers, thus ensuring more robust ROI and gross margins.

"With a solid foundation of returning customers with high repurchase rates, we feel more secure in our development," Xiao Zong admitted. "If every live stream relies solely on new customers for support, there will be a mismatch between products and customer needs, which is quite unsettling."

These cases are not isolated incidents. According to Jian Feng, after strong coordination between many merchants' video account live streaming rooms and private domains, quarterly repurchases can account for up to one-third of GMV in video account live streaming rooms.

Fei Mengya, Assistant General Manager of the Weimob Marketing Brand Growth Center, has found that the added value of a well-managed private domain is even more pronounced for mid-to-high-end brands.

She cited the example of the shoe brand Sijiatu, whose average order value is around 1,000 yuan. When salespeople share video account live streams in Moments and WeChat groups, GMV in live streams can increase by more than ten times compared to daily broadcasts.

While long-term stability may not be as exciting as overnight success, in today's context where the lowest prices and full refunds have become the norm, and the industry is increasingly competitive, pursuing steady long-term compounding effects rather than short-lived huge profits booms is a more practical and sustainable development path for merchants.

This is why Xiao Zong decided to focus on video accounts. From 2021 to 2023, the video account channel's contribution to Lezhi's GMV has increased from 20% to over 50%. This year, its video account GMV is expected to grow from 70 million last year to over 150 million. "On other platforms, it might be exciting with ups and downs, but growth on video accounts is relatively stable, and there are opportunities for advancement as long as one works hard."