Overcapacity, high costs, and US chips unwilling to pay, TSMC's US factory may be abandoned

![]() 08/16 2024

08/16 2024

![]() 577

577

As China's chip imports continue to decline, global chip overcapacity has become a reality, which is undoubtedly bad news for TSMC, the world's largest contract chip manufacturer. Moreover, its factory in the United States has not yet achieved mass production and may end up abandoned.

Despite TSMC's growing performance, it has reduced its capital expenditures for this year and significantly cut chip equipment purchases. ASML's reported earnings show that TSMC's contribution to its revenue has dropped to just 6%, compared to being ASML's largest customer during peak times, indicating a substantial reduction in chip equipment purchases due to TSMC's reduced capital expenditures.

The reason behind TSMC's decision is the high cost of advanced processes, and the unwillingness of US chip companies to bear the additional costs. This has prompted TSMC to cut costs, reduce equipment investments, and produce 3-nanometer processes using first-generation EUV lithography machines. It is said that TSMC is also developing 2-nanometer processes using existing first-generation EUV lithography machines.

For TSMC, producing chips in the United States is even more expensive. Previously, TSMC's former chairman Morris Chang estimated that the cost of producing chips in the United States could increase by 50%. With TSMC's plant construction in the United States, supply chain enterprises that have followed TSMC to set up factories there have stated that the cost of producing chips in the United States is not a 50% increase but a tripling!

Given these exorbitant costs, US chip companies have made it clear that they will not share these costs. Moreover, the chip subsidies provided by the United States to TSMC are only around 10%, raising the question of who will bear this additional cost. TSMC itself is already cutting capital expenditures, making it unrealistic for the company to shoulder the burden.

This is not the first time TSMC has attempted to establish a factory in the United States. In the 1990s, TSMC hoped to gain support from US chip companies by building a factory there. However, the high costs ultimately led to the failure of this venture, and TSMC subsequently closed the US factory and focused its development in Taiwan, leading to its subsequent success.

TSMC's current move to the United States is not primarily driven by business considerations but rather by policy changes in the United States. However, it is increasingly clear that the ultimate goal of US support remains its domestic chipmaker Intel, as Intel is an American company. Samsung and TSMC, which have set up factories in the United States, are not considered part of the 'in-group' by the US government.

Of the US$52 billion in chip subsidies previously offered, 70% went to US chip companies such as Intel and Micron. This year, the United States directly requested that ASML, a major lithography machine manufacturer, prioritize the delivery of six out of the ten 2-nanometer EUV lithography machines scheduled for mass production this year to Intel. This indicates that the United States still hopes to support Intel in gaining technological advantages in advanced processes. Recently, Intel announced that it has lit up its 18A process, equivalent to a 1.8-nanometer process, and expects to achieve mass production next year, while TSMC hopes to achieve mass production of 2-nanometer processes by then. In this way, Intel may truly regain its technological advantage in chip processes.

Once Intel regains its technological advantage in chip processes, the United States may encourage companies like NVIDIA and Qualcomm to outsource their chip production to Intel, which has already ventured into chip foundry services. If this happens, the significance of TSMC's factory in the United States will diminish, especially considering the extremely high cost of chip production in the country. Abandoning the factory may become an option for TSMC.

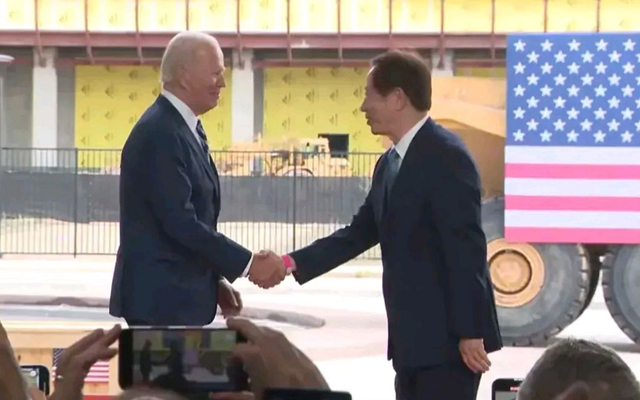

TSMC's abandoned US factory is not an isolated case. Foxconn, another Taiwanese company, also established a factory in the United States, which was eventually abandoned. When Donald Trump was president, Foxconn's chairman Terry Gou announced significant investments in the United States, and Trump even attended the groundbreaking ceremony. However, disputes over subsidies arose, and with the change in president to Joe Biden, the Foxconn factory in the United States never entered production.

This appears to be a characteristic of the United States, where policy planning lacks continuity. With each change in president, priorities shift, and previous plans often become obsolete. TSMC may face a similar situation.