New energy vehicle owners call for new forces in auto insurance

![]() 08/16 2024

08/16 2024

![]() 540

540

"

On one hand, owners are exhausted, and on the other hand, sales are soaring. The new energy vehicle market seems to have become a "besieged city" where people outside want to get in, and people inside want to get out. Amidst this prosperity, a crisis lurks – the "auto insurance triangle" of owners complaining about high prices, insurers shouting about losses, and automakers observing from the sidelines is facing challenges due to a series of major moves by automakers.

Cover Source: Unsplash"

Zhang Shuo finally decided to buy his first new energy vehicle last year. He did thorough research on everything from driving experience, travel experience, and even fuel consumption performance. However, he was shocked when he first bought it and even felt somewhat discouraged: for a car costing tens of thousands of yuan, he had to pay seven or eight thousand yuan in insurance premiums?

Zhang Shuo calculated in his mind that at this rate, the insurance premiums for several years would be enough to buy a new car. But now that the arrow has been shot, he can only reluctantly accept it.

When he encountered unpleasant things, he immediately opened the car owner group and prepared to "vent" about the insurance company. But before he knew it, the chat messages in the group had already reached "99+". In addition to those who shared his pain about the high insurance premiums, there were also those who complained about outrageous price increases: "Last year's insurance premium was just over 4,000 yuan, but this year it has soared to over 9,000 yuan. The problem is that there's no choice – only one company offered a quote. Aren't they trying to drive me crazy?"

Zhang Shuo watched in horror, speculating that this would be his fate next year. His new car still has a "new driver protection period," but he doesn't know where he can renew his insurance once that "buff" runs out.

Sure enough, another two-year-old car owner spoke up: "I didn't have any accidents in my first year, but I drove a lot, and this year they refused to insure me, saying my car model is under the insurance company's control. It's easy to buy a car, but not easy to insure it. Drive carefully and cherish it!"

After looking around, Zhang Shuo shook his head and sighed, completely losing confidence in new energy vehicles. At worst, next year he'll only buy compulsory traffic insurance and third-party liability insurance. At least the insurance premiums won't be too expensive, and he won't waste money for no reason.

While the car owner group was in an uproar, new energy passenger vehicles were ushering in a historic moment – in July, 840,000 conventional gasoline vehicles were sold retail, while 878,000 new energy passenger vehicles were sold, with a market penetration rate of 51.1%. This is the first time that monthly retail sales of domestic new energy passenger vehicles have exceeded those of gasoline passenger vehicles, and green license plates have officially become the majority.

On one hand, owners are exhausted, and on the other hand, sales are soaring. The new energy vehicle market seems to have become a "besieged city" where people outside want to get in, and people inside want to get out. Amidst this prosperity, a crisis lurks – the "auto insurance triangle" of owners complaining about high prices, insurers shouting about losses, and automakers observing from the sidelines is facing challenges due to a series of major moves by automakers.

New energy vehicles are heading towards a crossroads. Before popping the champagne for halftime, it's worth looking down at the road.

1

Unescapable High-Price Cycle

Everyone is lamenting the high cost of new energy vehicle insurance, and it's not without reason.

According to data from the National Monitoring and Management Platform for New Energy Vehicles, the average insurance premium for new energy commercial vehicles in 2023 reached 4,003 yuan, approximately 1.8 times that of traditional gasoline vehicles. Furthermore, according to predictions by Dongwu Securities, the average insurance premium for new energy vehicles will reach 5,001 yuan in 2024.

But what exactly makes it so expensive? Not only are many owners confused, but some insurance companies are also at a loss.

The reason may lie in the power system and accessories of new energy vehicles. The main power system of new energy vehicles is integrated and much more expensive than that of traditional cars, setting the first barrier for insurance premiums. In addition, accessories such as cameras and radar sensors are diverse and require high precision, further driving up prices.

More crucially, while the manufacturing threshold for new energy vehicles may seem low, and the core three-electric structure is not complicated, the difficulty lies in obtaining manufacturer authorization. Without manufacturer authorization for repairs, traditional auto repair shops struggle to fix new energy vehicles. Coupled with the fact that traditional technicians and equipment are generally tailored to gasoline vehicles that started earlier, owners can only turn to 4S shops, where repair costs are generally higher.

Many netizens comment, "Now that more and more people are buying new energy vehicles, why haven't insurance prices come down yet?" July's new energy vehicle sales only surpassed gasoline vehicle sales for the first time, meaning that they had previously been suppressed by them. "What you see around you is the world," and while it seems like there are countless green license plate owners, the overall market ownership rate is still low, failing to reach the economies of scale enjoyed by gasoline vehicles. Naturally, insurance companies are unwilling to lower their standards.

With high premiums, are insurance companies making money? The paradox is that, as veterans in the auto insurance market, insurance companies are also crying foul over losses.

An insider at an insurance company, Zhang Qiong (pseudonym), revealed that currently, each company has a limited number of car models, and repair solutions are not transparent enough. The biggest fear is an increase in claim rates, which will raise costs across the board. In fact, most insurance companies are losing money on new energy vehicle insurance business.

Why are claim rates remaining high? Firstly, new energy vehicles and gasoline vehicles have different operating logics, but many owners who previously drove gasoline vehicles have ingrained driving habits, leading to more collisions.

Secondly, many people prefer to drive new energy vehicles for ride-hailing services, but purchase and insure them as non-commercial vehicles. This results in high mileage and claim rates, thereby raising the industry's overall cost ratio and indirectly burdening private car owners with some of the insurance premiums. As a result, many insurance companies refuse to insure such vehicles.

Another major challenge facing the healthy development of insurance companies is the high claims ratio. According to the "New Energy Vehicle Insurance Market Analysis Report" issued by the China Banking and Insurance Information Technology Management Co., Ltd. (CBIT), the average premium for new energy vehicles is actually about 21% higher than that for gasoline vehicles. However, the claims ratio for new energy vehicle insurance is nearly 85%, putting most insurance companies' new energy vehicle insurance business on the brink of profitability.

Due to these losses, insurance companies are more cautious about new energy vehicles, which pose higher risks and claims. They set higher prices, thereby creating a "high-priced auto insurance cycle" where the more expensive it gets, the harder it is to sell, and the harder it is to sell, the more expensive it becomes.

2

New Players Enter the Green Game

The high cost of new energy vehicle insurance has long been a painful issue for both owners and insurance companies. Market participants have high hopes that new forces in auto insurance – insurers controlled by new energy automakers – will reduce insurance premium costs and reshape the auto insurance business model.

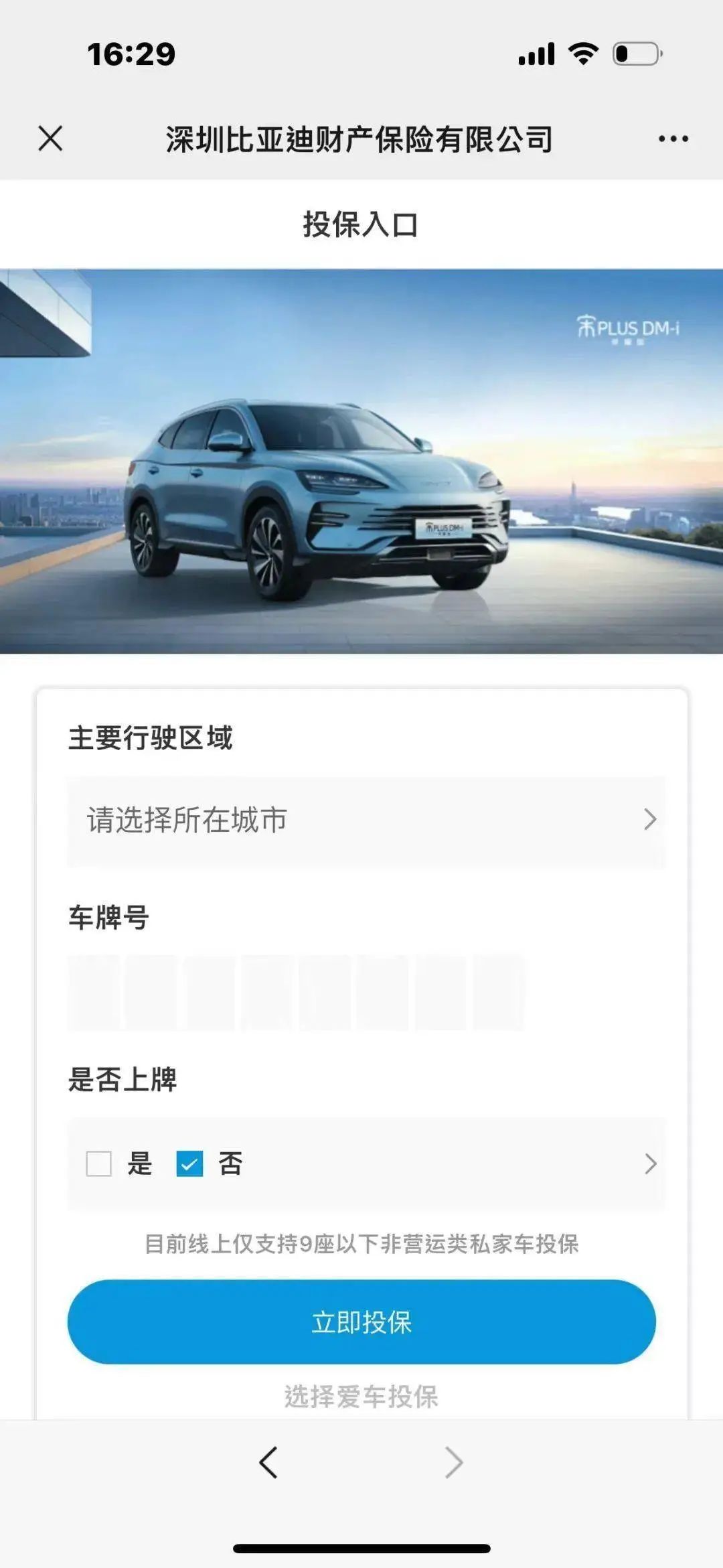

Recently, automakers have been active in the new energy vehicle insurance market. Shenzhen BYD Property & Casualty Insurance Co., Ltd., wholly owned by BYD, has officially launched insurance entry points in seven provinces, including Anhui, Jiangxi, Shandong (excluding Qingdao), Henan, Hunan, Guangdong, and Shaanxi.

In fact, this is not BYD's first strategic move. In March 2022, BYD established BYD Insurance Brokerage Co., Ltd. One year later, in May 2023, BYD acquired 100% of Yian Property & Casualty Insurance and renamed it BYD Property & Casualty Insurance.

In mid-May this year, BYD Property & Casualty Insurance issued its first auto insurance policy. Now, with the expansion of insurance entry points, "King Di" has entered the auto insurance market, opening up greater imagination for the new energy vehicle insurance market. Every move by BYD Property & Casualty Insurance has attracted widespread market attention.

Formerly known as Yian Property & Casualty Insurance, BYD Property & Casualty Insurance was once one of the four professional internet insurance companies approved by the China Banking and Insurance Regulatory Commission (CBIRC), but it once went down the path of debt. After taking over Yian Property & Casualty Insurance, BYD established a deep connection with owners through auto insurance and created a closed-loop service for the entire vehicle lifecycle to obtain a steady stream of after-sales revenue, significantly impacting existing insurance company service models and customer loyalty.

Tesla also wants a piece of the auto insurance pie. At the end of July, Tesla Insurance Brokerage (China) Co., Ltd. was officially registered with a registered capital of 50 million yuan, wholly owned by Tesla Insurance Services Co., Ltd. Its legal representative and chairman is Zhu Xiaotong, Tesla's senior vice president of automotive operations.

Don't think Tesla is just eyeing the auto insurance pie now; Elon Musk has long seen the business opportunity in new energy vehicle insurance. In April 2019, Tesla acquired Markel Corporation in the United States to obtain an insurance brokerage license.

Elon Musk made no secret of his ambition for the auto insurance market. During the third-quarter earnings call in 2020, he proposed that insurance would become a primary product for Tesla, accounting for 30% to 40% of the value of the entire vehicle business.

Shortly after obtaining the license, Tesla Motors Hong Kong established a wholly-owned subsidiary, Tesla Insurance Brokerage Co., Ltd., in the mainland market in 2020 to focus on insurance brokerage business. However, the company was never approved by regulators and was dissolved in April this year.

Tesla remains steadfast in its pursuit of auto insurance. This company registration can be seen as Tesla's renewed attempt to break the deadlock. Liu Jie, a loyal Tesla owner, said, "Less than four months after the dissolution of the previous company, another new company has been registered. Tesla is really into auto insurance. Car owners are in luck now."

Led by Tesla, domestic automakers such as GAC, SAIC, Xpeng, and NIO have followed suit, all establishing insurance agencies or brokerages in recent years to venture into the insurance sector.

It is worth noting that insurance brokerages engage in intermediary services such as "drafting insurance proposals for applicants, selecting insurers, and handling insurance procedures," "assisting insureds or beneficiaries in claims," and "reinsurance brokerage." Their income primarily comes from agency sales commissions, claims service fees, and consulting service fees. They do not have the substantive power to directly define auto insurance products or sell their own insurance.

Selling insurance is in full swing; if you can't sell insurance, you'll sell it as an agent. Automakers are going to great lengths and are willing to take risks. What are they after?

They are eyeing the blue ocean market of new energy vehicle insurance. It is large in scale and growing rapidly. According to Caijing.com data, the insurance premium scale for new energy vehicles in China was 32.5 billion yuan in 2021 and is expected to reach 154.3 billion yuan by 2025. Furthermore, according to CBIT's forecast, the premium scale will reach 400.7 billion yuan by 2030, making it an undeniably promising industry.

The "White Paper on Co-constructing the Chinese New Energy Vehicle Insurance Ecosystem" also points out that auto insurance, as the first service product that consumers encounter after purchasing a car, has a rigid demand attribute and stickiness, making it a gateway to serving car owners.

In the future, vehicle delivery will only be the starting point for automakers to create value. By leveraging auto insurance as a service lever, automakers can explore more post-vehicle ecosystems, owner rights, and other service systems.

While auto insurance losses pose risks in the short term, new energy vehicle insurance is undoubtedly "profitable" in the long run. Rather than giving away profits to insurance companies, automakers would be better off keeping auto insurance in their own hands, casting a long line for a big fish – it's all upside and no downside.

It's no wonder that BYD Chairman Wang Chuanfu once said that although the "new energy vehicle insurance industry is basically in a state of loss," it is mainly due to a disconnect between vehicle design and after-sales service. Therefore, BYD will further reduce costs and increase efficiency, so that new energy vehicle insurance can not only avoid losses but also generate profits.

3

Can Automakers Become "Troublemakers"?

Globally, auto insurance is no longer the domain of traditional insurance companies. Compared to insurers, automakers understand cars better, resulting in more reasonable and affordable auto insurance designs. There are even arguments that automakers will replace insurers.

From BYD's initiative to reduce auto insurance prices to Tesla's first step in auto insurance reform in the United States, automakers are shaking up the market and forcing all market players to transform, upgrade, and become more active.

Tesla's disruptive innovation lies in the UBI (Usage-Based Insurance) model, where each owner has a unique pricing method based on their real-time driving behavior, rather than the insurer's big data principles.

By collecting driving data through in-vehicle sensors, such as collisions, emergency braking, and sharp turns, owners with higher safety scores will enjoy lower auto insurance prices. If applied to domestic scenarios, private car owners will no longer have to bear additional costs for ride-hailing services, and prices may indeed come down, winning the hearts of car owners.

Furthermore, when new energy vehicles malfunction, automakers are naturally closely involved, so they are more willing to handle claims and increase owner loyalty to their brands. In terms of claims accuracy, automakers that collect more driving data also have an advantage, significantly improving post-incident efficiency.

While automakers have significant natural advantages in "crossing over" into auto insurance, it is not their "core business." In terms of insurance product actuarial science, risk management capabilities, and system matching capabilities, they are undoubtedly far from being able to independently operate auto insurance businesses.

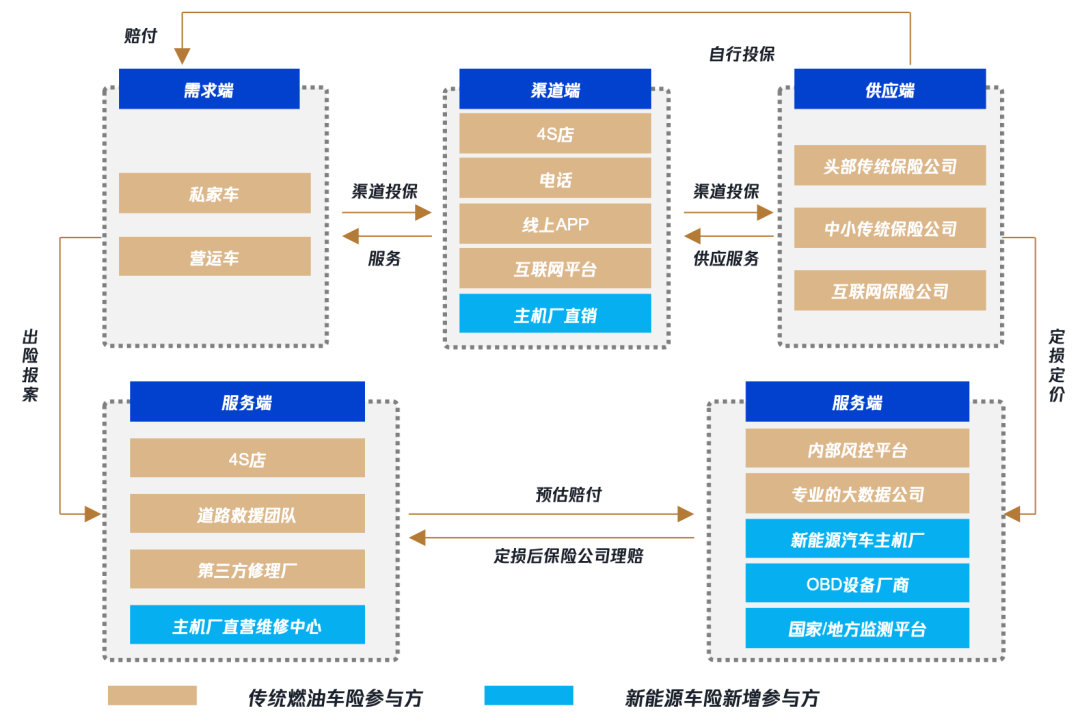

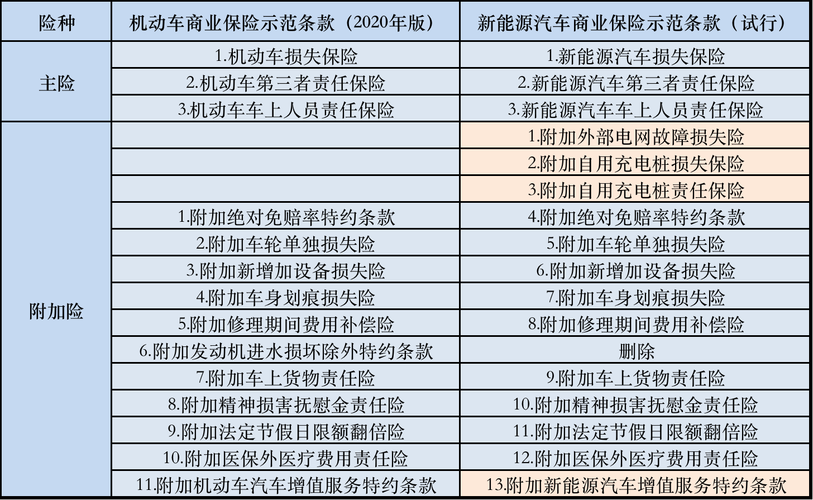

Facing the triangular relationship in the market, regulators have not been indifferent. In 2021, the China Insurance Association issued exclusive commercial insurance clauses for new energy vehicles (trial), guiding the insurance industry to include the "three-electric" system in the scope of new energy vehicle insurance coverage and protect the loss of self-use charging piles, among other things, striving to provide more effective and targeted insurance coverage for new energy vehicle consumption.

As insurers retreat and automakers advance, there are calls for the accelerated implementation of a new insurance system for smart electric vehicles, but numerous obstacles remain to be overcome.

Firstly, the market data sample size is limited. The overall market size of new energy vehicles is still relatively small, and there is insufficient data support for new clauses. Pricing and risk assessment are still under consideration. For new issues such as battery aging and spontaneous combustion risks, both insurers and automakers are "novices."

Secondly, there are flaws in insurance product design. Disconnections between billing methods and actual needs, rapid depreciation of new energy vehicles leading to misaligned claims, and underwriting challenges under technical risks are the three core dilemmas currently being discussed.

Thirdly, there are new challenges posed by autonomous driving technology. The "Luobo Kuaipao" pilot project in Wuhan has been ridiculed for its collisions with pedestrians and friction incidents, making it difficult to determine liability. After the jokes, accident damage assessment and claims processing have become complex challenges.

Now that various pain points are clear, for both automakers and insurers, confrontation is not the way out. Only by working together can they truly promote the orderly development of the market. For automakers, since they have data advantages, they might as well strengthen industrial integration and data sharing, actively solve the problems of unclear risks and insufficient data; insurers can fully provide risk management and pricing experience, link premiums to risks, and improve the efficiency of the entire market.

In addition, to accelerate product and service innovation in insurance and leverage the role of insurance funds, it is necessary to introduce the power of the asset side and long technology chains to address owners' concerns and make insurance itself no longer a risk.

Can holding an old-world ticket get you on board the new world ship? When old standards are no longer applicable, and new models have yet to take shape, the new energy vehicle insurance market, which is in a critical transition period, yearns for automakers to enter the market and "break the curse" themselves, while also waiting for traditional insurers, industry associations, and others to make concerted efforts.

It is undeniable that auto insurance is a blue ocean in the automotive industry, but the exploitation of rich mines cannot rely solely on the efforts of "new catfish" auto companies, but also needs to wait for the further maturity and development of the entire auto industry. (All characters in the text are pseudonyms)