Taobao, JD.com, and Pinduoduo: Who Can Solve the Problem of Merchants' Traffic Costs?

![]() 08/16 2024

08/16 2024

![]() 634

634

Since the end of July, the heated discussion about Taobao Tianmao introducing a "basic software service fee" has not yet cooled down, and Alibaba's latest quarterly financial report has already arrived.

Unsurprisingly, Alibaba, which has seen a decline of over 4%, delivered a less-than-stellar financial report. Revenue for the period was RMB 243.236 billion, up 4% year-on-year, but net profit declined sharply by 27%, which Alibaba attributed to a decrease in operating profit and an increase in investment impairments.

Specifically, for Taobao Tianmao Group, overall revenue declined by 1%, with customer management revenue in China's retail business increasing by just 1% year-on-year, while direct sales and others decreased by 9%, and China's wholesale business increased by 16% year-on-year.

Alibaba officially explained the 1% year-on-year increase in customer management revenue by stating that online GMV achieved high single-digit growth, partially offset by a decrease in the Take rate. The decrease in the Take rate was mainly due to the increasing proportion of GMV generated by emerging models with lower current monetization rates within Taobao Tianmao Group.

In other words, the low-price strategy implemented by Taobao Tianmao in the first half of this year contributed a significant amount of white-label GMV, and these merchants did not have significant advertising capabilities. Therefore, during the conference call, management confirmed that the 0.6% technical service fee would contribute revenue in the last seven months of the fiscal year.

However, this measure has also been criticized for increasing merchants' operating costs. Some merchants have also expressed that while the 0.6% fee does increase costs, it pales in comparison to the expenses associated with traffic promotion.

There is a widely circulated merchant revenue formula in the e-commerce industry: Merchant Revenue = Actual GMV - Costs = (Traffic * Conversion Rate * Average Order Value * Purchase Frequency) - (Production Costs + Marketing Costs + Logistics Costs)

Considering that most e-commerce merchants have a "buyer" attribute, production costs and logistics costs are not within their control. In reality, many merchants often seek to generate the most sales with as little marketing cost as possible, aiming to maximize their marketing ROI while pursuing the largest GMV.

However, a current challenge in e-commerce operations is that as platforms like Taobao raise monetization rates and there is an excess supply of merchants, online traffic is nearing depletion. This has led to a significant decline in merchants' marketing ROI, while costs continue to rise.

This issue particularly affects mid-tier merchants. The era of simply "opening a store, running some ads, and conducting a few promotions" to achieve significant sales volumes is gone for good.

In the early stages, there was strong consumer demand coupled with a severe shortage of product supply, so brands could make money no matter how they invested. However, as more brands emerged and consumer demand weakened, consumers' limited attention was continuously diluted, ultimately leading to rising marketing costs.

Today, the dilemma facing most merchants is that without investing in traffic, GMV growth cannot be achieved, but investing in traffic gradually becomes akin to working for the platform.

1

Taobao Tianmao: Lightening the Load or Adding Burden for Merchants?

After Taobao Tianmao was reported to have intensively adjusted merchant rules on July 26, some key changes were summarized: significant changes to store traffic rules, clearly using the "Experience Score" as the core basis for traffic allocation; relaxing the "only refund" policy for stores with high experience scores; and introducing a basic software service fee of 0.6% per order confirmed and received.

Upon the announcement, some media outlets astutely pointed out that Alibaba's series of changes could be categorized into two types: those related to merchant fee structures, affecting the platform's monetization rate (and merchants' costs), and those related to consumer experience and traffic allocation mechanisms.

Regarding the first type, Dolphin Investment Research conducted calculations in an article titled "Taobao Tianmao's Big Changes: Can Alibaba Have Any Hope?" The results showed that, combining both increases and decreases, the new rules would add approximately several billion to over ten billion yuan in additional revenue for Taobao Tianmao.

The 0.6% basic software service fee may seem like an additional cost to small and medium-sized merchants. However, in a survey of merchant operating costs, platform service fees, including commissions, accounted for more than 20% but were not the largest item.

"Multiple merchants stated that their traffic promotion expenses accounted for more than 50% of their cost structure, with some even reaching 70%,"

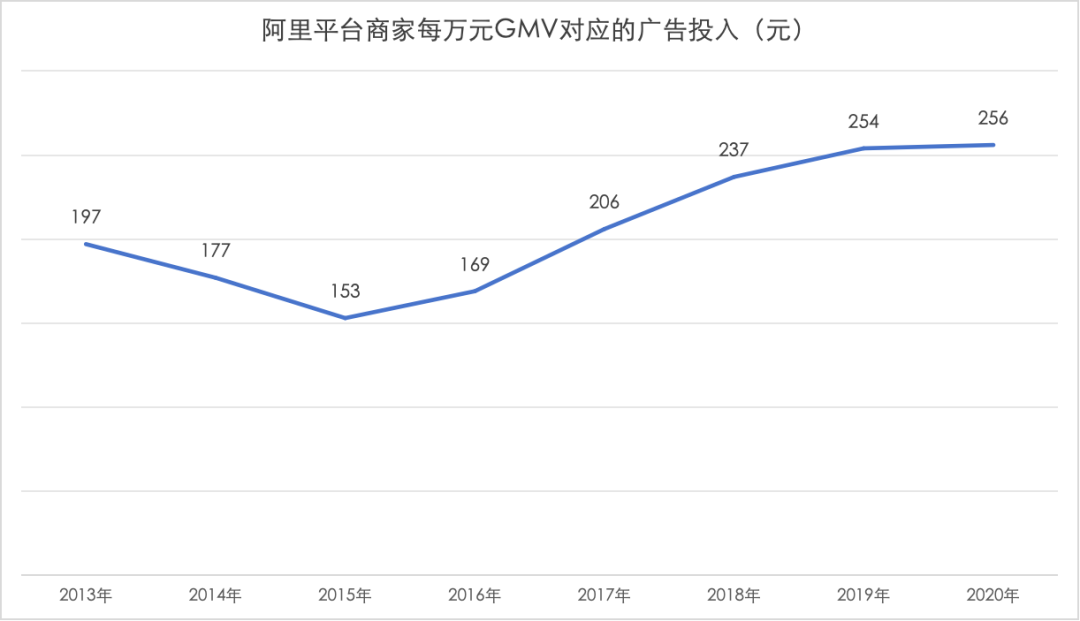

High traffic costs have not developed overnight. In 2018, the average traffic cost in the e-commerce industry was already between 10% and 40%, meaning that if a merchant sold a piece of clothing for RMB 1,000, up to RMB 400 could go to advertising fees for the platform. When Rumei went public in 2021, its prospectus revealed that its promotion expenses on Taobao had increased by 147.71% over two years.

This year, some e-commerce platform advertisers have openly stated that during the 618 promotional period, all platforms focused on low prices and strong paid promotion, and traffic costs were trending upwards. Some white-label merchants' traffic promotion costs (the proportion of traffic promotion expenses to GMV) reached 100%.

Even some brand merchants reliant on online channels find it difficult to escape. For example, Blue Moon's 2024 first-half-year earnings warning announcement showed that while the company's sales increased by over 38% year-on-year, it expected a loss of approximately RMB 620 million, an almost 300% year-on-year increase.

Heavy marketing costs leave merchants with only two options: persevere or refuse to bear the burden. A merchant in the personal care category, Xiao Yang, told us that they only paid for Pinxiaobao on Taobao, with zero traffic promotion expenses. "We focus more on word-of-mouth and repeat purchases, preferring to invest money in product research and development and experience."

In Xiao Yang's view, if platform operating costs exceed a safe threshold, the basic output cannot cover the investment, resulting in a loss. However, from the platform's perspective, merchants maintaining a certain level of promotion expenses can increase platform revenue.

Huatai Securities noted in a research report that in the first and second quarters of 2024, Taobao Tianmao sacrificed profits for direct subsidies, ostensibly to stimulate traffic growth and regain consumer trust, but the underlying motive was to drive merchant retention.

Therefore, a series of moves by Taobao Tianmao in the first half of the year aimed to convey two things to merchants:

1) The platform's traffic growth trend is improving, implying expanded incremental sales opportunities;

2) The ROI of the platform's commercial advertising tools has improved.

The essence of driving merchant retention is to cooperate with a series of marketing tools and adjust traffic allocation rules, prompting merchants to invest more in promotion expenses, generating corresponding incremental revenue and profits.

2

JD.com: The Intriguing "Gross Margin Protection"

Although JD.com and Taobao Tianmao are both e-commerce platforms, their models differ significantly. Simply put, Taobao Tianmao is a platform model that earns revenue from advertising and services, while JD.com typically earns by selling products at a markup. Of course, JD.com also has third-party products (3P) that earn transaction commissions and advertising revenue, but these represent a small portion.

Most of JD.com's revenue comes from its self-operated business. In 2023, JD.com's self-operated revenue reached RMB 873.1 billion, while third-party revenue was only RMB 213.5 billion.

Due to its smaller overall scale and the dominance of its self-operated business, which contributes over 80% of revenue, there is a clear ceiling for third-party merchants' marketing efforts on JD.com. If we look only at proportions, according to Photon Planet's research, if merchants do not adopt JD.com's integrated logistics solution (warehousing), marketing expenses on JD.com generally account for around 10%, with comprehensive costs, including third-party logistics, around 25%.

JD.com's focus remains on its self-operated business.

Essentially, when brand merchants operate on JD.com's self-operated platform, it's akin to the platform acting as a distributor. Merchants do not need to pay platform fees and only earn brand gross margins. However, to protect its own interests, JD.com typically includes a gross margin protection clause, commonly known as "gross margin protection" (GMP), in its distribution agreements.

Dayang, who has eight years of operational experience on JD.com, told us that JD.com's GMP comes in two forms: product GMP and comprehensive GMP.

Product GMP refers to a contractual gross margin rate set between the brand and JD.com's self-operated business, typically ranging from 10% to 25%. If the actual gross margin falls below this contractual rate, JD.com will deduct the difference from the merchant's payments for that month or the following month. The specific deduction formula is as follows:

Gross Margin Compensation = JD.com's actual sales for the period × contractual gross margin rate - actual gross margin

However, the GMP does not always trigger. It generally only comes into effect when JD.com's self-operated gross margin is impacted, such as during forced promotions (like price wars) that reduce product prices and hurt JD.com's profits. In such cases, JD.com deducts the lost profit plus its contractual profit from the merchant's payments.

In addition to product GMP, JD.com also has a comprehensive GMP, which allows merchants to offset part of their GMP with promotion expenses. JD.com sets a ratio between promotion expenses and overall sales, such as allowing 20% of promotion expenses to offset GMP.

For merchants, GMP is like a "marketing fee" paid to JD.com in exchange for guaranteed distribution. Under normal circumstances, JD.com's GMP benefits all three parties: suppliers and JD.com earn higher gross margins, while consumers receive a range of guaranteed services such as logistics and after-sales support. However, during price wars, GMP becomes a mandatory self-preservation measure for JD.com, leading to a lose-lose situation for both brands and the platform.

3

Pinduoduo: Merchants Complain While Stocking Up

Recently, TF Securities answered the question in a research report on Pinduoduo: Why can Pinduoduo stand out from the crowd?

While there are many internal and external factors, a crucial one is merchants' operating costs.

According to TF Securities, low operating costs are a core reason why small and medium-sized merchants choose Pinduoduo due to their limited risk tolerance and initial capital.

Based on TF Securities' data, Pinduoduo does not charge commissions on all agricultural products and non-Billion Subsidy merchants. For agricultural products not covered by the Billion Subsidy program, Pinduoduo charges a 1%-3% commission (compared to the 2%-5% commission on Tmall). JD.com's commissions vary based on whether the product is 1P or 3P, typically ranging from 3% to 10%.

The basic technical service fee is 0.6%, the same as on Taobao, but Pinduoduo merchants can receive a refund on this fee when participating in in-platform resource promotions. Refunds also apply to orders canceled or refunded during promotional periods or after confirmation of receipt.

Furthermore, the basic deposit and special category deposit amounts are lower than those of the other two platforms. Pinduoduo requires merchants to deposit a basic store deposit of RMB 1,000 and a special category deposit ranging from RMB 2,000 to RMB 100,000. JD.com's category deposits range from RMB 10,000 to RMB 200,000, while Tmall's store deposits range from RMB 50,000 to RMB 150,000 for different store types, with special category deposits ranging from RMB 10,000 to RMB 300,000.

In addition to these basic operating costs, merchants also calculate comprehensive operating costs.

Photon Planet mentioned a case where a seafood merchant earned RMB 100 on Pinduoduo, with cumulative costs for after-sales, traffic, and platform commissions totaling RMB 5-7. In contrast, costs on other channels ranged from RMB 12 to RMB 27.

This is similar to the business logic of Haidilao and Starbucks, where compared to the 20-30% rent expense ratio for ordinary restaurant brands, Haidilao's rent expense ratio is only 4%, and Starbucks' is 10%. This alone saves them huge profits annually.

Essentially, merchants make money on Pinduoduo because they pay less "rent," allowing them to break even or even profit from selling the same products at lower prices.

However, this model relies on the platform's ability to consistently provide low-cost traffic. Only when the platform's costs are low can it pass on benefits to merchants.

Looking at Pinduoduo's growth history, there are two stages of traffic acquisition that support this. The first was during its early stages with group buying activities on WeChat, and the second started with the Billion Subsidy program in Q3 2020. However, both of these were just icing on the cake. Fundamentally, Pinduoduo's traffic comes from its established low-price positioning.

It's no secret that Pinduoduo has a function to align prices for the same SKU. This function provides merchants with a price benchmark for the same SKU on the platform.

The platform has become increasingly granular in defining SKUs over the years. For example, when it comes to apples, the price benchmark for Red Fuji apples from Yantai is different from Huaniu apples from Tianshui.

If the price for the same SKU is below this benchmark, merchants can obtain free traffic. If it's above, merchants can choose to pay for traffic promotion.

No merchant wants to forgo high premiums and high gross margins, but to succeed in today's competitive landscape, merchants must develop and find more differentiated SKUs.

4

Conclusion

A cross-border e-commerce practitioner once gave an example: Suppose there are 50 folding chairs with a cost of USD 6 and a selling price of USD 19.99. Amazon charges an additional USD 10 for fulfillment. Merchants must also pay to ship the chairs from their warehouse to Amazon's fulfillment centers. On average, this leaves a profit of approximately USD 3 per chair on Amazon.

On Temu, the platform prices the chairs at USD 16. Shipping costs per chair are approximately USD 7, and storage fees for 50 chairs in an overseas warehouse are USD 15 per month, which is relatively low. Ultimately, the profit per chair on Temu is also approximately USD 3.

Temu can offer lower prices than Amazon while still generating the same profit per item, and Temu ships significantly more items than Amazon, motivating many Amazon sellers to simultaneously list on Temu.

The reason for sharing this example is that it perfectly explains why some merchants make money from the same products while others lose money, depending on where their costs lie.

So, let's return to the original formula:

Merchant Revenue = Actual GMV - Costs = (Traffic * Conversion Rate * Average Order Value * Purchase Frequency) - (Production Costs + Marketing Costs + Logistics Costs)

When production and logistics costs are fixed, marketing costs become the crucial variable affecting sales.

Disclaimer: This article is based on publicly available information or information provided by interviewees, but Decode and the article's author do not guarantee the completeness or accuracy of this information. Under no circumstances should the information or opinions expressed in this article be construed as investment advice to any person.