Tencent's 2Q24 Financial Report Analysis: Exceeding Expectations Growth

![]() 08/16 2024

08/16 2024

![]() 537

537

After the market close on August 14, Tencent Holdings (00700.HK) released its financial results for the second quarter of 2024, ending June 30. While revenue met Bloomberg consensus estimates, the company surpassed expectations in terms of net profit and Non-IFRS net profit, achieving 57.3 billion yuan in non-IFRS net profit, comparable to Tencent's performance in 2021, and a growth rate of 52.6% indicating continued improvement in profitability.

For a company of Tencent's size, single-digit percentage growth translates into billions of yuan in additional revenue. Where did Tencent exceed expectations to achieve such remarkable second-quarter growth? Looking ahead to the second half of the year, can Tencent's growth continue? This article provides a brief analysis.

01

Comprehensive Business Growth with Significant Margin Improvement

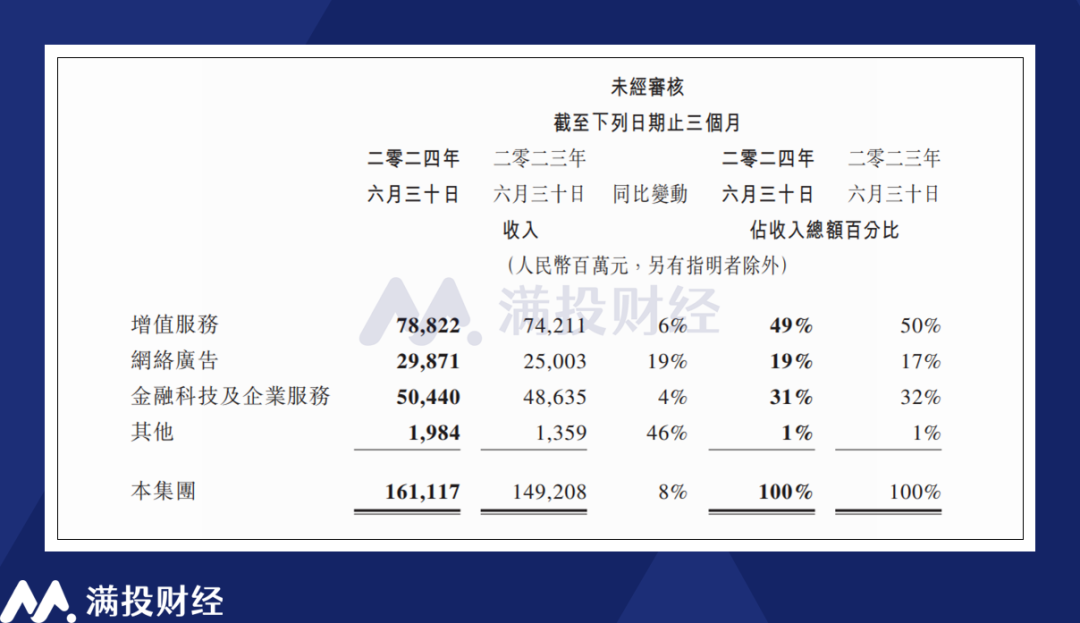

From an operational perspective, Tencent generated revenue of 161.12 billion yuan in the second quarter, a year-on-year increase of 8%. Breaking down the business segments, value-added services, online advertising, and fintech and enterprise services generated revenues of 78.82 billion yuan, 29.87 billion yuan, and 50.44 billion yuan, respectively, with year-on-year changes of 6%, 19%, and 4%. Both in absolute terms and growth rates, online advertising remained the primary driver of revenue growth.

In value-added services, Tencent launched the mobile version of the popular game "Dungeon & Fighter: Origins" in the second quarter, reviving revenue growth in the Chinese gaming market. Domestic game revenue increased by 9% to 34.6 billion yuan, maintaining stability quarter-over-quarter. Considering that "dnfm" was launched at the end of May, its revenue-generating period was relatively short, and its full impact on Tencent's gaming revenue has yet to be fully realized.

Overseas games also achieved 9% year-on-year growth, driven by international revenue from games like "PUBG MOBILE." As overseas income, it benefited from the RMB exchange rate movements in the second quarter. However, with the appreciation of the RMB in the third quarter, the exchange rate advantage for overseas income may diminish.

The value-added services related to video content were mixed, dragging down the growth rate of value-added services overall. Tencent Video's paid subscriber base increased by 13% year-on-year to 117 million, with music and video subscription revenues growing by 29% and 12%, respectively. In terms of content output, productions like "Prosperity" and "Celebration of the Year 2" continued to attract new viewers. However, video and live streaming businesses faced significant contractions, leading to a mere 3% year-on-year growth in social network revenue and a 0.6% quarter-over-quarter decline.

Regarding the other two business segments, online advertising benefited primarily from the growth of video accounts and mini-game apps, which sustained high user growth dividends. Similarly, the fintech and enterprise services business benefited from these factors, with merchant technical service fees and commissions from video accounts driving higher revenue for the fintech business, and the commercialization of WeChat Work contributing to the company's fintech revenue growth.

According to the announcement, Tencent's investments in AI large models drove growth across its various businesses. This included the company's AI platform's analysis of user behavior patterns, iterative upgrades to Tencent Cloud's computing power, and the launch and application of the AI assistant Tencent Yuanbao. Tencent's CEO Pony Ma also stated that the company would continue to invest in platforms and technologies, including AI, to create new business value and better serve user needs.

In terms of users, WeChat and WeChat International monthly active users reached 1.371 billion in the second quarter, a year-on-year increase of 3%. QQ had 571 million users, maintaining stability year-on-year, while paid value-added service accounts totaled 263 million, a year-on-year increase of 12%. Overall, the user base remains solid, providing a safety margin for the growth of Tencent's various businesses.

Tencent's overall gross profit in the second quarter increased by 21% year-on-year, with the gross margin rising from 47% in the same period last year to 53%, significantly outpacing revenue growth. The gross margins for value-added services, online advertising, and fintech services were 57%, 56%, and 48%, respectively, representing increases of 3%, 7%, and 10%. The growth in gross margins across business segments directly contributed to the overall gross margin increase.

02

'Investment Income' Drives Tencent's Primary Profit Expectation Gap

While Tencent's core business indeed achieved remarkable growth in the second quarter, there is still a considerable gap compared to its 82% profit growth and 52.6% Non-IFRS profit growth. From an expense perspective, Tencent's sales and marketing expenses and general and administrative expenses remained stable, with year-on-year changes of 0.1% and 0.03%, respectively, having minimal impact. Thus, the profit variation may be more attributed to Tencent's "non-operating income."

In the second quarter of 2024, Tencent's "share of profits of associates and joint ventures" amounted to 7.718 billion yuan, a 5.6-fold increase from 1.159 billion yuan in the same period last year, accounting for 13% of pre-tax profit. Under Non-IFRS, this figure reached 9.9 billion yuan, compared to 5.5 billion yuan in Q1 2024 and 3.9 billion yuan in Q2 2023. This significant profit expectation gap primarily stems from this source.

Generally, profits or losses from associates and joint ventures are recognized in the current period's profit and loss statement based on the investment company's performance and the investor's shareholding ratio, with corresponding adjustments to the carrying value. As of June 30, 2024, Tencent's total investment in associates and joint ventures amounted to 270.18 billion yuan, with 51% of these assets being listed companies. According to financial report disclosures, the fair value of these listed assets was 322.78 billion yuan.

Tencent's investments have garnered significant attention, including well-known companies like Meituan (03690.HK), Pinduoduo (PDD.US), JD.com (09618.HK), and the online brokerage FUTU Holdings (FUTU.US). Among its unlisted investments, Tencent holds stakes in overseas game studio associates. Although Tencent has not publicly disclosed specific investment lists or returns, the substantial increase in associate profits this year suggests that some of these "old acquaintances" may have also exceeded expectations.

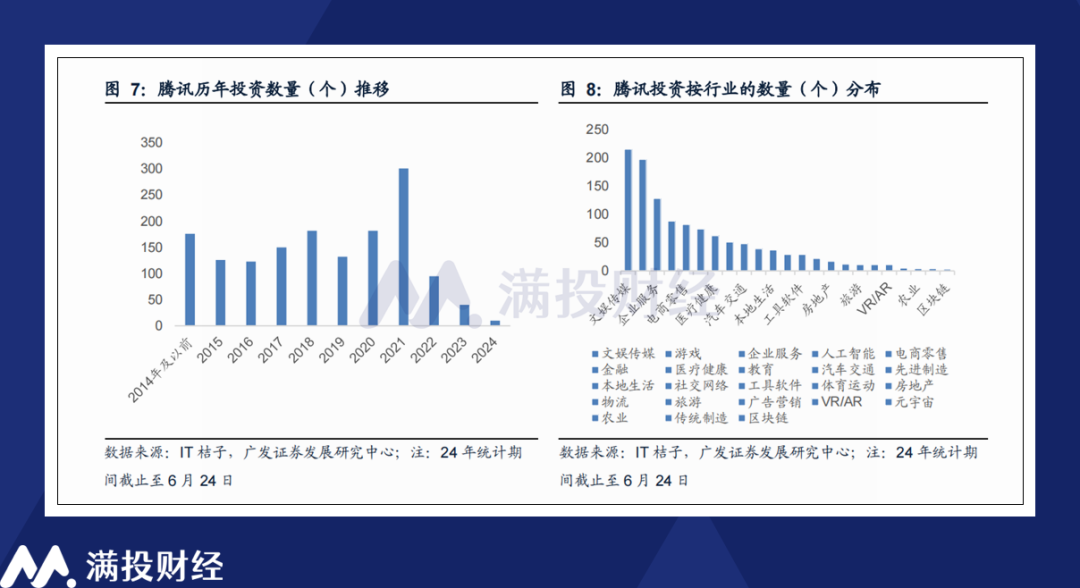

Tencent's investment strategy began in earnest in 2014, with significant increases in investments across various assets. By the end of 2023, Tencent had completed over 1,500 investment deals. Although the pace of investments has slowed since 2023, their impact became crucial to profit exceeding expectations in the second quarter of this year. After a decade of investment, Tencent may now be entering a peak period of investment returns.

Looking ahead, Tencent's role as an investor may gradually become more prominent as associate and joint venture profits grow. Evaluating Tencent's valuation or worth may thus become more complex.

03

Closing Remarks

According to Founder Securities' calculations, excluding associate and joint venture profits and tax rate changes, Tencent's Non-IFRS operating profit increased by 27% year-on-year in Q2 2024, closely aligning with the company's achievements in gross margin, indicating genuine operational improvements in its core business. If Tencent continues to optimize its business structure and expand high-margin operations, its growth could persist.

While Tencent's Q2 achievements might seem to rely on past investments, exceeding expectations with a trillion-yuan valuation symbolizes the company's vitality as a listed entity. With a market capitalization of 3.1 trillion yuan and a PE ratio of around 15, Tencent's share repurchases have been ongoing since 2023. Amid a fully adjusted Hong Kong stock market offering good value, Tencent's investment appeal continues to rise.

Beyond financial performance, Tencent, as a giant spanning consumer, entertainment, fintech, enterprise services, and advertising, derives revenue from various aspects of the economy, making its performance a forward-looking indicator. With Tencent's Q2 results exceeding expectations, optimism about the broader economy in the second half of the year may be warranted.

- End -