AI's Age of Exploration: Ignore PCB at Your Peril

![]() 08/16 2024

08/16 2024

![]() 495

495

This article is written based on publicly available information for information exchange purposes only and does not constitute any investment advice

01 Introducing PCB: The Mother of Electronics, Hard to Ignore

1) Wherever There Is Electricity, There Is PCB

Printed Circuit Board (PCB), also known as printed wiring board, is the backbone of electronics. Its name comes from the electronic printing process used in its manufacture.

PCB serves as the carrier and support base for electrical interconnection of electronic components. It provides electrical insulation and supports digital/analog signal transmission, power supply, and RF signal transmission/reception in electronic devices.

Understanding PCB isn't as complex as it seems. At home, different appliances connect through complex circuits, and electronic devices work similarly, with components connected by circuits. However, modern electronics strive for miniaturization, so components like chips, capacitors, inductors, resistors, and relays are interconnected through microcircuits on PCBs instead of bulky wires.

Thus, PCBs are ubiquitous in electronics, spanning industries like consumer electronics, PCs, telecommunications, automotive, and aerospace. They are affectionately called the 'mother of electronics.'

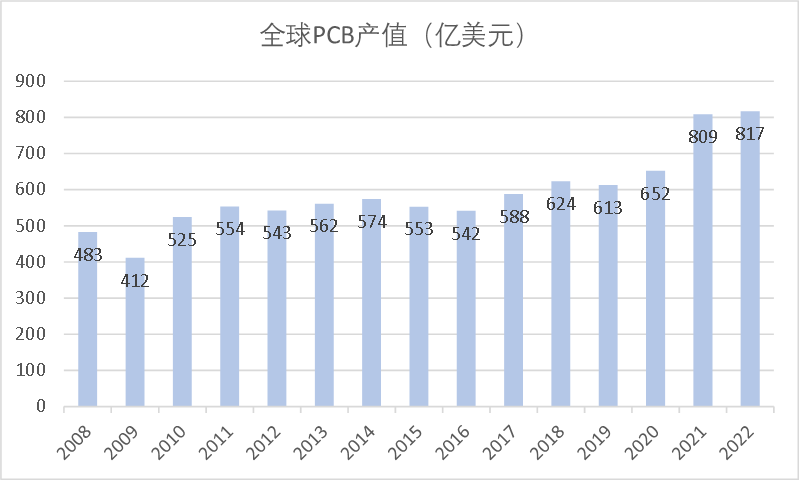

The PCB industry's market size has grown consistently with the digital economy, experiencing periodic fluctuations. According to Prismark, the global PCB market reached $81.7 billion in 2022, with a compound annual growth rate (CAGR) of 3.8%. By 2027, the market is expected to surpass $100 billion for the first time.

This is significant. The global semiconductor market is worth $500-600 billion, making the PCB market nearly one-fifth its size. China's PCB industry is globally competitive, far ahead of its semiconductor sector.

Figure: Global PCB Output Value, Source: Prismark

2) China Dominates the Global PCB Industry Benefiting from Industrial Transfer

Over the past decade, China's PCB industry grew at a CAGR of 8%, double the global rate of 3.8%. PCB is a balanced mix of capital, labor, and technology. As electronics manufacturing shifted from the US, Europe, and Japan to Korea, Taiwan, and finally China, seeking lower costs, China emerged as a natural fit.

China is a major PCB consumer and boasts advantages in labor, resources, policies, and industrial clustering. With Taiwanese and Hong Kong investments, China formed the world's largest PCB clusters in the Yangtze River Delta and Pearl River Delta.

In terms of capacity, China surpassed Japan in 2006 to become the world's largest PCB producer, accounting for 54% of global output. Japan and Taiwan retain high-end capacity, while Chinese firms are expanding in Southeast Asia, leading the industry.

Technically, Chinese PCB firms are formidable. Companies like Compal Electronics and Dongshan Precision have replaced Japanese firms in supplying FPCs for Apple products. In Tesla's smart car strategy, companies like Unimicron and Dongshan Precision are at the forefront. In AI servers, Chinese firms like Shanghai Aerospace Electronics Technology and Shenghong Technology are poised to surpass Taiwanese competitors in HDI board production.

Prismark predicts China will maintain its PCB dominance until 2028, with Southeast Asia's growth driven by Chinese investments rather than local firms.

3) Innovation Never Misses PCB

In the past six years, PCB has been integral to three major industry revolutions:

2019-2020: The global 5G rollout boosted PCB demand, with companies like Shenzhen Sunway Communication and Shanghai Aerospace Electronics Technology supplying telecom equipment manufacturers, recording up to 500% gains.

2021: The rise of ECUs in cars increased PCB demand. Tesla's innovation drove demand, benefiting suppliers like Unimicron and Dongshan Precision.

2023-2024: The AI compute infrastructure race elevated PCB technology requirements. Companies like Shanghai Aerospace Electronics Technology, Shenghong Technology, and Shenzhen Nanzan Circuit Technology performed impressively.

NVIDIA's AI servers showcase PCB's technological advancements. Its DGX and GB200 NVL72 servers incorporate advanced PCB designs, driving demand for HDI boards. Prismark predicts 16% CAGR for HDI boards from 2023-2028.

With AI server upgrades and product advancements, the PCB market for AI servers is projected to grow from under $400 million to nearly $4 billion by 2025.

02 Revisiting PCB: Reality Check

Despite its $100 billion market size, technological innovations, and China's competitive PCB firms, PCB investments can be challenging.

While the industry appears attractive on paper, its analysis is complex, and investments can be tumultuous. Even market leaders like Compal Electronics, Shanghai Aerospace Electronics Technology, and Shenzhen Nanzan Circuit Technology have experienced significant price volatility. Many smaller firms have even lost value.

1) Fragmentation: PCB's Achilles' Heel

Unlike other tech industries, PCB's technology barrier isn't high, with few revolutionary changes since 2006. The supply chain is short, involving copper foil, glass fiber cloth, and resin to make copper-clad laminates, which are then processed into PCBs.

This leads to three types of fragmentation:

Product Fragmentation: PCBs include single-sided, double-sided, multi-layer, HDI, substrate, and flexible boards, with more types emerging to meet evolving demands.

Demand Fragmentation: Major downstream applications like smartphones (19%), PCs (14%), consumer electronics (13%), telecom (13%), automotive (13%), and servers (12%) create a diverse market with no dominant segment.

Company Fragmentation: Over 40 listed PCB firms in China span market caps from $150 million to $12 billion, with rankings fluctuating. Tracking them all is daunting.

This fragmentation reduces investment success rates, making the industry bumpy despite its potential. Even market leaders like Compal Electronics hold just 6-7% global market share.

2) Growth Traps: Questioning Industry Value

Value traps refer to buying low-valued stocks overlooking underlying issues, leading to further declines. Similarly, growth traps deceive investors with high revenue growth but little profit or cash flow.

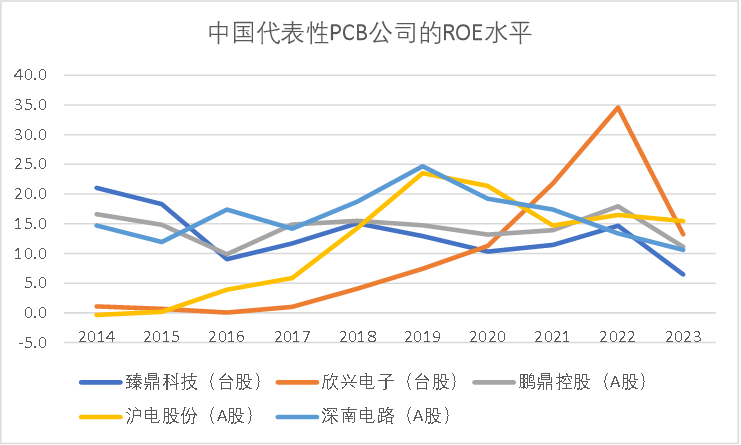

The PCB industry resembles a growth trap. Leading firms like Compal Electronics, Unimicron, and Shenzhen Nanzan Circuit Technology have average ROEs of 13-14%, decent but not outstanding, considering their hard work and scale.

Innovation isn't PCB's primary driver. Its advancements are passive, driven by downstream needs. True innovation comes from customers, limiting PCB suppliers' pricing power and industry cohesion.

PCB manufacturing lacks the strong economies of scale and barriers found in wafer fabrication. The industry is large but fragmented, with small, scattered firms. This makes for a thin snowpack on the investment slope.

Figure: Modest ROEs for PCB Leaders, Source: Company Financial Reports

03 Navigating PCB Investments: A Moderate Opportunity

PCB appears a promising sector with Chinese dominance, but deeper analysis reveals a bumpy, thinly snowed slope. It's a decent industry position but only a moderate business opportunity, suitable for staged or targeted investments rather than long-term commitments.

To capitalize, focus on structural growth:

1. Emphasize Structural Growth: Despite fragmentation, PCB's diverse downstream applications offer opportunities. Focus on innovation trends like miniaturization (multi-layer and flexible PCBs) and high-frequency/high-speed boards driven by AI and 5G.

By identifying and investing in these trends, investors can navigate PCB's bumpy slope and potentially reap rewards from this moderate but dynamic industry.

Focus on these two directions and related downstream industries. If a company happens to be riding the wave of downstream innovation, it is likely to enjoy a round of high growth with value reassessment. But at the same time, other types of PCBs may still be mediocre. PCB companies' pessimism varies, and we only need to focus on those lucky ones who are riding the wave.

2. Embrace major customers

There are a vast variety of PCBs, and manufacturers typically offer customized solutions tailored to customer needs, covering aspects such as PCB board type, material, number of layers, trace width/spacing, board thickness, and production capacity. This results in a situation where, despite the significant influence of customers, they cannot do without excellent PCB suppliers. After all, maintaining a multi-supplier system in their key products is not advantageous and can easily lead to quality issues.

We have observed that in the long-term business competition, domestic PCB companies have increasingly become core partners for major downstream customers, including Apple, NVIDIA, Tesla, Amazon, Huawei, ZTE, and many more, all of which have Chinese companies involved.

This is crucial for grasping localized opportunities. If a customer experiences significant product iterations and innovations, its core PCB supplier will also expand its scale accordingly. This is more direct and effective than simply analyzing the downstream market, as high-quality customers often dictate downstream dynamics, and new products generally offer the most substantial profits.

Conclusion: With the fervor surrounding AI computing infrastructure and AI terminal investments, market interest in PCBs continues to grow. However, the dramatic fluctuations can be confusing for those in the industry. Looking at the mountain, it is a mountain; then it is not a mountain; but in the end, it is still a mountain. By peeling away the layers from an industrial perspective, we can get closer to the truth.