Liu Qiangdong took charge in this year, JD.com increased profits but not revenue

![]() 08/16 2024

08/16 2024

![]() 471

471

By reducing costs, improving logistics, and offering subsidies.

Author: Xue Xingxing

Editor: Jiang Jiao

Cover: "The Big Short"

After recording its slowest quarterly revenue growth since going public, JD.com achieved its highest quarterly profit ever through cost reduction, efficiency gains, logistics contributions, and government subsidies, marking the first time its overall net profit margin reached 5%. Yesterday, after JD.com released its Q2 2024 earnings report, its U.S. stock price surged straight up, closing up 4.25%.

JD.com CFO Shan Su explained during the earnings call that the slower revenue growth in the second quarter was primarily due to short-term factors such as the high base effect of summer products like air conditioners. The improvement in profit margins was mainly driven by enhanced supply chain efficiency, leading to a significant year-over-year improvement in gross margin.

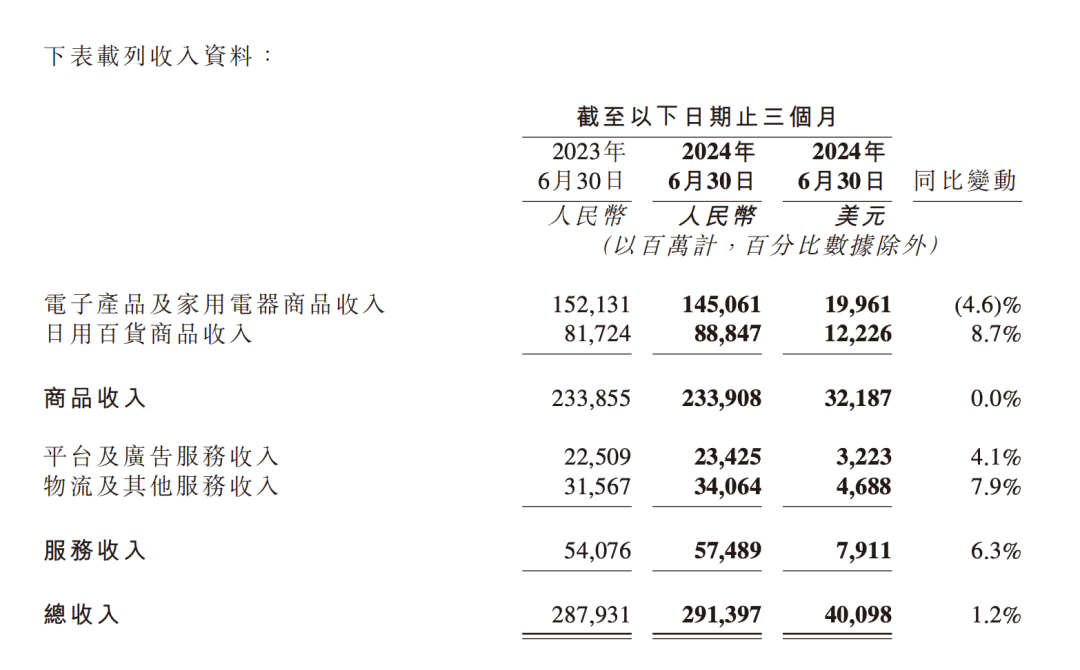

Objectively speaking, consumer spending was weak in the second quarter of this year, and major e-commerce platforms struggled in the price war. Alibaba, which released its Q2 earnings around the same time as JD.com, reported a revenue growth rate of 4%, while Tmall and Taobao experienced a year-over-year decline of 1%. JD.com's revenue growth rate of 1.2% was a record low, significantly lower than the 11% quarterly growth rate of online retail sales nationwide. Even though JD.com's daily necessities revenue surged 8.7% year-over-year, this growth was offset by a decline in its larger electronics business, which fell 4.6% year-over-year, resulting in flat total merchandise revenue and dragging down overall revenue.

JD.com CEO Xu Ran repeatedly emphasized profit during the earnings call. She said that healthy business development requires a comprehensive consideration of GMV, profit, and cash flow performance, and that all three indicators need to be balanced at all times. They will still prioritize the low-price strategy, but low prices should not be achieved through subsidies but rather through cost advantages from economies of scale and operational efficiency improvements. During the earnings call, JD.com's management team stated that their goal for the year is to exceed the growth rate of China's retail sales and expressed confidence in achieving long-term high-single-digit profit margins.

01|Lowest Quarterly Revenue Growth Rate in History

Since 2021, JD.com's double-digit growth has been declining steadily. In the first quarter of last year, JD.com recorded its lowest revenue growth rate of 1.38%, but quickly rebounded to 7.6% in the second quarter. This year, while JD.com's revenue growth was still 7% in the first quarter, it declined sharply in the second quarter. The stock price reflected market sentiment to some extent. In 2020, when JD.com listed in Hong Kong, its share price reached a new high of HK$410.60 in February of the following year, but it has since been on a downward trend. When Xu Ran took over as CEO of JD.com in May 2023, the company's Hong Kong stock price had already fallen to HK$144.80. Over the past six months, JD.com's Hong Kong stock price reached a high of HK$136.80 on May 20, when 618 sales began, but has not recovered to that level since.

JD.com's Hong Kong stock price has halved since its IPO. Xu Ran's takeover was the result of a near-complete overhaul of JD.com's management team. Over the past few years, the heads of JD.com's major divisions, including retail, health, and logistics, have nearly all been replaced. The climax of this overhaul was the departure of Xu Lei, the company's de facto second-in-command who created the 618 shopping festival. He served as CEO of JD.com Mall from 2018 and officially became the group's CEO in 2022, but left the position after just one year. Some observers believe that Xu Ran, who once served as CFO, is better able to implement Liu Qiangdong's vision. Over the past year, under Liu Qiangdong's remote guidance, JD.com has revived its low-price strategy, launched a hundred-million subsidy program, supported third-party merchants in price wars, and successfully gained attention during Singles' Day by challenging Li Jiaqi. However, it is difficult to say that JD.com's low-price strategy has achieved significant results.

Throughout 2023, JD.com's quarterly revenue growth rates were 1.4%, 7.6%, 1.7%, and 3.6%, a far cry from its previous growth rates. More effective were JD.com's cost-cutting measures, such as shutting down overseas operations and reducing operating costs. Last year, JD.com's net profit increased by 133% year-over-year to RMB 24.2 billion, and its non-GAAP net profit increased by 24.8% year-over-year to RMB 35.2 billion.

This year, JD.com's profit growth has consistently outpaced its revenue growth. In the first quarter, while revenue grew 7%, net profit increased by 13.9% year-over-year, and non-GAAP net profit increased by 17.2% year-over-year. Despite just 1.2% revenue growth in the second quarter, JD.com achieved a net profit of RMB 12.6 billion, up 92.1% year-over-year, and a non-GAAP net profit of RMB 14.5 billion, up 69% year-over-year. Liu Qiangdong has not appeared on JD.com's earnings calls in a long time, but his presence still looms over the company's headquarters in Yizhuang. During this year's 618 shopping festival, a leaked video of Liu Qiangdong's "internal wolf-like pep talk" went viral, in which he declared that those who do not strive are not his brothers and called on employees to work hard - arguably the biggest news of the 618 period for JD.com this year.

02|Logistics Supports Growth, Subsidies Total RMB 4.5 Billion

To some extent, JD.com's profits are like a sponge soaked in water; squeezing it always yields something. JD.com CFO Shan Su said that the company's improved profit margins stem from its continuous cost advantages and efficiency gains. There is some truth to this, as JD.com's inventory turnover days have continued to decline over the past year, with 29.8 days in the second quarter of this year, nearly two days fewer than last year. More notably, JD.com has continued to reduce costs.

In the second quarter, JD.com's operating costs decreased by 0.4% year-over-year, a reduction of RMB 1 billion, while general and administrative expenses decreased by 9.6%, a reduction of RMB 300 million. JD.com's revenue consists of two parts: merchandise revenue, primarily from self-operated products, and service revenue contributed by third-party sellers, including platform advertising and logistics revenue. In the second quarter of this year, JD.com's merchandise revenue saw little growth, while service revenue increased by 6.3% year-over-year due to the influx of third-party sellers.

Screenshot of JD.com's Q2 2024 Earnings Report. Of the three major segments - JD.com Retail, JD.com Logistics, and New Businesses (including Dada, JD Logistics Development, and JDX) - JD.com Retail's revenue grew by just 1.5% in the second quarter, while New Businesses declined by 35% year-over-year. Only JD.com Logistics achieved 7.7% growth, with an operating margin of 4.9%, the highest among the three segments. JD.com Logistics' previously released financial report showed that it achieved an adjusted net profit of RMB 3.12 billion in the first half of this year, a year-over-year increase of 2,631.2%. JD.com Logistics has been profitable for five consecutive quarters. In addition to this revenue, JD.com also recognized RMB 4.7 billion in non-operating profit in the quarter, RMB 3.5 billion higher than the same period last year.

JD.com explained that this profit was primarily due to increased government subsidies and reduced investment-related losses. Earlier this year, government departments issued the "Action Plan for Promoting Large-scale Equipment Upgrading and Consumer Goods Trade-in," launching a new round of large-scale home appliance replacements. Xu Ran said during the earnings call that it is estimated that this trade-in strategy will bring some incremental growth to home appliances and JD.com.

In the first half of the year, JD.com spent a total of US$3.3 billion repurchasing shares. At the close of Hong Kong trading today (August 16), JD.com's share price was HK$108.20, up 8.91%.