Just overtaking Wenjie, Leapmotor sets a new military order: become TOP5 in three years

![]() 08/19 2024

08/19 2024

![]() 677

677

Volume ratio is more important than gross margin

Author | Wang Lei, Liu Yajie

Editor | Qin Zhangyong

After six months of price wars, it's time to accept the test of the market. Leapmotor was the first to release its 2024 half-year report.

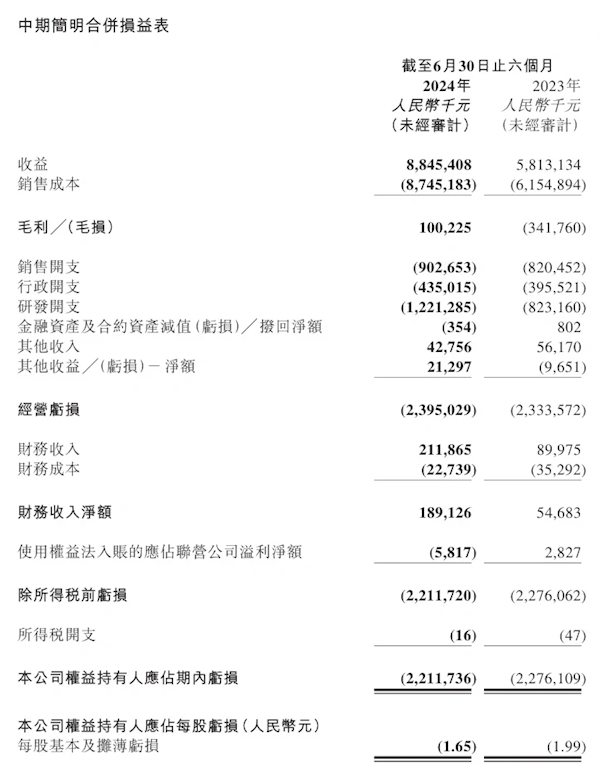

In the first half of the year, revenue reached 8.85 billion yuan, a year-on-year increase of 52.2%, with 86,696 vehicles delivered, a year-on-year increase of 94.8%.

Looking at these two sets of data alone, it does leave other new car makers far behind, ranking firmly in the first tier in terms of both growth and delivery volume. More interestingly, in last week's sales ranking, Leapmotor surpassed Wenjie and is now second only to Lixiang, truly becoming the "little Lixiang".

Although the book value data is good, the impact of the price war can still be seen from an overall perspective.

The most obvious is that although revenue has surged, net losses are still flat year-on-year, both at around 220 million yuan. Gross margin has improved, but only from -1.4% in the first quarter to 1.1% in the second quarter.

However, Leapmotor is confident about the second half of the year, planning to sell 250,000-300,000 vehicles in 2024 with a gross margin of 5%-10%.

Who gave Leapmotor such confidence?

01 Revenue soars while losses remain flat

First, let's look at Leapmotor's fundamentals over the past six months.

In the first half of this year, Leapmotor's operating revenue was 8.85 billion yuan, a year-on-year increase of 52.2%. This surge in revenue was thanks to the continuous increase in sales. In the first half of this year, Leapmotor delivered a cumulative total of 86,696 new vehicles, a year-on-year increase of 94.8%, setting a new half-year record for deliveries and ranking after Lixiang, Wenjie, Zeekr, and NIO.

The upward trend continues, with Leapmotor delivering over 20,000 vehicles in July, surpassing Zeekr and NIO to become the third-ranked new force, after Lixiang and Wenjie.

Thanks to economies of scale, Leapmotor's gross margin for the first half of the year was 1%, up from -5.9% in the same period last year, marking the second time Leapmotor's gross margin has turned positive.

However, Leapmotor's positive gross margin in the first half of the year is largely attributed to its performance in the second quarter.

Leapmotor's revenue in the second quarter reached 5.359 billion yuan, a year-on-year increase of 22.6% and a quarter-on-quarter increase of 53.7%. Compared to the first quarter's gross margin of just -1.4%, the second quarter's gross margin increased significantly to 2.8%, lifting the first half's gross margin to 1.1%.

Even though the second quarter's gross margin increased substantially, it was still below market expectations, which had previously projected a gross margin of 5.5% for Leapmotor in the second quarter of this year.

In the first half of the year, the net loss attributable to equity holders of the company was 2.212 billion yuan, narrower than the 2.276 billion yuan in the same period in 2023 but not significantly. The adjusted net loss was 2.016 billion yuan, compared to 1.937 billion yuan in the same period in 2023.

Leapmotor has also provided an explanation for the significant increase in gross margin during the reporting period without a noticeable narrowing of losses. This is primarily due to increased R&D investments and the transition from old to new models. In the first half of this year, R&D expenses reached 1.221 billion yuan, an increase of 48.4% year-on-year.

Wu Qiang, Co-President of Leapmotor, explained that while the company's gross margin increased by 440 million yuan year-on-year in the first half, R&D expenses increased by nearly half, consuming nearly 400 million yuan more than the previous year, resulting in an offset.

Specifically, R&D expenses include investments in the development of future new models and intelligent driving technologies. Leapmotor has also embarked on developing an "end-to-end large model" for intelligent driving and application development.

According to Leapmotor's disclosed timeline, it plans to introduce more advanced intelligent driving capabilities and further functional optimizations in the second half of 2024, including open-road point-to-point commuting capabilities and memory parking in parking lots. It also plans to introduce urban intelligent driving functions (CNAP) based on the end-to-end intelligent driving large model within 2025.

In addition, Leapmotor has hired many new employees this year, especially R&D talent.

The financial report shows that as of June 30, 2024, Leapmotor had a total of 10,844 full-time employees, of which 47.2% were in manufacturing roles and 3823 (35.3%) were in R&D roles. At the end of last year, there were only 2,929 R&D personnel, so the company has expanded its R&D team by nearly 1,000 in just six months.

The other side of increased revenue without increased profits is the aftermath of the intense price war at the end of the first quarter, which dragged down the entire first-half performance.

Leapmotor, which relies on "cost-effectiveness" in the market, has mainly positioned its models in the 100,000-200,000 yuan price range. However, pricing power in this segment is still dominated by BYD, leaving Leapmotor to follow its pricing strategy.

In February of this year, BYD launched its "Glory Edition" models, forcing Leapmotor, with highly overlapping price ranges, to follow suit with price cuts.

In early March, Leapmotor launched its 2024 models with across-the-board price reductions. The C01 saw price reductions of 13,000-50,000 yuan, while the T03 saw reductions of 10,000-20,000 yuan. Additionally, limited-time discounts of 15,000-32,000 yuan were offered on 2023 models.

Leapmotor's concessions at the terminal affected the profit per vehicle. According to the financial report, the cost per vehicle in the first quarter was 106,000 yuan, an increase of 17,000 yuan from the previous quarter, which was the main reason for the negative gross margin in the first quarter.

Moreover, the 2024 models were launched in March, meaning that the impact of price reductions was only partially reflected in the first quarter, and the full impact of price reductions for the new C10 model, which completed its ramp-up in the second quarter, was reflected in that quarter.

In the second quarter of this year, Leapmotor's average selling price per vehicle decreased by 4,000 yuan quarter-on-quarter. The increased proportion of the lower-priced C10 electric version and the impact of price reductions on the 2024 models were fully reflected in the second quarter, leading to a decline in the average selling price per vehicle.

02 Aiming to become TOP5 in three years

Compared to NIO, Xpeng, and Lixiang, Leapmotor's presence is not as prominent. However, in terms of actual sales, this dark horse is gaining momentum rapidly.

According to their own statements, their goal is to become one of the top eight automotive brands in the Chinese market next year, enter the top six the year after, and become one of the top five in the third year. They hope to achieve overall profitability by 2025.

It won't be easy to achieve the goal of becoming one of the top five in the market in three years. The current market is highly competitive, with both traditional automakers and new carmakers vying for the last remaining market share. Nobody knows who will survive in the end.

Zhu Jiangming, Founder and Chairman of Leapmotor, said on a conference call that the company would continue to increase investments in human resources, computing power, and equipment in the field of intelligent driving for some time to come. In his view, the next three years will be a critical period for Leapmotor's development, including whether it can become one of the top five in the market, which will depend on whether the company can survive well.

"In the Chinese market, every automaker must seize the next three years," said Zhu Jiangming. He believes that in three years, there may be very few purely fuel-powered vehicles left, with only electric, extended-range, and plug-in hybrid vehicles remaining.

As for market share, Zhu Jiangming has his own judgment. From Leapmotor's perspective, volume is more important than gross margin or gross profit. Without scale, there will be no capital for competition in the future. "Of course, we can't sell at a loss. We must have a certain gross margin and gross profit. Leapmotor aims to achieve an average gross margin of 5% this year, or even better, and move towards 10% next year, ultimately reaching 15%," he said.

Currently, Leapmotor's main models are the C10, C11, and C16, which contribute over 70% of sales. The C16, which was launched in June this year, received over 10,000 orders in its first month on the market.

Moreover, compared to other new carmakers, Leapmotor's biggest differentiated competitive advantage lies in its partnership with the Stellantis Group.

On May 14th of this year, the Stellantis Group and Leapmotor formally established a joint venture, Leapmotor International, in which Leapmotor holds a 49% stake.

The joint venture exclusively owns the rights to export and sell Leapmotor vehicles to all global markets outside of Greater China, as well as the exclusive rights to locally manufacture Leapmotor vehicles.

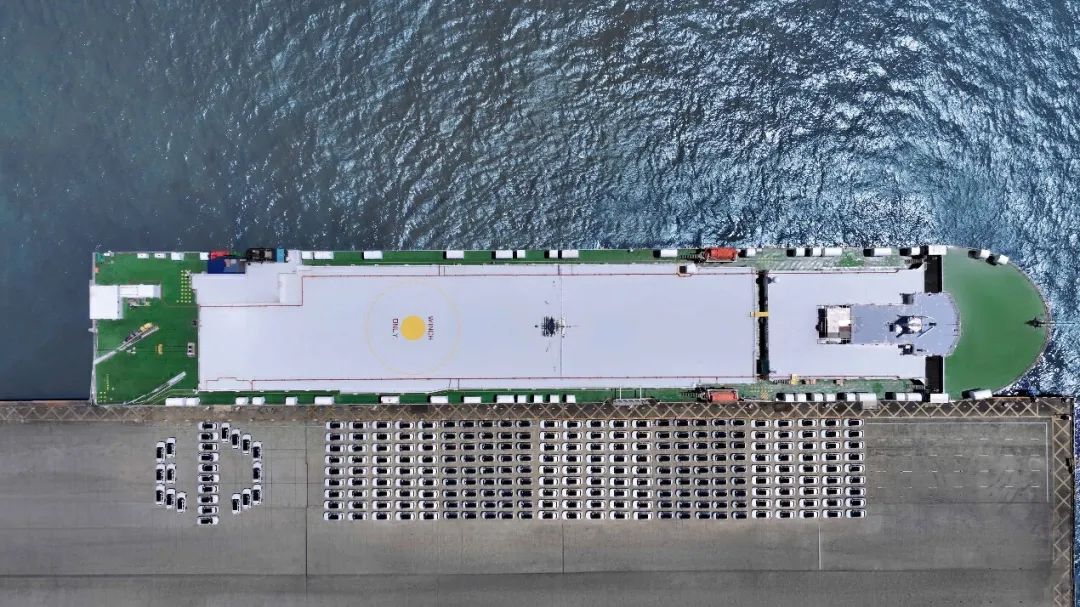

To date, nearly 2,000 C10 and T03 vehicles have been shipped to Europe by sea, and more extended-range electric vehicles will be introduced to meet the different needs of the European market.

By the end of this year, Leapmotor International plans to expand its sales network in Europe to over 200 outlets and to 500 outlets by 2026. In the fourth quarter of this year, Leapmotor International will also enter the Asia-Pacific, Middle East, Africa, and South America markets.

With the help of the Stellantis Group's sales channel advantages, Leapmotor can easily expand its global reach.

Leapmotor expects to export 60,000-100,000 vehicles in 2025, and next year, it will launch the B-series models, which are expected to further boost sales.

Now that more than half of the transition to new energy has been completed, automakers have limited time left. With the help of the Stellantis Group, Leapmotor's advantages will be amplified. Whether it can become TOP5 in three years depends on whether the market will buy it.