US Stocks: After the Scare, Back to the Music?

![]() 08/20 2024

08/20 2024

![]() 429

429

After a series of incidents such as the delay of NVIDIA's Blackwell, tech giant jitters, employment declines, and the Bank of Japan's interest rate hike, the market is taking a closer look and realizing that the US economy has its own inertia, not swinging wildly from boom to bust overnight.

In our previous Strategy Weekly, "US Stocks Continue to Explode with 'Ghost Stories', No Bottom to the Drop?", Dolphin Insights mentioned that July's employment and unemployment data should not be taken too seriously due to weather disruptions. The adjustment in US stocks appears more like a valuation correction amidst a backdrop of continued gains, fueled by various "ghost stories." Assuming the economy does not take a sharp downturn but rather follows a soft landing path, the likelihood of interest rate cuts increases, thereby reducing risks for US stocks. Subsequent July economic data, including inflation and retail sales, point to a soft landing rather than a recession.

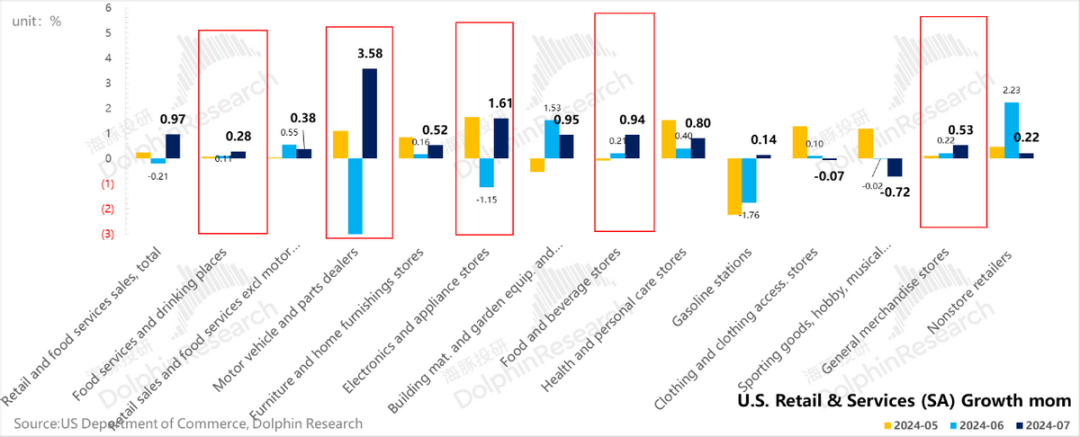

I. Consumption Engine: Slowing Down, Not Collapsing

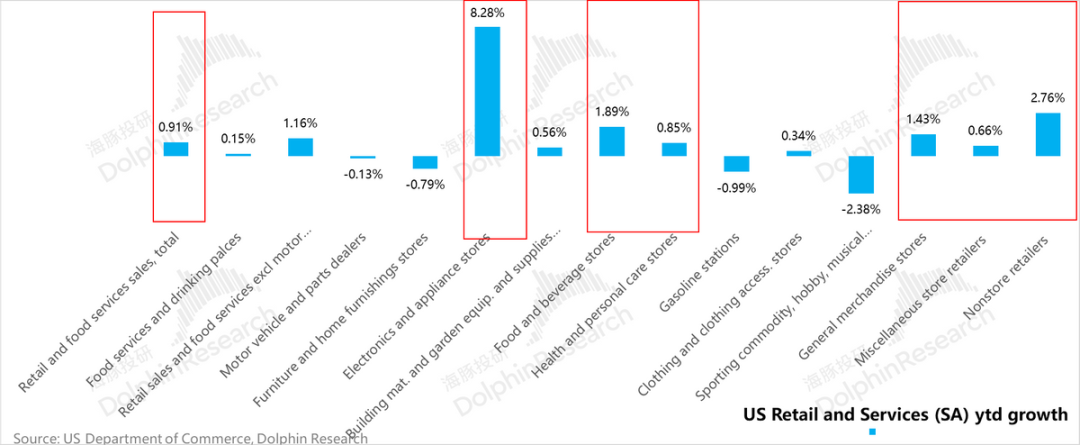

When US retail sales for June were released, the seasonally adjusted month-on-month total was negative, leading some to prematurely declare the death of the US consumption engine. However, July proved them wrong, as auto and parts retail sales, the largest category in retail sales with monthly volatility, rebounded significantly.

Moreover, other discretionary spending categories such as 3C, electronics, construction materials, gardening, and even the struggling restaurant industry, began to recover. Essential spending categories like food and beverages, healthcare, and daily necessities also accelerated their growth rates this month.

Smoothing out monthly fluctuations and looking at year-to-date changes, it becomes evident that rigid demand remains resilient, while discretionary spending categories like autos, furniture, and sports hobbies generally performed poorly, and restaurant spending gradually weakened. This represents a slowing trend in consumption growth rather than a sudden collapse.

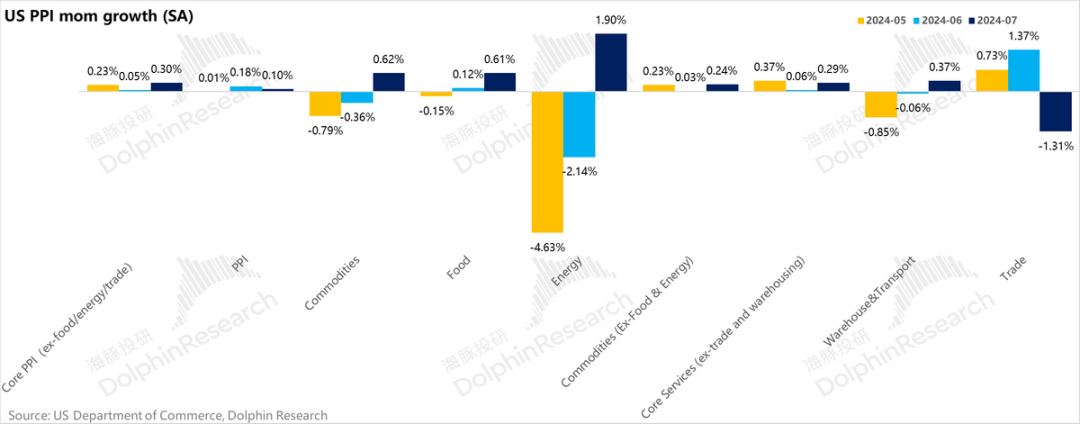

II. Another Month of Good Inflation News

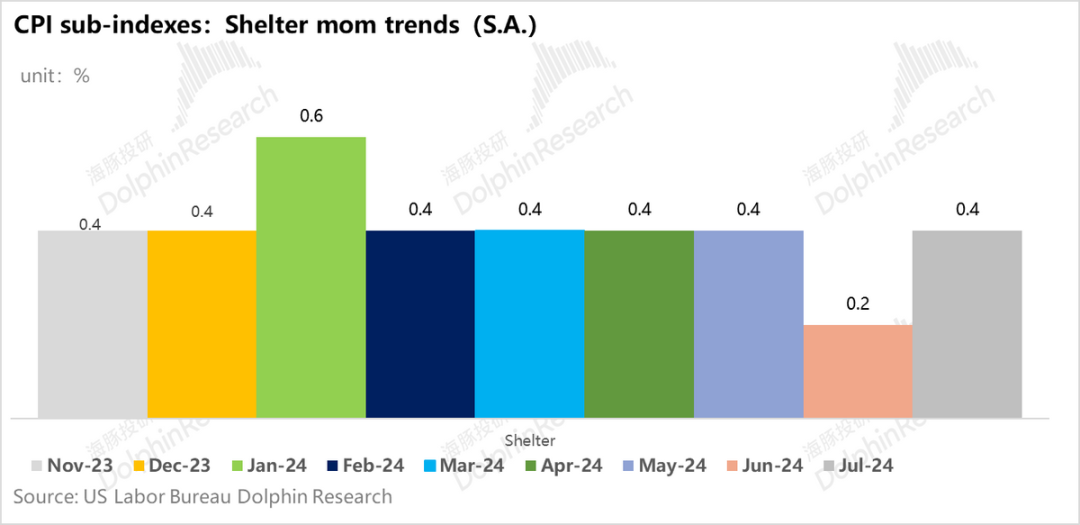

June's data raised concerns about overtightening, but July saw shelter costs return to a 0.4% month-on-month increase, pushing core CPI back into the safe zone of 0.17% from 0.06% for three consecutive months. This should give the Fed confidence to proceed with interest rate cuts.

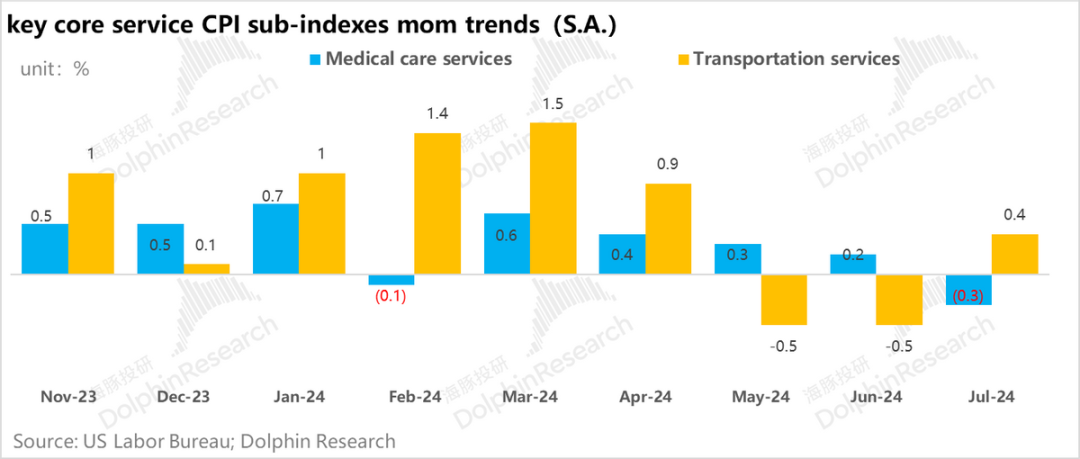

The recent CPI decline appears more sustainable. Besides food and energy, which have seen inflation ease, core services (excluding shelter costs) are also declining significantly. Key components like medical care and transportation prices have been trending downwards in the past three months.

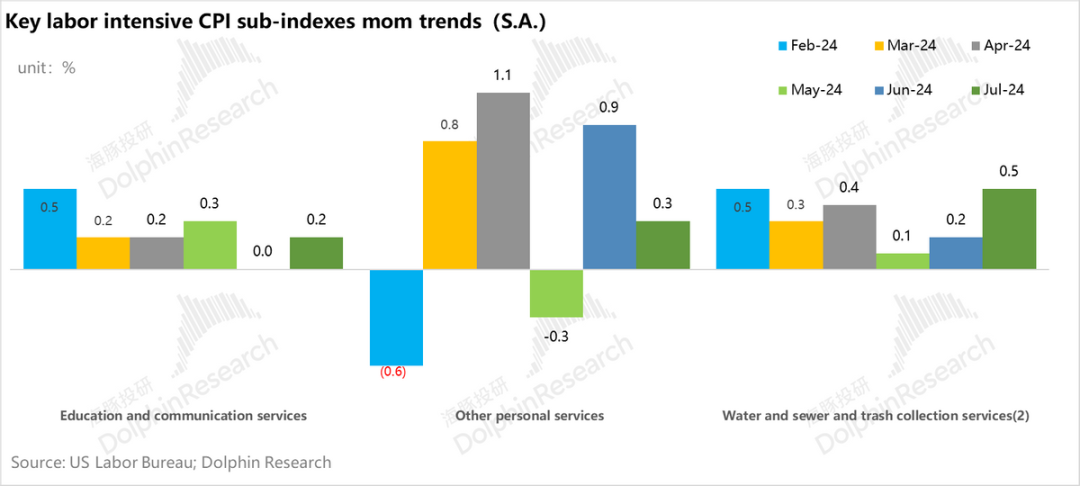

The relatively uncertain factor remains sectors with high labor costs, such as education, personal services, and waste disposal.

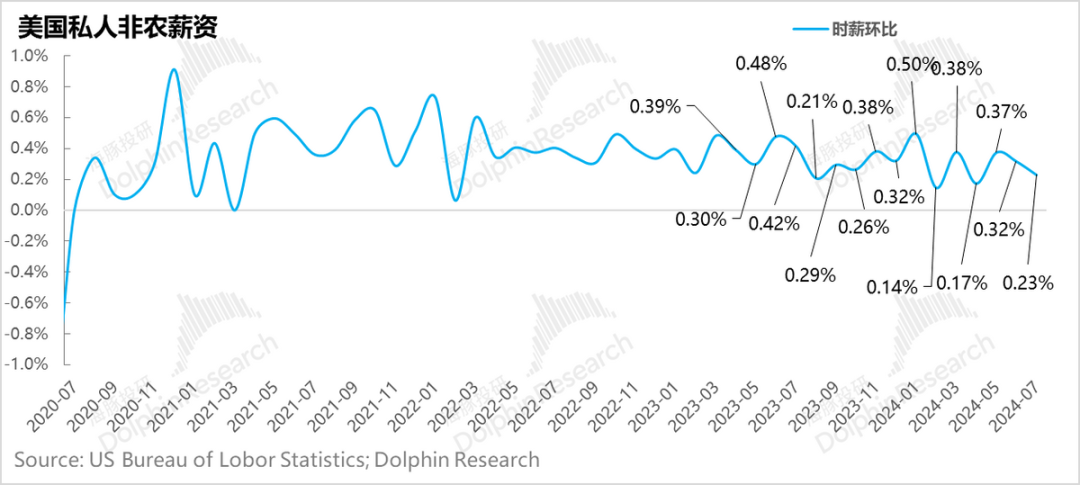

However, with faster labor supply growth and rising unemployment, wage growth is returning to a manageable range. July's nominal wage growth was 0.2%, within the safe zone for monthly growth.

Collectively, July's inflation data points to a soft landing for the US economy rather than a direct recession.

Moreover, Dolphin Insights' coverage of various trading platforms during earnings season, including Amazon's revenue guidance, Airbnb's quarterly results and guidance, and even Uber's weaker North American orders, all indicate a gradual weakening in consumption and economic growth. However, these declines, supported by healthy household balance sheets, resemble a slow and natural process rather than a sudden storm.

The micro-level experience also suggests a soft landing for the US economy, not a hard landing or no landing at all.

III. Opportunities in Chinese and US Stocks Post-Adjustment

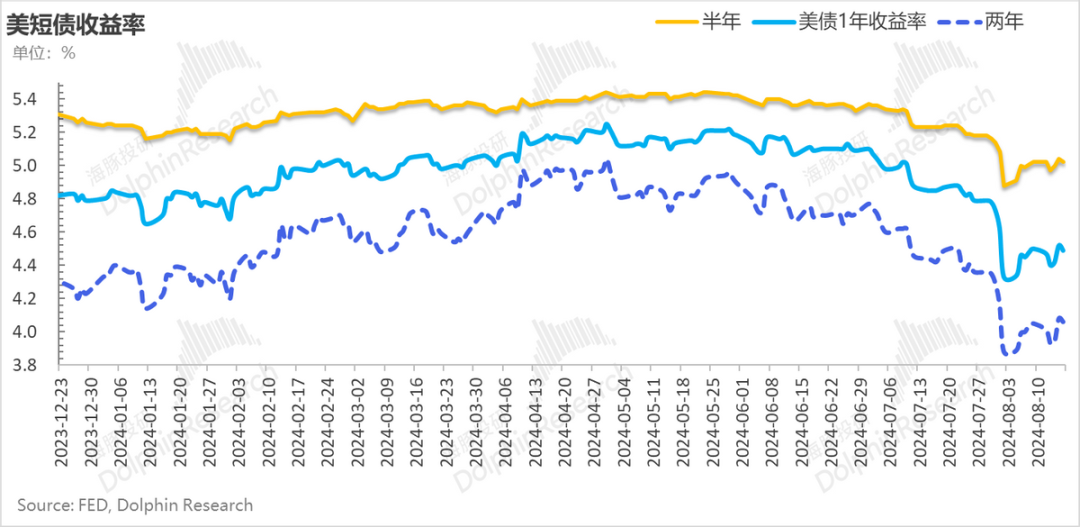

On a soft landing path, earnings per share (EPS) growth slows, but the risk-free rate also declines due to disinflation and interest rate cut expectations. Recent retail sales and inflation data have led to slightly higher interest rate cut expectations, now at two to three times this year, within a reasonable range. This has fully priced in rate cuts this year and tempered some of the overvaluation seen under optimistic expectations.

In this scenario, Dolphin Insights prefers assets with higher sensitivity to discount rates and slower EPS growth, or those with overseas growth offsetting North American slowdowns and mitigating the negative impact of a weaker US dollar.

Besides the well-known tech giants with nearly 50% of revenue from overseas, some high-quality niche players, like Uber, with strong overseas growth, can not only offset North American weakness but also drive overall growth. Their current investments also appear more manageable compared to the US giants.

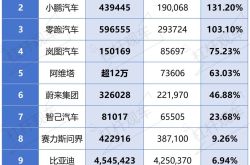

Chinese stocks have not benefited significantly from US rate cut expectations, but Dolphin Insights believes that as US rate cuts kick in, some room may open up for RMB rate cuts, helping to ease high borrowing costs and weaken economic growth expectations. With government spending expected to pick up in the second half and short-term earnings season negatives gradually dissipating, Chinese stocks could see a rebound with US rate cuts.

Dolphin Insights has begun to rebuild positions trimmed earlier.

IV. Portfolio Rebalancing and Performance

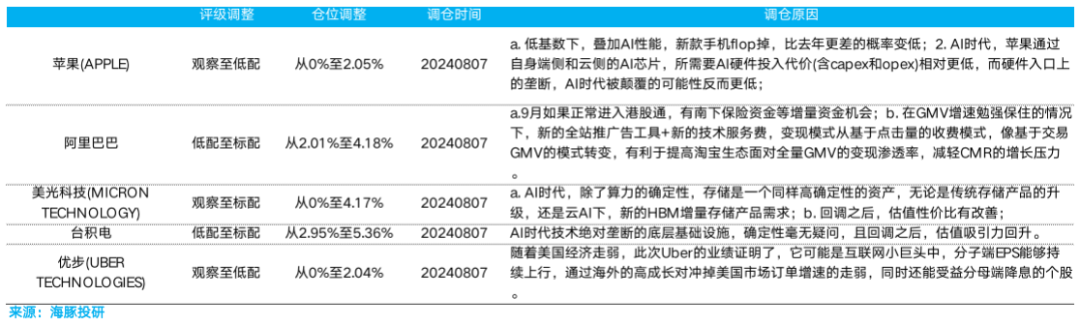

With the US earnings season over and the yen rate hike-induced valuation correction ending, Dolphin Insights slightly increased positions based on individual stock performance and upside potential.

Focusing on AI-related high-end wafer fabrication and flash memory, Dolphin Insights cautiously selected Apple among tech giants due to its strong hardware recovery prospects, relatively low AI investment costs, and high certainty of outcomes.

Selected stocks and rebalancing reasons are as follows:

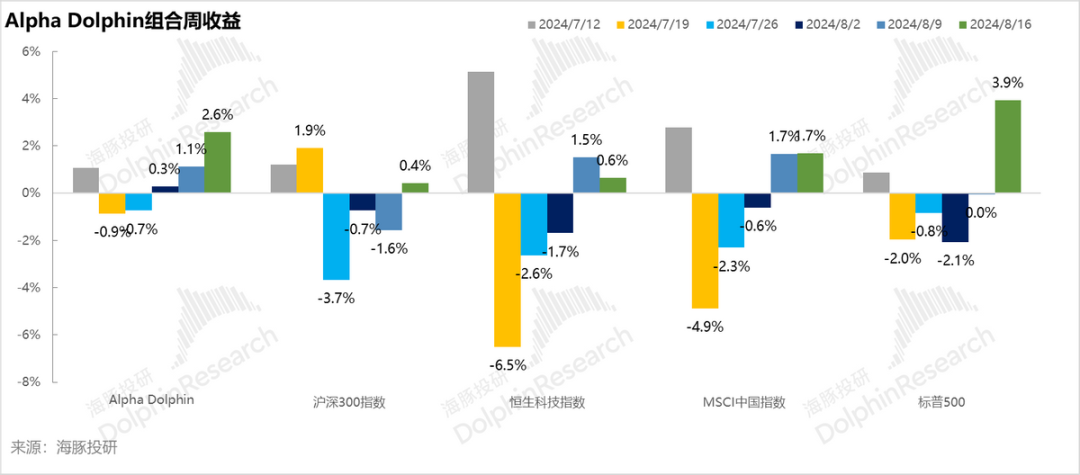

Portfolio returns rose 2.6% last week, outperforming MSCI China (+1.7%), Hang Seng Tech Index (+0.6%), and CSI 300 (+0.4%) but underperforming the S&P 500 (+3.9%).

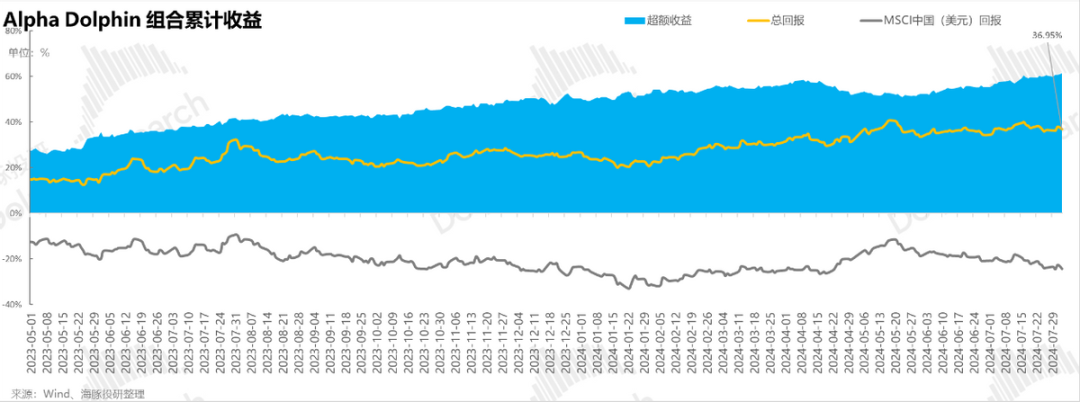

Since inception, the portfolio has generated an absolute return of 42%, outperforming MSCI China by 64%. With an initial virtual asset value of $100 million, the current value stands at $144 million.

V. Individual Stock Performance Contributions

With the yen rate hike risk subsiding and earnings season ending, recent CPI and retail sales data indicate the US economy is on a soft landing path. US stock trading has returned to normal, with soft landing rate cut expectations and a weaker US dollar benefiting companies with higher overseas exposure. Trading has returned to tech giants.

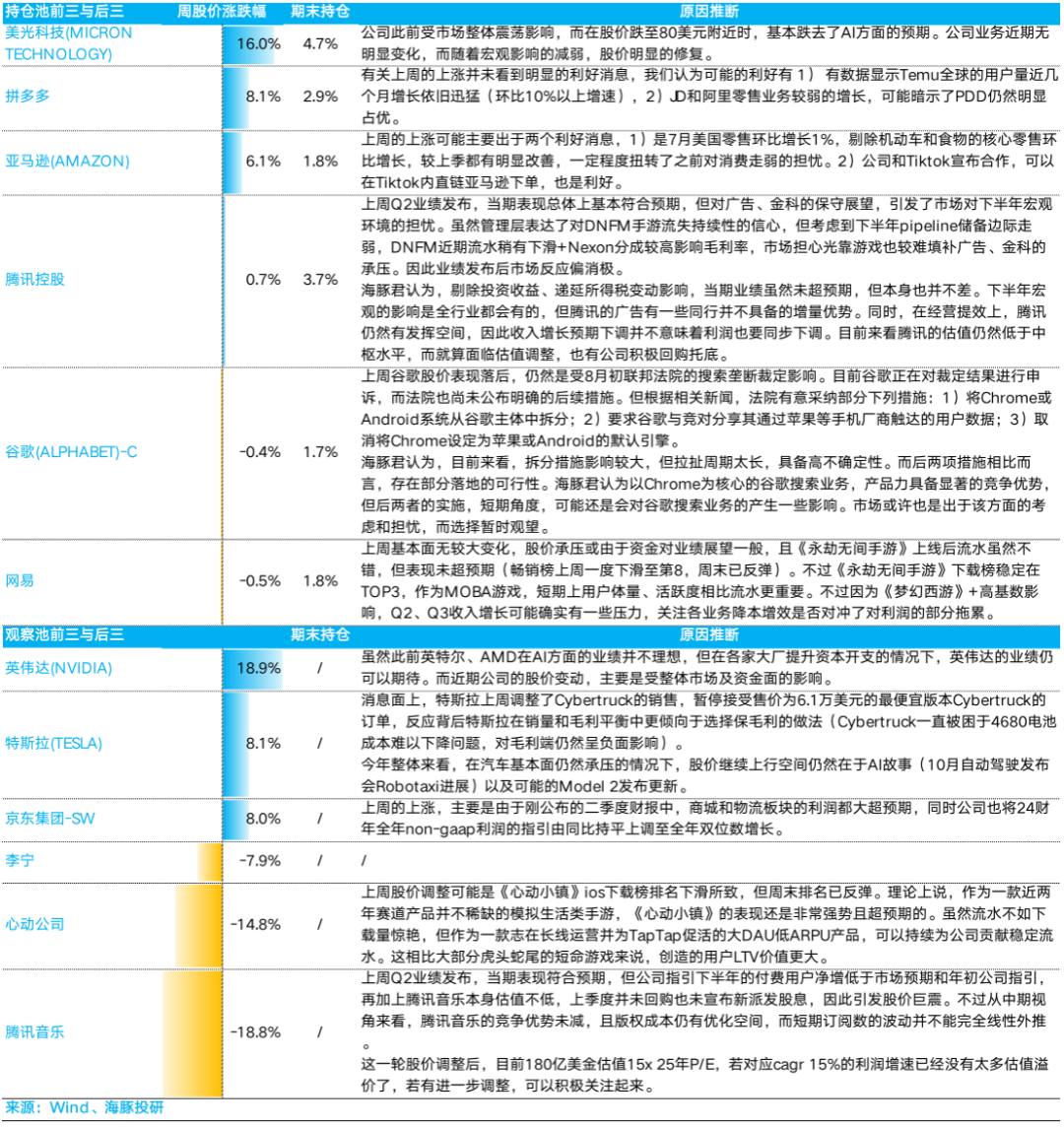

Dolphin Insights explains the significant price movements in its stock pool last week as follows:

VI. Portfolio Asset Allocation

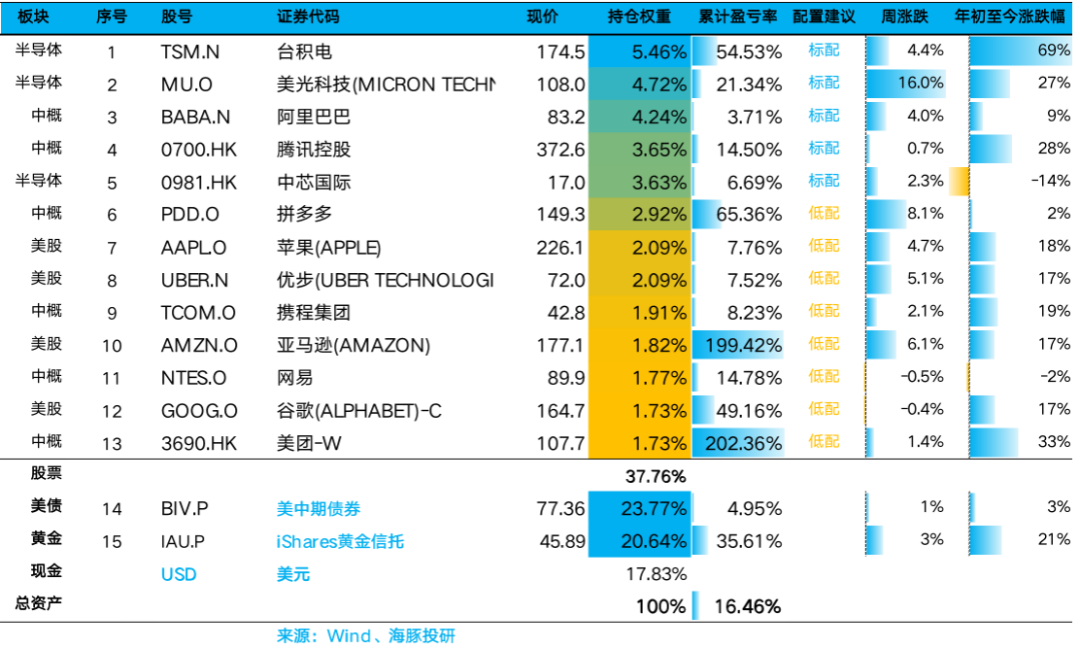

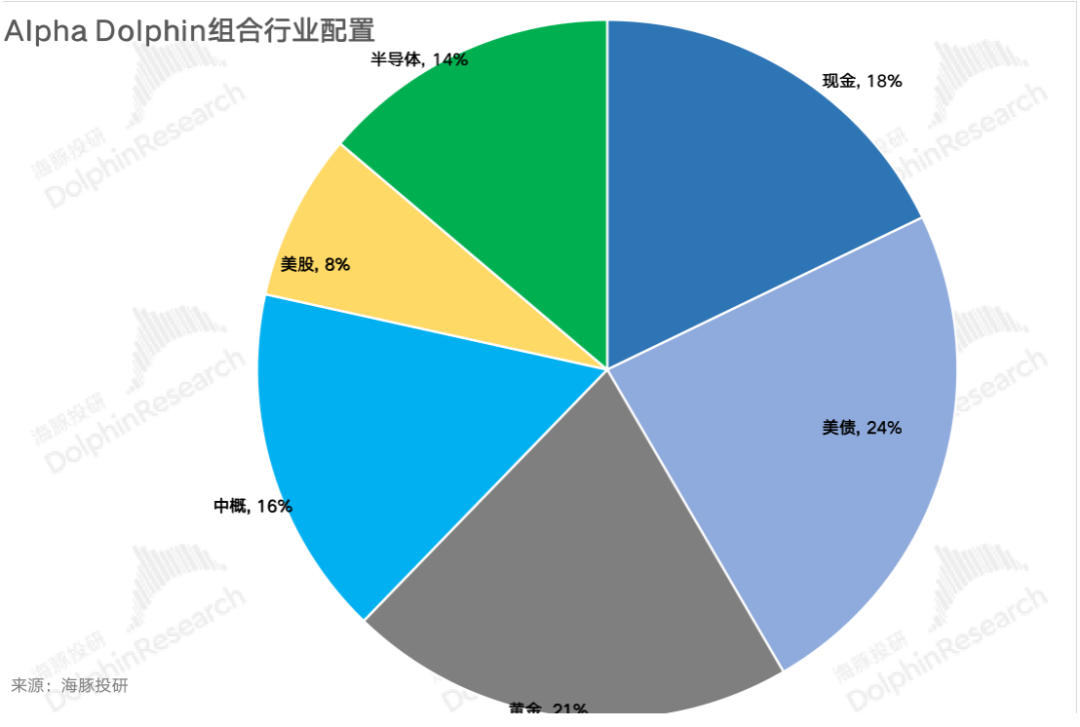

The Alpha Dolphin virtual portfolio holds 13 stocks and equity ETFs, with five standard and eight underweight positions. The remainder is allocated to gold, US Treasuries, and USD cash. As of last weekend, the asset allocation and equity holdings were as follows:

VII. Key Events This Week

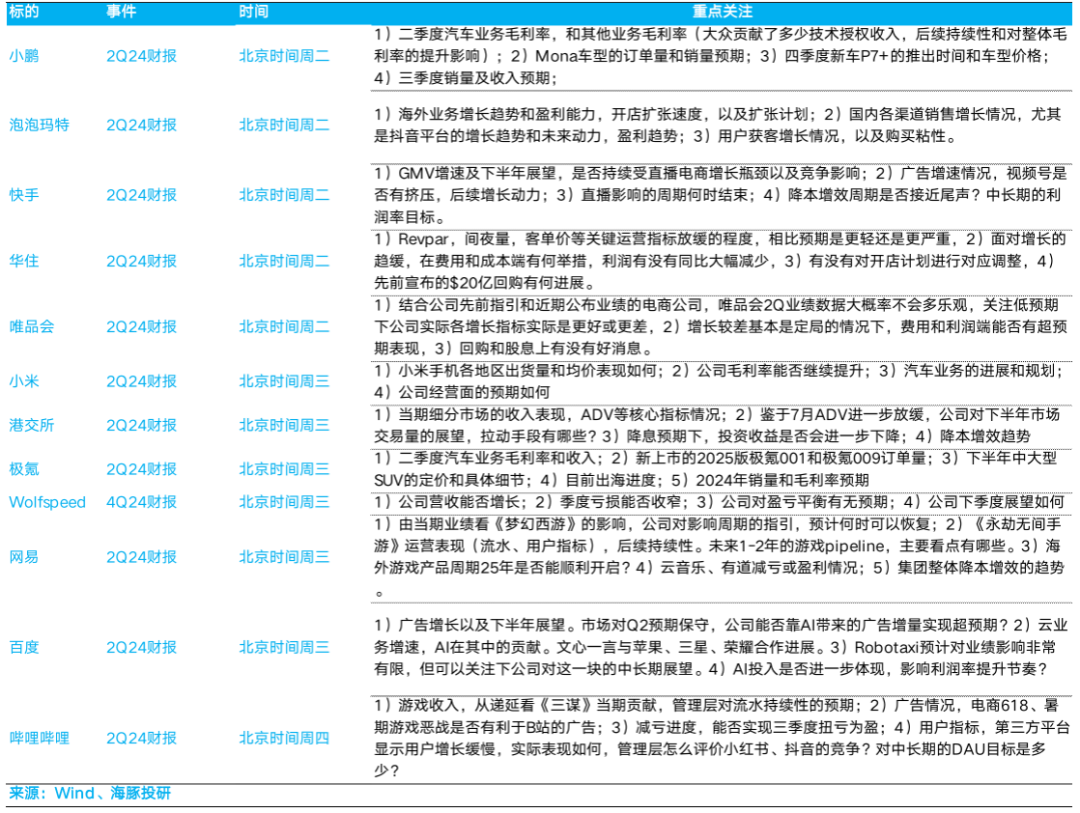

The US earnings season has ended, and Chinese companies like Alibaba and Tencent have released their results. This week, niche Chinese players will report earnings. Key companies to watch include POP MART, Bilibili, and Xiaomi, each with unique overseas strategies.

For other companies like Kuaishou, Baidu, Huazhu, and Vipshop, avoiding bombshells will be a relief. For new energy vehicle players like XPeng and ZEEKR, observation remains key to understanding the intensity of competition in the second half.

Dolphin Insights' focus on these companies is summarized below: