More bargaining chips in supplier negotiations: JD.com's dividend can last for another six months

![]() 08/20 2024

08/20 2024

![]() 540

540

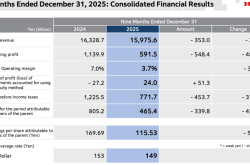

In recent days, many friends have excitedly said, 'I didn't expect it, JD.com launched a satellite.' The reason for the surprise is that despite the backdrop of consumption upgrading, JD.com is still adhering to the strategy of 'low price first' (the overall consumer market is also relatively weak), which typically erodes corporate profits. However, in the Q2 2024 financial report, JD.com has indeed launched a 'satellite', with operating profit reaching 10.5 billion yuan, an increase of nearly 25% year-on-year.

Among them, JD.com's retail operating profit increased from 8.1 billion yuan in the same period last year to 10.1 billion yuan. This reality differs greatly from the initial presupposition, surprising many friends.

In fact, in our previous analysis of JD.com, we have conducted a very detailed analysis of the improvement in its retail sector profits, all of which have been verified:

1) General merchandise has become the main force driving the improvement of JD.com's gross margin, partly due to favorable timing and partly due to its years of operational experience. Simply put, in the current domestic demand environment, JD.com's bargaining power with suppliers has increased, which has helped improve its profitability.

2) JD.com's open platform strategy has not stopped. On the contrary, with marketing expenses rising again, JD.com is eager to compensate for its user base shortcomings by acquiring new users, as without users, subsidies to merchants would be meaningless.

3) JD.com's operations remain prudent. Whether from a business strategy or human resource management perspective, JD.com hopes to improve sustainability by enhancing efficiency in the short term.

These factors largely explain the improvement in JD.com's profit and loss statement. However, on the other hand, the stagnant growth of self-operated e-commerce casts a shadow over the company. If the total volume does not increase, profitability improvements will eventually reach their limits. How should we evaluate JD.com then?

With these questions in mind, we have written this article with the following core viewpoints:

Firstly, the improved negotiation power with suppliers in self-operated businesses is an important reason for JD.com's recent profitability improvements.

Secondly, JD.com's open platform business is still in the 'water storage' stage, requiring it to monetize concessions to appease merchants.

Thirdly, JD.com's dividend period may last for about another six months. Time is of the essence.

Improved Negotiation Position with Suppliers

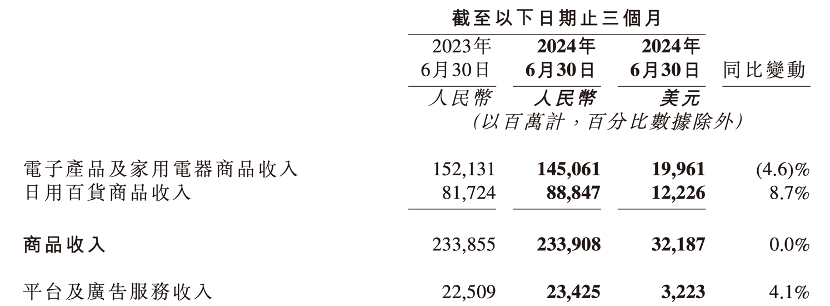

In Q2 2024, JD.com's self-operated business did not experience growth year-on-year. Affected by factors such as the real estate downturn, 3C and home appliances experienced a contraction, while daily necessities grew significantly.

With the decline of offline retail channels represented by GOME and Suning, JD.com has become the largest single channel for 3C and home appliances. This has given JD.com greater bargaining power with suppliers, and coupled with the weak domestic demand environment, these factors have prompted upstream suppliers to actively make concessions to JD.com.

JD.com implements its 'low price' strategy in two main ways:

1) Demanding lower prices from upstream suppliers;

2) Subsidizing consumers through the platform.

Based on our observations and analysis, JD.com primarily relies on the former approach. In other words, even though total revenue has stagnated, JD.com can still squeeze out profits from upstream procurement. This is the main reason for profitability improvements, in addition to cost reduction and efficiency enhancement.

The same is true for daily necessities. After social order returned to normal at the end of 2022, significant changes occurred in the retail industry. For example, after the 'safeguarding people's livelihood' dividend disappeared, offline supermarkets suddenly became empty, with few customers.

It was originally thought that this would be the beginning of a boom in offline retail, but customers simply refused to buy. At the same time, companies such as Meituan and Douyin vigorously promoted instant retail, turning offline supermarkets into suppliers that gradually no longer directly face consumers (Walmart, Carrefour retreat in China, Pangdonglai had to rescue Yonghui).

We can imagine that in the original retail ecosystem of supermarkets, some manufacturers only needed to negotiate entry with a dozen leading supermarket chains and set prices for storage. However, after supermarkets' ability to control inventory gradually disappeared, manufacturers needed to find new channels.

JD.com's general merchandise sales exceeded 88.8 billion yuan in a single quarter (Q2 2024). Such a centralized procurement advantage is naturally valued by manufacturers. Coupled with JD.com's logistics support, customers only need to deliver goods to JD.com's warehouses, saving many circulation hassles. At this time, JD.com's supermarkets have increased pricing power over general merchandise manufacturers. The contribution of general merchandise to the improvement of self-operated gross margin has thus been strengthened. Even though JD.com continues to emphasize low prices, it can still achieve high gross margins for general merchandise.

Generally speaking, if overall demand is weak, it should be bearish for retailers. However, JD.com can use its channel advantage to increase its bargaining power with the supply chain, significantly improving profitability even with almost no revenue growth.

This conclusion is not based on speculation but can be verified by specific data.

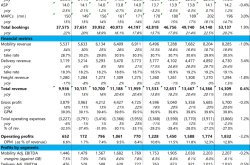

After 2021, JD.com accelerated the construction of its open platform, such as the high-profile launch of the low-priced platform Jingxi. Business model adjustments inevitably affect the income statement results. For example, after 2021, JD.com's gross margin grew with the growth of the open platform (as the proportion of self-operated business revenue decreased). However, in recent quarters, the two lines have diverged somewhat.

For example, in Q1 2024, both the proportion of self-operated business revenue and gross margin increased, and in Q2 2024, the improvement in gross margin was significantly greater than the decrease in the proportion of self-operated business revenue.

These all point to an improvement in JD.com's self-operated business gross margin.

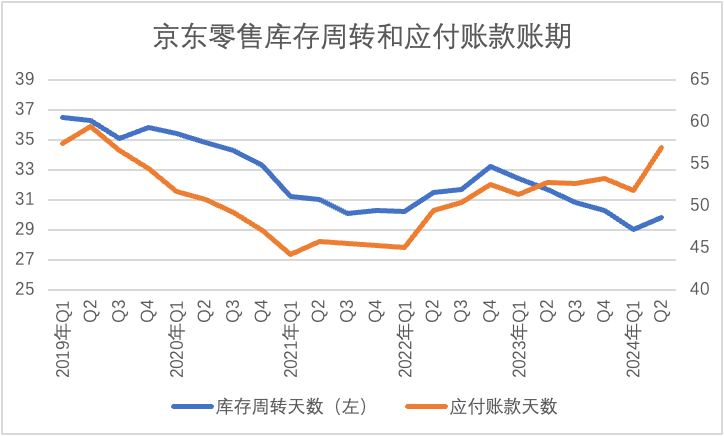

JD.com's 'efficiency improvement' is not only reflected in the gross margin indicator but also in the operating turnover speed. In recent years, JD.com has improved inventory turnover efficiency by controlling inventory scale. On the other hand, its payment terms with suppliers have been quietly extended (Q2 2024 was almost the highest in recent years).

Payment terms are often seen as the result of a game between producers and sellers. In other words, when the channel is strong, it will demand longer payment terms from upstream suppliers. If suppliers are strong (with products in short supply), they will inevitably demand higher premiums and shorter payment terms.

Verified by data, we find that:

1) JD.com's self-operated gross margin is indeed improving;

2) Suppliers' negotiation position is indeed weaker.

The inference and reality align, which is the main reason for JD.com's self-operated business to improve profitability.

Dividend for another six months, JD.com still needs to work hard

In contrast, JD.com's open platform presents a different picture.

On the one hand, the business GMV is still expanding, with advertising and platform revenue growing by 4.1% year-on-year in the quarter. On the other hand, marketing expenses grew by 7.3% year-on-year.

The success of the open platform primarily depends on the total traffic volume. When a company's strategy shifts towards this model, it will push up traffic acquisition costs (low-price subsidies can also be seen as a broad sense of 'traffic acquisition').

If JD.com has strong bargaining power with self-operated merchants and is in a strong position in price negotiations, its negotiations with open platform merchants are relatively weaker. The platform must offer merchants sufficient preferential policies, including but not limited to increasing traffic acquisition and reducing monetization rates.

Even the stagnation of self-operated business growth is a result of platform regulation: internal resources are tilted more towards the open platform, and the weight of self-operated business decreases accordingly.

Recently, mainstream e-commerce platforms have announced the end of 'involution' and the shift from a low-price model to GMV-driven growth. Only JD.com insists on low prices. As a major tag for JD.com, 'consumption upgrading' once gave the platform huge premium space, but in the new consumption environment, this advantage has become a burden. Therefore, the company hopes to force itself to complete the transformation in adversity (third-party order volume and GMV share will exceed that of self-operated business), cultivating the open platform into a new profit source.

This leads JD.com to a shift in profit structure:

1) The profitability of its originally low-margin self-operated business is amplifying;

2) The originally highly profitable open platform business needs to recoup its profitability in the short term.

So, how long can this momentum last?

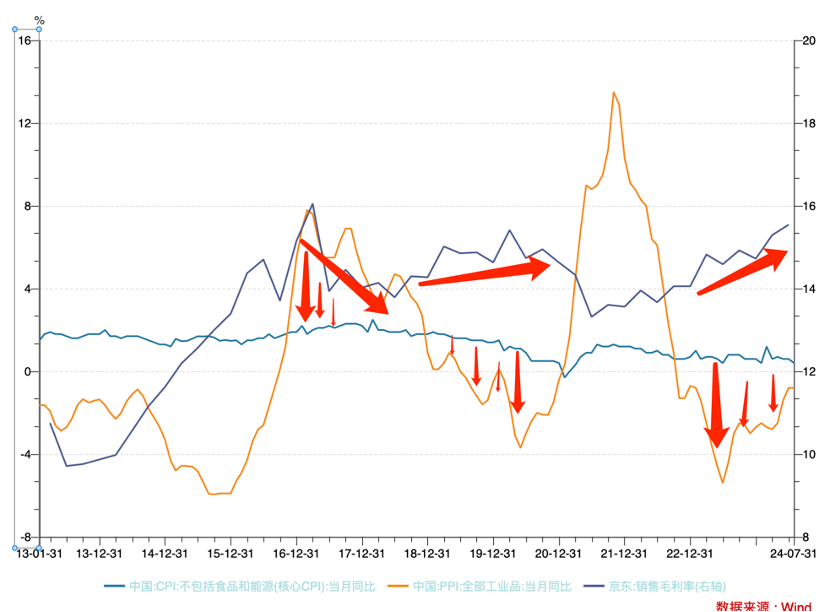

In macroeconomic analysis, CPI (Consumer Price Index) and PPI (Producer Price Index) are two common price measurement indicators, often used to deduce supply and demand relationships.

We can also use these to represent the game between upstream suppliers and downstream channels. Simply put, if the upstream is in a strong negotiation position, PPI performance is more prominent (higher product ex-factory prices), and vice versa, if the downstream is more prominent, CPI changes are more direct.

The above hypothesis can be well verified in JD.com's case. For example, since the second half of 2022, China's PPI has been declining, widening the gap with CPI, indicating a more passive position for upstream suppliers. During this period, JD.com's gross margin has been rising.

However, on the other hand, PPI has recently experienced a significant rebound, albeit still at a low level, narrowing the gap with CPI. This is mainly attributed to:

1) China's current destocking cycle is nearly complete, and inventory changes in industrial manufactured goods have rebounded recently;

2) Extremely loose monetary policy and proactive fiscal policy are gradually taking effect, which is also conducive to improving aggregate demand.

Assuming that PPI can maintain this momentum from the fourth quarter of 2024 to the first half of 2025, the game between upstream and downstream will reverse in the retail market: upstream suppliers will regain pricing power.

For JD.com, the time window to continue 'eating' the market dividend explained in this article is relatively narrow. In the next six months or so, JD.com needs to quickly change consumer perceptions, expand its user base, complete the shift from a high proportion of self-operated business to open platform business, and transform from selling products to selling traffic.

Otherwise, once the window of opportunity passes and the negotiation position between upstream and downstream shifts, JD.com will face dual challenges of gross margin and growth. Other platforms are no longer enthusiastic about low prices, but JD.com still pursues them relentlessly. Management hopes to complete the transformation of business models and operations within a limited window, and the sense of urgency is understandable.

Before the market closes the door on aggregate demand, competitors' withdrawal from the game has opened a window for JD.com, resulting in a situation where total revenue stagnates while profit margins rebound rapidly, creating the current 'unexpected' JD.com.

The next six months or so are crucial for JD.com. Whether it will break through new ceilings or remain trapped in 'making the best of a bad situation' (also known as cost reduction and efficiency enhancement), we will wait and see.