Game turnaround: Tencent regains its composure

![]() 08/20 2024

08/20 2024

![]() 580

580

Tencent Games' Longevity Strategy

Written by: Chen Dengxin

Edited by: Li Ji

Typeset by: Annalee

Tencent Games delivers a new performance.

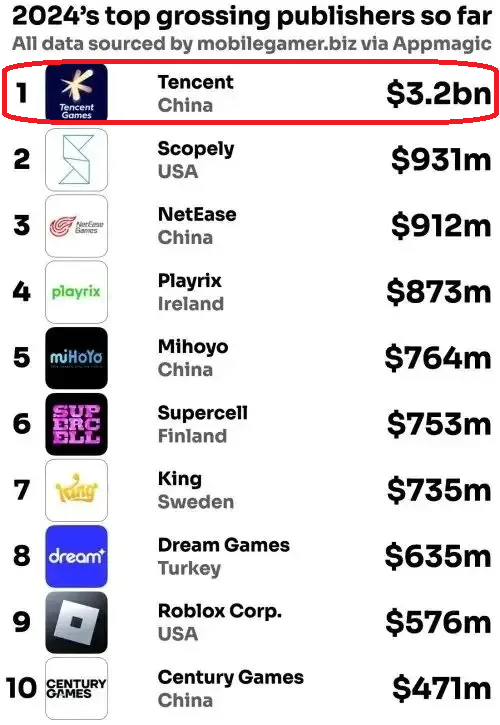

Recently, Tencent announced its financial results for the second quarter of 2024, reporting domestic game revenue of 34.6 billion yuan, up 9% year-on-year, and international game revenue of 13.9 billion yuan, also up 9% year-on-year.

In response, Tencent's Chairman and CEO Pony Ma expressed satisfaction: "Our domestic game revenue has resumed growth, and our international game revenue has accelerated, thanks to increased user engagement in several evergreen games and the successful launches of several new games."

This suggests that Tencent's strategy of allowing "evergreen products to sprout new shoots and rejuvenate themselves" is bearing fruit, with evergreen games and emerging titles working together to become Tencent's key growth engine once again.

As a result, Tencent Games has regained its confidence.

The market shifts left, while Tencent Games moves right

As the cornerstone of Tencent's business, Tencent Games has always played the role of a "cash cow," carrying the company's high expectations. Naturally, it cannot afford to fail.

However, in recent years, the gaming industry's growth dividends have gradually disappeared, with the market transitioning from incremental to stagnant growth. The industry views anime-style games as the "key" to unlocking growth, with many players entering this "blue ocean."

Tencent is no exception.

Public data shows that since 2021, Tencent has launched over 20-30 anime-style games, with SPARK 2023 alone announcing six such titles, accounting for one-third of the new games introduced during that period. Tencent has also invested in a large number of anime game developers, funding major titles such as "Honkai: Star Rail" and "NIKKE: Goddess of Victory."

Nevertheless, the most influential games in Tencent's product matrix remain gameplay-driven titles, such as the evergreen hits "Honor of Kings" and "Game for Peace."

Ren Yuxin, President of Tencent Interactive Entertainment Group, stated: "Competitive battle games are still the crown jewels among current games. This is our foundation, and we must protect it, not be swayed by current trends in MMO and anime games."

In this context, evergreen games like "Honor of Kings" and "Game for Peace" bear the responsibility of driving Tencent Games' stable growth.

According to Dian Dian Data's "2024H1 Global Mobile Game Market Data Report," Tencent games accounted for six of the top 10 highest-grossing mobile games on the Chinese App Store in the first half of 2024, with "Honor of Kings" and "Game for Peace" topping the list.

In fact, Tencent only needs to delve deeper into its evergreen games, making its strengths even stronger, to confidently compete with rivals' new releases and capture more users and market share.

The "China Game Industry Report 2024H1" released by the China Audio-Video and Digital Publishing Association's Game Working Committee and Game Professional Committee shows that domestic game revenue in the second quarter was 74.629 billion yuan, down 2.7% year-on-year by 2.125 billion yuan.

In contrast, Tencent Games achieved 9% positive growth in the domestic market, standing out from the industry's negative trend.

How Evergreen Games Sprout New Shoots

In reality, for "old trees to sprout new shoots," continuous innovation and optimization are crucial.

Take "Honor of Kings" as an example. Its classic 5v5 gameplay has accompanied players for nearly nine years, and in 2024, it introduced a new 10v10 mode, allowing 20 players to engage in large-scale battles on an expanded map, reigniting players' enthusiasm.

A veteran player told Zinc Scale that "10v10 is more exciting for new players, with constant action, lowering the barrier to entry. For veterans, it's more challenging, requiring them to ensure the team's overall economic advantage while also providing growth resources for each team member, increasing the difficulty of resource allocation."

Moreover, the new hero "Yuanliu's Son" has overturned previous perceptions.

As the first multi-class customizable hero in "Honor of Kings," players can not only choose the hero's gender and appearance but also assign a profession, each with unique attributes and skills. This significantly enhances the hero's versatility, offering players a more personalized gaming experience.

Furthermore, game designers are getting closer to players.

Game designers are responsible for crafting backstories, gameplay rules, damage formulas, and other critical details, which significantly impact game quality and reputation. However, their perspectives often differ from those of players.

In 2024, "Honor of Kings" revived the "Planners' Mic" account, directly communicating with players and addressing sensitive issues, enabling a deeper understanding of players' needs and solidifying the game's fundamentals.

Unsurprisingly, "Honor of Kings" remains popular.

Crucially, "Honor of Kings" not only defends its foundation but also expands it through internationalization, further opening up growth opportunities for evergreen games.

Public data shows that after the global launch of "Honor of Kings"'s international version (Honor of Kings) on June 20, 2024, it surpassed 50 million downloads in its first month, demonstrating strong market appeal and topping the MOBA mobile game downloads chart in July in the Southeast Asian market.

It's worth noting that "Honor of Kings" is not the only game experiencing a resurgence.

In the first half of 2024, "Game for Peace" introduced multiple updates, including "Sky Island Assembly" and "Return of Excitement," along with new game modes like "Subway Escape" and the limited-time "Battle Royale" mode, which boosted player engagement through innovative gameplay.

According to Goldman Sachs' report, Tencent's evergreen games, including "Honor of Kings" and "Game for Peace," saw a 27% year-on-year increase in revenue in Q2 2024, up from 11% in Q1.

It is evident that Tencent has found a methodology for nurturing evergreen games: Instead of using the game's life cycle as an excuse, Tencent Inspire the innovation of the team , transitioning from extensive to fine-grained, standardized, and humanized operations, continuously revitalizing the product and keeping players engaged with fresh content.

Rising Stars Steal the Show: More Cards to Play?

More importantly, Tencent Games' emerging titles are on the rise, not only driving growth but also showing potential to become evergreen hits, promising fresh blood for the company's evergreen game lineup.

Among them, "Dungeon & Fighter: Origin" is particularly noteworthy.

Since its launch on May 21, 2024, "Dungeon & Fighter: Origin" has become one of the most dazzling new mobile games, generating 1 billion yuan in revenue in its first week and topping the global mobile game best-seller list in June.

Morningstar analyst Ivan Su previously predicted that "Dungeon & Fighter: Origin" would generate 22 billion yuan in revenue in 2024, contributing 3% to Tencent's annual total revenue.

Clearly, "Dungeon & Fighter: Origin" is poised to become Tencent's next evergreen hit.

In fact, meeting the criteria of over 5 million daily active users and over 4 billion yuan in annual revenue for mobile games is a given for "Dungeon & Fighter: Origin." The only test remains its longevity.

James Mitchell, Tencent's Chief Strategy Officer, expressed optimism about "Dungeon & Fighter: Origin's" long-term operation, noting its excellent retention rate over the first 60 days, a crucial indicator of game longevity. He added that the game's long development cycle and rich subsequent content would be released opportunistically.

Beyond "Dungeon & Fighter: Origin," several other promising evergreen candidates exist.

For instance, user engagement in the auto-chess mobile games "Teamfight Tactics" and "League of Legends: Wild Rift" continues to rise. According to QuestMobile, both games saw double-digit year-on-year growth in user hours in the first half of 2024, consistently ranking among the top 10 best-selling domestic games.

Another example is "Valorant," which has been available on PC for over a year, consistently exceeding 1 million peak concurrent users and ranking fourth on the "Internet Cafe Game Heat Rank" in Q2 2024.

Thus, whether mobile or PC, Tencent Games boasts a rich pipeline of evergreen game candidates. As its product matrix expands, revenue will grow, while customer acquisition costs will decrease, strengthening Tencent's financial performance.

Morgan Stanley predicts that Tencent Games' revenue growth will reach 13% in the second half of 2024, while CLSA forecasts double-digit growth in Q3 2024, with adjusted EBIT profit increasing by approximately 20% year-on-year.

In summary, Tencent is no longer focused on others' cards but on its evergreen games. Its existing evergreen games have withstood the test of time and the market, while its potential evergreen games are experiencing breakthrough growth, giving Tencent more cards to play.

Undoubtedly, Tencent has regained its composure.