Has Wu Yongming found Alibaba's performance "engine" in the year since taking over?

![]() 08/21 2024

08/21 2024

![]() 597

597

As the largest commercial organization in China, Alibaba has had a difficult year.

Since Wu Yongming took over Alibaba a year ago, the entire group has undergone a major overhaul in terms of organization, philosophy, and business, which is crucial for Alibaba to face the increasingly fierce competition ahead.

If we compare the current Alibaba with its past from these three aspects, we can see that the giant has quietly transformed into something entirely different.

1

Views on Philosophy and Consumer Vision

Although Alibaba recently released its financial results for the first half of this year, revealing subtle changes throughout the group, we prefer to start from the core—how Alibaba, with Taobao and Tmall as its flagship businesses, views the transformation of the consumer industry.

It's important to note that Alibaba lacked a core philosophy to guide it for a long time.

Looking back at Alibaba's values, the "Six New Values" were seldom mentioned for a long period, not because they were unimportant but because the times were changing.

Facing competition from low-cost players like Pinduoduo and Douyin E-commerce, Alibaba lost its core direction in e-commerce. It struggled to navigate changing consumer trends and counter low-cost strategies, appearing uncertain and disoriented.

Furthermore, Jack Ma's retirement signaled the end of Alibaba's focus on consumption upgrades, leaving the company vulnerable to low-cost competition.

Taobao and Tmall have been in a state of flux for a long time. For a giant company like Alibaba, such uncertainty is highly concerning. Alibaba implemented various strategies like the "Billion Subsidy Plan," instant refunds, and automatic price comparisons, indicating that it was being dragged into its competitors' game.

However, around the end of the first quarter and early April of this year, Alibaba gradually began to change its strategy.

Fortunately, Alibaba's older generation, represented by Joe Tsai, has been brave enough to acknowledge mistakes and discuss them publicly, marking the first step towards change.

One significant event for Alibaba this year was redefining its core customer base. Joe Tsai's self-reflection reestablished the fundamental understanding that consumers are Alibaba's customers, giving the company a new direction.

Around the same time, Alibaba chose to integrate 1688 into Taobao, launching a "low-cost strategy" centered on Taobao Factories. Unlike low-cost strategies focused on merchants or middlemen, this strategy leverages Taobao Factories as a guarantee, positioning Alibaba as the backbone behind low prices.

Another, less noticeable but crucial move by Alibaba this year was revitalizing its 88VIP membership program.

Alibaba has become more willing to share data on 88VIP, previously a lesser-known aspect. As of the first half of 2024, Alibaba had 42 million 88VIP members, up from 32 million at the end of 2023 and 35 million at the end of March 2024.

Combining the strategies of Taobao Factories and 88VIP, it is reasonable to expect that when the number of 88VIP members exceeds 100 million, it will become a new engine driving Alibaba's domestic retail business.

Regarding consumer perceptions, Alibaba appears to be reassessing its low-cost strategy. After years of focusing on premium products, it is now embracing lower prices. Consumer perceptions of quality and brands are likely to shift in the coming years.

2

The Return of 'Old-Timers'

Organizational stability is crucial for Alibaba.

Since Daniel Zhang's retirement, Alibaba's management has undergone several changes. Its core retail business, led by Jiang Fan before being handed over to Dai Shan and then Wu Yongming, has been in flux.

Currently, Alibaba is led by Joe Tsai and Wu Yongming.

Joe Tsai needs no introduction, but Wu Yongming brings several interesting labels: his technical background, early involvement in Taobao, and status as an 'old-timer' at Alibaba.

Interestingly, many consumer brands have chosen to bring back their founding teams in response to changes in the retail and consumer industries.

Old founders or founding teams have two advantages over professional managers when facing new challenges in the consumer industry:

First, they have experienced the full cycle of change in the consumer industry, giving them a deeper understanding and clearer perception of industry trends. Wu Yongming, in particular, has been involved in the development of B2B, Taobao, Alimama, and other retail initiatives, giving him a unique insight into the industry that professional managers cannot match.

Second, 'old-timers' have a deep sense of personal stake in the success or failure of the company, which drives them to make decisions that professional managers might not consider.

Alibaba has faced questions about its priorities: should it prioritize GMV, suppliers, or consumers? Reports suggest that Jack Ma once returned to Taobao, identifying problems and outlining three directions: returning to users, returning to Taobao's roots, and returning to the internet. These directions align with Wu Yongming's approach.

Alibaba needs both continuity and change, including theoretical guidance. Wu Yongming must build on existing ideas and develop new ones to guide Taobao and Tmall in this new competitive landscape.

In the fiercely competitive e-commerce landscape, Alibaba faces intense competition from Pinduoduo. It's like changing a tire on a highway—there's no time to think. On one hand, the price war rages on; on the other, Alibaba must forge a new theory to guide its actions.

For Wu Yongming, finding a new direction for Alibaba has been the most important task in the year since he took over.

3

Alibaba's Three Engines

Turning to Alibaba's performance, its financial results for the first half of 2024 were modest, but three new engines are emerging. Besides the impressive growth in membership, Alibaba's international business and intelligent cloud services have also performed well.

In the past, Alibaba's retail business, centered on Taobao and Tmall, supported its exploration of other areas like Alibaba Cloud, Cainiao, and local services, among others. Alibaba's investments also formed a moat around its core business.

Now, things are changing. Alibaba's international business and intelligent cloud services are gradually becoming major contributors to the company's revenue.

Since Dai Shan introduced the "1+6+N" strategy, each business unit has become more independent. In particular, the international business and intelligent cloud services are on track to become significant revenue generators.

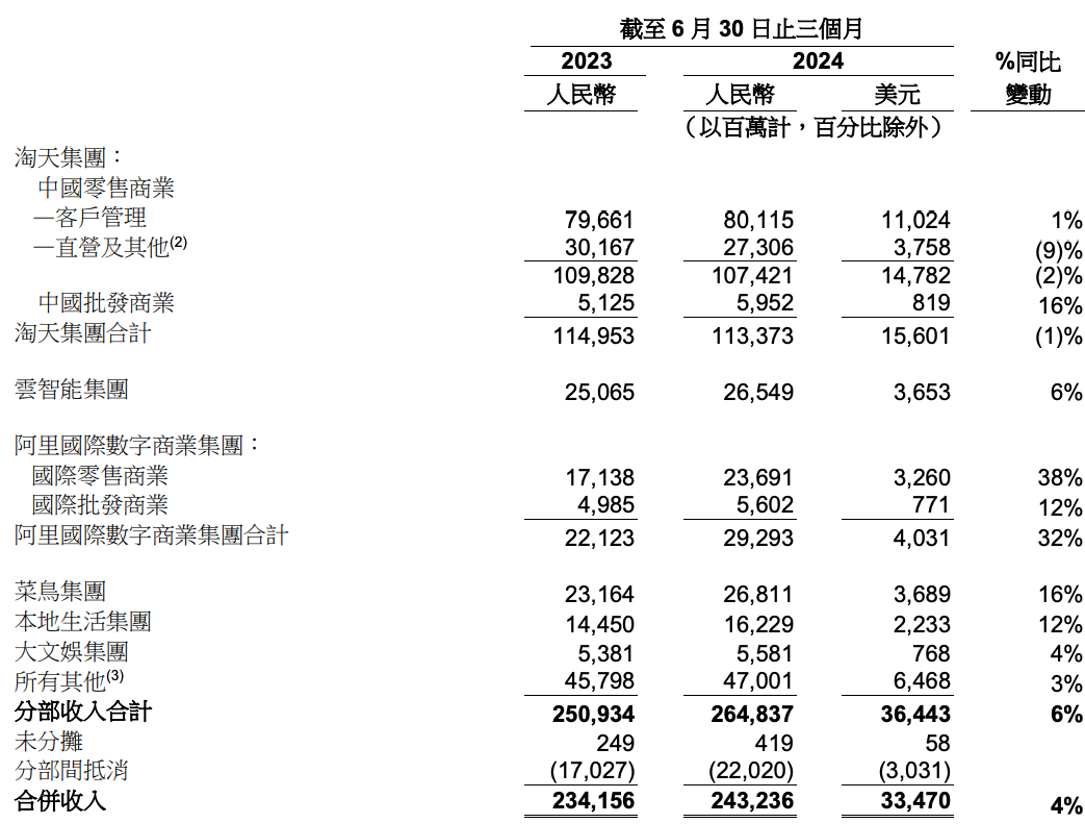

In terms of business scale, Taobao and Tmall, international business, Cainiao, intelligent cloud services, local services, and digital media and entertainment were Alibaba's top performers in Q2 2024. However, in terms of growth rate, international business, Cainiao, local services, and intelligent cloud services led the way. International retail commerce grew by 38% YoY in Q2, while intelligent cloud services grew by 6%, both outpacing the overall growth rate of 4%.

First, intelligent cloud services have maintained steady revenue growth. In Q2 2024, its EBITA reached 2.34 billion yuan, a year-on-year increase of 155%, the highest growth rate among all Alibaba's businesses. In Q1, it was 1.43 billion yuan, while in Q4 2023, it was 2.36 billion yuan. From Q2 to Q4 2023, the total was 4.69 billion yuan, consistently leading in EBITA growth across Alibaba's businesses, transforming from a money-losing to a profitable venture.

Alibaba's international business, led by Jiang Fan, the former CEO of Taobao and Tmall Group, has seen significant growth. In December 2021, Alibaba reorganized its structure, establishing the "Overseas Digital Commerce" segment under Jiang Fan's leadership, overseeing Global SpeedtoBuy, International Trade, Lazada, and other overseas subsidiaries.

In 2022, the year Pinduoduo launched TEMU, Alibaba's international business grew by over 30%. In 2023, growth accelerated to 44%, and the momentum continued into Q2 2024.

Jiang Fan, who was expelled from Alibaba's partnership in 2023, has been reinstated, a testament to his contributions to the company.