Xiaopeng: Difficult sales, finally seeing a glimmer of hope?

![]() 08/21 2024

08/21 2024

![]() 678

678

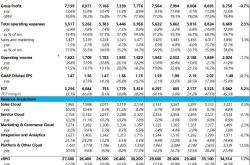

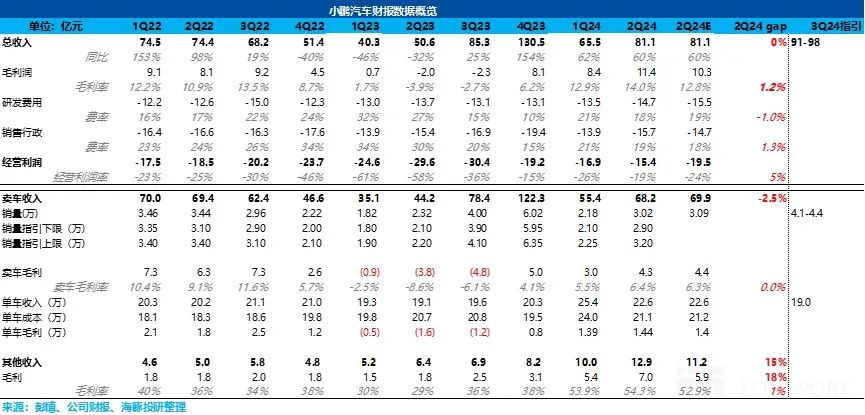

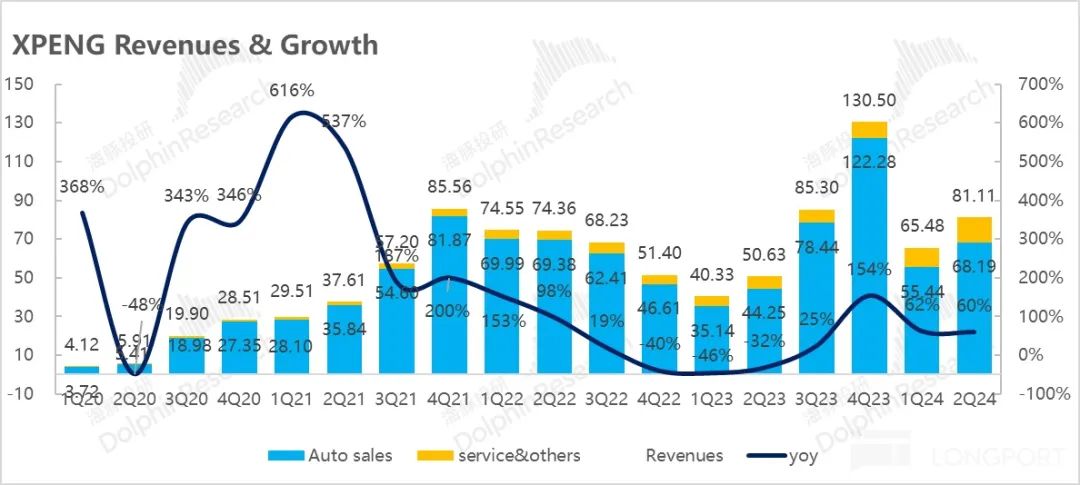

Xiaopeng Motors released its second-quarter financial report for 2024 after the Hong Kong stock market closed and before the U.S. stock market opened on August 20, 2024, Beijing time. The market had relatively optimistic expectations for Xiaopeng's gross margin in its vehicle manufacturing business this quarter. In terms of actual performance:

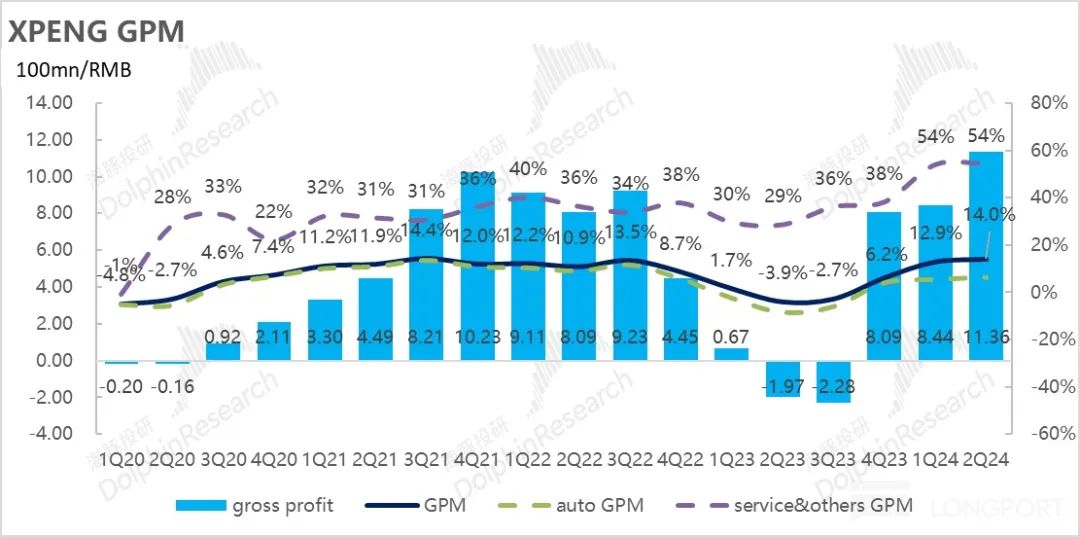

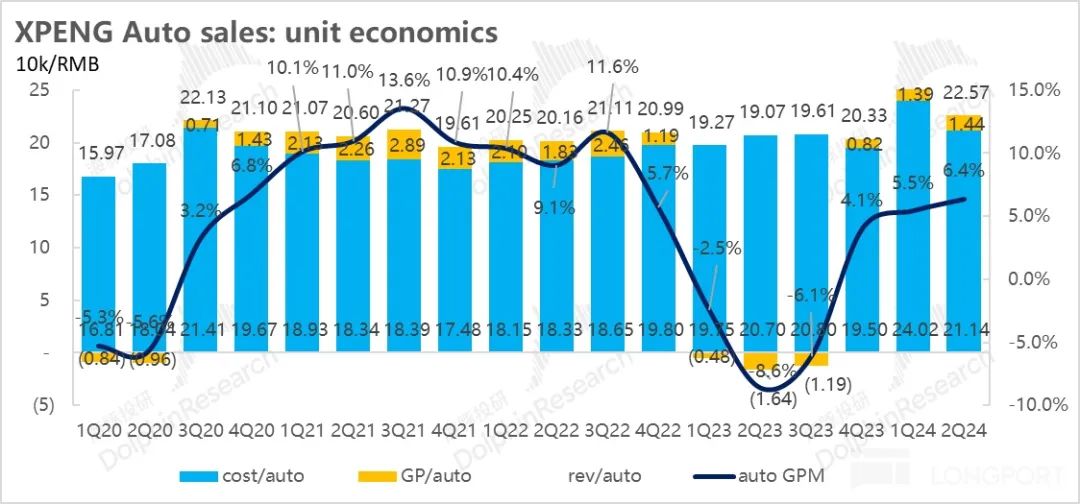

1) Gross margin for automotive sales continues to improve quarter-over-quarter: The gross margin for the automotive business in the second quarter was 6.4%, continuing to improve quarter-over-quarter. The main reason behind this improvement is the significant reduction in costs, which may be related to the increase in capacity utilization due to the rebound in sales quarter-over-quarter, the reduction in impairment losses for the P5 model (not specifically disclosed), and the success of cost reduction efforts through technology.

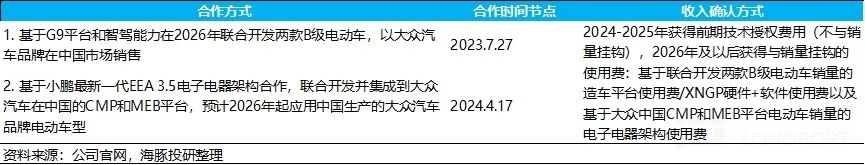

2) Continued recognition of revenue from the Volkswagen partnership, contributing to recurring income: Xiaopeng's overall gross margin for the second quarter reached 14%, exceeding market expectations of 12.8%. The key factor driving this excess was the partnership with Volkswagen, with upfront licensing fees being recognized. The expansion of the Volkswagen partnership in the second quarter (details below) led to continued growth in other income, which is expected to become recurring income and drive an increase in the overall gross margin.

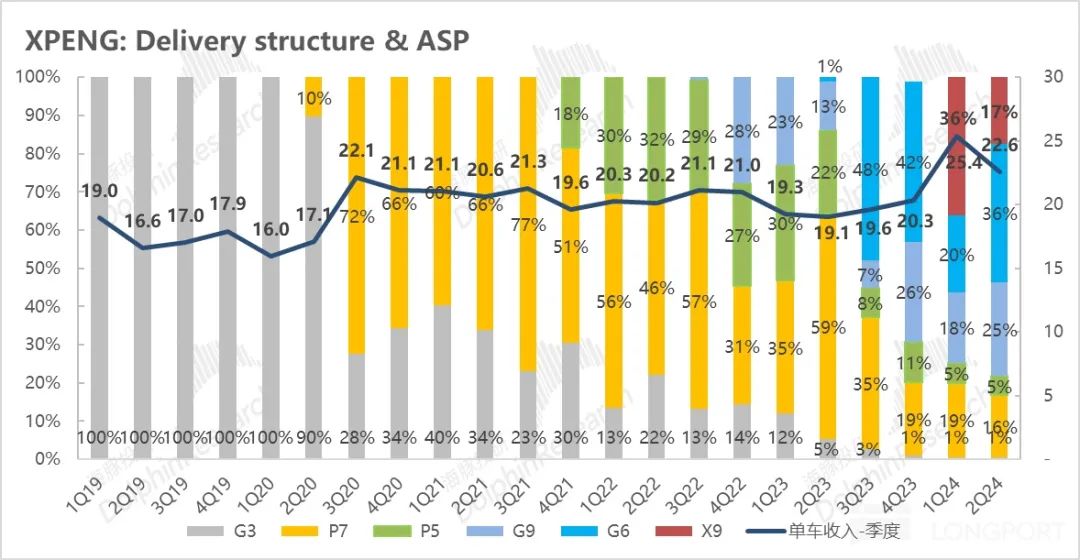

3) Average selling price decreased quarter-over-quarter but was in line with market expectations: The average selling price per vehicle in this quarter was RMB 226,000. Due to the deterioration of the sales mix (with a decrease in the proportion of X9 models) and the continuation of price reductions for flagship models G6/G9 to boost sales, the average selling price decreased quarter-over-quarter but was within market expectations.

4) Third-quarter guidance implies that Mona M03 orders and sales may exceed expectations: The third-quarter sales guidance of 41,000 to 44,000 vehicles exceeds market expectations of 38,000 vehicles, indicating that sales in September may approach 20,000 vehicles, a significant quarter-over-quarter increase that is likely driven by Mona M03. This offers hope for a turnaround in Xiaopeng's sales.

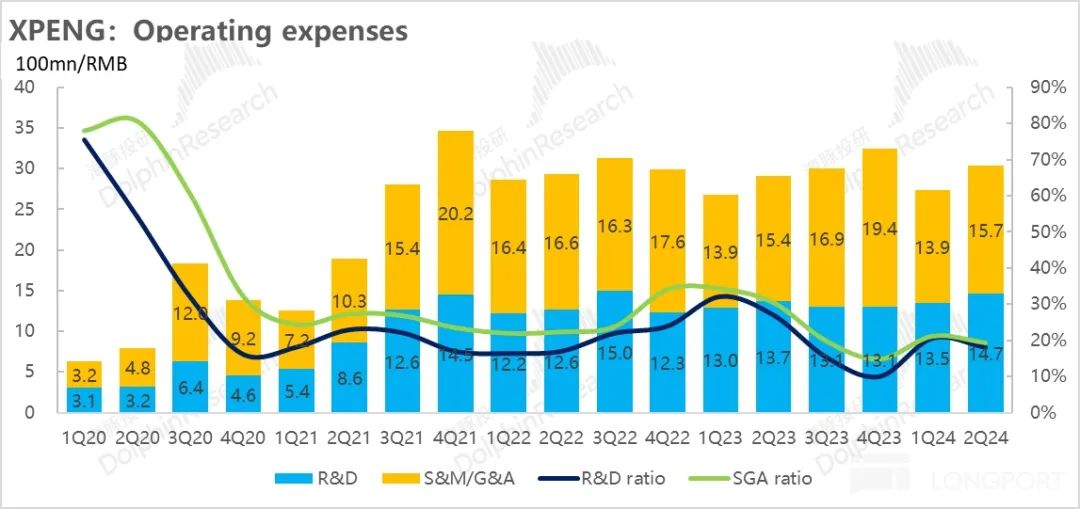

5) Operating expenses were generally in line with expectations: On the R&D expense side, while the company had previously communicated that R&D expenses would increase in 2024, the increase in R&D expenses in this quarter was modest and lower than market expectations of RMB 1.55 billion.

On the sales expense side, as sales rebounded quarter-over-quarter, the increase in commissions paid to franchise stores (dealers) and marketing, promotion, and advertising expenses exceeded market expectations.

Dolphin Investment Insights:

From a second-quarter performance perspective, Xiaopeng delivered a solid performance with gross margins slightly exceeding expectations, primarily due to increased revenue from the Volkswagen partnership.

In terms of the automotive business, although the average selling price per vehicle decreased quarter-over-quarter due to the deterioration of the sales mix (with a decrease in the proportion of X9 models) and continued price reductions for flagship models G6/G9, this was within market expectations. However, the significant reduction in the cost per vehicle and the possible reduction in impairment losses for the P5 model (not specifically disclosed) contributed to a quarter-over-quarter increase in the gross margin for the automotive business.

Looking at the third-quarter sales guidance, the expected sales range of 41,000 to 44,000 vehicles exceeds market expectations of 38,000 vehicles. With 11,000 vehicles sold in July and sales in August expected to be roughly similar to July based on current weekly sales trends, this implies that sales in September may approach 20,000 vehicles, a significant quarter-over-quarter increase. This suggests that the delivery of Mona M03 in September may exceed order expectations, driving a rapid recovery in deliveries that month.

In terms of third-quarter revenue guidance, the expected revenue range of RMB 9.1 to 9.8 billion implies an average selling price per vehicle of approximately RMB 190,000, slightly lower than market expectations of RMB 200,000. This suggests an increase in the proportion of low-priced Mona M03 deliveries, leading to a quarter-over-quarter decrease in the average selling price per vehicle.

However, both the third-quarter sales and revenue expectations suggest that Mona M03 orders are strong and sales may exceed expectations, which is a tangible positive for Xiaopeng, which has struggled with sales in recent times.

The market's current sales expectations for Xiaopeng in 2024 are still around 170,000 vehicles. Dolphin Insights expects Xiaopeng's sales in 2024 to be in the range of 160,000 to 180,000 vehicles, corresponding to a 2024 P/S ratio of 1.4 to 1.6 times, which is relatively reasonable. However, if Mona M03 proves to be a hit and the P7+ can drive a further recovery in the gross margin for the automotive business in the fourth quarter, Xiaopeng's share price may have further upside potential.

Below is the main text

I. Xiaopeng's gross margin for the automotive business rebounded quarter-over-quarter in this quarter

As Xiaopeng's second-quarter sales figures have already been released, investors are more concerned about its gross margin when the financial report is published.

Due to the recovery in Xiaopeng's sales in the second quarter compared to the first quarter, the market had expected the gross margin for its automotive business to improve quarter-over-quarter to 6.3%. Xiaopeng's reported gross margin for the automotive business in the second quarter was 6.4%, which was broadly in line with market expectations.

Dolphin Insights believes that the main reason for the improvement in the gross margin for the automotive business in this quarter was the reduction in costs:

a) Average selling price per vehicle: Deterioration in the model mix and price reductions led to a quarter-over-quarter decrease of RMB 28,000 in the average selling price per vehicle

The average selling price per vehicle in the second quarter was RMB 226,000, a decrease of RMB 28,000 quarter-over-quarter, which was in line with Dolphin Insights' estimates and market expectations based on previous guidance.

The decline in Xiaopeng's average selling price per vehicle in this quarter was primarily due to two factors:

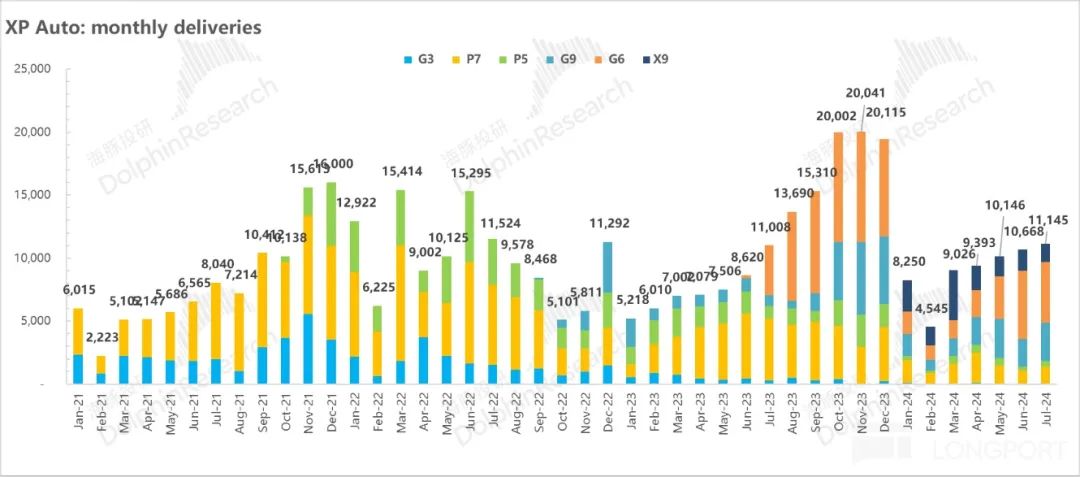

1) Deterioration in the model mix: In the first quarter, Xiaopeng's high-priced pure electric MPV X9 (priced at RMB 359,800 to RMB 419,800) was launched and achieved peak sales of nearly 4,000 vehicles priced above RMB 300,000 due to its high cost-effectiveness in March. However, as the high-end pure electric MPV market is still limited by inadequate infrastructure and limited market space, the sustainability of sales was low. In the second quarter, the proportion of X9 in the model mix decreased from 36% in the first quarter to 17% in the second quarter.

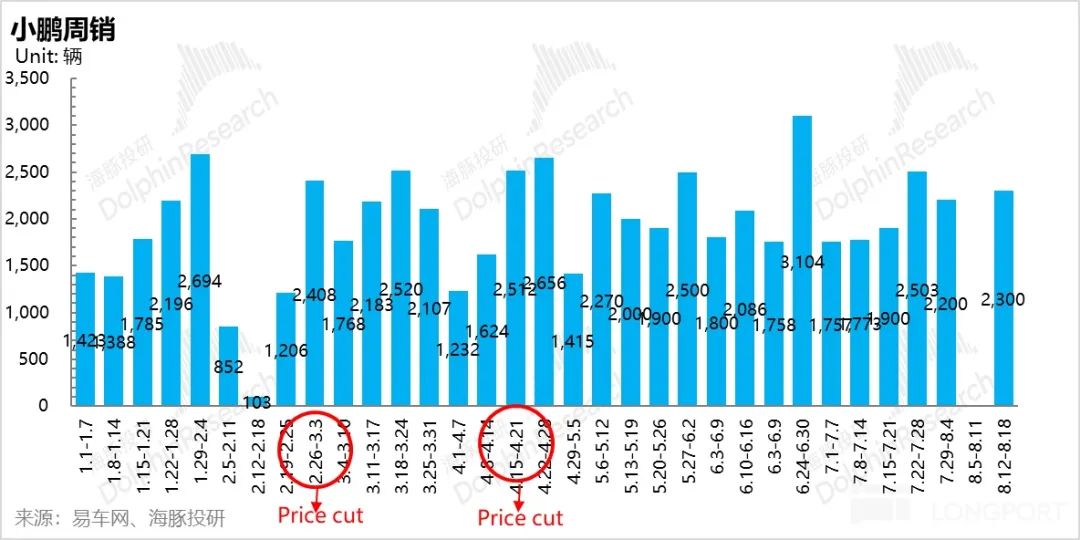

2) Price reductions due to weak sales: In the first quarter, Xiaopeng began price reductions in March due to the sales off-season and increased competition, with reductions of RMB 20,000 to RMB 50,000 (8% to 15%) for the P7i, RMB 20,000 (7% to 10%) across the G6 range, and RMB 5,000 to RMB 10,000 (1.4% to 4%) for the G9. While these price reductions began in March, their impact was only partially reflected in the first-quarter average selling price and fully reflected in the second quarter.

In the second quarter, Xiaopeng's flagship models G6 and G9 did not recover to expected sales levels, and the company continued to reduce prices by RMB 10,000 to RMB 15,000 (3% to 5%) for these models while also continuing to clear inventory of the older P5 model.

b) Cost per vehicle: A larger decrease in the cost per vehicle drove the rebound in the gross margin for the automotive business

The cost per vehicle in the second quarter was RMB 211,000, a decrease of RMB 29,000 quarter-over-quarter. Dolphin Insights believes this was primarily due to:

1) A quarter-over-quarter increase in sales by 38% to 30,000 vehicles, leading to an increase in capacity utilization and a decrease in the cost per vehicle

2) A decrease in the proportion of high-cost X9 models in the model mix from 36% in the first quarter to 17% in the second quarter

3) A possible reduction in impairment losses for the P5 model in this quarter: In the first quarter, Xiaopeng recognized impairment losses and purchase commitment losses for the P5 model, dragging down the gross margin for the automotive business by 3.2%. The actual gross margin for vehicle sales was 8.7%, and the impact of impairment losses for the P5 model may have decreased in the second quarter (but was not specifically disclosed)

4) Some success in cost reduction efforts: Xiaopeng has been working to reduce costs through platform modularization and joint procurement with Volkswagen. The cost reduction plan may have achieved some success in this quarter.

c) Gross profit per vehicle: Slightly increased quarter-over-quarter

With the average selling price per vehicle decreasing by RMB 28,000 and the cost per vehicle decreasing by RMB 29,000, Xiaopeng earned a gross profit of RMB 14,000 per vehicle sold in the second quarter, an actual quarter-over-quarter increase of RMB 500. The gross margin for vehicle sales increased to 6.4% from 5.5% in the previous quarter.

II. Third-quarter sales guidance exceeds market expectations, possibly implying higher-than-expected Mona M03 orders

a) Third-quarter automotive sales target: 41,000 to 45,000 vehicles, exceeding market expectations of 38,000 vehicles

Since the beginning of the year, Xiaopeng's sales and orders have been declining. Although sales recovered somewhat in the second quarter, the recovery was slow, and the competitiveness of Xiaopeng's models has declined as competitors continue to launch new models and reduce prices.

Currently, the flagship model G6 is facing competition from price reductions by new models such as BYD's Song L and Zhidegi LS6, as well as Tesla's Model Y. The P7 is also facing pressure from new models such as ZEEKR 001 and ZEEKR 007, as well as Xiaomi's SU7. Orders and sales have been weak, and Xiaopeng has been forced to reduce prices due to the decline in sales and orders, but sales have recovered slowly. With no new product cycle yet underway, weekly sales have remained at around 2,000 vehicles.

Xiaopeng's third-quarter sales guidance of 41,000 to 45,000 vehicles implies that sales in September may approach 20,000 vehicles (19,000 to 23,000 vehicles), a significant quarter-over-quarter increase.

Assuming that sales of other models remain unchanged at around 10,000 vehicles, this likely implies that Mona M03 could achieve monthly sales of around 10,000 vehicles in its first delivery month (launched in August, delivered in September). Xiaopeng has previously stated that Mona M03 orders are significantly higher than G6 orders during the same period, which is a tangible positive for Xiaopeng, which has struggled with sales.

b) Third-quarter revenue guidance implies continued downward pressure on average selling prices

Xiaopeng's third-quarter revenue guidance is RMB 9.1 to 9.8 billion. Assuming other revenue remains the same as in the second quarter (RMB 1.3 billion), the implied average selling price for the third quarter is approximately RMB 190,000, a quarter-over-quarter decrease of RMB 36,000 and below market expectations of around RMB 200,000.

The continued downward pressure on average selling prices in the third quarter may be due to a further decrease in the proportion of high-priced pure electric MPV X9 sales: In the second quarter, the proportion of X9 in the model mix decreased from 36% in the first quarter to 17%, and the proportion of X9 sales continued to decline in July, with monthly sales falling to around 1,500 vehicles (13% of total sales).

However, it may also imply that deliveries of the low-priced Mona M03 model (with a starting price of only RMB 135,900) have exceeded expectations, leading to an increase in its proportion in the model mix and a lower-than-expected average selling price in the third quarter. Although the initial ramp-up in Mona M03 deliveries is expected to drag down gross margins in the third quarter, Xiaopeng's main challenge at present is to reverse its declining sales trend. If Mona M03 orders and deliveries exceed expectations, this will be a tangible positive for Xiaopeng.

III. Overall revenue meets expectations, with gross margins exceeding market expectations

In the second quarter, Xiaopeng achieved total revenue of RMB 8.1 billion, in line with market expectations, and a consolidated gross margin of 14%, exceeding market expectations of 12.8%. This was primarily driven by growth in revenue and gross margins from other businesses.

a) Automotive sales revenue: RMB 6.8 billion in the quarter, slightly below market expectations of RMB 7.0 billion

In terms of volume, deliveries in the second quarter were 30,000 vehicles, a quarter-over-quarter increase of 38%, roughly in the middle of the previously provided guidance range of 29,000 to 32,000 vehicles but slightly below market expectations of 31,000 vehicles.

However, compared to other new energy vehicle companies, Xiaopeng's sales recovery in the second quarter was slow, and it has fallen behind in the new energy vehicle sector. Looking back at the recovery trends and reasons for sales in the second quarter, Dolphin Insights found that companies that recovered sales more quickly benefited from seasonal factors and had the following characteristics:

1) They were in a major product year or had launched new hit models that drove sales recovery in the second quarter: For example, BYD's new product year with DMI 5.0 technology, Lixiang's brand expansion with the L6 (monthly sales exceeding 20,000+), and AITO's hit model M9 (monthly sales exceeding 15,000+) based on brand strength, channels, and intelligent driving capabilities.

2) They had significant changes to their 2024 models or significant price reductions: For example, BYD's Honor edition had significant price reductions, making electric vehicles cheaper than gasoline vehicles and reducing the price range of plug-in hybrids from RMB 100,000 to RMB 200,000 to RMB 70,000 to RMB 150,000. ZEEKR's 2024 model of the 001 had significant changes and a price reduction of RMB 31,000 to RMB 57,000 compared to the previous model.

Looking back at Xiaopeng's performance in the second quarter, the main reasons for its slow sales recovery were:

1) Slow response to intense competition: Historically, Xiaopeng has had the ability to create hit models, but sales have not been sustainable-

When G6 was launched, it reached a peak monthly sales of 8,000-9,000 units due to its advanced autonomous driving capabilities, pricing advantage, and 800V technology. However, sales plummeted to less than 2,000 units in January this year and only recovered to less than 5,000 units in July after continuous price cuts (with a starting price reduction of RMB 30,000).

The refreshed G9 was delivered in October 2023 and achieved a peak monthly sales of nearly 6,000 units with lower pricing, advanced autonomous driving capabilities, and streamlined SKU offerings. However, sales dropped to less than 1,000 units in February and recovered to around 3,000 units in July due to price cuts on the G9 (with a further reduction of RMB 20,000 on the starting price of the refreshed model). The most direct reason is intensifying competition in the 200,000-300,000 RMB pure electric vehicle segment, where new models are launched frequently. All newly launched pure electric models this year come standard with 800V technology and rapidly improving autonomous driving capabilities, gradually erasing Xpeng's former lead.

However, the indirect reason lies in Xpeng's slow adjustment speed amidst fierce competition, potentially indicating issues with organizational efficiency, management, and marketing. Unlike ZEEKR 001's major refresh and price adjustment, Xpeng's 2024 model year refreshes were relatively minor (most refreshed models were announced in 2023, with the P7 still limited to 500V fast charging, and only the G6 refresh was announced in 2024 with minimal configuration changes and a focus on price cuts).

2) Limited market space for pure electric MPVs, and the new product cycle has yet to commence:

In terms of new vehicles, Xpeng only launched the pure electric MPV X9 in the first half of this year. Despite achieving peak sales of nearly 4,000 units in the over 300,000 RMB pure electric MPV segment upon launch in March due to its high cost-effectiveness compared to the ZEEKR 009 and LIXIANG Mega, sales have since dropped to less than 2,000 units as the high-end pure electric MPV market remains constrained by inadequate infrastructure, limiting market potential, and the new product cycle has yet to commence.

b) Services and Others: Collaboration with Volkswagen boosts revenue and gross margin through technology licensing fees

This quarter's revenue from services and others reached RMB 1.3 billion, exceeding market expectations of RMB 1.12 billion, while the gross margin for other businesses reached 54.3%, also exceeding market expectations of 53%. The higher-than-expected revenue from services and others was primarily driven by the growth in technology licensing revenue from Xpeng's collaboration with Volkswagen. This collaboration began in July 2023, initially focusing on jointly developing two B-segment electric vehicles based on the G9 platform and Xpeng's autonomous driving capabilities for launch in 2026. In April 2024, the scope was expanded to include collaboration based on Xpeng's latest-generation EEA 3.5 electronic and electrical architecture, to be jointly developed and integrated into Volkswagen's CMP and MEB platforms in China.

Although both collaboration models will generate fees based on Volkswagen's vehicle sales in 2026, upfront technology licensing fees (not tied to sales) will be received in 2024-2025. These technology licensing fees, with gross margins of over 90%, directly boost Xpeng's revenue and gross margin from other businesses. Xpeng has previously stated that this high-margin revenue stream will be recurring in subsequent quarters, and it expects to record revenue from this platform and software technology service every quarter, further elevating Xpeng's overall business gross margin.

IV. Sequential Increase in Operating Expenses

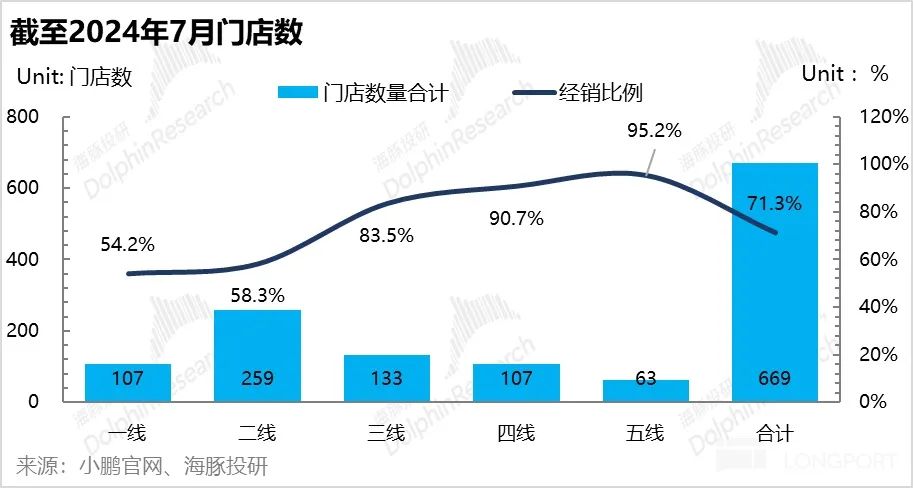

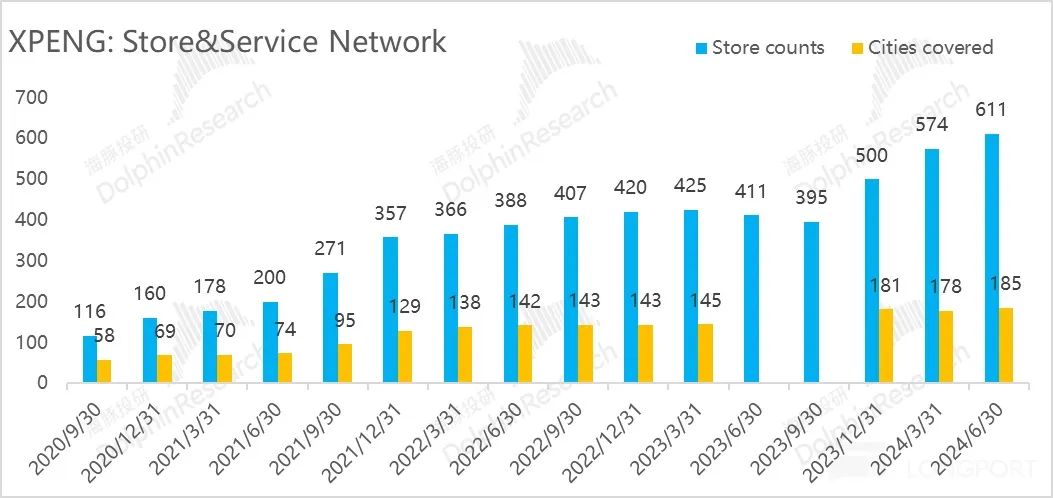

Positioned with intelligence as its core competitiveness, Xpeng is destined to continuously invest in R&D to fortify this advantage. The company is also deepening its channel reform through the Jupiter Plan to increase the proportion of franchised dealerships and transition from a direct sales model to a dealership model.

1) R&D Expenses: RMB 1.47 billion, slightly lower than market expectations of RMB 1.55 billion

This quarter, Xpeng's R&D expenses reached RMB 1.47 billion, an increase of RMB 120 million from the previous quarter but slightly lower than market expectations of RMB 1.55 billion. Xpeng's R&D investments are primarily focused on intelligence and new model development. In terms of intelligence, Xpeng views it as its core competitiveness, making it difficult to reduce R&D expenses. In terms of new models, Mona M03 and P7+ are set to be launched in the second half of the year. Currently, Xpeng has introduced China's first mass-produced end-to-end large model based on the neural network XNet+ planning and control large model XPlanner+ large language model XBrain. The application of this end-to-end large model has accelerated the expansion of XNGP to all cities, with XNGP expected to be available in all cities by July this year, placing Xpeng and Huawei in the first tier in terms of expansion speed.

To reduce XNGP's costs, Xpeng has also shifted to a pure vision-based autonomous driving solution similar to Tesla's FSD (such as the upcoming Mona M03 and P7+, which are not expected to be equipped with LiDAR). While the upfront hardware costs are reduced, processing and inference capabilities must be sufficient to handle the vast amount of data collected by cameras, making it challenging to reduce R&D expenses. Xpeng has previously stated that its full-year 2024 R&D expense guidance is between RMB 7 billion and RMB 7.5 billion, with R&D investments in "AI technology centered on autonomous driving" totaling RMB 3.5 billion. Xpeng anticipates continued upward trends in R&D expenses, and it currently possesses a maximum computing power reserve of 2.51 EFLOPS.

2) Selling, General, and Administrative Expenses: RMB 1.57 billion, higher than market expectations of RMB 1.47 billion

Selling, general, and administrative expenses reached RMB 1.57 billion this quarter, an increase of RMB 190 million from the previous quarter and exceeding market expectations of RMB 1.47 billion. The increase was primarily due to higher commissions paid to franchised dealerships and increased marketing, promotion, and advertising expenses. Xpeng launched the Jupiter Plan channel reform initiative in Q3 2022 to increase the proportion of franchised dealerships, with a focus on lower-tier cities. By expanding its dealership model, Xpeng has rapidly expanded its coverage in lower-tier cities, preparing for the launch of its lower-priced "Mona" models. As of the end of Q2, Xpeng had 611 stores, with approximately 71% of them being franchised dealerships. The net increase in store count for Q2 was 37, and the pace of store openings has accelerated significantly since the company began adopting a dealership model in lower-tier cities earlier this year.

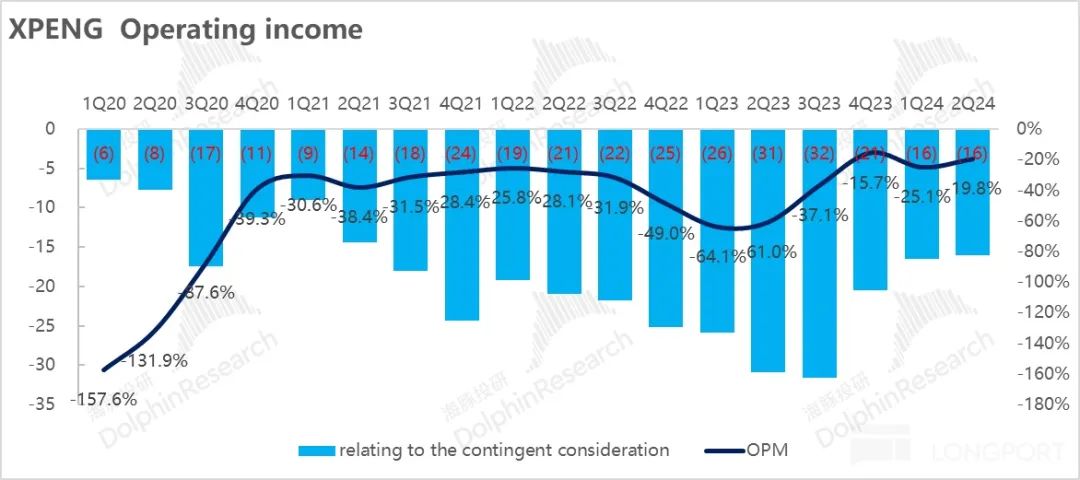

This quarter's operating loss was RMB 1.6 billion, lower than market expectations of nearly RMB 2 billion in losses. This was primarily due to higher-than-expected gross margins and an increase of nearly RMB 200 million in other income, primarily driven by increased government subsidies.

V. Xpeng's Hope: Can Sales Decline Be Reversed with Mona M03 and P7+

Looking ahead to the second half of the year, Xpeng's new product cycle will commence with the launch of Mona M03 and P7+:

1) Xpeng Mona M03: Xpeng's bet on a high-volume model

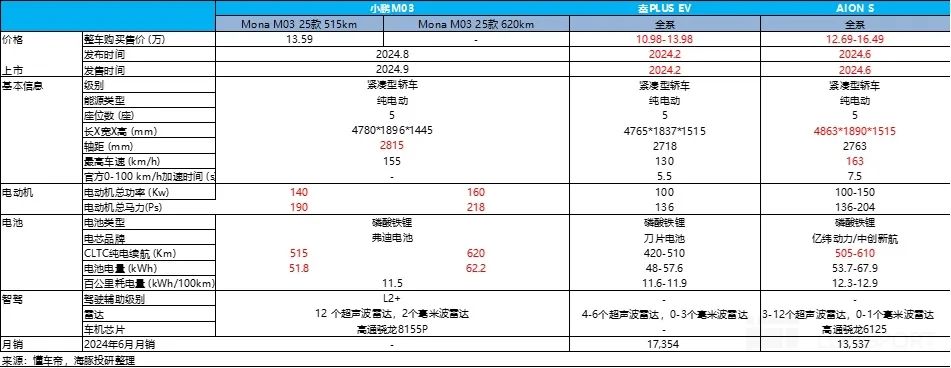

Xpeng will soon launch the first model in its mid-to-low-end Mona series, the M03, with a starting price of just RMB 135,900. The M03's differentiating advantages over competitors include: 1) Offering autonomous driving capabilities at an affordable price point below RMB 150,000; 2) A driving range of 515-620 km, leading competitor models; and 3) A powerful electric motor for enhanced acceleration performance. The M03 is a collaboration between Xpeng and Didi and will be sold to both B2B and B2C customers. Currently, the top-selling pure electric sedans in the 100,000-200,000 RMB price range sold 14,000/17,000 units in June. Xpeng has high sales expectations for this model, hoping for steady-state sales of over 10,000 units, making it Xpeng's primary high-volume model. Based on third-quarter sales expectations, it may indicate that Xpeng M03's first delivery month could reach around 10,000 units, signaling a turnaround in Xpeng's declining sales this year.

2) Xpeng P7+: Xpeng's model aimed at improving gross margins

The P7+ is expected to be launched in Q4 this year and will achieve a 25% cost reduction for the first time. Xpeng anticipates that this sedan's gross margin will be higher than its existing models (excluding X9), potentially achieving double-digit gross margins, driving an increase in Xpeng's overall automotive business gross margin. However, pricing for the P7+ is crucial. Competitors in the market include the ZEEKR 001 2023 (with an autonomous driving version priced at RMB 269,000-329,000, addressing its autonomous driving shortcomings and adopting NVIDIA Orin X*2 chips across the lineup) and Xiaomi SU7's autonomous driving version (priced at RMB 245,900-299,900). The P7+'s primary advantages are spaciousness, autonomous driving capabilities, and high aesthetics. Based on competitors' pricing, the P7+'s estimated pricing is in the RMB 250,000-300,000 range. However, competition is fierce in the 200,000-300,000 RMB pure electric vehicle segment, and Dolphin Insights conservatively estimates monthly sales of around 5,000 units. The key lies in whether pricing exceeds expectations.

Currently, market expectations for Xpeng's 2024 sales remain around 170,000 units. Dolphin Insights' expectations for Xpeng's 2024 sales are in the range of 160,000-180,000 units, corresponding to a 2024 P/S ratio of 1.4-1.6 times, which is relatively reasonable. However, if the Mona M03 proves to be a hit and the P7+ drives a continued increase in automotive business gross margins in Q4, Xpeng's share price may have room for further upside.