Beneath the bustling city, Tongcheng's "Travel Pinduoduo" faces a tough battle in the second half of the year

![]() 08/21 2024

08/21 2024

![]() 502

502

With a strong backer, how can Tongcheng prove its independence to the market?

As the financial reporting season arrives, Tongcheng's second-quarter results seem somewhat disjointed.

According to Fastdata's "2023 China Outbound Tourism Industry Development Report," among domestic OTA platforms, Ctrip holds 54.7% of the market share, ranking first; Fliggy accounts for 27.1%; while Tongcheng Travel accounts for 11.5%.

As a dark horse with low visibility but consistently exceeding expectations, this financial report once again showcases Tongcheng's ability to navigate market cycles, earning it the nickname "Travel Pinduoduo" of the OTA world.

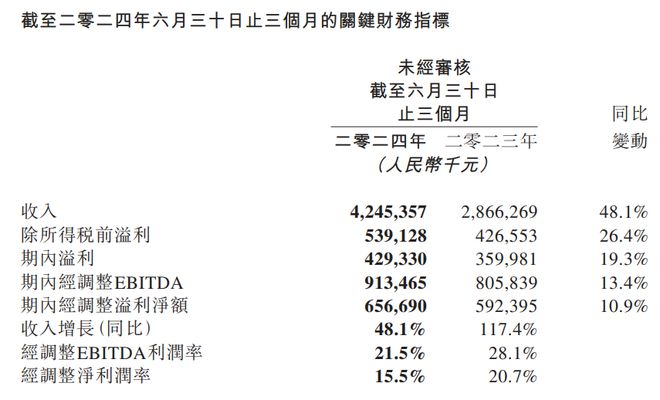

On August 20th, Tongcheng Travel released its financial report. On the surface, in the second quarter of this year, Tongcheng Travel's revenue increased by 48.1% year-on-year to RMB 4.25 billion, and adjusted net profit increased by 10.9% year-on-year to RMB 660 million, setting a new record for quarterly revenue.

However, beneath this impressive performance, Tongcheng is entering a crucial juncture.

Its adjusted EBITDA margin declined from 28.1% in Q2 2023 to 21.5% in the same quarter of 2024, and its adjusted net profit margin dropped from 20.7% to 15.5%.

As Tongcheng scales up, it seems to face a situation where profit margins continue to be diluted.

These mixed results lead one to ponder: what makes Tongcheng Travel stand out? Where lies its core competency? Amidst the current challenging atmosphere, what should Tongcheng be concerned about for its future?

01

Targeting the lower-tier market, has Tongcheng, the "Travel Pinduoduo," accurately captured the market rhythm?

In fact, before this financial report was released, several listed companies in the travel sector had already published their interim reports, with varying results.

Among the 15 peer companies that have released their semi-annual reports or previews on the A-share market, 5 reported growth, 1 achieved profitability, 2 saw declines, and 7 remained in the red.

This echoes the performance of the tourism market this year. While people still have a strong willingness to spend on necessary travel and accommodation, their desire for non-essential spending after reaching destinations has significantly decreased.

This explains why Tongcheng, whose main business revolves around transportation and accommodation, has seen more growth on the revenue front.

"Special Forces Tourism" has gained popularity since last year, with "spending only a hundred yuan per day" and "saving money and time" becoming popular among travelers.

Taking the May Day holiday this year as an example, according to estimates by the Data Center of the Ministry of Culture and Tourism, domestic tourist trips totaled 295 million, up 7.6% year-on-year and 28.2% higher than the same period in 2019; total domestic tourist spending reached RMB 166.89 billion, up 12.7% year-on-year and 13.5% higher than 2019. However, per capita spending was RMB 565.73, with daily per capita spending at RMB 113.15, compared to RMB 603.44 and RMB 150.86 in 2019, respectively. Daily per capita spending during the May Day holiday in 2024 was 25% lower than the same period in 2019.

Willing to travel but unwilling to spend has become the norm. Coincidentally, Tongcheng, which originated in the lower-tier market, has accurately captured this trend.

In fact, Tongcheng Travel has demonstrated its resilience during economic downturns in previous quarters.

Throughout 2023, Tongcheng Travel achieved revenue of RMB 11.896 billion, up 80.7% year-on-year and 60.7% higher than 2019, setting a new record. Last year, the domestic tourism industry as a whole had not yet recovered to its 2019 levels, indicating that not only did Tongcheng's core performance indicators far exceed those of 2019, but this achievement was made despite a less favorable macroeconomic environment, making it all the more remarkable.

By the first quarter of 2024, Tongcheng's recovery was also superior to the industry as a whole; the company generated revenue of RMB 3.866 billion in Q1, up 49.5% year-on-year, with adjusted net profit of RMB 558 million, up 10.9% year-on-year, exceeding market expectations.

Tongcheng's ability to consistently lead the industry in this cycle is attributed to its corporate positioning and tone since its establishment.

As early as 2020, Tongcheng Travel made in-depth development of non-first-tier city markets one of its core strategies. At that time, it also innovated in its supply side by operating a "Travel+" model and rural tourism projects. For instance, it collaborated on esports events, such as LPL and KPL, to create "Travel+Esports" experiences and partnered with music to drive interest among younger demographics through "Travel+Music".

According to data from the Qianzhan Industry Research Institute, the user base of OTA in third-tier and lower-tier cities has been growing rapidly since 2017, with penetration rates also steadily increasing. Tongcheng's strategy aligns with this trend.

Image source: Qianzhan Industry Research Institute

According to the financial report, as of the end of 2023, registered users from China's non-first-tier cities accounted for 86.9% of Tongcheng Travel's total platform users. After acquiring Tongcheng Guolv and integrating its tourism and vacation business, Tongcheng has established partnerships with multiple airlines and airports, actively expanded travel scenarios such as cars, ride-hailing, buses, and subways, and leveraged the competitive advantage of differentiated transportation prices to form a core competency in the lower-tier market.

By this summer, the trend of targeting the lower-tier market remained unchanged. Big data from travel platforms showed that bookings for hotels in fourth- and fifth-tier cities and their subordinate counties during the summer holidays led all city categories, with high-end hotel bookings up 47% year-on-year.

Statistics show that China's counties account for over 90% of the country's land area and over 70% of its population. The market is vast, and Tongcheng still has plenty of opportunities.

02

Backed by Tencent and Ctrip, does Tongcheng enjoy the benefits of strong backers?

Beyond targeting the lower-tier market, Tongcheng is often compared to Pinduoduo for another reason—Tencent's support.

In the past, Pinduoduo was once known as a mini-game built on WeChat, evolving from simple sharing and Cut a knife activities into a giant that rivals Taobao and JD.com, with Tencent's "cultivation" playing a crucial role.

Tongcheng has also benefited from this resource dividend.

In 2018, Tongcheng Travel signed a tourism resource sales framework agreement with Tencent, which was renewed in 2020. In 2021 and 2022, Tongcheng Travel paid Tencent commissions of RMB 3.105 million and RMB 1.94 million, respectively, and RMB 5.224 million in the first nine months of 2023.

A single sentence best describes the benefits Tencent's ecosystem brings to Tongcheng: When opening WeChat and navigating to "Me - Services - Travel - Train/Flight Tickets/Hotels," the Tongcheng Travel platform interface appears.

Image source: WeChat's "Train/Flight Tickets" interface

Leveraging Tencent's support has yielded significant results. In 2023, approximately 80% of Tongcheng Travel's average monthly active users came from WeChat Mini Programs.

If there's one notable difference between Tongcheng and Pinduoduo, it's that Tongcheng also leans on Ctrip, the industry leader.

Ctrip's competitive advantage lies in its inventory resources, particularly in the mid-to-high-end market, which complements Tongcheng Travel's offerings.

According to a high-end hotel service staff member, Ctrip customers are given the highest priority within the hotel, and Ctrip reviews are highly valued as a feedback channel. Another industry insider revealed that Ctrip has many exclusive hotel contracts, and hotels that breach these contracts face delisting or removal from the platform.

With Ctrip's investment and a complementary business layout, Tongcheng has avoided vicious price wars, protected its profits, and maintained a stable foundation even amidst external shocks.

The biggest competitor comes from Douyin. Last summer, Chengdu Haituo Travel Agency Co., Ltd. was quietly established. After a shareholding analysis, it became clear that Douyin was the true "mastermind" behind this move, marking its significant entry into the travel market.

In the past two years, Douyin has elevated its travel business to a primary department, testing the waters with traffic tilt and significantly lower commissions for accommodation services than the industry average. Public data shows that in May 2022, Douyin officially announced a 4.5% commission rate for travel merchants joining its platform, compared to the industry average of 10%-12%.

This lower commission rate has attracted many small and medium-sized businesses to establish a presence on Douyin. By September 2023, over 14,000 scenic spots and more than 100,000 hotels had opened official accounts on Douyin. Douyin's low commission rate facilitated rapid growth in its travel business. Data shows that in 2023, the number of active travel merchants on Douyin increased nearly sevenfold year-on-year, with payment GMV surging over 300-fold.

Without the support of Ctrip and Tencent, Tongcheng Travel alone would likely struggle to withstand such fierce competition.

Finally, in June of this year, Douyin announced an increase in accommodation commission rates from 4.5% to 8%. Many small and medium-sized businesses were caught off guard by this news.

Once again, Tongcheng persevered.

03

Amidst ongoing concerns, Tongcheng sets its sights on overseas markets

That being said, Tongcheng Travel is far from being complacent.

On the one hand, while Tencent and Ctrip are currently helping, a souring relationship could become a hindrance.

Tongcheng is acutely aware of this. As early as its IPO stage, the prospectus noted that while partnering with Tencent to integrate the platform into WeChat and Mobile QQ leveraged their traffic, "we cannot assure you that we will be able to maintain our current level of cooperation with Tencent in the future. If our relationship with Tencent (especially regarding our platforms under Tencent) terminates or decreases due to Tencent launching its own online travel portal or partnering with other online travel agencies, or if any revised or new commercial terms with Tencent are unfavorable to us, or if Tencent ceases to provide resources on its platforms or adequately promote our products and services, our business and prospects will be adversely affected."

On the other hand, Tongcheng lags behind in content development.

Today, it's almost standard for apps to include a "video" interface, from e-commerce, news, and social apps to search, music, and utility apps. Tongcheng Travel belongs to the minority that doesn't.

Image source: Ctrip's short video UI

As early as December 2020, Tongcheng Travel officially announced the launch of "Tongcheng Zhenhuixuan," a service brand dedicated to providing high-quality travel video content, on its app and Mini Program. At the same time, Tongcheng Travel introduced a short video incentive plan, including a traffic incentive plan where influencers could earn thousands of yuan based on video views by using the hashtag #Tongcheng Zhenhuixuan, and a "Send You on a Trip" plan offering free travel shooting resources to five influencers each month.

At that time, users could access the channel by opening the Tongcheng Travel app, navigating to "Me - Travel Tools," or searching for the Tongcheng Travel Mini Program and selecting "My - Exciting Activities."

However, both methods are no longer valid. The lack of short videos hinders Tongcheng's ability to retain traffic.

Nonetheless, Tongcheng is continuously pushing for diversification. Beyond further expanding its hotel management, Tongcheng is also focusing on overseas markets.

Data shows that in the first quarter of this year, China's inbound and outbound personnel exceeded 141 million, up 117.8% year-on-year. A report released by a travel platform on June 10th indicated that international cruise bookings surged over 14 times compared to last year's Dragon Boat Festival holiday. According to the China Tourism Academy's "Annual Report on China's Outbound Tourism Development (2023-2024)," outbound tourist numbers exceeded 87 million in 2023 and are expected to reach 130 million in 2024, up 50% year-on-year.

Tongcheng Travel has also identified the potential in overseas markets.

In the first half of 2024, Tongcheng Travel launched HopeGoo, an international travel booking platform supporting 16 global currencies and multiple operating languages, providing one-stop travel services to international travelers. It has partnered with the Serbia National Tourism Organization, the Portugal Tourism Board, and co-launched the "Korea Youth Travel Card" with the Korea Tourism Organization, tailored for young Chinese tourists.

The financial report revealed that its daily international flight bookings hit a new high in Q2, up over 160% year-on-year, while international hotel nights booked increased by nearly 140% year-on-year.

04

Market value declines, and the challenge of finding a second growth curve persists

To enhance its risk resilience, Tongcheng is exploring a second growth curve beyond travel and hospitality. However, the path to exploration is fraught with challenges.

Exposed during the 315 consumer rights event in March, Tongcheng Finance's App was found to have a "cash loan" scheme involving gift cards. Both the parent company Tongcheng Travel and Tongcheng Finance faced a sustained regulatory storm and public opinion backlash.

Image source: Tongcheng Finance Weibo

In June, it was again exposed for unauthorized sharing of user information with lending platforms, further escalating public opinion.

Perhaps due to these concerns, in August, Tongcheng Travel announced the termination of its acquisition plan for Guangzhou Lujin Technology Co., Ltd. (hereinafter referred to as "Guangzhou Lujin"), signaling its abandonment of further investments in financial technology.

Internet platforms naturally boast a large user base and strong big data analytics capabilities, enabling them to more accurately assess user risk and credit profiles, thereby offering more personalized financial products and services.

Internet giants like Alibaba, Tencent, Baidu, Meituan, JD.com, and Kuaishou have shown immense interest in lending businesses due to their profitability. Take Ant Group as an example; according to Jiemian News, Ant Consumer Finance, which handles Huabei and Jiebei consumer credit services, generated a net profit of RMB 841 million in 2022 and approximately RMB 1.28 billion in the first half of 2023, a year-on-year increase of approximately 175%.

The inability to break into the financial services sector has short-term implications for Tongcheng Travel's profit margins and long-term impacts on its strategic planning and capital market valuation.

Moreover, looking at Tongcheng Travel's Hong Kong stock, after mid-April, its total market value stabilized above HKD 50 billion (approximately RMB 46.682 billion) and hit an all-time high on April 15th, with an intraday market value peaking at HKD 51.189 billion.

Image source: Baidu Stock Connect

At that time, some voices expressed that this was a regular performance driven by two forces: the continuous strengthening of macroeconomic expectations and the restoration of valuation.

In fact, LY.com may also have benefited greatly from its acquisitions and consolidations.

It is understood that in 2023, LY.com successively acquired Beijing LY.com Tourism Investment Group Co., Ltd. and Hainan Yanoda Harmony Tourism Co., Ltd., holding shares of 100% and 57.2%, respectively. The former is a group composed of multiple regional travel agencies, while the latter focuses on the operation of tropical forest parks. These two acquisitions have been included in LY.com's financial statements since December 1, 2023.

This is a crucial factor in the significant growth of LY.com's performance in 2023. Financial reports show that in the fourth quarter of 2023, LY.com's revenue reached 3.145 billion yuan, an increase of 109.6% year-on-year; adjusted net profit was 483 million yuan, a substantial increase of 1,188.3% year-on-year.

In contrast, in the first quarter of 2024, LY.com's revenue and adjusted net profit increased by 49.5% and 10.9% year-on-year, respectively, significantly lower than the fourth quarter's performance.

Starting from mid-April, as the liquidity of Hong Kong stocks weakened, LY.com also began to enter a downward cycle. As of the close on August 20, LY.com was quoted at HK$13.120 per share, down 41.82% from the peak of HK$22.550 per share in April.

Profitability issues also continued to be reflected in the Q2 quarterly report. In the second quarter, adjusted net profit was 660 million yuan, and the adjusted net profit margin was 15.5%. Although this was an improvement from 14.4% in the first quarter, it was still significantly lower than the 19.5% in the same period in 2023.

Considering that the performance growth effect brought about by acquisitions and consolidations can usually only last for about a year, if LY.com's core business fails to achieve sustained high growth, its overall growth potential may gradually weaken.

Today, while LY.com is still in the stage of "outperforming the broader market," if it fails to find more profitable methods soon, it may still struggle to find a long-term solution for sustained growth in today's fragile market environment.

05

Closing Thoughts

Dialectics teaches us that everything should be viewed from two sides.

In terms of revenue and profit, LY.com's financial report for the just-concluded second quarter was a mixed bag.

However, in the second half of the year, which is the peak travel season, leveraging the summer and National Day holidays will be essential for the tourism market.

Still waters run deep. Whether LY.com can complete its content layout, reduce its reliance on Tencent, strengthen its traffic guidance capabilities, make further decisive progress in overseas markets, and find more profitable methods will all determine its direction in the second half of the year.