Is Kuaishou Slowing Down as Live Streamers Fade Away?

![]() 08/21 2024

08/21 2024

![]() 431

431

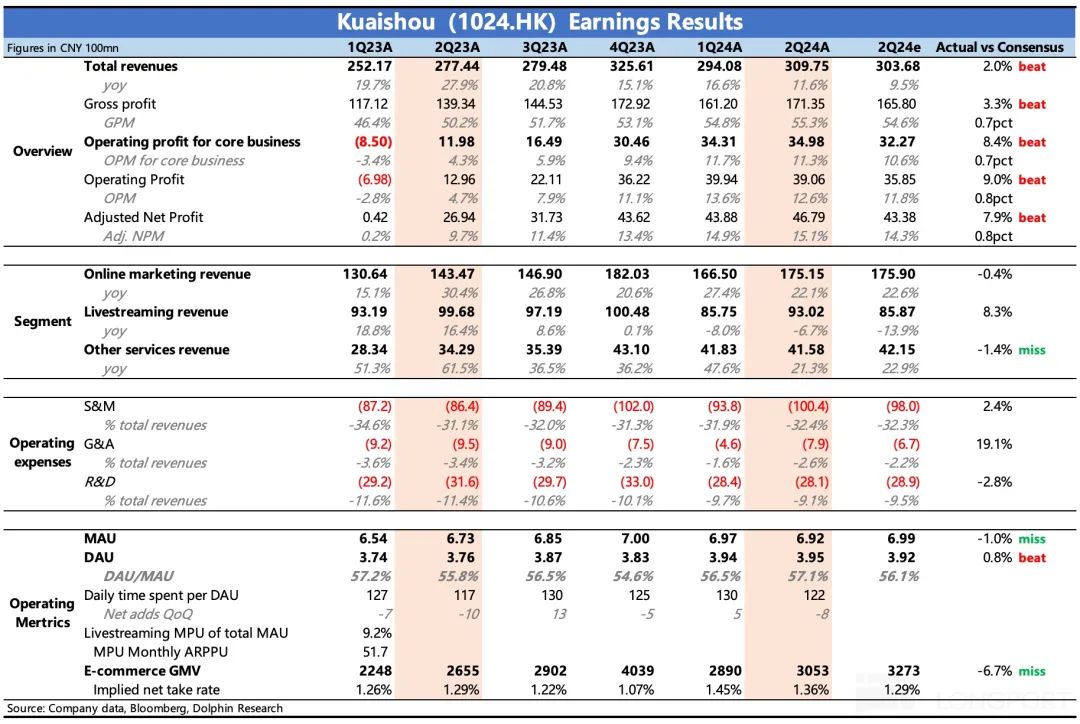

At first glance, Kuaishou's Q2 results exceeded expectations in both revenue and profit, but the overperformance was primarily driven by live streaming rewards. In terms of key metrics that Dolphin Insights values highly, there were no surprises, instead confirming some of our pre-earnings concerns.

Specifically:

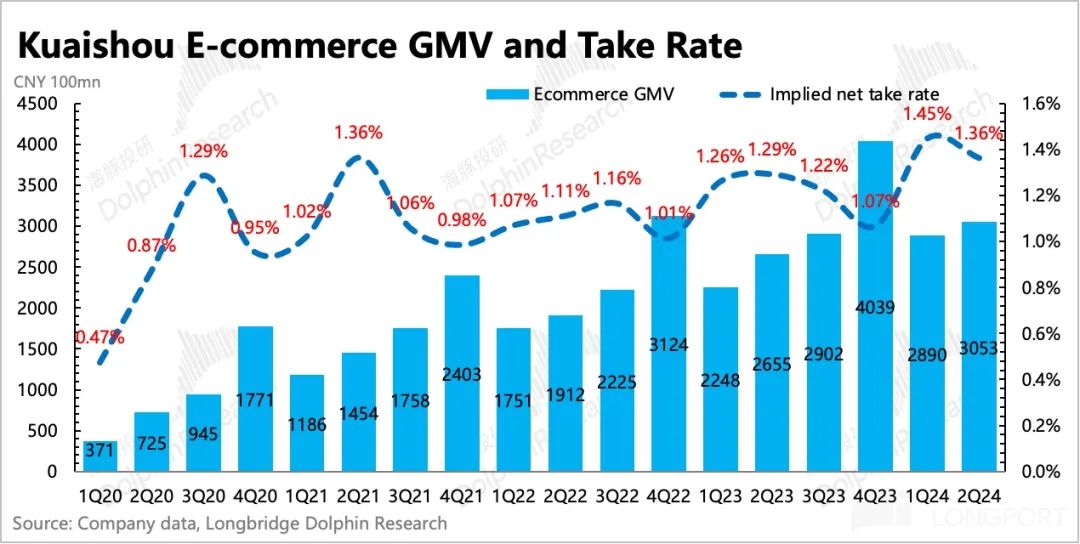

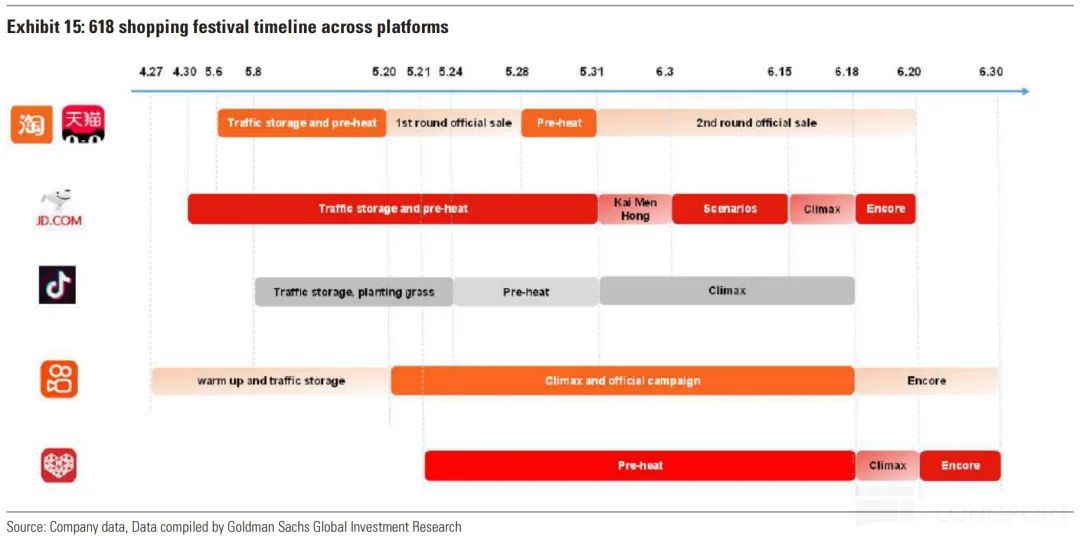

1. The Longest 618, But Mediocre GMV Growth?: Q2 GMV grew by only 15% YoY, falling short of the consensus expectation of 18% according to BBG. Previous data from third-party platforms on live streaming e-commerce had already hinted at weakening GMV growth for Kuaishou (due to factors such as fewer live streams by top broadcasters and market saturation). Despite Kuaishou starting the 618 promotions early and ending late, the resulting GMV was somewhat disappointing.

Of course, the stock price's downward pressure over the past month suggests market expectations may have already adjusted. Thus, concerns about a potential weakening of GMV guidance for Q3 need to be addressed by management during the earnings call, which could have a more significant impact on current market expectations.

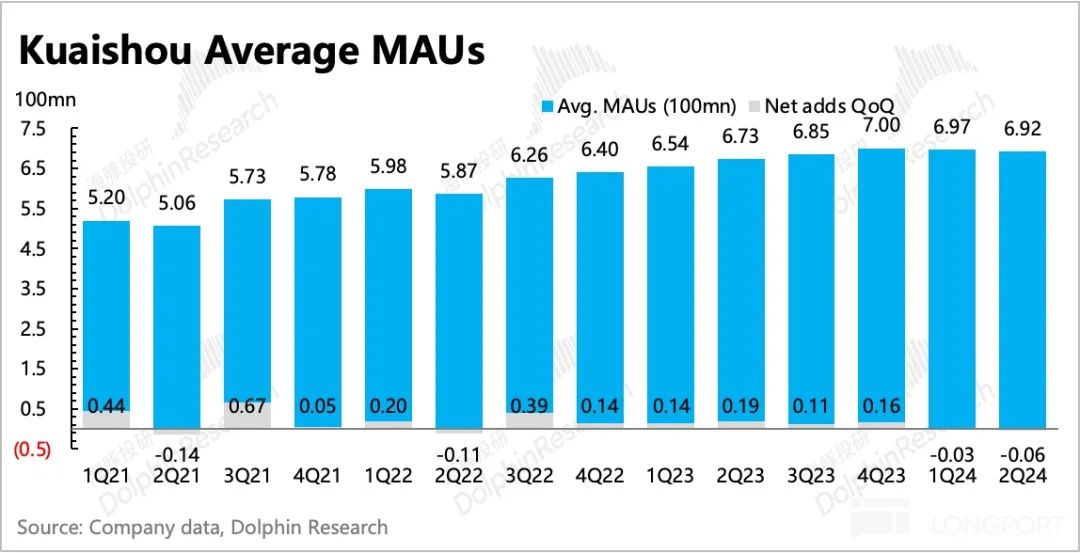

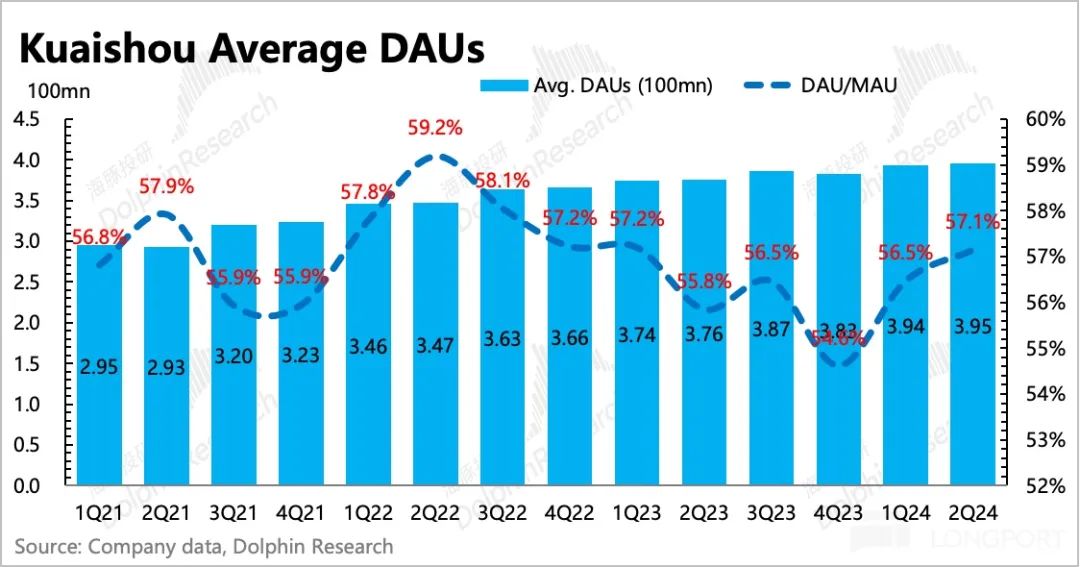

2. Slow User Growth, and Monetization Strategies Aren't Working?: MAU declined QoQ to 692 million in Q2, missing market expectations of 699 million. However, sales and marketing expenses still amounted to RMB 10 billion, RMB 200 million more than market expectations.

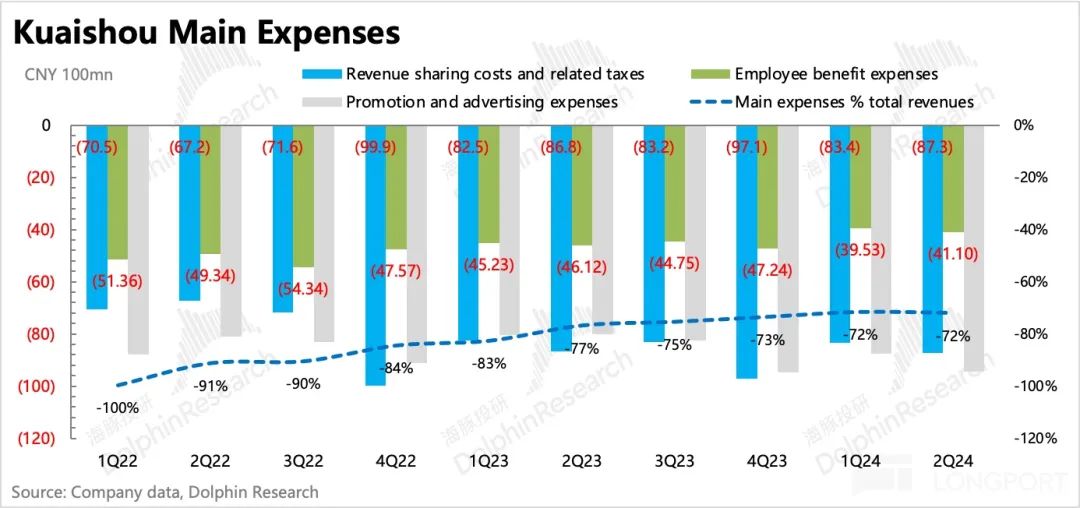

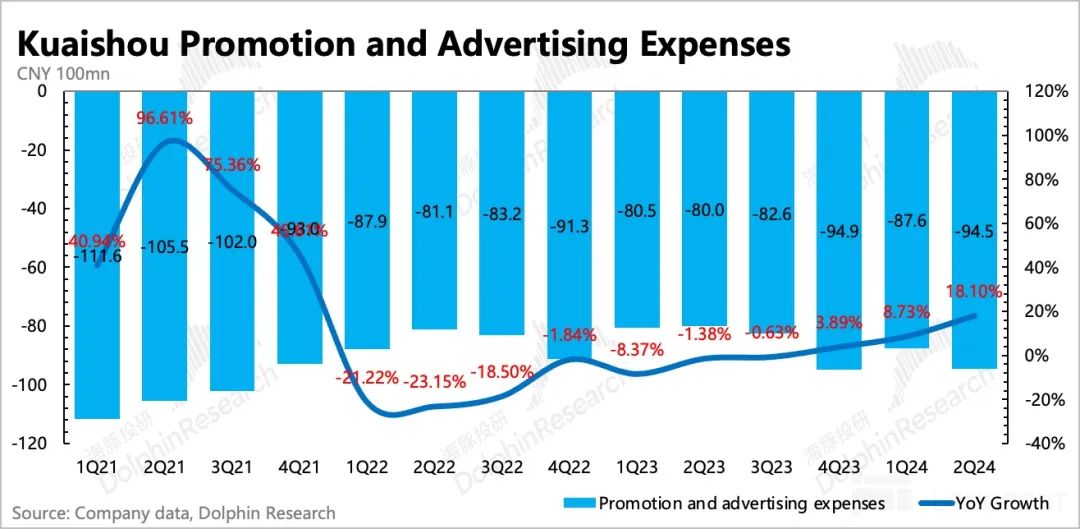

Sales and marketing expenses primarily consist of RMB 9.4 billion in promotion costs, with minimal spending on salesperson compensation. The market had hoped that Kuaishou, with its high user stickiness, would gradually reduce monetization expenses or improve user acquisition efficiency. After all, Kuaishou's marketing expense ratio is as high as 32%, compared to 10%-20% for mature social platforms.

On a brighter note, DAU exceeded expectations, reflecting a slight improvement in user stickiness on the platform. Additionally, we anticipate a rebound in traffic due to the Olympics in Q3.

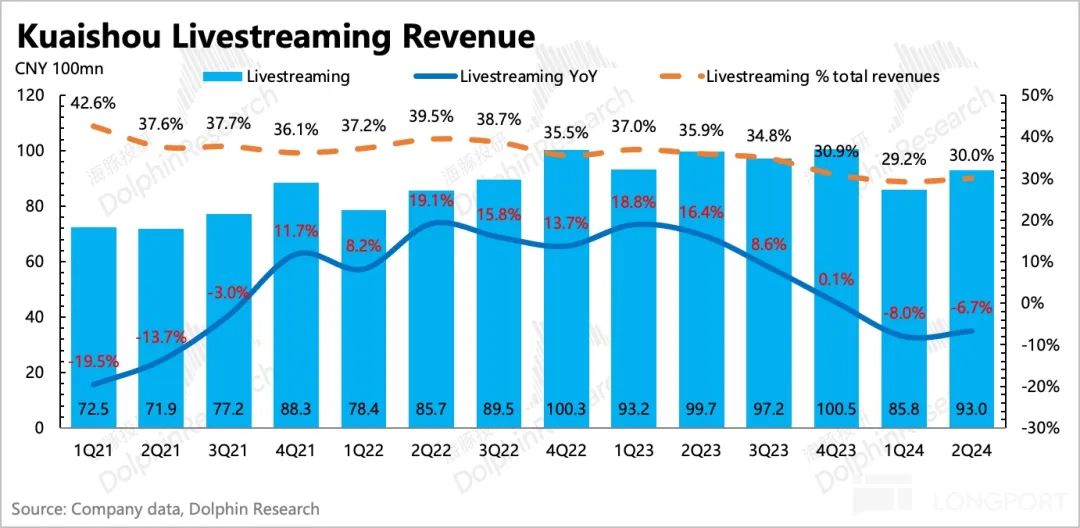

3. Actively Introducing Guilds to Offset Live Streaming Regulations: The impact of proactive content rectification in live streaming has persisted for nearly a year, still affecting Q2. Market expectations were generally low, anticipating a 10%-15% decline. In reality, live streaming rewards revenue declined by only 6.7% YoY in Q2, exceeding expectations. This was primarily due to Kuaishou actively introducing more live streaming guilds, with the number of signed guilds increasing by 50% YoY and the number of broadcasters growing by 60%.

However, Dolphin Insights believes it's crucial to examine the types of newly introduced guilds and broadcasters. If they focus primarily on e-commerce, they may inevitably fall into the same trap of insufficient penetration momentum in live streaming e-commerce. On the other hand, if they emphasize entertainment, they could strengthen Kuaishou's position as a premium content distribution channel.

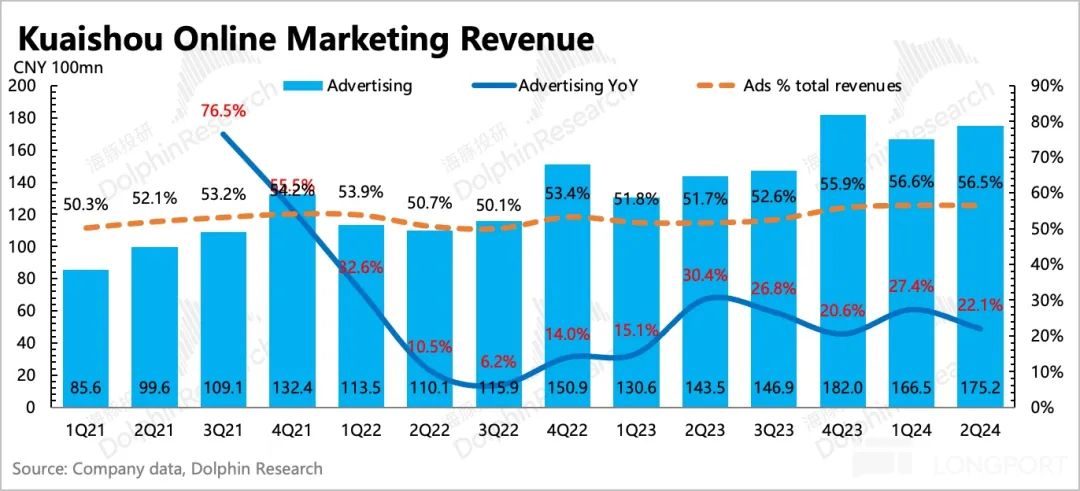

4. Strong Advertising Growth Leveraging Channel Advantages: Q2 advertising revenue grew robustly, up 22% YoY, in line with market expectations.

On one hand, the peak e-commerce season and smart marketing solutions are expected to drive solid in-app advertising performance. On the other hand, out-of-app advertising benefited from product upgrades (UAX) and industry-specific growth, seasonality, and intensifying competition in sectors like entertainment, e-commerce, and local services. Especially for entertainment content (games & short dramas), coupled with Kuaishou's short video channel advantages, Dolphin Insights expects double-digit out-of-app advertising growth, accelerating QoQ.

5. Cost Reduction Continues, but Efficiency Gains Stall?: Q2 adjusted profit exceeded expectations primarily due to revenue and gross margin exceeding expectations, indicating more significant cost optimization. This was primarily driven by declines in revenue sharing, bandwidth depreciation, and intangible asset amortization, leading to a slightly higher-than-expected gross margin.

Operating expenses were primarily driven by the higher sales and marketing expenses mentioned earlier, while G&A and R&D expenses declined YoY. SBC increased significantly QoQ, possibly due to year-end bonuses, but YoY comparisons still reflect improved operational efficiency from cost-cutting measures.

6. Share Repurchases Remain Modest: Q2 share repurchases continued but at a slower pace compared to the previous quarter. Monthly changes suggest repurchases have generally followed market value movements, with no significant announcements to enhance shareholder returns. The previously announced RMB 16 billion repurchase plan over 36 months has seen shareholder returns increase slightly from 2% to 2.8% due to market value declines.

As of Q2-end, Kuaishou had net cash of RMB 21.1 billion, or RMB 53.1 billion including short-term investments. With the core business already profitable and cash flow positive, substantial cash outflows are unlikely. Therefore, increased share repurchases could provide support during periods of negative market sentiment and stock price pressure.

7. Detailed Financial Report Data Overview

Dolphin Insights Perspective: As a platform with entertainment as its facade and e-commerce at its core, Kuaishou is often viewed by the market primarily as an e-commerce stock, with a focus on GMV performance. The noticeable decline in live streaming GMV disclosed by third-party platforms due to the frequent absences of top broadcasters like Xinba in April already indicated weakness in Q2. Although the company's communication suggested the decline wasn't as severe as reported by third-party platforms, it didn't deny the trend of weakening GMV growth.

Meanwhile, the competition in e-commerce has intensified this year, with traditional e-commerce platforms stepping up efforts to offer lower prices, simplify discount processes, optimize recommendation algorithms, and provide traffic subsidies to merchants. This has weakened the original low-price advantage of live streaming e-commerce, leading to stagnant user penetration. Moreover, KOL broadcasters with 10%-20% commission rates appear less cost-effective to merchants.

From a platform perspective, amid slowing overall growth, there's a stronger incentive to reduce the influence of top broadcasters and support branded store broadcasts, thereby capturing a share of the commissions previously earned by top broadcasters. Consequently, platforms heavily reliant on live streaming e-commerce, such as Kuaishou and Douyin, have shifted their focus to marketplace e-commerce since the second half of last year.

These two trends point to a slowdown in live streaming e-commerce penetration, which, while an industry-wide phenomenon, could have a relatively more significant negative impact on Kuaishou due to its heavy emphasis on private domains and live streaming.

To offset the negative impact, Kuaishou's progress in transitioning to a broader marketplace model will be crucial. However, the share of marketplace GMV in Q2 increased only slightly from Q1. Given that Kuaishou is actively introducing new live streaming guilds and broadcasters, some of whom focus on e-commerce, it's challenging for Kuaishou to reduce its dependence on live streaming e-commerce in the short term and escape the industry trend's influence.

Apart from GMV, another long-standing concern is user acquisition through monetization efforts, essentially discussing whether there's room for long-term profit margin improvement.

The market hopes to see continued optimization in sales and marketing expenses or rates, while also avoiding user loss (though growth slowdown is already evident). While Kuaishou has maintained a sales and marketing expense ratio of around 30% for over a year, mature platforms typically have ratios of 10%-20%, indicating potential for compression and optimization. However, if maintaining such a high marketing expense ratio is necessary to stabilize user traffic, it could erode market confidence in Kuaishou's platform advantages like high private domain stickiness and long-term profit growth potential.

Overall, Dolphin Insights' feedback on the Q2 report is mixed. Considering the current low valuation (current market value of HKD 193.8 billion corresponds to less than 8x adjusted net profit for 2025) and the fact that third-party platforms have already disclosed high-frequency data on Kuaishou's GMV and user numbers, suggesting some adjustment in market expectations. Therefore, the market's reaction to the earnings report may be more influenced by management's guidance for the rest of the year. It's recommended to focus on the earnings call to see if management can provide guidance that increases confidence and alleviates concerns.

Detailed Analysis Below

I. Users: MAU Slowdown, Monetization Strategies Ineffective?

In Q2, Kuaishou's MAU declined QoQ by 5 million to 692 million, missing market expectations. Although Q2 is traditionally a slow season for entertainment platforms, Kuaishou's heavy e-commerce presence has made its performance more influenced by e-commerce seasons. In fact, the 618 shopping festival failed to attract more new users to Kuaishou, with two consecutive quarters of QoQ declines raising concerns about user saturation.

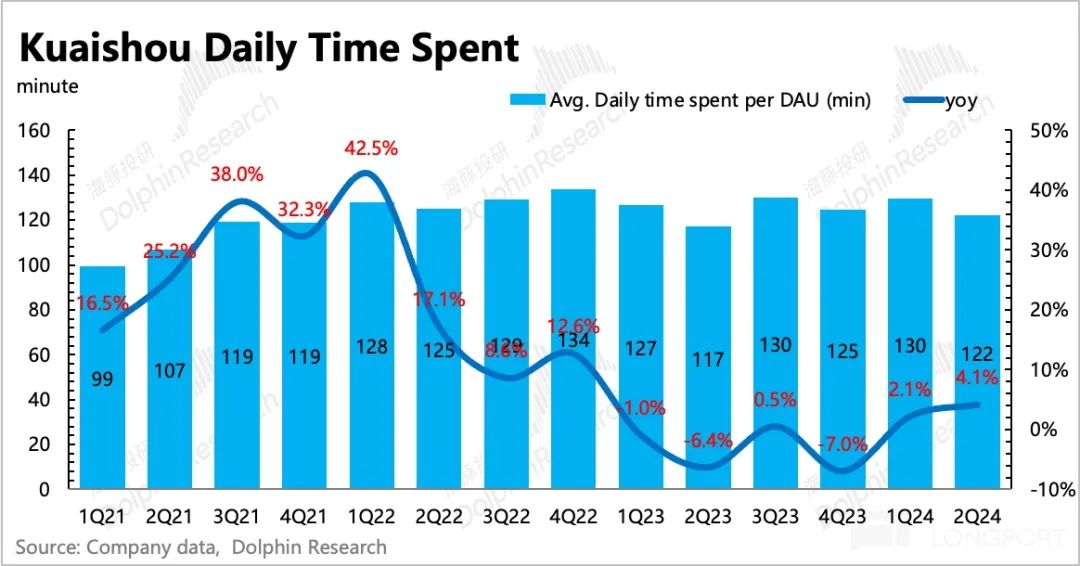

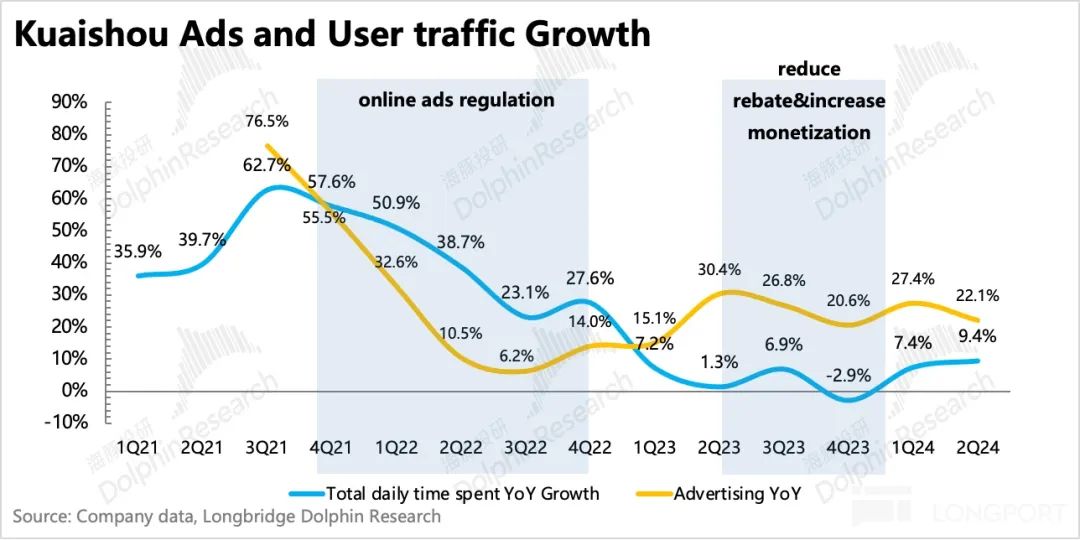

Despite stagnant user growth, the remaining active users' engagement on the platform has continued to improve, as evidenced by: 1) Daily average usage time increasing YoY to 122 minutes; 2) DAU/MAU ratio improving QoQ, indicating higher user stickiness; and 3) Total daily user time increasing 9.4% YoY and slightly accelerating QoQ.

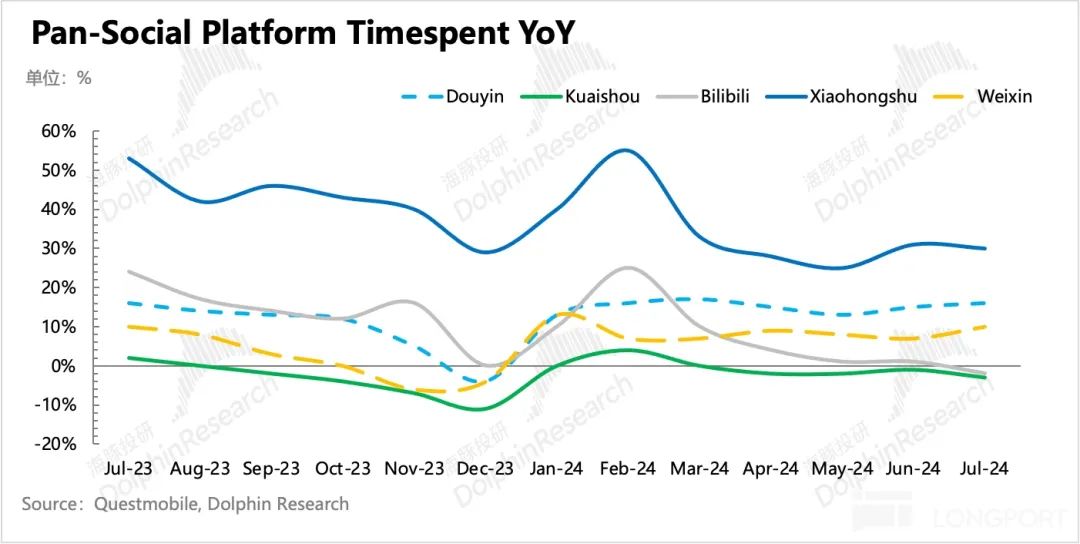

While these numbers may seem reassuring in isolation, when placed in the broader context of increased competition from platforms like Douyin, WeChat Video, and Xiaohongshu, it becomes evident that Kuaishou faces growing challenges amidst its large user base.

II. E-commerce: The Longest 618, But Mediocre GMV Growth?

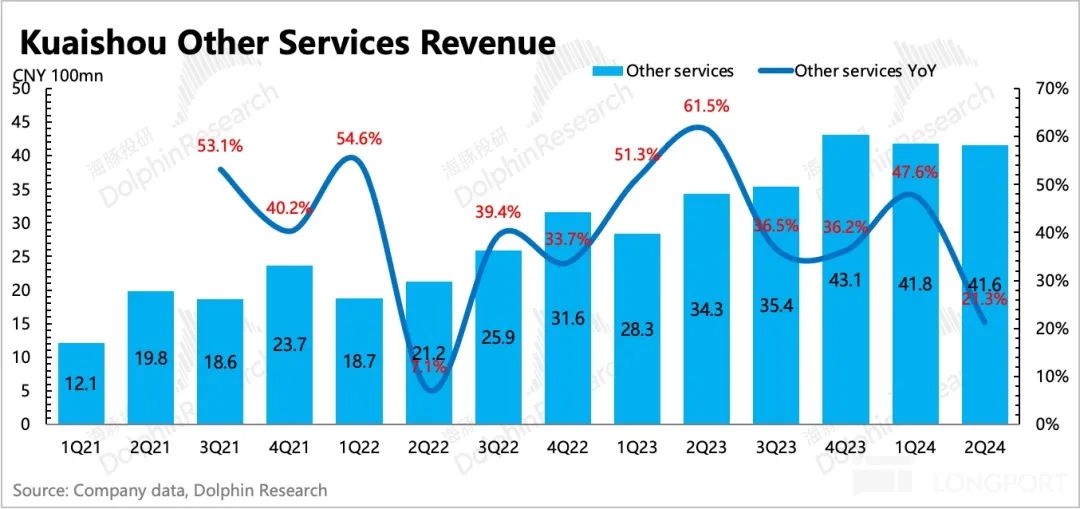

Q2 e-commerce revenue grew 21.3% YoY, slightly below market expectations, primarily due to GMV issues. The commission rate declined slightly QoQ to 1.36%, potentially due to merchant rebates during the 618 shopping festival.

Q2 GMV grew 15% YoY, missing the consensus expectation of 18% according to BBG. Previous data from third-party platforms on live streaming e-commerce had already hinted at weakening GMV growth for Kuaishou (due to factors like fewer live streams by top broadcasters and market saturation). Despite Kuaishou's early start and late finish to the 618 promotions, the resulting GMV was somewhat disappointing.

Of course, the stock price's downward pressure over the past month suggests market expectations have already adjusted. Thus, concerns about a potential weakening of GMV guidance for Q3 need to be addressed by management during the earnings call, which could have a more significant impact on current market expectations. To offset the negative impact of live streaming e-commerce, Kuaishou's progress in transitioning to a broader marketplace model will be crucial.

However, the share of marketplace GMV in Q2 increased only slightly from 'over 25%' in Q1 to 'reaching 25%' in Q2. The company's year-end goal is to increase this share to 25%-30%, and while the current progress is within plan, it lags behind Douyin, which surpassed 40% in June. This suggests Kuaishou's transition pace is notably slower. It remains to be seen whether this is due to deliberate slowing or objective difficulties.

Dolphin Insights leans towards a combination of both factors. Deliberate slowing could stem from a focus on 'differentiation,' as Kuaishou's private domains and live streaming set it apart from other social platforms. However, these differentiating features may also constrain the pace of transition.

Additionally, considering that Kuaishou is actively introducing new live streaming guilds and broadcasters, some of whom focus on e-commerce, it will be challenging for Kuaishou to reduce its dependence on live streaming e-commerce in the short term and escape the industry trend's influence. Dolphin Insights discussed the short-term transition pains in detail in the previous quarter's review and won't repeat them here.

The resulting question is whether Kuaishou can alleviate e-commerce revenue pressure by increasing monetization (commissions + advertising). Assuming an e-commerce advertising share of around 54% (slightly higher than Q1 due to the e-commerce peak season), the combined monetization rate of commissions and advertising is expected to reach 4.5%, a YoY increase of 0.7 percentage points, in line with Kuaishou's previous steady-state target of 4.5%. Dolphin Insights believes that Full site promotion + Cut Fan / Support small and medium-sized anchors + Assist in brand self broadcasting are the main reasons for Kuaishou's gradual increase in e-commerce monetization rates. These actions essentially shorten the profit chain between Kuaishou and merchants, allowing the platform to capture more profits from the industry chain. Amid industry competition, forcibly increasing monetization rates is an inelegant solution. However, Kuaishou's sales trusteeship model launched in April (especially for manufacturing merchants with weak sales capabilities) could indirectly achieve higher take rates, which warrants continued observation.

III. Advertising: Strong Growth Driven by Channel Advantages

Q2 advertising revenue grew 22% YoY to RMB 17.5 billion, in line with expectations, though naturally slowing QoQ due to the high base effect. Excluding e-commerce advertising (expected to grow 25%-30% YoY), Dolphin Insights estimates that out-of-app and alliance advertising revenue grew by 15%. Compared to Q1, growth continued to recover.

["The company explained that the launch of the UAX (Universal Advertising Exchange), a smart marketing solution dedicated to the external advertising cycle, provided advertisers with a more comprehensive marketing service. However, Dolphin Insights believes that within vertical advertising, sectors like entertainment, e-commerce, and local life are driven by industry development, seasonal fluctuations, and intensifying competition within the industry. Especially for entertainment content (games & short dramas), combined with Kuaishou's advantage in short video channels, Dolphin Insights expects the growth rate of external advertising to reach double digits, with a sequential acceleration. In Q2, the growth rate of total user daily time continued to rebound to 9.4%, resulting from the year-over-year increase in traffic and daily average time spent, which is expected to support the accelerated growth of advertising as well."]

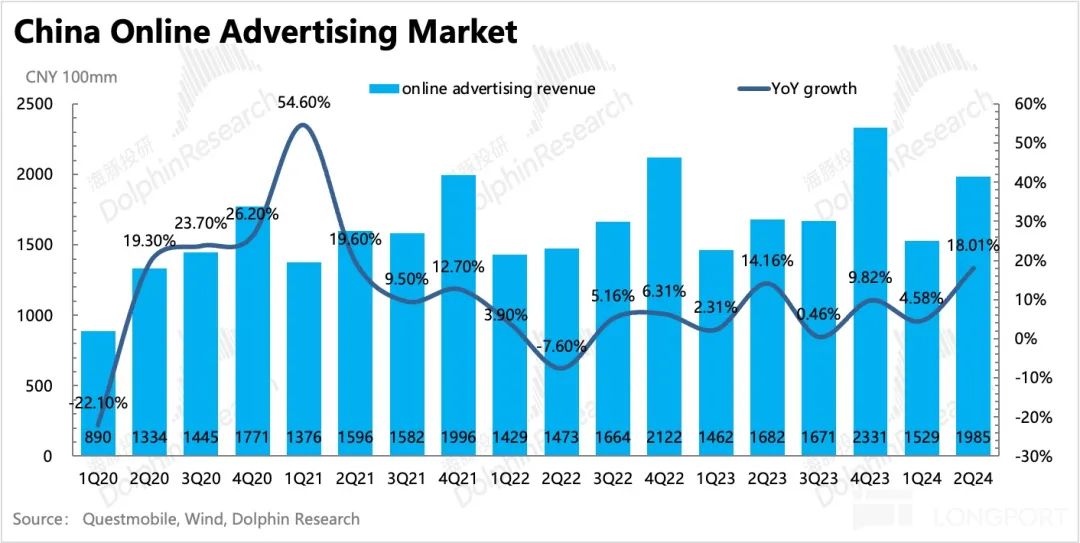

["Looking solely at the second quarter, Kuaishou's performance still surpassed the overall online advertising industry. According to QM data, while the online advertising growth rate rebounded in Q2, Kuaishou still outperformed the industry. Similar to Tencent's logic, social platforms with e-commerce attributes and short video channel advantages have stronger anti-cyclical capabilities."]

["IV. Actively Introducing Unions to Offset the Impact of Live Streaming Rectification"]

["The impact of Kuaishou's proactive rectification of live streaming content has lasted for nearly a year, and the second quarter was still within this impact period. Therefore, the market generally had low expectations, anticipating a decline of 10%-15%. In reality, live streaming tipping income reached 9.3 billion in Q2, with a year-over-year decline of only 6.7%, exceeding expectations. This is mainly attributed to Kuaishou's active introduction of more live streaming unions, with the number of signed unions increasing by 50% year-over-year and the number of anchors growing by 60% in Q2."]

["In addition to accelerating the introduction of unions, Kuaishou continued to expand live streaming scenarios (such as job recruitment and real estate brokerage). Q2 growth: 1) The daily average number of resumes submitted on KuaiPin increased by 130% year-over-year (up 180% YoY in the previous quarter), maintaining a high growth momentum. 2) The Ideal Home business is inevitably affected by the environment. In Q2, mainly due to the relaxation of home purchase policies in first-tier cities, Kuaishou may not necessarily benefit precisely, so real estate transaction volumes were not disclosed this quarter, but the daily average search volume was mentioned to have increased ninefold year-over-year."]

["It is also worth mentioning that Dolphin Insights believes it is necessary to further examine the types of newly introduced live streaming unions and anchors. If product promotion is the primary focus, it will inevitably fall into the negative impact of insufficient penetration momentum in current live streaming e-commerce. If entertainment is the main focus, it can instead strengthen Kuaishou's position as a high-quality channel for content promotion and distribution."]

["V. Slowdown in Profit Margin Improvement? The Most Critical Expense Remains Unreduced"]

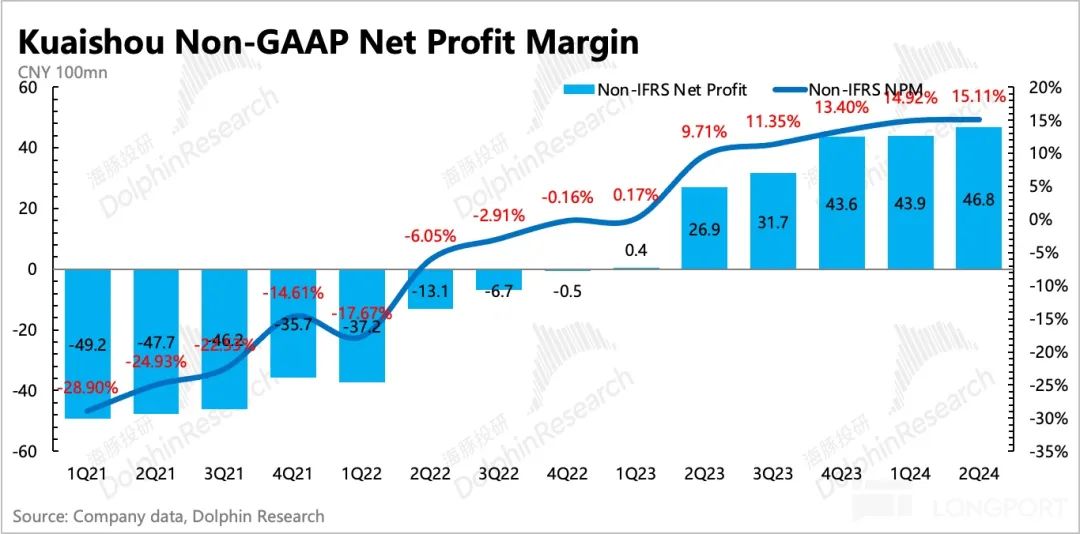

["In Q2, Kuaishou achieved a GAAP net profit of 3.98 billion, a slight sequential decline, indicating that it has passed the fastest growth stage. The net profit margin was 12%, down 2 percentage points sequentially, mainly due to sequential increases in marketing expenses and administrative expenses. Under Non-GAAP, net profit was 4.68 billion (primarily due to the addition of 723 million in SBC equity compensation expenses), with a profit margin of 15.1%, showing a significant slowdown in improvement compared to Q1."]

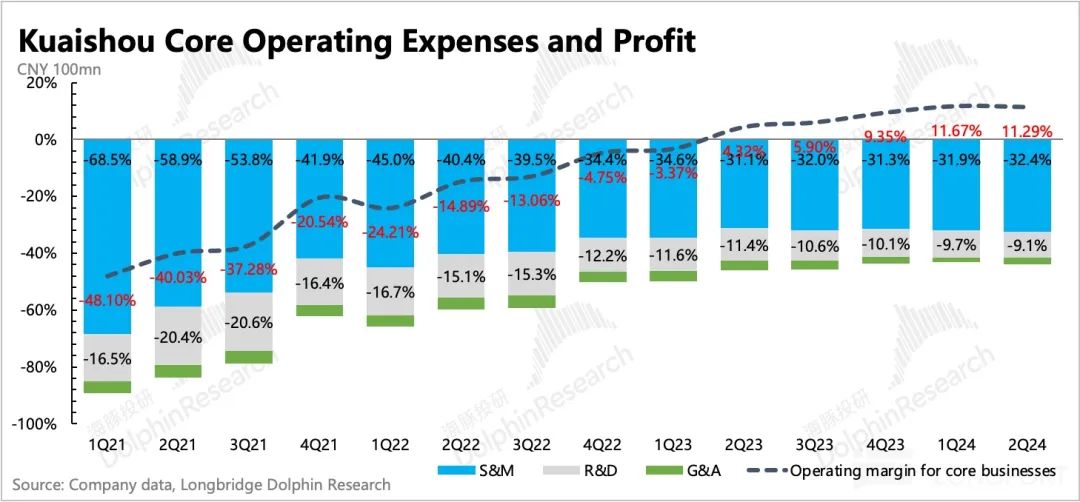

["As Kuaishou's net profit includes certain gains (such as government subsidies and financial investment income), Dolphin Insights typically focuses on core operating profit metrics (revenue - cost - operating expenses) when assessing its primary business performance. In Q2, core operating profit reached 3.5 billion, with a profit margin of 11.3%, slightly exceeding market expectations, with the positive variance of over 200 million yuan primarily stemming from cost optimization."]

["Overall, the improvement in profit margin primarily resulted from cost optimization, primarily driven by smaller-than-expected declines in revenue sharing, bandwidth depreciation, and intangible asset amortization, leading to a slightly higher-than-expected gross margin. Operating expenses were primarily driven by higher sales expenses mentioned earlier, while administrative and R&D expenses continued to decline year-over-year. SBC increased significantly sequentially, possibly due to year-end bonuses, but year-over-year, it still reflects the improvement in operating efficiency from the layoff cycle."]

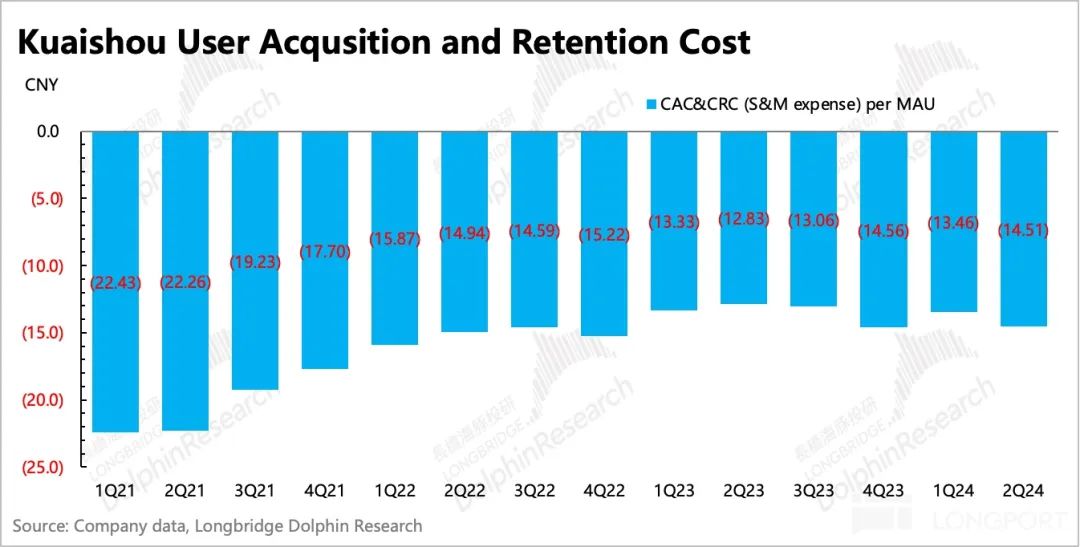

["However, the market had hoped for optimization in sales expenses, which instead increased by 15% year-over-year, with 95% attributed to customer acquisition costs. Looking solely at customer acquisition expenses, they grew by 18% year-over-year. Nevertheless, MAU declined rather than increased during this period, raising questions about whether existing users also require the current level of marketing expenses to maintain their activity. When combined with content costs and viewed through Dolphin Insights' previously proposed "user retention cost," it appears that user costs in this area have been difficult to further optimize over the past year. This implies that profit margin improvement may rely solely on revenue growth and long-term optimization of internet-native bandwidth costs in the later stages."]

["By region (domestic and overseas), the domestic market is the main driver of profits, but the overseas market's pace of loss reduction has been temporarily suspended."]